A.M. Best Upgrades Credit Ratings of Kingstone Insurance Company and Kingstone Companies, Inc.

April 12 2017 - 12:50PM

Business Wire

A.M. Best has upgraded the Financial Strength Rating

(FSR) to A- (Excellent) from B++ (Good) and the Long-Term Issuer

Credit Rating (Long-Term ICR) to “a-” from “bbb” of Kingstone

Insurance Company (KICO) (Kingston, NY). Concurrently, A.M.

Best has upgraded the Long-Term ICR to “bbb-” from “bb” of

Kingstone Companies, Inc. [NASDAQ: KINS] (Delaware), the

insurance holding company of KICO. The Long-Term ICR outlooks have

been revised to stable from positive, while the outlook for the FSR

remains stable.

The rating upgrades are based on the improved risk-adjusted

capitalization of KICO, following a $23.0 million capital

contribution from KINS on March 1, 2017; improved underwriting

results and operating returns in recent years; and increased

catastrophe reinsurance coverage.

The ratings and outlooks reflect KICO’s solid risk-adjusted

capitalization, favorable five-year operating performance and local

market knowledge in New York. KICO’s risk-adjusted capitalization

has significantly improved in recent years, driven by a $15.0

million capital contribution from its parent, following an $18.8

million public offering on Dec. 13, 2013. The capital raised in

this public offering also enabled management to repay all of its

outstanding debt at KINS. Additionally, KINS completed a private

placement of $5.0 million of its common stock on April 15, 2016,

and following the approval of the New York State Department of

Financial Services, $3.0 million was contributed to the surplus of

KICO. Furthermore, following a $30.2 million public offering by

KINS in February 2017, $23.0 million of capital was contributed to

KICO’s surplus on March 1, 2017, to improve capitalization and

support future growth plans.

KICO’s favorable operating performance is reflected in the

company’s double-digit five-year pre-tax returns on revenue and

equity, generated by positive net underwriting income and

supplemented by net investment and other income. These five-year

operating returns compare favorably with the industry composite

average.

Partially offsetting KICO’s positive rating factors are its

dependence on reinsurance and its concentration of risk, primarily

in downstate New York, which exposes it to weather-related events

as well as to market, regulatory and judicial issues. Additionally,

KICO reported substantial growth in net premiums written in recent

years, driven by increased retention on its quota share reinsurance

contracts and new policy growth. However, KICO’s increased capital

position and financial flexibility are sufficient to support

management’s future growth plans. Furthermore, KICO historically

reported adverse loss reserve development in most calendar and

accident years, driven in part by historical lead paint claims.

However, loss reserve development has been modestly favorable in

recent calendar and accident years, driven by management’s

strategic initiatives.

While KICO’s single-state concentration exposes it to

weather-related events, catastrophe exposure is partially mitigated

through catastrophe reinsurance, which it has purchased at

increased limits in recent years, as well as the use of hurricane

deductibles, visual risk inspections, distance-from-shore

restrictions and surcharges. Additionally, KICO has been expanding

its operating territory to regions beyond the New York metropolitan

area.

This press release relates to Credit Ratings that have been

published on A.M. Best’s website. For all rating information

relating to the release and pertinent disclosures, including

details of the office responsible for issuing each of the

individual ratings referenced in this release, please see A.M.

Best’s Recent Rating Activity web page. For

additional information regarding the use and limitations of Credit

Rating opinions, please view Understanding Best’s Credit

Ratings.

A.M. Best is the world’s oldest and most authoritative

insurance rating and information source. For more information,

visit www.ambest.com.

Copyright © 2017 by A.M. Best Rating

Services, Inc. and/or its subsidiaries. ALL RIGHTS

RESERVED.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170412005934/en/

A.M. BestKenneth Tappen, +1 908-439-2200, ext.

5248Senior Financial

Analystkenneth.tappen@ambest.comorJoseph Burtone, +1

908-439-2200, ext.

5125Directorjoseph.burtone@ambest.comorChristopher

Sharkey, +1 908-439-2200, ext. 5159Manager, Public

Relationschristopher.sharkey@ambest.comorJim Peavy, +1

908-439-2200, ext. 5644Director, Public

Relationsjames.peavy@ambest.com

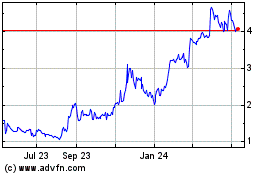

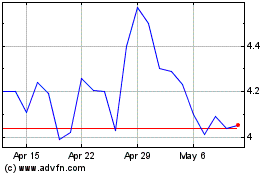

Kingstone Companies (NASDAQ:KINS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Kingstone Companies (NASDAQ:KINS)

Historical Stock Chart

From Apr 2023 to Apr 2024