|

|

The city of new York

Office of the comptroller

1 centre street

New York, NY 10007

─────────────

Scott M. Stringer

Comptroller

|

|

April 6, 2017

Vote “AGAINST” Settlement Director Barry Smitherman at NRG’s April 27 Annual Meeting

FOR Proposal 7 Requesting Disclosure of Corporate Political Spending

Dear fellow NRG Energy shareowner:

I write on behalf of the New York City Pension Funds (“NYC Funds”) to urge you to vote AGAINST director nominee Barry T. Smitherman and FOR Proposal 7, requesting political spending transparency, at the NRG Energy, Inc. (“NRG”) annual meeting on April 27, 2017. Mr. Smitherman, together with C. John Wilder, joined the NRG board in February 2017 as part of a hasty settlement with Elliott Management Corporation (“Elliott”), an activist hedge fund that first disclosed its NRG stake the prior month, and its partner Bluescape Energy Partners (collectively, “Elliott/Bluescape”).

Elliott has a record of seeking board representation as a tactic to push for the break-up or sale of a company.1 As part of its settlement with Elliott/Bluescape, NRG’s board formed a Business Review Committee (“BRC”) to review and make recommendations with respect to cost savings and asset sales, among other initiatives. Messrs. Smitherman and Wilder (collectively, “the Elliott/Bluescape Directors”) are two of three independent directors on the five-member Committee, which Mr. Wilder chairs. Our decision to oppose Mr. Smitherman’s election is based on the following concerns:

| 1. |

Elliott/Bluescape’s short-term orientation and commonly deployed strategy to seek further cost cuts and asset sales are on a collision course with NRG’s strategy to maximize long-term shareowner value, which appears to be on track and delivering strong results. Their directors have disproportionate representation on the BRC now considering the company’s future.

|

| 2. |

The NRG board appointed the two directors representing short-term investors in a hasty and deeply flawed process that limited its time to conduct due diligence, deprived most NRG shareowners of meaningful input and exposed larger concerns with its board succession planning.

|

| 3. |

Mr. Smitherman’s stated view that climate change is a “hoax” disqualifies him to serve as a director of a company that, in its 2016 Form 10-K, cites climate change as a material risk and sets forth that its strategy to maximize long-term shareowner value is predicated on managing climate-related risks while concurrently seizing market opportunities created by climate change.

|

Proposal 7 requests that the board oversee and disclose NRG’s political spending. A similar resolution received the support of 49.4% of the votes cast at NRG’s 2016 annual meeting.

The NYC Funds have $170 billion in assets under management and are substantial long-term NRG shareowners, with more than 1.27 million shares. We detail our concerns further below.

This is not a solicitation of authority to vote your proxy.

Please DO NOT send us your proxy card as it will not be accepted.

April 6, 2017

Page 2

| 1. |

Elliott/Bluescape’s apparent focus on cutting costs and selling assets at NRG jeopardizes the company’s strategy to maximize long-term shareowner value, which appears to be on track.

|

NRG is one of the largest independent power producers and retail energy providers in the U.S. As detailed in the Company’s 2016 Form 10-K, its strategy is to maximize long-term shareowner value through the safe production and sale of reliable and affordable power, while positioning itself to meet the increasing demand for sustainable, low carbon energy. Consistent with this strategy, NRG established the goal of cutting its greenhouse gas emissions by 50% by 2030, and 90% by 2050.

The company’s business segments are grouped into Generation, Retail, Renewables and NRG Yield. NRG Yield, Inc. is a publicly-traded company formed to serve as the primary vehicle through which NRG owns, operates and acquires contracted renewable and conventional generation and thermal infrastructure assets.2 NRG owned a 55.1% voting interest in NRG Yield as of December 31, 2016.

According to Mauricio Gutierrez, NRG’s President and CEO, NRG’s differentiated model provides a competitive advantage and sets “NRG apart from others in the industry;” and the integration of Generation, Retail and Renewables allows the company to “capture operational and commercial synergies in a way that makes the whole of our business greater than the sum of its parts.”3

The board named Mr. Gutierrez as CEO in December 2015 after a steep drop in NRG’s share price caused by low natural gas prices and poor performance of its residential solar business. Under Mr. Gutierrez’s leadership, NRG has scaled back residential solar and pursued a three-pronged strategy to (1) simplify and streamline the business (through significant cost savings); (2) reposition the portfolio (through asset sales and renewable investments); and (3) strengthen the balance sheet to ride out a low natural gas price environment.4

These steps appear to be paying off. NRG achieved $539 million in cost reductions compared with a 2015 baseline, far above its $400 million reduction target;5 reported strong Adjusted EBITDA of $3.3 billion in 2016, including record Adjusted EBITDA in its Retail segment; and recently reaffirmed its 2017 financial guidance.6 Significantly, from the date Mr. Gutierrez became CEO through January 13, 2017, the last trading day before Elliott and Bluescape filed their Schedule 13Ds, NRG generated total shareowner return of 36%, significantly outperforming the Utility Index and its three Bloomberg-defined peers, as highlighted in the table below.

NRG’s Total Shareowner Returns Relative to Peers

|

DATE RANGE

|

DESCRIPTION

|

NRG

|

S5UTIL

INDEX

|

CALPINE

|

AES

|

DYNEGY

|

|

1/17/17 - 3/30/17

|

Elliott/Bluescape 13D Date to Present

|

20.0

|

5.1

|

-12.7

|

-6.0

|

-26.3

|

|

12/3/15 - 1/13/17

|

Gutierrez named CEO to Pre-Elliott 13D

|

36.0

|

21.3

|

-10.3

|

28.1

|

-29.2

|

|

12/2/14 - 12/2/15

|

1 Year Before Gutierrez named CEO

|

-64.0

|

-5.8

|

-38.1

|

-28.3

|

-55.6

|

Source: Bloomberg

In light of the Company’s strategy and performance, we question the need for a BRC of the board to “review and make recommendations to the board with respect to operational and cost excellence initiatives; potential portfolio and/or asset de-consolidations, dispositions and optimization; capital structure and allocation; and broader strategic initiatives.”7 Elliott’s historically short investment time horizon and Elliott/Bluescape’s disproportionate representation on the BRC exacerbate our concerns.

This is not a solicitation of authority to vote your proxy.

Please DO NOT send us your proxy card as it will not be accepted.

| 2. |

The board’s quick settlement with Elliott/Bluescape was the result of a deeply flawed process by a board in need of a pro-active and thoughtful approach to board refreshment.

|

Elliott and its Founder/CEO Paul Singer have a record of acquiring large stakes over a short time, seeking board representation as one of its tactics to break up or sell a company, and then selling its stake.8 Based on an analysis of data compiled by Activist Insight, Elliott’s average holding period was under one year for its last 10 investment exits9; either Elliott sold its shares or the company was sold. In the case of NRG, Elliott discloses in its Schedule 13D that it began acquiring NRG shares (to form a 6.9% stake) on December 12, 2016, and Bluescape (a 2.5% stake) on November 30, 2016.

We appreciate that boards must weigh a variety of factors when deciding whether to settle with an activist. The NRG board, however, has not explained why it agreed to its settlement with Elliott/Bluescape. Given the apparent conflicts between Elliott’s and NRG’s respective time horizons and resulting business priorities, and our specific concerns with Mr. Smitherman described below, shareowners are left wondering whether a settlement with short-term oriented investors was reached too soon and whether prior engagement with NRG’s long-term investors would have led to a better result for the company and all of its shareowners.

Given long director tenures – six of 13 directors have served on the board for at least 10 years (a seventh long-tenured director retired as part of the settlement with Elliott/Bluescape) – and lack of adequate racial and gender diversity on NRG’s board, we believe the board should promptly develop a robust refreshment and succession planning process that (a) seeks diverse directors with the mix of relevant skills, experiences and backgrounds necessary to oversee effectively the company’s business strategy and risks and (b) engages NRG’s long-term shareowners.

| 3. |

The board’s flawed process led to the appointment of director Smitherman, whose view that climate change is a “hoax” disqualifies him to oversee NRG’s strategy and risks.

|

As a candidate for Texas Attorney General in 2013, Mr. Smitherman boasted that he had “been battling this global warming hoax for 6 years now. The earth is not warming…" While at a conference of utility commissioners in 2013, Mr. Smitherman tweeted from the conference, “Don’t be fooled — not everyone believes in global warming.”10 And in an interview with the Associated Press in 2013, Mr. Smitherman told a reporter that “[c]limate change is, in my estimation, not an issue associated with CO2 and greenhouse gasses.”11

As long-term shareowners, we believe that NRG’s board should have diverse skills, experience and perspectives. But directors’ diverse perspectives can only foster better board decision-making if they are rooted in a shared understanding of relevant facts and science. In light of Mr. Smitherman’s stated views on climate change, which are incompatible with NRG’s disclosed business strategy and risks, we question his ability to act in the best interests of NRG and its shareowners. Additionally, we believe his role on the board sends a demoralizing message to the many NRG employees responsible for implementing the company’s existing business strategy and managing its risks.

This is not a solicitation of authority to vote your proxy.

Please DO NOT send us your proxy card as it will not be accepted.

NRG lacks a system of transparency and accountability for its political activity, which poses financial and reputational risks to the company and warrants support FOR Proposal 7.

NRG lags many utility companies that publicly disclose political spending, including AES Corporation, AGL Resources, American Electric Power, Dominion Resources, Edison International, Entergy, Exelon, and PPL Corporation. Among other concerns, NRG does not currently disclose potentially significant contributions that may be channeled anonymously into the political process through trade associations and non-profit groups that need not disclose contributions. Such payments may far surpass the contributions that must be publicly reported.

The NYC Funds believe that companies should ensure robust board oversight of political contributions and full transparency by disclosing corporate assets spent in this area, consistent with our request in Proposal 7. A similar resolution received substantial shareowner support, equal to 49.4% of the votes cast, at NRG’s 2016 annual meeting.

* * *

In light of the above concerns, we urge our fellow investors to vote AGAINST Mr. Smitherman and FOR Proposal 7.

Please contact Michael Garland, Assistant Comptroller for Corporate Governance and Responsible Investment, at mgarlan@comptroller.nyc.gov or (212) 669-2517, for additional information.

Sincerely,

Scott M. Stringer

New York City Comptroller

1 See “Profiles of Selected Shareholder Activists”, issued by Lazard, September 2016, page 28; and current SharkRepellent’s Activist Profile on Elliott, page 1. In addition, as detailed on page 3 above, Elliott’s average holding period leading up to its last 10 investment exits was under one year.

3 NRG Energy Q4 2016 Results - Earnings Call Transcript https://seekingalpha.com/article/4050498-nrg-energy-nrg-q4-2016-results-earnings-call-transcript?page=2.

4 Fourth Quarter 2016 Earnings Presentation, NRG Energy, 2/28/2017 http://investors.nrg.com/phoenix.zhtml?c=121544&p=irol-EventDetails&EventId=5246552.

5 Fourth Quarter 2016 Earnings Presentation, NRG Energy, 2/28/2017 http://investors.nrg.com/phoenix.zhtml?c=121544&p=irol-EventDetails&EventId=5246552.

6 NRG Energy Press Release on its 2016 Results and 2017 Financial Guidance, 2/28/2017 http://investors.nrg.com/phoenix.zhtml?c=121544&p=irol-newsArticle&ID=2250009.

7 NRG Energy 2017 proxy statement, page 13 http://investors.nrg.com/phoenix.zhtml?c=121544&p=irol-SECText&TEXT=aHR0cDovL2FwaS50ZW5rd2l6YXJkLmNvbS9maWxpbmcueG1sP2lwYWdlPTExNDczNTg3JkRTRVE9MCZTRVE9MCZTUURFU0M9U0VDVElPTl9FTlRJUkUmc3Vic2lkPTU3.

8 See footnote 1 above.

9 Excludes a Swedish company, Industrial and Financial Systems AB, for which data was unavailable. For these calculations, holding periods are based on when Elliott filed its Schedule 13D for each investment.

10 See “Scientific consensus remains that the planet is warming,” Politifact, 12/13/13 http://www.politifact.com/texas/statements/2013/dec/13/barry-smitherman/scientific-consensus-remains-planet-warming/; and “Head Texas Oil and Gas Regulator Questions Climate Change,” NPR, 7/25/13 https://stateimpact.npr.org/texas/2013/07/25/head-texas-oil-and-gas-regulator-questions-climate-change/.

11 http://lubbockonline.com/texas/2013-11-10/ag-candidate-smitherman-aborted-would-vote-gop.

This is not a solicitation of authority to vote your proxy.

Please DO NOT send us your proxy card as it will not be accepted.

This regulatory filing also includes additional resources:

j46171px14a6g.pdf

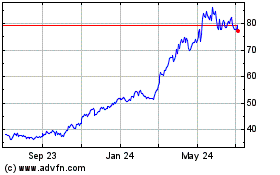

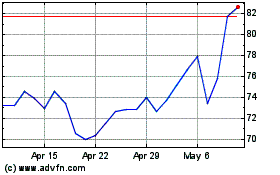

NRG Energy (NYSE:NRG)

Historical Stock Chart

From Mar 2024 to Apr 2024

NRG Energy (NYSE:NRG)

Historical Stock Chart

From Apr 2023 to Apr 2024