Kayne Anderson Midstream/Energy Fund Provides Unaudited Balance Sheet Information & Announces its Net Asset Value & Asset Cov...

April 03 2017 - 8:50PM

Business Wire

Kayne Anderson Midstream/Energy Fund, Inc. (the “Fund”)

(NYSE:KMF) today provided a summary unaudited statement of assets

and liabilities and announced its net asset value and asset

coverage ratios under the Investment Company Act of 1940 (the “1940

Act”) as of March 31, 2017.

As of March 31, 2017, the Fund’s net assets were $396.3 million

and its net asset value per share was $17.98. As of March 31, 2017,

the Fund’s asset coverage ratio under the 1940 Act with respect to

senior securities representing indebtedness was 462% and the Fund’s

asset coverage ratio under the 1940 Act with respect to total

leverage (debt and preferred stock) was 357%.

Kayne Anderson Midstream/Energy Fund,

Inc.

Statement of Assets and Liabilities March 31, 2017

(Unaudited) (in millions) Per

Share Investments $ 550.1 $ 24.96 Cash and cash equivalents 0.5

0.02 Deposits 0.3 0.01 Accrued income 1.4 0.07 Receivables for

securities sold 3.8 0.17 Other assets 1.9 0.09 Total

assets 558.0 25.32 Term loan 28.0 1.27 Senior

notes 91.0 4.13 Preferred stock 35.0 1.59 Total

leverage 154.0 6.99 Payable for securities

purchased 6.2 0.28 Other liabilities 1.5 0.07 Total

liabilities 7.7 0.35 Net assets $ 396.3 $ 17.98 The

Fund had 22,034,170 common shares outstanding as of March 31, 2017.

As of March 31, 2017, equity and debt investments were 86% and

14%, respectively, of the Fund’s long-term investments of $550

million. Long-term investments were comprised of Midstream Company

(46%), MLP and MLP Affiliate (38%), Other Energy (2%), and Debt

(14%).

The Fund’s ten largest holdings by issuer at March 31, 2017

were:

Units / Shares

(in

thousands)

Amount

($

millions)

Percent ofLong-TermInvestments

1. ONEOK, Inc. (Midstream Company)* 807 $44.8 8.1% 2. Plains GP

Holdings, L.P. (Midstream MLP) 1,356 42.6 7.7% 3. Enbridge Energy

Management, L.L.C. (Midstream MLP) 1,805 33.2 6.0% 4. Targa

Resources Corp. (Midstream Company) 552 33.1 6.0% 5. The Williams

Companies, Inc. (Midstream Company) 1,084 32.1 5.8% 6. Enbridge,

Inc. (Midstream Company) 477 20.0 3.6% 7. KNOT Offshore Partners LP

(Midstream Company) 802 18.7 3.4% 8. GasLog Partners LP (Midstream

Company) 740 18.1 3.3% 9. Golar LNG Partners LP (Midstream Company)

752 16.8 3.0% 10. Energy Transfer Partners, L.P. (Midstream MLP)**

423 15.4 2.8% _____________

* On February 1, 2017, ONEOK, Inc. (“OKE”) and ONEOK Partners, L.P.

(“OKS”) announced an agreement to combine in a stock-for-unit

merger transaction. On a combined basis, OKE and OKS represent 9.3%

of long-term investments as of March 31, 2017. ** On

November 21, 2016, Energy Transfer Partners, L.P. (“ETP”) and

Sunoco Logistics Partners L.P. (“SXL”) announced an agreement to

combine in a unit-for-unit merger. On a combined basis, ETP and SXL

represent 4.4% of long-term investments as of March 31, 2017.

The Fund is a non-diversified, closed-end management investment

company registered under the Investment Company Act of 1940 whose

common stock is traded on the NYSE. The Fund’s investment objective

is to provide a high level of total return with an emphasis on

making quarterly cash distributions to its stockholders by

investing at least 80% of its total assets in securities of

companies in the Midstream/Energy Sector, consisting of: (a)

Midstream Master Limited Partnerships (“MLPs”), (b) Midstream

Companies, (c) Other MLPs and (d) Other Energy Companies. The Fund

anticipates that the majority of its investments will consist of

investments in Midstream MLPs and Midstream Companies. See Glossary

of Key Terms on page ii of the Prospectus for definitions of

certain key terms.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS: This press

release contains "forward-looking statements" as defined under the

U.S. federal securities laws. Generally, the words "believe,"

"expect," "intend," "estimate," "anticipate," "project," "will" and

similar expressions identify forward-looking statements, which

generally are not historical in nature. Forward-looking statements

are subject to certain risks and uncertainties that could cause

actual results to differ from the Fund’s historical experience and

its present expectations or projections indicated in any

forward-looking statements. These risks include, but are not

limited to, changes in economic and political conditions;

regulatory and legal changes; MLP industry risk; leverage risk;

valuation risk; interest rate risk; tax risk; and other risks

discussed in the Fund’s filings with the SEC. You should not place

undue reliance on forward-looking statements, which speak only as

of the date they are made. The Fund undertakes no obligation to

publicly update or revise any forward-looking statements made

herein. There is no assurance that the Fund’s investment objective

will be attained.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170403006700/en/

KA Fund Advisors, LLCMonique Vo,

877-657-3863http://www.kaynefunds.com/

Kayne Anderson NextGen E... (NYSE:KMF)

Historical Stock Chart

From Aug 2024 to Sep 2024

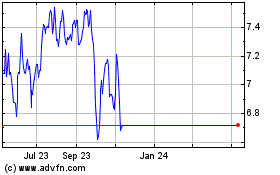

Kayne Anderson NextGen E... (NYSE:KMF)

Historical Stock Chart

From Sep 2023 to Sep 2024