Neonode Inc. (NASDAQ:NEON), the Optical Interactive Sensing

Technology Company, today reported financial results for the fourth

quarter and year ended December 31, 2016.

Highlights:

- Automotive customers sold 940,000 cars with zForce in 2016, a

167% increase over 2015

- Printer customers sold 8.8 million printers with zForce in

2016, a 56% increase over 2015

- Shipped approximately 9,000 AirBar units in Q4 2016

- We established global distribution for our consumer products

with the largest distributor in the world, Ingram Micro

- More than 44 million products on the market with Neonode

technology today

- Entered into a Joint Venture with SmartEye AB to merge

eye-tracking and touch in a sensor module

“In 2016 we focused investments in the development of our

technology and highly automated manufacturing processes. We are now

able to offer embedded hardware sensors to our customers which

allows them to reduce time to market for their products. Selling

modules enable us to enter new markets and earn higher profits

compared to licensing,” said Thomas Eriksson, Neonode CEO. “We

reached a key milestone in December when we started shipping our

first consumer electronics product, AirBar.”

“AirBar is powered by our sensor modules which we now produce

and ship in volume. In 2016, we established a global distribution

channel with Ingram Micro and began shipping our 15.6 inch version

for PCs. Consumers now can purchase AirBar through major retailers

such as Amazon, Best Buy and Walmart. At CES in January 2017, we

announced our new AirBar for Apple MacBook Air and new sizes for

Windows based PCs. These products are scheduled to ship by the end

of March 2017. To expand sales, AirBar will be available soon on

Dell.com in the US and later in Europe and India,” continued Mr.

Eriksson.

“In 2016 licensing revenue increased driven by our automotive

and printer customers. Automotive license revenues increased 126%

over 2015 and printer license revenues increased 64%. Our customers

continue to release new products and we expect license revenues to

continue to increase in 2017. We now have licensing, modules and

consumer products contributing to our total revenues,” concluded

Mr. Eriksson.

Financial Results for the Fourth Quarter and Year Ended

December 31, 2016

Our revenue for fiscal 2016 was $10.2 million, an 8% decrease

compared to $11.1 million in fiscal 2015. In 2016 the majority of

our revenue was derived from license fees and we had much lower

non-recurring engineering fees (“NRE”) compared to 2015. License

fees represented 82% of our total revenue in 2016 compared to 63%

in 2015 and increased a total of 18.5% in 2016 compared to 2015

primarily due to a 64% increase in license fees earned from our

printer customers and a 126% increase in license fees earned from

our automotive customers which was partially offset by a 49%

decrease in license fees earned from our e-reader customers.

NRE revenue decreased 58% in 2016 as compared to 2015 because we

have been able to reduce the number of full custom design projects

as we begin offering sensor modules to our customers. In 2016, we

continued to earn NRE revenue from a limited number of design

projects that are primarily targeted for future inclusion of sensor

modules. 79% of our total NRE revenues in 2016 were earned from

automotive projects.

In Q4 2016, we started manufacturing and selling AirBar, our

first branded consumer product using our sensor modules. We

recorded $0.1 million of sales revenue and approximately $0.1

million to deferred revenue related to our AirBar shipments in

2016. Deferred revenue represents shipments of AirBar to our

distributors that they purchased and held in inventory at year

end.

Our combined total gross margin is 87% in 2016 compared to 66%

in 2015. The increase in gross margin is primarily due to a higher

percentage of our total revenue is derived from license fees in

2016 compared to 2015. License fees have a 100% gross margin and to

the extent they are a higher percentage of our total revenue our

overall gross margin will be higher. In 2016, license fees

accounted for 82% of total revenue compared to 63% in 2015. NRE

projects accounted for the most of the remaining revenue and had a

25% gross margin in 2016 compared to 7% in 2015. Our cost of

revenues for 2015 includes a $1.2 million one-time write-off

related to cost to develop our zForce PLUS platform because we now

primarily use zForce AIR in our new sensor modules.

Operating expenses decreased 7% to $14.0 million for fiscal 2016

compared to $15.0 million for fiscal 2015. Research and development

expense (“R&D”) increased 13% in 2016 to $7.1 million compared

to $6.3 million in 2015. Included in R&D expense for 2016 are

investments of $1.1 million of pre-production manufacturing

start-up costs and approximately $0.8 million of non-recurring

expenses related to final development of the new NN1003 ASIC. Our

sales and marketing expenses for 2016 decreased 24% over 2015. The

decrease is primarily related to decrease in salaries related to a

reduction in headcount and a reduction in stock option expense.

Total general & administrative expenses for 2016 decreased 18%

over 2015. These decreases are primarily related to a decrease in

salaries related to a reduction in headcount and a reduction in

stock option expense.

Net loss for fiscal 2016 was $5.3 million, or $0.12 per share,

compared to a net loss of $7.8 million, or $0.19 per share, in

fiscal 2015.

Our revenue for the fourth quarter of fiscal 2016 is $2.9

million, a 3% decrease, compared to $3.0 million for the fourth

quarter of 2015. Revenues for the fourth quarter of fiscal 2016

included $2.3 million from license fees, $0.5 million, from NRE

fees and $0.1 million from sales of AirBar compared to revenues of

$1.7 million from license fees and $1.3 million from NRE fees for

the fourth quarter of 2015. Our gross margin was $2.5 million, or

89%, in 2016 compared to $1.2 million, or 39%, in the same quarter

of 2015. Our cost of revenues in 2015 included the development

write-offs discussed above. Our total operating expenses of $3.0

million for the fourth quarter of 2016 were on plan and were a 20%

decrease, compared to $3.7 million for the fourth quarter 2015. Net

loss for the fourth quarter of fiscal 2016 was $0.4 million, or

$0.01 loss per share, compared to a net loss of $2.6 million, or

$0.06 loss per share, for the fourth quarter in 2015.

Cash and accounts receivable totaled $5.0

million at December 31, 2016 compared to $4.4 million at December

31, 2015. Common shares on a fully diluted basis including common

stock, stock options and warrant outstanding totaled approximately

58.6 million shares on December 31, 2016 compared to approximately

46.5 million shares at December 31, 2015.

Shelf Registration Filing

Neonode today also is filing a shelf

registration statement to replace the existing shelf registration

statement filed by Neonode in 2014, which is set to expire in June

after a three-year term. Under the replacement shelf registration

statement, once declared effective by the Securities and Exchange

Commission, Neonode may offer and sell from time to time in the

future, in one or more offerings, common stock having a maximum

aggregate offering price of $20 million.

Conference Call Information

Neonode will host a conference call Wednesday

March 15, 2017 at 10AM Eastern Daylight Time (EDT)/3PM Central

European Time (CET) featuring remarks by, and Q&A with, Thomas

Eriksson, CEO, Lars Lindqvist, CFO and David Brunton, Head of

Investor Relations.

The dial-in number for the conference call is

toll-free: (877) 539-0733 (U.S. domestic) or +1 (678) 607-2005

(international). To access the call all participants must use the

following Conference ID: #66598269. Please make sure to call at

least five minutes before the scheduled start time.

To register for the call, and listen online, please

click:http://event.on24.com/wcc/r/1362245-1/05819A93C8A4ECCB9DEFF52235F3BE20

For interested individuals unable to join the

live event, a digital recording for replay will be available for 30

days after the call's completion – 3/15/2017 (13:00PM EDT) to

4/15/2017 (23:59PM EDT). To access the recording, please use one of

these Dial-In Numbers (800) 585-8367 or (404) 537-3406, and the

Conference ID #66598269.

About NeonodeNeonode Inc. (NASDAQ:NEON)

develops and licenses optical interactive sensing technologies.

Neonode’s patented optical interactive sensing technology is

developed for a wide range of devices like automotive systems,

printers, PC devices, monitors, mobile phones, tablets and

e-readers. NEONODE and the NEONODE Logo are trademarks of Neonode

Inc. registered in the United States and other countries. AIRBAR is

a trademark of Neonode Inc. All other trademarks are the property

of their respective owners.

For more information please visit www.neonode.com.

Safe Harbor Statement

This press release contains forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. These include, but are not limited to,

statements relating to expectations, future performance or future

events, and product cost, performance, and functionality matters.

These statements are based on current assumptions, expectations and

information available to Neonode management and involve a number of

known and unknown risks, uncertainties and other factors that may

cause Neonode's actual results, levels of activity, performance or

achievements to be materially different from any expressed or

implied by these forward-looking statements.

These risks, uncertainties, and factors are

discussed under "Risk Factors" and elsewhere in Neonode's public

filings with the U.S. Securities and Exchange Commission from time

to time, including Neonode's annual report on Form 10-K, quarterly

reports on Form 10-Q, and current reports on Form 8-K. You are

advised to carefully consider these various risks, uncertainties

and other factors. Although Neonode management believes that the

forward-looking statements contained in this press release are

reasonable, it can give no assurance that its expectations will be

fulfilled. Forward-looking statements are made as of today's date,

and Neonode undertakes no duty to update or revise them.

Disclaimer

A shelf registration statement as described in

this press release is being filed with the Securities and Exchange

Commission but has not yet become effective. Securities may not be

sold nor may offers to buy be accepted prior to the time the shelf

registration statement becomes effective. This press release does

not constitute an offer to sell or the solicitation of an offer to

buy securities, nor shall there be any sale of the securities in

any state or jurisdiction in which such offer, solicitation or sale

would be unlawful prior to the registration or qualification under

the securities laws of any such state or jurisdiction. Any offering

of the securities covered by the shelf registration statement will

only be by means of a prospectus and an accompanying prospectus

supplement.

| |

| NEONODE INC. |

| CONSOLIDATED BALANCE SHEETS |

| (In thousands, except share and per share amounts) |

| |

| |

|

As of December 31, 2016 |

|

|

As of December 31, 2015 |

|

|

ASSETS |

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

| Cash |

|

$ |

3,476 |

|

|

$ |

3,082 |

|

| Accounts

receivable, net |

|

|

1,548 |

|

|

|

1,346 |

|

| Projects

in process |

|

|

- |

|

|

|

158 |

|

|

Inventory |

|

|

696 |

|

|

|

- |

|

| Prepaid

expenses and other current assets |

|

|

1,949 |

|

|

|

747 |

|

| Total

current assets |

|

|

7,669 |

|

|

|

5,333 |

|

| |

|

|

|

|

|

|

|

|

| Investment in joint

venture |

|

|

3 |

|

|

|

- |

|

| Property and equipment,

net |

|

|

2,031 |

|

|

|

594 |

|

| Total

assets |

|

$ |

9,703 |

|

|

$ |

5,927 |

|

| |

|

|

|

|

|

|

|

|

| LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

|

|

|

| Accounts

payable |

|

$ |

1,286 |

|

|

$ |

965 |

|

| Accrued

payroll and employee benefits |

|

|

1,001 |

|

|

|

932 |

|

| Accrued

expenses |

|

|

172 |

|

|

|

382 |

|

| Deferred

revenues |

|

|

1,921 |

|

|

|

1,475 |

|

| Current

portion of capital lease obligations |

|

|

228 |

|

|

|

57 |

|

| Total

current liabilities |

|

|

4,608 |

|

|

|

3,811 |

|

| |

|

|

|

|

|

|

|

|

| Capital lease

obligation, net of current portion |

|

|

960 |

|

|

|

283 |

|

| Total

liabilities |

|

|

5,568 |

|

|

|

4,094 |

|

| |

|

|

|

|

|

|

|

|

| Commitments and

contingencies |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Stockholders’

equity |

|

|

|

|

|

|

|

|

| Series B

Preferred stock, 54,425 shares authorized with par value of

$0.001; 83 shares |

|

|

|

|

|

|

|

|

| issued

and outstanding at December 31, 2016 and 2015, respectively.

(In the event |

|

|

|

|

|

|

|

|

| of

dissolution, each share of Series B Preferred stock has a

liquidation preference |

|

|

|

|

|

|

|

|

| equal to

par value of $0.001 over the shares of common stock) |

|

|

- |

|

|

|

- |

|

| Common

stock, 70,000,000 shares authorized at December 31, 2016 and

2015, |

|

|

|

|

|

|

|

|

|

respectively, with par value of $0.001; 48,844,503 and 43,805,586

shares issued |

|

|

|

|

|

|

|

|

| and

outstanding at December 31, 2016 and 2015, respectively |

|

|

49 |

|

|

|

44 |

|

|

Additional paid-in capital |

|

|

183,667 |

|

|

|

175,504 |

|

|

Accumulated other comprehensive (loss) income |

|

|

(171 |

) |

|

|

46 |

|

|

Accumulated deficit |

|

|

(179,040 |

) |

|

|

(173,749 |

) |

| Total

Neonode Inc. stockholders’ equity |

|

|

4,505 |

|

|

|

1,845 |

|

| Noncontrolling

interests |

|

|

(370 |

) |

|

|

(12 |

) |

| Total

stockholders’ equity |

|

|

4,135 |

|

|

|

1,833 |

|

| Total

liabilities and stockholders’ equity |

|

$ |

9,703 |

|

|

$ |

5,927 |

|

| |

| NEONODE INC. |

| CONSOLIDATED STATEMENTS OF

OPERATIONS |

| (In thousands, except per share amounts) |

|

|

| |

|

Years Ended December 31, |

|

|

|

|

2016 |

|

|

2015 |

|

|

2014 |

|

| Revenue: |

|

|

|

|

|

|

|

|

|

| License fees |

|

$ |

8,350 |

|

|

$ |

7,045 |

|

|

$ |

3,156 |

|

| Sensor modules

sales |

|

|

149 |

|

|

|

- |

|

|

|

- |

|

| Non-recurring

engineering |

|

|

1,714 |

|

|

|

4,070 |

|

|

|

1,584 |

|

| Total revenues |

|

|

10,213 |

|

|

|

11,115 |

|

|

|

4,740 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

| Sensor module |

|

|

54 |

|

|

|

- |

|

|

|

- |

|

| Non-recurring

engineering |

|

|

1,284 |

|

|

|

3,780 |

|

|

|

1,509 |

|

| Total cost of

revenues |

|

|

1,338 |

|

|

|

3,780 |

|

|

|

1,509 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Total gross margin |

|

|

8,875 |

|

|

|

7,335 |

|

|

|

3,231 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

| Research and

development |

|

|

7,069 |

|

|

|

6,279 |

|

|

|

7,373 |

|

| Sales and

marketing |

|

|

2,857 |

|

|

|

3,753 |

|

|

|

3,250 |

|

| General and

administrative |

|

|

4,093 |

|

|

|

4,999 |

|

|

|

6,799 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total

operating expenses |

|

|

14,019 |

|

|

|

15,031 |

|

|

|

17,422 |

|

| Operating loss |

|

|

(5,144 |

) |

|

|

(7,696 |

) |

|

|

(14,191 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Other expense,

net: |

|

|

|

|

|

|

|

|

|

|

|

|

| Interest expense |

|

|

(47 |

) |

|

|

(18 |

) |

|

|

(14 |

) |

| Other expense, net |

|

|

(91 |

) |

|

|

(28 |

) |

|

|

(16 |

) |

| Total other expense,

net |

|

|

(138 |

) |

|

|

(46 |

) |

|

|

(30 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Loss before provision

for income taxes |

|

|

(5,282 |

) |

|

|

(7,742 |

) |

|

|

(14,221 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Provision for income

taxes |

|

|

367 |

|

|

|

93 |

|

|

|

13 |

|

| Net loss including

noncontrolling interests |

|

|

(5,649 |

) |

|

|

(7,835 |

) |

|

|

(14,234 |

) |

| Less: Net loss

attributable to noncontrolling interests |

|

|

358 |

|

|

|

15 |

|

|

|

- |

|

| Net loss attributable

to Neonode Inc. |

|

$ |

(5,291 |

) |

|

$ |

(7,820 |

) |

|

$ |

(14,234 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Loss per common

share: |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and diluted loss

per share |

|

$ |

(0.12 |

) |

|

$ |

(0.19 |

) |

|

$ |

(0.36 |

) |

| Basic and diluted –

weighted average number of common shares outstanding |

|

|

45,690 |

|

|

|

41,202 |

|

|

|

39,532 |

|

|

|

| NEONODE INC. |

| CONSOLIDATED STATEMENTS OF COMPREHENSIVE

LOSS |

| (In thousands) |

|

|

| |

|

Years ended December 31, |

|

| |

|

2016 |

|

|

2015 |

|

|

2014 |

|

| |

|

|

|

|

|

|

|

|

|

| Net loss including

noncontrolling interests |

|

$ |

(5,649 |

) |

|

$ |

(7,835 |

) |

|

$ |

(14,234 |

) |

| Other comprehensive

income (loss): |

|

|

|

|

|

|

|

|

|

|

|

|

| Foreign currency

translation adjustments |

|

|

(217 |

) |

|

|

(103 |

) |

|

|

138 |

|

| Comprehensive loss |

|

|

(5,866 |

) |

|

|

(7,938 |

) |

|

|

(14,096 |

) |

| Less: Comprehensive

loss attributable to noncontrolling interests |

|

|

358 |

|

|

|

15 |

|

|

|

- |

|

| Comprehensive loss

attributable to Neonode Inc. |

|

$ |

(5,508 |

) |

|

$ |

(7,923 |

) |

|

$ |

(14,096 |

) |

|

|

| NEONODE INC |

| CONSOLIDATED STATEMENTS OF STOCKHOLDERS’

EQUITY |

| (In thousands) |

|

|

| |

|

Series BPreferredStock Shares Issued |

|

|

Series BPreferredStock Amount |

|

|

CommonStockShares Issued |

|

|

Common StockAmount |

|

|

AdditionalPaid-inCapital |

|

|

AccumulatedOther ComprehensiveIncome (loss) |

|

|

Accumulated Deficit |

|

|

Total Neonode Inc. Stockholders’Equity |

|

|

Noncontrolling Interests |

|

|

TotalStockholders’Equity |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balances, January 1, 2014 |

|

|

83 |

|

|

$ |

- |

|

|

|

37,934 |

|

|

$ |

38 |

|

|

$ |

157,994 |

|

|

$ |

11 |

|

|

$ |

(151,695 |

) |

|

$ |

6,348 |

|

|

$ |

- |

|

|

$ |

6,348 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stock option and

warrant compensation expense to employees, directors and

vendors |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

1,729 |

|

|

|

- |

|

|

|

- |

|

|

|

1,729 |

|

|

|

- |

|

|

|

1,729 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Proceeds from sale

ofcommon stock, net ofoffering costs |

|

|

- |

|

|

|

- |

|

|

|

2,500 |

|

|

|

2 |

|

|

|

9,251 |

|

|

|

- |

|

|

|

- |

|

|

|

9,253 |

|

|

|

- |

|

|

|

9,253 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Common stock issuedupon

exercise of commonstock warrants |

|

|

- |

|

|

|

- |

|

|

|

21 |

|

|

|

- |

|

|

|

36 |

|

|

|

- |

|

|

|

- |

|

|

|

36 |

|

|

|

- |

|

|

|

36 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Foreign

currencytranslation adjustment |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

138 |

|

|

|

- |

|

|

|

138 |

|

|

|

- |

|

|

|

138 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(14,234 |

) |

|

|

(14,234 |

) |

|

|

- |

|

|

|

(14,234 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balances, December 31, 2014 |

|

|

83 |

|

|

$ |

- |

|

|

|

40,455 |

|

|

$ |

40 |

|

|

$ |

169,010 |

|

|

$ |

149 |

|

|

$ |

(165,929 |

) |

|

$ |

3,270 |

|

|

$ |

- |

|

|

$ |

3,270 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stock option and

warrant compensation expense toemployees, directors and

vendors |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

1,075 |

|

|

|

- |

|

|

|

- |

|

|

|

1,075 |

|

|

|

- |

|

|

|

1,075 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Proceeds from sale

ofcommon stock, net ofoffering costs |

|

|

- |

|

|

|

- |

|

|

|

3,200 |

|

|

|

3 |

|

|

|

5,419 |

|

|

|

- |

|

|

|

- |

|

|

|

5,422 |

|

|

|

- |

|

|

|

5,422 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Common stock issuedupon

exercise of common stock warrants |

|

|

- |

|

|

|

- |

|

|

|

151 |

|

|

|

1 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

1 |

|

|

|

- |

|

|

|

1 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Foreign currency

translation adjustment |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(103 |

) |

|

|

- |

|

|

|

(103 |

) |

|

|

- |

|

|

|

(103 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-controlling

interestsPronode initial contribution |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

3 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(7,820 |

) |

|

|

(7,820 |

) |

|

|

(15 |

) |

|

|

(7,835 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balances, December 31, 2015 |

|

|

83 |

|

|

$ |

- |

|

|

|

43,806 |

|

|

$ |

44 |

|

|

$ |

175,504 |

|

|

$ |

46 |

|

|

$ |

(173,749 |

) |

|

$ |

1,845 |

|

|

$ |

(12 |

) |

|

$ |

1,833 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stock option

compensationexpense to employees, directors and vendors |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

255 |

|

|

|

- |

|

|

|

- |

|

|

|

255 |

|

|

|

- |

|

|

|

255 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Proceeds from sale

ofcommon stock and pre-fundedwarrants, net of offering costs |

|

|

- |

|

|

|

- |

|

|

|

5,027 |

|

|

|

5 |

|

|

|

7,908 |

|

|

|

- |

|

|

|

- |

|

|

|

7,913 |

|

|

|

- |

|

|

|

7,913 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Common stock issued

uponexercise of common stockwarrants |

|

|

- |

|

|

|

- |

|

|

|

12 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Foreign currency

translationadjustment |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(217 |

) |

|

|

- |

|

|

|

(217 |

) |

|

|

- |

|

|

|

(217 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(5,291 |

) |

|

|

(5,291 |

) |

|

|

(358 |

) |

|

|

(5,649 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balances,

December 31, 2016 |

|

|

83 |

|

|

$ |

- |

|

|

|

48,845 |

|

|

$ |

49 |

|

|

$ |

183,667 |

|

|

$ |

(171 |

) |

|

$ |

(179,040 |

) |

|

$ |

4,505 |

|

|

$ |

(370 |

) |

|

$ |

4,135 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NEONODE INC. |

| CONSOLIDATED STATEMENTS OF CASH

FLOWS |

| (In thousands) |

| |

|

|

|

Years Ended December 31, |

|

|

|

|

2016 |

|

|

2015 |

|

|

2014 |

|

|

|

|

|

|

|

|

|

|

|

|

| Cash flows from

operating activities: |

|

|

|

|

|

|

|

|

|

| Net loss

(including noncontrolling interests) |

|

$ |

(5,649 |

) |

|

$ |

(7,835 |

) |

|

$ |

(14,234 |

) |

|

Adjustments to reconcile net loss to net cash used in operating

activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation expense |

|

|

255 |

|

|

|

1,075 |

|

|

|

1,729 |

|

| Bad debt

expense |

|

|

- |

|

|

|

- |

|

|

|

167 |

|

|

Depreciation and amortization |

|

|

360 |

|

|

|

187 |

|

|

|

202 |

|

| Loss on

disposal of property and equipment |

|

|

91 |

|

|

|

28 |

|

|

|

16 |

|

| Changes

in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

| Accounts

receivable |

|

|

(204 |

) |

|

|

(239 |

) |

|

|

(304 |

) |

| Projects

in process |

|

|

158 |

|

|

|

38 |

|

|

|

530 |

|

|

Inventory |

|

|

(737 |

) |

|

|

- |

|

|

|

- |

|

| Prepaid

expenses and other current assets |

|

|

(1,316 |

) |

|

|

(263 |

) |

|

|

(60 |

) |

| Accounts

payable and accrued expenses |

|

|

343 |

|

|

|

871 |

|

|

|

363 |

|

| Deferred

revenues |

|

|

447 |

|

|

|

(1,925 |

) |

|

|

(233 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net cash

used in operating activities |

|

|

(6,252 |

) |

|

|

(8,063 |

) |

|

|

(11,824 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Cash flows from

investing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

| Purchase

of property and equipment |

|

|

(987 |

) |

|

|

(198 |

) |

|

|

(115 |

) |

|

Investment in joint venture |

|

|

(3 |

) |

|

|

- |

|

|

|

- |

|

| Proceeds

from sale of property and equipment |

|

|

5 |

|

|

|

- |

|

|

|

7 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net cash

used in investing activities |

|

|

(985 |

) |

|

|

(198 |

) |

|

|

(108 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Cash flow from

financing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

| Proceeds

from exercise of warrants |

|

|

- |

|

|

|

- |

|

|

|

36 |

|

| Proceeds

from issuance of common stock and pre-funded warrants, net of

offering costs |

|

|

7,913 |

|

|

|

5,422 |

|

|

|

9,253 |

|

|

Contributions from noncontrolling interests |

|

|

- |

|

|

|

3 |

|

|

|

- |

|

| Principal

payments on capital lease obligations |

|

|

(116 |

) |

|

|

(57 |

) |

|

|

(34 |

) |

| Net cash

provided by financing activities |

|

|

7,797 |

|

|

|

5,368 |

|

|

|

9,255 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Effect of exchange rate

changes on cash |

|

|

(166 |

) |

|

|

(154 |

) |

|

|

(9 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net change in cash |

|

|

394 |

|

|

|

(3,047 |

) |

|

|

(2,686 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Cash at beginning of

year |

|

|

3,082 |

|

|

|

6,129 |

|

|

|

8,815 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Cash at end of

year |

|

$ |

3,476 |

|

|

$ |

3,082 |

|

|

$ |

6,129 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Supplemental disclosure

of cash flow information: |

|

|

|

|

|

|

|

|

|

|

|

|

| Cash paid

for interest |

|

$ |

48 |

|

|

$ |

18 |

|

|

$ |

14 |

|

| Cash paid

for income taxes |

|

$ |

367 |

|

|

$ |

93 |

|

|

$ |

5 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Supplemental disclosure

of non-cash investing and financing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

| Purchase

of equipment with capital lease obligation |

|

$ |

983 |

|

|

$ |

- |

|

|

$ |

530 |

|

For more information, please contact:

Investor Relations:

David Brunton

Email: david.brunton@neonode.com

CFO

Lars Lindqvist

E-mail: lars.lindqvist@neonode.com

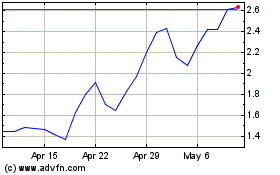

Neonode (NASDAQ:NEON)

Historical Stock Chart

From Mar 2024 to Apr 2024

Neonode (NASDAQ:NEON)

Historical Stock Chart

From Apr 2023 to Apr 2024