UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

SCHEDULE 14A INFORMATION

(Rule 14a-101)

Proxy Statement Pursuant to Section 14(a) of the

Securities and Exchange Act of 1934

(Amendment No. )

|

|

|

|

|

|

|

|

Filed by the Registrant

|

þ

|

Filed by a Party other than the Registrant

|

o

|

|

|

|

|

|

|

Check the appropriate box:

|

|

o

|

Preliminary Proxy Statement

|

|

o

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

þ

|

Definitive Proxy Statement

|

|

o

|

Definitive Additional Materials

|

|

o

|

Soliciting Material Pursuant to Section 240.14a-12

|

The Dixie Group, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

|

|

|

|

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

þ

|

No fee required.

|

|

o

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

5)

|

Total fee paid:

|

|

|

|

|

o

|

Fee paid previously with preliminary materials.

|

|

|

|

|

o

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

1)

|

Amount Previously Paid:

|

|

|

|

|

|

2)

|

Form, Schedule or Registrant Statement No.:

|

|

|

|

|

|

3)

|

Filing Party:

|

|

|

|

|

|

4)

|

Date Filed:

|

|

|

|

THE DIXIE GROUP, INC.

475 Reed Road

Dalton, Georgia 30720

(706) 876-5800

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To the Shareholders of The Dixie Group, Inc.:

The Annual Meeting of Shareholders of The Dixie Group, Inc. will be held at the Corporate Office, 475 Reed Road, Dalton, Georgia, on May 3, 2017 at 8:00 a.m., Eastern Time, for the following purposes:

|

|

|

|

1.

|

To elect nine individuals to the Board of Directors for a term of one year each;

|

|

|

|

|

2.

|

To cast an advisory vote on the Company’s Executive Compensation for its named executive officers (“Say-on-Pay”);

|

|

|

|

|

3.

|

To ratify appointment of Dixon Hughes Goodman LLP to serve as independent registered public accountants of the Company for 2017; and

|

|

|

|

|

4.

|

Such other business as may properly come before the Annual Meeting of Shareholders or any adjournment thereof.

|

Only shareholders of record of the Common Stock and Class B Common Stock at the close of business on February 24, 2017, are entitled to notice of, and to vote at, the Annual Meeting or any adjournment thereof.

Your attention is directed to the Proxy Statement accompanying this Notice for more complete information regarding the matters to be acted upon at the Annual Meeting.

The Dixie Group, Inc.

Daniel K. Frierson

Chairman of the Board

Dalton, Georgia

Dated: March 23, 2017

PLEASE READ THE ATTACHED MATERIAL CAREFULLY AND COMPLETE, DATE AND SIGN THE ENCLOSED PROXY AND RETURN IT PROMPTLY TO THE COMPANY IN THE ENCLOSED POSTAGE-PAID ENVELOPE SO THAT YOUR SHARES OF COMMON STOCK AND CLASS B COMMON STOCK WILL BE REPRESENTED AT THE MEETING. IF YOU ATTEND THE MEETING, YOU MAY REVOKE YOUR PROXY AND VOTE YOUR SHARES IN PERSON, SHOULD YOU SO DESIRE.

Important Notice

Regarding Internet

Availability of Proxy Materials

for the

Annual Meeting of Shareholders

to be held on

May 3, 2017

The proxy statement and annual report to shareholders are available under "Annual Report and Proxy Materials" at

www.thedixiegroup.com/investor/investor.html

.

THE DIXIE GROUP, INC.

475 Reed Road

Dalton, Georgia 30720

Phone (706) 876-5800

ANNUAL MEETING OF SHAREHOLDERS

May 3, 2017

PROXY STATEMENT

INTRODUCTION

The enclosed Proxy is solicited on behalf of the Board of Directors of the Company for the purposes set forth in the accompanying Notice of Annual Meeting of Shareholders. This Proxy Statement and the enclosed Proxy will be mailed on or about March 23, 2017, to shareholders of record of the Company’s Common Stock and Class B Common Stock as of the close of business on February 24, 2017.

At the Annual Meeting, holders of the Company’s Common Stock, $3.00 par value per share (“Common Stock”), and Class B Common Stock, $3.00 par value per share (“Class B Common Stock”), will be asked to: (i) elect nine (9) individuals to the Board of Directors for a term of one year each, (ii) cast an advisory vote on the Company’s executive compensation for its named executive officers; (iii) ratify the appointment of Dixon Hughes Goodman LLP to serve as independent registered public accountants of the Company for 2017, and (iv) transact any other business that may properly come before the meeting.

The Board of Directors recommends that the Company’s shareholders vote (i)

FOR

electing the nine (9) nominees for director; (ii)

FOR

approving the Company’s executive compensation of its named executive officers; and (iii)

FOR

ratifying the appointment of Dixon Hughes Goodman LLP to serve as independent registered public accountants of the Company for 2017.

RECORD DATE, VOTE REQUIRED AND RELATED MATTERS

The Board has fixed the close of business on February 24, 2017, as the Record Date for the determination of shareholders entitled to notice of, and to vote at, the Annual Meeting. In accordance with the Company’s Charter, each outstanding share of Common Stock is entitled to one vote, and each outstanding share of Class B Common Stock is entitled to 20 votes, exercisable in person or by properly executed Proxy, on each matter brought before the Annual Meeting. Cumulative voting is not permitted. As of February 24, 2017, 15,248,338 shares of Common Stock, representing 15,248,338 votes, were held of record by approximately 3,000 shareholders (including an estimated 2,600 shareholders whose shares are held in nominee names) and 870,714 shares of Class B Common Stock, representing 17,414,280 votes, were held by 10 individual shareholders, together representing an aggregate of 32,662,618 votes.

Shares represented at the Annual Meeting by properly executed Proxy will be voted in accordance with the instructions indicated therein unless such Proxy has previously been revoked. If no instructions are indicated, such shares will be voted (i)

FOR

electing the nine (9) nominees for director; (ii)

FOR

approving the Company’s executive compensation of its named executive officers; and (iii)

FOR

ratifying the appointment of Dixon Hughes Goodman LLP to serve as independent registered public accountants of the Company for 2017.

Any Proxy given pursuant to this solicitation may be revoked at any time by the shareholder giving it by (i) delivering to the Corporate Secretary of the Company a written notice of revocation bearing a later date than the Proxy, (ii) submitting a later-dated, properly executed Proxy, or (iii) revoking the Proxy and voting in person at the Annual Meeting. Attendance at the Annual Meeting will not, in and of itself, constitute a revocation of a Proxy. Any written notice revoking a Proxy should be sent to The Dixie Group, Inc., P.O. Box 2007, Dalton, Georgia 30722-2007, Attention: Derek Davis.

The persons designated as proxies were selected by the Board of Directors and are Daniel K. Frierson, Lowry F. Kline and John W. Murrey, III. The cost of solicitation of Proxies will be borne by the Company.

The presence, in person or by Proxy, of the holders of a majority of the aggregate outstanding vote of Common Stock and Class B Common Stock entitled to vote is necessary to constitute a quorum at the Annual Meeting. In accordance with Tennessee law, Directors are elected by the affirmative vote of a plurality of the votes cast in person or by Proxy at the Annual Meeting.

Approval of the Company’s executive compensation for its named executive officers will be deemed to have been obtained if the number of votes properly cast in favor of such compensation exceeds the number of votes cast against such compensation.

Ratification of the appointment of Dixon Hughes Goodman LLP to serve as independent registered public accountants of the Company for 2017 will be approved if the votes properly cast favoring ratification exceed the votes cast opposing ratification.

Shares covered by abstentions and broker non-votes, while counted for purposes of determining the presence of a quorum at the Annual Meeting, are not considered to be affirmative or negative votes. Abstentions and broker non-votes will have no effect upon the election of a nominee for director, so long as such nominee receives any affirmative votes.

A copy of the Company’s Annual Report for the year-ended December 31, 2016, is enclosed herewith.

The Board is not aware of any other matter to be brought before the Annual Meeting for a vote of shareholders. If, however, other matters are properly presented, Proxies representing shares of Common Stock and Class B Common Stock will be voted in accordance with the best judgment of the proxy holders.

PRINCIPAL SHAREHOLDERS

Shareholders of record at the close of business on February 24, 2017, the Record Date, will be entitled to notice of and to vote at the Annual Meeting.

The following is information regarding beneficial owners of more than 5% of the Company's Common Stock or Class B Common Stock. Beneficial ownership information is also presented for (i) the executive officers named in the Summary Compensation Table; (ii) all directors and nominees; and (iii) all directors and executive officers, as a group, as of February 24, 2017 (except as otherwise noted).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name and Address of Beneficial Owner

|

Title of Class

|

Number of Shares Beneficially Owned(1)(2)

|

|

% of Class

|

|

|

Daniel K. Frierson

|

|

|

|

|

|

|

111 East and West Road

|

Common Stock

|

1,005,634

|

|

|

(3)

|

6.2

|

|

|

%

|

|

Lookout Mountain, TN 37350

|

Class B Common Stock

|

870,714

|

|

|

(4)

|

100.0

|

|

|

%

|

|

|

|

|

|

|

|

|

|

|

Dimensional Fund Advisors, L.P.

|

|

|

|

|

|

|

Palisades West, Building One,

|

|

|

|

|

|

|

|

|

6300 Bee Cave Road

|

Common Stock

|

1,091,102

|

|

|

(5)

|

7.2

|

|

|

%

|

|

Austin, TX 78746

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hodges Capital Holdings, Inc.

|

|

|

|

|

|

|

|

|

2905 Maple Avenue

|

Common Stock

|

2,280,660

|

|

|

(6)

|

15.0

|

|

|

%

|

|

Dallas, TX 75201

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Royce & Associates, LLC

|

|

|

|

|

|

|

745 Fifth Avenue

|

Common Stock

|

1,366,631

|

|

|

(7)

|

9.0

|

|

|

%

|

|

New York, NY 10151

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Robert E. Shaw

|

|

|

|

|

|

|

115 West King Street

|

Common Stock

|

1,125,000

|

|

|

(8)

|

7.4

|

|

|

%

|

|

Dalton, GA 30722-1005

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Wells Fargo & Company, on behalf of the

following subsidiaries:

|

|

|

|

|

|

|

Wells Capital Management Incorporated

|

|

|

|

|

|

|

Wells Fargo Fund Management, LLC

|

|

|

|

|

|

|

Wells Fargo Clearing Services, LLC

|

|

|

|

|

|

|

420 Montgomery Street

|

Common Stock

|

1,554,810

|

|

|

(9)

|

10.2

|

|

|

%

|

|

San Francisco, CA 94163

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Additional Directors and Executive Officers

|

Title of Class

|

Number of Shares Beneficially Owned (1)

|

|

% of Class

|

|

|

|

|

|

|

|

|

|

William F. Blue, Jr.

|

Common Stock

|

18,091

|

|

|

(10)

|

|

|

*

|

|

|

|

|

|

|

|

|

Charles E. Brock

|

Common Stock

|

10,941

|

|

|

(11)

|

|

|

*

|

|

|

|

|

|

|

|

|

Paul B. Comiskey

|

Common Stock

|

106,486

|

|

|

(12)

|

|

|

*

|

|

|

|

|

|

|

|

|

W. Derek Davis

|

Common Stock

|

73,222

|

|

|

(13)

|

|

|

|

*

|

|

|

|

|

|

|

|

|

Jon A. Faulkner

|

Common Stock

|

139,522

|

|

|

(14)

|

|

|

|

*

|

|

|

|

|

|

|

|

|

D. Kennedy Frierson, Jr.

|

Common Stock

|

214,487

|

|

|

(15)

|

|

1.4

|

|

|

%

|

|

|

Class B Common Stock

|

180,700

|

|

|

(4)

|

20.8

|

|

|

%

|

|

|

|

|

|

|

|

|

|

|

E. David Hobbs

|

Common Stock

|

7,259

|

|

|

(16)

|

|

|

*

|

|

|

|

|

|

|

|

|

Walter W. Hubbard

|

Common Stock

|

21,801

|

|

|

(17)

|

|

|

*

|

|

|

|

|

|

|

|

|

Lowry F. Kline

|

Common Stock

|

54,299

|

|

|

(18)

|

|

|

*

|

|

|

|

|

|

|

|

|

V. Lee Martin

|

Common Stock

|

30,381

|

|

|

(19)

|

|

|

|

*

|

|

|

|

|

|

|

|

|

Hilda S. Murray

|

Common Stock

|

10,941

|

|

|

(20)

|

|

|

*

|

|

|

|

|

|

|

|

|

John W. Murrey, III

|

Common Stock

|

40,079

|

|

|

(21)

|

|

|

*

|

|

|

|

|

|

|

|

|

Michael L. Owens

|

Common Stock

|

6,775

|

|

|

(22)

|

|

|

*

|

|

|

|

|

|

|

|

|

All Directors, Named Executive Officers and

|

Common Stock

|

1,556,333

|

|

|

(23)

|

|

9.6

|

|

|

%

|

|

Executive Officers as Group (14 Persons) **

|

Class B Common Stock

|

870,714

|

|

|

(24)

|

|

100.0

|

|

|

%

|

* Percentage of shares beneficially owned does not exceed 1% of the Class.

** The total vote of Common Stock and Class B Common Stock represented by the shares held by all directors and executive officers as a group is

18,099,899

votes or

55.4%

of the total vote.

|

|

|

|

(1)

|

Under the rules of the Securities and Exchange Commission and for the purposes of these disclosures, a person is deemed to be a “beneficial owner” of a security if that person has or shares “voting power,” which includes the power to vote or to direct the voting of such security, or “investment power,” which includes the power to dispose or to direct the disposition of such security. Under these rules, more than one person may be deemed to be a beneficial owner of the same securities. The Class B Common Stock is convertible on a share-for-share basis into shares of Common Stock, and accordingly, outstanding shares of such stock are treated as having been converted to shares of Common Stock for purposes of determining both the number and percentage of class of Common Stock for persons set forth in the table who hold such shares.

|

|

|

|

|

(2)

|

Does not include 244,775 shares of Common Stock owned by The Dixie Group, Inc. 401(k) Retirement Savings Plan (the “401(k) Plan”) for which Daniel K. Frierson is a fiduciary and for which T. Rowe Price Trust Company serves as Trustee. Participants in the 401(k) Plan may direct the voting of all shares of Common Stock held in their accounts, and the Trustee must vote all shares of Common Stock held in the 401(k) Plan in the ratio reflected by such direction. Participants may also direct the disposition of such shares. Accordingly, for purposes of these disclosures, shares held for participants in the 401(k) Plan are reported as beneficially owned by the participants.

|

|

|

|

|

(3)

|

Mr. Daniel K. Frierson's beneficial ownership of Common Stock and Class B Common Stock may be summarized as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number of Shares Common Stock

|

|

Number of Shares Class B Common Stock

|

|

|

Shares held outright

|

3,263

|

|

|

|

405,306

|

|

|

(a)

|

|

Shares held in his Individual Retirement Account

|

3,567

|

|

|

(a)

|

17,061

|

|

|

(a)

|

|

Shares held in 401(k) Plan

|

796

|

|

|

(a)

|

—

|

|

|

|

|

Shares held by his wife

|

—

|

|

|

|

94,879

|

|

|

(c)

|

|

Shares held by his children, their spouses and grandchildren

|

55,690

|

|

|

(b)

|

230,072

|

|

|

(c)

|

|

Unvested restricted stock

|

21,404

|

|

|

(a)

|

117,910

|

|

|

(a)

|

|

Shares held by family Unitrust

|

—

|

|

|

|

5,486

|

|

|

(a)

|

|

Options to acquire Common Stock, exercisable within 60 days

|

50,000

|

|

|

(a)

|

—

|

|

|

|

|

Deemed conversion of his Class B Common Stock

|

870,714

|

|

|

|

—

|

|

|

|

|

Total

|

1,005,434

|

|

|

|

870,714

|

|

|

|

(a) Sole voting and investment power

(b) Shared voting and investment power

(c) Sole voting and shared investment power

|

|

|

|

(4)

|

The 870,714 includes 324,951

shares of Class B Common Stock are held subject to a Shareholder's Agreement among Daniel K. Frierson, his wife, two of their five children (including D. Kennedy Frierson, Jr.) and certain family trusts which hold Class B Common Stock, pursuant to which Daniel K. Frierson has been granted a proxy to vote such shares. The Shareholder's Agreement relates only to shares of Class B Common Stock held by each of the parties to the agreement. Pursuant to the agreement Daniel K. Frierson is granted a proxy to vote such shares of Class B Common Stock so long as they remain subject to the agreement. The Class B Common Stock is convertible on a share for share basis in to shares of Common Stock; however, upon conversion such shares are no longer subject to the agreement. Nevertheless, the parties to the agreement may be deemed to be members of a "group" for purposes of Section 13(d) of the act and for purposes of reporting beneficial ownership of the Common Stock of The Dixie Group, Inc., and accordingly Daniel K. Frierson, and the other parties to the agreement have jointly filed a report on Schedule 13(d) reporting beneficial ownership of the Common Stock which they own.

|

|

|

|

|

(5)

|

Dimensional Fund Advisors, L.P. has reported beneficial ownership of an aggregate of 1,091,102 shares of Common Stock, as follows: 1,071,615 shares of Common Stock, for which it has sole voting power, and 1,091,102 shares of Common Stock for which it has sole dispositive power. The reported information is based upon the Schedule 13G filed by Dimensional Fund Advisors, L.P. with the Securities and Exchange Commission on February 9, 2017.

|

|

|

|

|

(6)

|

Hodges Capital Holdings, Inc. Craig Hodges, First Dallas Securities, Inc., Hodges Capital Management, Inc., Hodges Fund, Hodges Pure Contrarian Fund, and Hodges Small Fund has reported beneficial ownership of an aggregate of 2,280,660 shares of Common Stock. Hodges Capital Holdings, Inc. reports having shared voting power of 1,903,855 and 2,280,666 shared dispositive power. The reported information is based upon the Schedule 13G filed by Hodges Capital Holdings, Inc. with the Securities and Exchange Commission on February 17, 2017.

|

|

|

|

|

(7)

|

Royce & Associates LLC has reported beneficial ownership of 1,366,631 shares of Common Stock for which it has sole dispositive power and sole voting power. The reported information is based upon the Schedule 13G filed by Royce & Associates LLC with the Securities and Exchange Commission on January 6, 2017.

|

|

|

|

|

(8)

|

Robert E. Shaw has reported the beneficial ownership of an aggregate of 1,125,000 shares of Common Stock for which he has 1,125,000 shared voting power and 1,125,000 shared dispositive power. The reported information is based upon the 13G filed by Mr. Shaw with the Securities and Exchange Commission on February 8, 2017.

|

|

|

|

|

(9)

|

Wells Fargo & Company has reported the beneficial ownership of an aggregate of 1,554,810 shares of Common Stock, on behalf the following subsidiaries: Wells Capital Management Incorporated, Wells Fargo Funds Management, LLC, and Wells Fargo Clearing Services, LLC. It has reported 764,313 shares of Common Stock for which it has shared voting power. The reported information is based on a Form 13G filed on January 9, 2017.

|

|

|

|

|

(10)

|

Mr. William F. Blue's beneficial ownership may be summarized as follows:

|

|

|

|

|

|

|

|

|

Number of Shares Common Stock

|

|

Shares held outright

|

11,529

|

|

|

Performance Units, convertible into shares of Common Stock on retirement as a director

|

6,562

|

|

|

Total

|

18,091

|

|

|

|

|

|

(11)

|

Mr. Charles E. Brock's beneficial ownership may be summarized as follows:

|

|

|

|

|

|

|

|

|

Number of Shares Common Stock

|

|

Shares held outright

|

—

|

|

|

Performance Units, convertible into shares of Common Stock on retirement as a director

|

10,941

|

|

|

Total

|

10,941

|

|

|

|

|

|

(12)

|

Mr. Paul B. Comiskey's beneficial ownership may be summarized as follows:

|

|

|

|

|

|

|

|

|

Number of Shares Common Stock

|

|

Shares held outright

|

39,023

|

|

|

Unvested Restricted Stock

|

48,663

|

|

|

Held in 401(k) Plan

|

800

|

|

|

Exercisable Stock Options

|

18,000

|

|

|

Total

|

106,486

|

|

|

|

|

|

(13)

|

Mr. W. Derek Davis's beneficial ownership may be summarized as follows:

|

|

|

|

|

|

|

|

|

Number of Shares Common Stock

|

|

Shares held outright

|

47,502

|

|

|

Shares held by his wife

|

4,500

|

|

|

Unvested Restricted Stock

|

14,463

|

|

|

Held in 401(k) Plan

|

4,257

|

|

|

Exercisable Stock Options

|

2,500

|

|

|

Total

|

73,222

|

|

|

|

|

|

(14)

|

Mr. Jon A. Faulkner's beneficial ownership may be summarized as follows:

|

|

|

|

|

|

|

|

|

Number of Shares Common Stock

|

|

Shares held outright

|

54,033

|

|

|

Unvested Restricted Stock

|

74,489

|

|

|

Exercisable Stock Options

|

11,000

|

|

|

Total

|

139,522

|

|

|

|

|

|

(15)

|

Mr. D. Kennedy Frierson Jr.'s beneficial ownership may be summarized as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

Number of Shares Common Stock

|

|

Number of Shares Class B Common Stock

|

|

|

Shares held outright

|

—

|

|

|

85,140

|

|

(a)

|

|

Shares held by his wife

|

100

|

|

|

—

|

|

|

|

Shares held in trust(s) for children

|

2,585

|

|

|

12,000

|

|

(a)

|

|

Shares held in 401(k)

|

2,301

|

|

|

—

|

|

|

|

Unvested Restricted Stock

|

6,801

|

|

|

83,560

|

|

(a)

|

|

Options to acquire Common Stock, exercisable within 60 days

|

22,000

|

|

|

—

|

|

|

|

Deemed conversion of Class B Stock

|

180,700

|

|

|

—

|

|

(a)

|

|

Total

|

214,487

|

|

|

180,700

|

|

|

|

|

|

|

(a)

|

Subject to Shareholder's Agreement described in Note (4), above. Mr. Kennedy Frierson has sole investment power, and no voting power with respect to such shares.

|

(16) Mr. E. David Hobbs' beneficial ownership may be summarized as follows:

|

|

|

|

|

|

|

|

Number of Shares Common Stock

|

|

Shares held outright

|

2,364

|

|

|

Unvested Restricted Stock

|

4,895

|

|

|

Total

|

7,259

|

|

|

|

|

|

(17)

|

Mr. Walter W. Hubbard's beneficial ownership may be summarized as follows:

|

|

|

|

|

|

|

|

|

Number of Shares Common Stock

|

|

Shares held outright

|

—

|

|

|

Performance Units, convertible into shares of Common Stock on retirement as a director

|

21,801

|

|

|

Total

|

21,801

|

|

|

|

|

|

(18)

|

Mr. Lowry F. Kline's beneficial ownership may be summarized as follows:

|

|

|

|

|

|

|

|

|

Number of Shares Common Stock

|

|

Shares held outright

|

31,198

|

|

|

Performance Units, convertible into shares of Common Stock on retirement as a director

|

23,101

|

|

|

Total

|

54,299

|

|

|

|

|

|

(19)

|

Mr. V. Lee Martin resigned from the company on September 15, 2016. His beneficial ownership may be summarized as follows:

|

|

|

|

|

|

|

|

|

Number of Shares Common Stock

|

|

Shares held outright

|

30,381

|

|

|

Unvested Restricted Stock

|

—

|

|

|

Total

|

30,381

|

|

|

|

|

|

(20)

|

Ms. Hilda S. Murray's beneficial ownership may be summarized as follows:

|

|

|

|

|

|

|

|

|

Number of Shares Common Stock

|

|

Shares held outright

|

—

|

|

|

Performance Units, convertible into shares of Common Stock on retirement as a director

|

10,941

|

|

|

Total

|

10,941

|

|

|

|

|

|

(21)

|

Mr. John W. Murrey's beneficial ownership may be summarized as follows:

|

|

|

|

|

|

|

|

|

Number of Shares Common Stock

|

|

Shares held outright

|

3,468

|

|

|

Performance Units, convertible into shares of Common Stock on retirement as a director

|

36,111

|

|

|

Held by wife

|

500

|

|

|

Total

|

40,079

|

|

|

|

|

|

(22)

|

Mr. Michael L. Owens' beneficial ownership may be summarized as follows:

|

|

|

|

|

|

|

|

|

Number of Shares Common Stock

|

|

Shares held outright

|

—

|

|

|

Performance Units, convertible into shares of Common Stock on retirement as a director

|

6,775

|

|

|

Total

|

6,775

|

|

|

|

|

|

(23)

|

Includes: (i) 221,579 shares of Common Stock owned directly by individuals in this group; (ii) 8,154 shares of Common Stock allocated to accounts in the 401(k) Plan of members of this group; (iii) options, which are either immediately exercisable, or exercisable within 60 days of the Record Date to purchase 103,500 shares of Common Stock; (iv) 116,232 shares of Common Stock held pursuant to performance units issued as payment of one-half of the annual retainer for the Company's non-employee directors; (v) 60,690 shares of Common Stock owned by immediate family members of certain members of this group; (vi) 3,567 shares held in individual retirement accounts; (vii) 170,715 unvested restricted shares of Common Stock held by individuals in this group, which shares may be voted by such individuals; and (viii)

870,714 shares of Class B Common Stock held by individuals in this group, that could be converted on a share for share basis into shares of Common Stock.

|

|

|

|

|

(24)

|

Includes: (i) 870,714 shares of Class B Common Stock held subject to the Shareholder Agreement described in Note (4) above.

|

PROPOSAL ONE

ELECTION OF DIRECTORS

Information About Nominees for Director

Pursuant to the Company’s Bylaws, all Directors are elected to serve a one year term, or until their successors are elected and qualified. The Board of Directors is permitted to appoint directors to fill the unexpired terms of directors who resign.

The names of the nominees for election to the Board, their ages, their principal occupation or employment (which has continued for at least the past five years unless otherwise noted), directorships held by them in other publicly-held corporations or investment companies, the dates they first became directors of the Company, and certain other relevant information with respect to such nominees are as follows:

William F. Blue, Jr

., age 58, is Chairman of the Board of The Hopeway Foundation in Charlotte, North Carolina. From 2008 until his retirement in 2014, he served as Vice Chairman of Investment Banking and Capital Markets, part of Wells Fargo Securities, LLC, in Charlotte. Throughout his 29-year investment banking career, he represented foreign and domestic corporations in financing and advisory assignments, including acquisitions, divestitures, recapitalizations, fairness opinions, and public and private equity and debt offerings. From 1998 until 2008, Mr. Blue served as group head of the Wachovia Consumer and Retail Investment Banking group. Before joining Wachovia, he was a managing director in the Mergers and Acquisitions group of NationsBanc Montgomery Securities, the predecessor firm to Banc of America Securities. Mr. Blue is a member of the Company's Audit Committee, the Company's Compensation Committee and the Company's Executive Committee. He has been a director of the Company since October 2014.

Charles E. Brock

, age 52, is the President and Chief Executive Officer of Launch Tennessee, a public-private partnership, focused on the development of high-growth companies in Tennessee. Previously, he served as the Executive Entrepreneur of The Company Lab, a Chattanooga organization that serves as “the Front Door for Entrepreneurs” in Southeast Tennessee and one of Launch Tennessee's regional accelerators. Mr. Brock was a founding partner of the Chattanooga Renaissance Fund, a locally based angel investment group. Mr. Brock also serves as a director of Four Bridges Capital Advisors, a Chattanooga based boutique investment bank as well as director of Pinnacle Financial Partners. Mr. Brock is a member of the Company’s Audit Committee and a member of the Company's Nominations and Corporate Governance Committee. He has been a director of the Company since 2012.

Daniel K. Frierson

, age 75, is Chairman of the Board of the Company, a position he has held since 1987. He also has been Chief Executive Officer of the Company since 1980 and a director of the Company since 1973. Mr. Frierson serves as a director of Astec Industries, Inc., a manufacturer of specialized equipment for building and restoring the world’s infrastructure headquartered in Chattanooga, Tennessee, and Louisiana-Pacific Corporation, a manufacturer and distributor of building materials headquartered in Nashville, Tennessee. Mr. Frierson is Chairman of the Company’s Executive Committee.

D. Kennedy Frierson, Jr.

, age 50, is Chief Operating Officer of the Company, a position he has held since 2009. He has been President of Masland Residential, General Manager of Dixie Home, President of Bretlin as well as various other positions in operations, sales and senior management of the Company since 1998. He has been a director of the Company since 2012.

Walter W. Hubbard

, age 73, served as President and Chief Executive Officer of Honeywell Nylon, Inc., a wholly-owned subsidiary of Honeywell International, a manufacturer of nylon products from 2003 until his retirement in 2005. Prior to becoming President of Honeywell Nylon, Mr. Hubbard served as Group Vice President, Fiber Products of BASF Corporation from 1994 until 2003. Mr. Hubbard is a member of the Company’s Audit Committee and the Company's Compensation Committee. He has been a director of the Company since 2005.

Lowry F. Kline

, age 76, served as a director of Coca-Cola Enterprises, Inc. from April 2000 until April 2008, serving as Chairman from April 2002 until April 2008, and as Vice Chairman from April 2000 to April 2003. Mr. Kline served as Chief Executive Officer of Coca-Cola Enterprises, Inc. from April 2001 until January 2004 and from December 2005 to April 2006. Prior to becoming Chief Executive Officer for Coca-Cola Enterprises, Inc., he held a number of positions with said company, including Chief Administrative Officer, Executive Vice President and General Counsel. Mr. Kline is a member of the Board of Directors of Jackson Furniture Industries, Inc., headquartered in Cleveland, Tennessee and is a former director of McKee Foods Corporation, headquartered in Collegedale, Tennessee. Mr. Kline is Chairman of the Company’s Compensation Committee, a member of the Company’s Audit Committee and a member of the Company’s Executive Committee. He has been a director of the Company since 2004.

Hilda S. Murray

, age 62, is the Corporate Secretary and Executive Vice President of TPC Printing & Packaging, a specialty packaging and printing company in Chattanooga, Tennessee. She is also founder and President of Greener Planet, LLC, an environmental compliance consultant to the packaging and printing industry. Ms. Murray is a member of the Company’s Audit Committee and the Company’s Nominations and Corporate Governance Committee. She has been a director of the Company since 2012.

John W. Murrey, III

, age 74, previously served as a Senior member of the law firm of Witt, Gaither & Whitaker, P.C. in Chattanooga, Tennessee until June 30, 2001. Since 1993, Mr. Murrey has served as a director of Coca-Cola Bottling Co. Consolidated, a Coca-Cola bottler headquartered in Charlotte, North Carolina and has served on its Audit Committee. From 2003 to 2007, he also served as a director of U. S. Xpress Enterprises, Inc., a truckload carrier headquartered in Chattanooga, Tennessee, and was Chairman of its Audit Committee. Mr. Murrey has been a director of the Company since 1997 and is a member of the Company’s Audit Committee and is Chairman of the Company’s Nominations and Corporate Governance Committee.

Michael L. Owens

, age 60, is Assistant Dean of Graduate Programs and Lecturer in the College of Business at the University of Tennessee at Chattanooga, Chattanooga, Tennessee. Prior to joining the University of Tennessee at Chattanooga, Mr. Owens was President of Coverdell & Company, Atlanta, Georgia. Prior to joining Coverdell, he was Senior Vice President and Chief Operating Officer of Monumental Life Insurance Company. He has been a director of the Company since 2014 and is Chairman of the Company's Audit Committee.

D. Kennedy Frierson, Jr., the Company’s Vice President and Chief Operating Officer, is the son of Daniel K. Frierson. No other director, nominee, or executive officer of the Company has any family relationship, not more remote than first cousin, to any other director, nominee, or executive officer.

Considerations with Respect to Nominees

In selecting the slate of nominees for 2017, the independent directors of the Board considered the familiarity of the Company’s incumbent Directors with the business and prospects of the Company, developed as a result of their service on the Company’s Board. The Board believes that such familiarity will be helpful in their service on the Company’s Board. With respect to all nominees, the independent directors of the Board noted the particular qualifications, experience, attributes and skills possessed by each nominee. These qualifications are reflected in the business experience listed under each nominee’s name, above. In order of the list of nominees, such information may be summarized as follows: Mr. Blue is an experienced investment banker having been Vice Chairman of Wells Fargo Securities and involved with capital formation, mergers, acquisitions and financing of various types of ventures. Mr. Brock is experienced in establishing new businesses having been involved in the establishment of both Foxmark Media and CapitalMark Bank and Trust. Mr. Daniel K. Frierson has served with the Company in several management and executive capacities his entire adult life, and has been Chief Executive Officer since 1980 and a Board member since 1973. In such capacity, he has been instrumental in planning and implementing the transition of the Company to its current position as a manufacturer of residential and commercial soft floorcovering products. Additionally, Mr. Frierson has experience as a board member of other public companies as well as significant trade group experience relevant to the Company’s business. He is well known and respected throughout the industry. Mr. D. Kennedy Frierson, Jr. has served with the Company in various capacities since 1992. He is currently Chief Operating Officer and has most recently led the Company’s Masland Residential business. Mr. Hubbard has highly relevant industry experience with businesses that are fiber producers and fiber suppliers, and that have served as fiber suppliers to the Company. Mr. Hubbard’s experience in the management of Honeywell Nylon and BASF Corporation, as outlined above, has given him valuable experience in management, relevant to his duties as a Director of the Company. Ms. Murray has a long history of executive management experience at TPC Printing and Packaging, a provider to the specialty packaging business as well as experience with environmental controls and footprint through Greener Planet. Mr. Kline has a long history of management and board level experience with the world’s largest bottler and distributor of Coca Cola Products. Additionally, he has an extensive background in business, corporate and securities law. Mr. Kline has served as a Director of the Company for several years, as reflected above, and chairs the Company’s Compensation Committee. Mr. Murrey has extensive experience in corporate, securities and business law, has experience drawn from board and committee service with several publicly-traded companies, other than the Company; prior to his retirement in 2001, he represented the Company as counsel. Mr. Murrey is chairman of the Company's Nominations and Corporate Governance Committee. Mr. Owens has extensive business and management experience, having served as President of Coverdell & Company prior to joining the University of Tennessee at Chattanooga. In addition, he has auditing experience having been employed as a certified public accountant and is Chairman of the Company's Audit Committee

The Board of Directors recommends that the Company’s shareholders vote FOR electing the nine (9) nominees for director.

MEETINGS AND COMMITTEES OF THE BOARD OF DIRECTORS

Meetings of the Board of Directors

The Board of Directors of the Company met six (6) times in 2016.

Committees, Attendance, and Directors' Fees

The Company has a standing Executive Committee, Audit Committee, Compensation Committee, and Nominations and Corporate Governance Committee. Copies of the Charters of the Company’s Audit Committee, Compensation Committee and Nominations and Corporate Governance Committees may be found on the Company’s website at

www.thedixiegroup.com/investor/investor.html

.

Members of the Executive Committee are Daniel K. Frierson, Chairman, William F. Blue, Jr. and Lowry F. Kline. Except as otherwise limited by law or by resolution of the Board of Directors, the Executive Committee has and may exercise all of the powers and authority of the Board of Directors for the management of the business and affairs of the Company, which power the Executive Committee exercises between the meetings of the full Board of Directors. The Executive Committee acted once, by written consent, in 2016.

Members of the Audit Committee are Michael L. Owens, Chairman, William F. Blue, Jr., Charles E. Brock, Walter W. Hubbard, Lowry F. Kline, Hilda S. Murray, and John W. Murrey, III. All of the members of the Audit Committee are “independent directors” as that term is defined by applicable regulations and rules of the National Association of Securities Dealers, Inc. (“NASD”). The Audit Committee evaluates audit performance, handles relations with the Company’s independent auditors, and evaluates policies and procedures relating to internal accounting functions and controls. The Audit Committee has the authority to engage the independent accountants for the Company. The Audit Committee operates pursuant to an Audit Committee Charter adopted by the Board of Directors. The Audit Committee has implemented pre-approval policies and procedures related to the provision of audit and non-audit services performed by the independent auditors. Under these procedures, the Audit Committee approves the type of services to be provided and the estimated fees related to those services.

The Audit Committee met four (4) times in 2016.

Members of the Compensation Committee are Lowry F. Kline, Chairman, William F. Blue, Jr., and Walter W. Hubbard. The Compensation Committee administers the Company’s compensation plans, reviews and may establish the compensation of the Company’s officers, and makes recommendations to the Board of Directors concerning such compensation and related matters. The Compensation Committee acts pursuant to a written Charter adopted by the Board of Directors.

The Compensation Committee may request recommendations from the Company’s management concerning the types and levels of compensation to be paid to the Company’s executive officers. Additionally, the Compensation Committee is authorized to engage compensation consultants and may review and consider information and recommendations of compensation consultants otherwise engaged by the Company or the Board of Directors in connection with the assessment, review and structuring of compensation plans and compensation levels. For a description of the Compensation Committee actions with respect to Compensation of Executive Officers in 2016, see

Compensation Discussion and Analysis - Compensation for 2016

.

Annually, the Compensation Committee reviews the performance of the Chief Executive Officer against goals and objectives established by the Committee as part of the process of determining his compensation. The Compensation Committee reports to the Board on its performance review.

The Compensation Committee met one (1) time in 2016.

The members of the Nominations and Corporate Governance Committee are John W. Murrey, III, Chairman, Charles E. Brock, and Hilda S. Murray. The Nominations and Corporate Governance Committee develops and recommends for board approval corporate governance guidelines.

The Nominations and Corporate Governance Committee’s Charter includes the duties of a nominating committee. Nominees approved by a majority of the Committee are recommended to the full Board. In selecting and approving director nominees, the Committee considers, among other factors, the existing composition of the Board and the mix of Board members appropriate for the perceived needs of the Company. The Committee believes continuity in leadership and board tenure increase the Board’s ability to exercise meaningful board oversight. Because qualified incumbent directors provide stockholders the benefit of continuity of leadership and seasoned judgment gained through experience as a director of the Company, the Committee will generally give priority as potential candidates to those incumbent directors interested in standing for re-election who have satisfied director performance expectations, including regular attendance at, preparation for and meaningful participation in Board and committee meetings.

The Nominations and Corporate Governance Committee also considers the following in selecting the proposed nominee slate:

|

|

|

|

•

|

at all times at least a majority of directors must be “independent” in the opinion of the Board as determined in accordance with relevant regulatory and NASD standards;

|

|

|

|

|

•

|

at all times at least three members of the Board must satisfy heightened standards of independence for Audit Committee members; and

|

|

|

|

|

•

|

at all times the Board should have at least one member who satisfies the criteria to be designated by the Board as an “audit committee financial expert”.

|

In selecting the current slate of director nominees, the Committee considered overall qualifications and the requirements of the makeup of the Board of Directors rather than addressing separate topics such as diversity in its selection. The Board considered the value of the incumbents’ familiarity with the Company and its business as well as the considerations outlined above under the heading

Considerations with Respect to Nominees

.

The Nominations and Corporate Governance Committee met one (1) time in 2016.

Board Leadership Structure

Mr. Daniel K. Frierson currently serves as the Chairman of the Board and the Chief Executive Officer of the Company. The positions of Chief Executive Officer and Chairman of the Board are combined. Executive sessions of the Board are chaired by the chairman of the Compensation Committee, Lowry F. Kline, who, as noted above, has extensive management and Board experience independent of his experience with the Company. Mr. Kline and the independent directors set their own agenda for meetings in executive session and may consider any topic relevant to the Company and its business. The Company believes that regular, periodic, meetings held in executive session, in the absence of management members or management directors, provide the Board an adequate opportunity to review and address issues affecting management or the Company that require an independent perspective. Additionally, the Company’s Audit Committee holds separate executive sessions with the Company’s independent registered public accounts, internal auditor and management. The Audit Committee also sets its own agenda and may consider any relevant topic in its executive sessions.

Director Attendance

During 2016, no director attended fewer than 75% of the total number of meetings of the Board of Directors and any Committee of the Board of Directors on which he served. All directors are invited and encouraged to attend the annual meeting of shareholders. In general, all directors attend the annual meeting of shareholders unless they are unable to do so due to unavoidable commitments or intervening events.

Director Compensation

Directors who are employees of the Company do not receive any additional compensation for their services as members of the Board of Directors. Non-employee directors receive an annual retainer of $36,000, payable one-half in cash and one-half in value of Performance Units (subject to a $5.00 per share minimum value for determination of the number of performance units to be issued). Performance Units are redeemable upon a director’s retirement for an equivalent number of shares of the Company’s Common Stock. In addition to the annual retainer, directors who are not employees of the Company receive $1,500 for each Board meeting attended and $1,000 for each committee meeting attended. Chairmen of the Audit and Compensation committees receive an additional annual payment of $8,000 and the Chairmen of the Nominations and Corporate Governance Committee receives an additional annual payment of $4,000. For an additional discussion of Director Compensation, see the tabular information below under the heading,

“Director Compensation.”

Independent Directors

The Board has determined that William F. Blue, Jr., Charles E. Brock, Walter W. Hubbard, Lowry F. Kline, Hilda S. Murray, John W. Murrey, III, and Michael L. Owens are independent within the meaning of the standards for independence set forth in the Company’s corporate governance guidelines, which are consistent with the applicable Securities and Exchange Commission (“SEC”) rules and NASDAQ standards.

Executive Sessions of the Independent Directors

The Company’s independent directors meet in executive session at each regularly scheduled quarterly meeting of the Board, with the chair of the Compensation Committee serving as chair of such executive sessions.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, and regulations of the SEC thereunder, require the Company’s executive officers and directors and persons who beneficially own more than 10% of the Company’s Common Stock, as well as certain affiliates of such persons, to file initial reports of such ownership and monthly transaction reports covering any changes in such ownership with the SEC and the National Association of Securities Dealers. Executive officers, directors and persons owning more than 10% of the Company’s Common Stock are required by SEC regulations to furnish the Company with all such reports they file. Based on its review of the copies of such reports received by it, the Company believes that, during fiscal year 2016, all filing requirements applicable to its executive officers, directors, and owners of more than 10% of the Company's Common Stock have been met.

Management Succession

Periodically, the Board reviews a succession plan, developed by management, addressing the policies and principles for selecting successors to the Company’s executive officers, including the Company’s CEO. The succession plan includes an assessment of the experience, performance and skills believed to be desirable for possible successors to the Company’s executive officers.

Certain Transactions between the Company and Directors and Officers

The Company’s Nominations and Corporate Governance Committee has adopted written policies and procedures concerning the review, approval or ratification of all transactions required to be disclosed under the SEC’s Regulation S-K, Rule 404. These policies and procedures cover all related party transactions required to be disclosed under the SEC’s rules as well as all material conflict of interest transactions as defined by relevant state law and the rules and regulations of NASDAQ that are applicable to the Company, and require that all such transactions be identified by management and disclosed to the committee for review. If required and appropriate under the circumstances, the committee will consider such transactions for approval or ratification. Full disclosure of the material terms of any such transaction must be made to the committee, including:

|

|

|

|

•

|

the parties to the transaction and their relationship to the Company, its directors and officers;

|

|

|

|

|

•

|

the terms of the transaction, including all proposed periodic payments; and

|

|

|

|

|

•

|

the direct or indirect interest of any related parties or any director, officer or associate in the transaction.

|

To be approved or ratified, the committee must find any such transaction to be fair to the Company. Prior approval of such transactions must be obtained generally, if they are material to the Company. If such transactions are immaterial, such transactions may be ratified and prior approval is not required. Ordinary employment transactions may be ratified.

Certain Related Party Transactions

During its fiscal year ended December 31, 2016, the Company purchased a portion of its product needs in the form of fiber, yarn, and carpet from Engineered Floors, an entity substantially controlled by Robert E. Shaw, a shareholder of the Company. Mr. Shaw has reported holding approximately 7.4% of the Company’s Common Stock, which, as of year-end, represented approximately 3.4% of the total vote of all classes of the Company’s Common Stock. Engineered Floors is one of several suppliers of such products to the Company. Total purchases from Engineered Floors for 2016 were approximately $7.3 million; or approximately 2.4% of the Company’s cost of goods sold in 2016. In accordance with the terms of its charter, the Compensation Committee reviewed the Company’s supply relationship with Engineered Floors. The dollar value of Mr. Shaw’s interest in the transactions with Engineered Floors is not known to the Company.

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

The Audit Committee of the Board of Directors is composed of seven members, each of whom is an independent, non-employee director. The Audit Committee operates under a written Audit Committee Charter adopted and approved by the Board of Directors. The Charter is reviewed at least annually by the Committee. While the Committee has the responsibilities and powers set forth in its written charter, it is not the duty of the Committee to plan or conduct audits. This function is conducted by the Company’s management and its independent registered public accountants.

The Committee has reviewed and discussed with management the audited financial statements of the Company for the year ended December 31, 2016 (the “Audited Financial Statements”). In addition, the Committee has discussed with Dixon Hughes Goodman LLP all matters required by applicable auditing standards.

The Committee also has received the written report, disclosure and the letter from Dixon Hughes Goodman required by PCAOB Rule 3526, “Communication with Audit Committees Concerning Independence”, and the Committee has reviewed, evaluated, and discussed with that firm the written report and its independence from the Company. The Committee also has discussed with management of the Company and Dixon Hughes Goodman LLP such other matters and received such assurances from them as the Committee deemed appropriate.

Based on the foregoing review and discussions and relying thereon, the Committee has recommended to the Company’s Board of Directors the inclusion of the Company’s Audited Financial Statements in the Company’s Annual Report on Form 10-K for the year ended December 31, 2016, to be filed with the Securities and Exchange Commission.

THE AUDIT COMMITTEE

Michael L. Owens, Chairman

William F. Blue, Jr.

Charles E. Brock

Walter W. Hubbard

Lowry F. Kline

Hilda S. Murray

John W. Murrey, III

AUDIT COMMITTEE FINANCIAL EXPERT

The Board has determined that Michael L. Owens, Chairman of the Audit Committee, is an audit committee financial expert as defined by Item 407(d)(5) of Regulation S-K of the Securities Exchange Act of 1934, as amended, and is independent within the meaning of Rule 10A-3(b)(l) of the Securities Exchange Act of 1934 of the Securities Exchange Act of 1934. For a brief list of Mr. Owens’ relevant experience, please refer to Mr. Owens’ biographical information as set forth in the Election of Directors section of this proxy statement. Additionally, the Board believes the remaining members of the Audit Committee would qualify as audit committee financial experts, within the meaning of applicable rules, based on each individual's qualification and expertise.

COMPENSATION DISCUSSION AND ANALYSIS

The Compensation Committee sets compensation for the Company’s executive officers, and its decisions are reported to and reviewed by the Board of Directors. The Compensation Committee currently consists of three independent directors chosen annually by the Board.

Compensation of the Company’s executive officers is intended to be competitive with compensation offered by other companies generally similar to the Company in size and lines of business. In determining what types and levels of compensation to offer, the Committee may review relevant, publicly available data and, from time to time, it may receive advice and information from professional compensation consultants.

The Elements of Executive Officer Compensation

Compensation for each of the Company’s executive officers consists generally of base salary, retirement plan benefits and other customary employment benefits, as well as potential cash incentive awards and stock plan awards pursuant to an annual incentive plan reviewed and adopted by the Committee at the beginning of each year. The annual incentive plan is customarily structured so that a significant portion of each executive’s potential annual compensation may consist of equity awards, the award value of which is tied to accomplishing both financial and non-financial goals and objectives.

Compensation for 2016

.

Effective February 11, 2016, the Compensation Committee selected performance goals and a range of possible incentives for the Company’s 2016 Incentive Compensation Plan (the “2016 Plan”). Pursuant to the 2016 Plan, each executive officer had the opportunity to earn a Cash Incentive Award, a Primary Long-Term Incentive Award of restricted stock, and an award of restricted stock denominated as “Career Shares.” The potential range of cash incentives and conditions to vesting of the restricted stock awards are described below.

For 2016, each executive officer also received customary retirement plan benefits and other customary employment benefits, as in prior years.

Salary for 2016

. The base salaries for the executive officers were not adjusted during 2016. See the 2016 Summary Compensation Table for a tabular presentation of the amount of salary and other compensation elements paid in proportion to total compensation for each named executive officer.

Potential Incentive Awards for 2016

. The CEO and all executive officers whose responsibilities primarily relate to corporate level administration had the opportunity to earn a cash payment ranging from 15% to no more than 105% of such executive’s base salary (from 45% to 105% for the Chief Executive Officer and Chief Operating Officer, and from 30% to 90% for the Chief Financial Officer and from 15% to 75% for all other officers). Fifty percent of the amount of the potential award was based on achievement of specified levels of operating income from continuing operations for the Company, as adjusted for unusual items, 30% of the amount was based on achievement of specified levels of operating income of the Company’s residential business operations, as adjusted for unusual items, and 20% of the amount was based on achievement of specified levels of the Company’s commercial business operating income, as adjusted for unusual items.

Executive officers whose responsibilities primarily relate to one of the Company’s business units, had the opportunity to earn a cash payment ranging from 15% to no more than 75% of such participant’s base salary. Fifty five percent of the amount was based on achievement of specified levels of their annual business unit operating income, as adjusted for unusual items, 30% was based on the achievement of specified levels of the Company’s consolidated operating income, as adjusted for unusual items, and 15% was based on achievement of specified levels of the annual operating income of the Company’s other business units, as adjusted for unusual items.

Primary Long-Term Incentive Share Awards and Career Shares Awards for 2016

.

The incentive plan provided for two possible awards of restricted stock: Primary Long-Term Incentive Share Awards and Career Share Awards. Receipt of the Primary Long-Term Incentive Share Awards was contingent on the Company’s achievement of minimum levels of adjusted operating income and, in the case of Career Share Awards was contingent on the Company's having a profitable operating income, as adjusted.

The Primary Long-Term Incentive Share Award was designed as a possible award of restricted shares, in value equal to no more than 35% of the executive’s base salary as of the beginning of 2016 plus any cash incentive award paid for such year. Any Primary Long-Term Incentive Share Awards, if earned, vest ratably over three years.

Career Shares were designed as a possible award of restricted stock valued at 20% of each executive officer’s base salary as of the beginning of the year, excluding the Company’s Chief Operating Officer and Chief Financial Officer. The level of career share awards was set at 35% and 30%, respectively, of the Chief Operating Officer’s and Chief Financial Officer’s base salary for 2016.

In accordance with past practice, any such award, if earned, would be granted in 2017. For participants age 61 or older, the Career Share Awards vest ratably over two years from the date of the grant. For the participants age 60 or younger, shares vest ratably over five years from the date of grant after the participant reaches age 61.

Additionally, all Share Awards are subject to vesting or forfeiture under certain conditions as follows: death, disability or a change in control will result in immediate vesting of all Share Awards; termination without cause will also result in immediate vesting of all Career Share Awards and in immediate vesting of that portion of Long-Term Incentive Share Awards that have been expensed; voluntary termination of employment prior to retirement, or termination for cause will result in forfeiture of all unvested awards; to the extent that the Company has recognized compensation expense related to the shares subject to the awards, such amounts vest at retirement age and are paid out by March 15th of the subsequent year.

All awards of restricted stock are subject to a $5.00 minimum price per share when determining the number of shares awarded. The Compensation Committee retained the discretion to reduce any award by up to 30% of the amount otherwise earned based on the participant’s failure to achieve individual performance goals set by the committee.

2016 Incentive Awards

.

No cash Awards were made for 2016 for the named executive officers. No Primary Long-Term Incentive Share Awards were granted in 2017 with respect to 2016 for the named executive officers. No Career Share Awards were granted in 2017 with respect to 2016 for the named executive officers.

Incentive Compensation Applicable to 2017.

Following year-end, the Committee adopted an incentive plan for 2017 providing for possible cash incentive awards and restricted stock awards in the form of Long-Term Incentive Share Awards and Career Share awards, as in prior years, and similar in structure to the annual plan adopted for 2016. Any such awards, if earned, would be paid, in the case of the cash award, or granted, in the case of the restricted stock awards, in March 2018.

Retirement Plans and Other Benefits

. The Company’s compensation for its executive officers also includes the opportunity to participate in two retirement plans, one qualified and one non-qualified for federal tax purposes, and certain health insurance, life insurance, relocation allowances, and other benefits. Such benefits are designed to be similar to the benefits available to other exempt, salaried associates of the Company, and to be comparable to and competitive with benefits offered by businesses with which the Company competes for executive talent.

Executive officers may elect to contribute a limited amount of their compensation to the qualified plan and make deferrals into the non-qualified plan (up to 90% of total compensation). Although the plans permit the Company to make discretionary contributions in an aggregate amount equal to up to 3% of the executive officer’s cash compensation, for 2016 the Company made a contribution of 1% to the qualified plan, while no Company contributions were made to the non-qualified plan.

Compensation Considerations for 2016 and 2017

.

The tax effect of possible forms of compensation on the Company and on the executive officers is a factor considered in determining types of compensation to be awarded. Similarly, the accounting treatment accorded various types of compensation may be an important factor used to determine the form of compensation. The incentive compensation rules under section 162m are technical and complex. Accordingly, as in past years, the Committee considered the possible tax effects of cash incentives and equity incentive awards that may not qualify as “incentive compensation” under Section 162m of the Internal Revenue Code. The Company held a “Say on Pay” vote at its annual meeting in 2016. At that meeting, in excess of 93% of the votes were cast “For” approval of our executive compensation as described in the Proxy Statement for that meeting. The Committee intends to consider these results as part of its ongoing review of executive compensation.

Termination Benefits

. Upon a Participant's reaching retirement age (as defined in the plan), all Long-Term Incentive Plan and Career Share restricted stock awards vest to the extent such awards have been expensed in the Company’s financial statements. As of year-end, Daniel K. Frierson, and Paul B. Comiskey were the only Named Executive Officers eligible for retirement in accordance with the terms of the restricted stock awards. If Mr. Frierson had retired at year end, the number of shares subject to such awards that would have vested and the value of such shares would have been 21,142 shares and $76,110. If Mr. Comiskey had retired at year end, the number of shares subject to such awards that would have vested and the value of such shares would have been 9,984 shares and $35,943. For purposes of valuing the foregoing awards, the Company used the year-end market value of the Company’s Common Stock, which was $3.60/share.

For the year ended December 31, 2016, termination benefits will be payable to Mr. V. Lee Martin, who resigned September 15, 2016, in the form of a continuation of his salary for the 9 month period following his resignation. Additionally, the restricted stock awards that were vested as of his resignation were paid to him. See All Other Compensation table following the Summary Compensation table.

Compensation Committee Report

The Compensation Committee has reviewed and discussed the Compensation Discussion and Analysis, set forth above, with management.

Based on our review and the discussions we held with management, we have recommended to the Board of Directors that the Compensation Discussion and Analysis be included in the Company’s Proxy Materials.

Respectfully submitted,

Lowry F. Kline, Chairman

William F. Blue, Jr.

Walter W. Hubbard

EXECUTIVE COMPENSATION INFORMATION

The following table sets forth information as to all compensation earned during the fiscal years ended December 27, 2014 and December 26, 2015 and December 31, 2016 to (i) the Company's Chief Executive Officer; and (ii) the Company's Chief Financial Officer, (iii) the three other most highly compensated executive officers who served as such during the fiscal year ended December 31, 2016 (the

“

Named Executive Officers

”

), and Mr. V. Lee Martin, who resigned effective September 2016. For a more complete discussion of the elements of executive compensation, this information should be read in conjunction with the other tabular information presented in the balance of this section.

Summary Compensation Table

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name and Principal Position (a)

|

Year (b)

|

Salary ($)(c)(1)

|

Bonus ($)(d)(2)

|

Stock Awards ($)(e)(3)

|

Option Awards ($)(f)

|

Nonqualified Compensation Earnings ($)(h)(4)

|

All Other Compensation ($)(i)(5)

|

Total ($) (j)

|

|

|

|

|

|

|

|

|

|

|

|

Daniel K Frierson

Chief Executive Officer

|

2016

|

625,000

|

|

—

|

|

109,000

|

|

—

|

|

—

|

|

5,479

|

|

739,479

|

|

|

2015

|

625,000

|

|

—

|

|

1,102,427

|

|

—

|

|

—

|

|

5,004

|

|

1,732,431

|

|

|

2014

|

625,000

|

|

326,650

|

|

481,802

|

|

—

|

|

—

|

|

6,866

|

|

1,440,318

|

|

|

|

|

|

|

|

|

|

|

|

|

D. Kennedy Frierson, Jr. Chief Operating Officer

|

2016

|

320,000

|

|

—

|

|

97,664

|

|

—

|

|

—

|

|

5,479

|

|

423,143

|

|

|

2015

|

320,000

|

|

—

|

|

108,355

|

|

—

|

|

—

|

|

5,004

|

|

433,359

|

|

|

2014

|

320,000

|

|

148,532

|

|

222,460

|

|

—

|

|

—

|

|

6,597

|

|

697,589

|

|

|

|

|

|

|

|

|

|

|

|

|

Paul B. Comiskey

Vice President,

President Residential

|

2016

|

300,000

|

|

—

|

|

52,320

|

|

—

|

|

—

|

|

5,479

|

|

357,799

|

|

|

2015

|

300,000

|

|

—

|

|

325,349

|

|

—

|

|

—

|

|

5,004

|

|

630,353

|

|

|

2014

|

300,000

|

|

151,174

|

|

217,224

|

|

—

|

|

—

|

|

6,755

|

|

675,153

|

|

|

|

|

|

|

|

|

|

|

|

|

Jon A. Faulkner, Chief Financial Officer

|

2016

|

270,000

|

|

—

|

|

70,632

|

|

—

|

|

—

|

|

5,389

|

|

346,021

|

|

|

2015

|

270,000

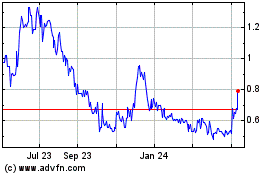

|