Filed Pursuant to Rule 424(b)(5)

Registration No. 333-198718

|

|

|

|

|

|

|

CALCULATION OF REGISTRATION FEE

|

|

Title of each class of securities Offered

|

Maximum Aggregate offering Price

|

Amount of Registration Fee (1)

|

|

4.500% Notes due 2022

|

$350,000,000

|

$40,565

|

|

|

|

|

(1)

|

Calculated in accordance with Rule 457(r).

|

Prospectus Supplement

(To Prospectus dated September 12, 2014)

Enstar Group Limited

$350,000,000

4.500% Senior Notes due 2022

We are offering $350 million aggregate principal amount of 4.500% Senior Notes due 2022 (the “Notes”). Interest on the Notes is payable semi-annually in arrears on March 10 and September 10 of each year commencing on September 10, 2017. The Notes will mature on March 10, 2022 unless earlier redeemed. We may redeem all or a portion of the Notes at any time and from time to time at the applicable redemption price described under the heading “Description of the Notes-Optional Redemption.”

The Notes will be our unsecured and unsubordinated obligations and will rank equally in right of payment with all of our other existing and future obligations that are unsecured and unsubordinated, senior in right of payment to any future obligations we incur that are expressly subordinated in right of payment to the Notes, effectively subordinated to any of our existing and future secured indebtedness to the extent of the value of the assets securing such indebtedness, and structurally subordinated to all existing and future liabilities of our subsidiaries.

_______________________________________________

|

|

|

|

Investing in the Notes involves risks. You should carefully consider the discussion under “Risk Factors” beginning on page

S-5

of this prospectus supplement and in the reports we file with the Securities and Exchange Commission that are incorporated by reference in this prospectus supplement and the accompanying prospectus before buying the Notes.

|

_______________________________________________

Neither the U.S. Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

|

|

|

|

|

|

|

|

|

|

|

|

Per Note

|

|

|

|

Total

|

|

Initial public offering price(1)

|

100.000

|

%

|

|

$

|

350,000,000

|

|

|

Underwriting discount(2)

|

0.600

|

%

|

|

$

|

2,100,000

|

|

|

Proceeds, before expenses, to Enstar Group Limited

|

99.400

|

%

|

|

$

|

347,900,000

|

|

(1)

The initial public offering price set forth above does not include accrued interest, if any. Interest on the Notes will accrue from March 10, 2017 and must be paid by the purchasers if the Notes are delivered after March 10, 2017.

(2)

See “Underwriting (Conflicts of Interest)” for additional disclosure regarding the underwriting discount, commissions and estimated offering expenses.

The Notes will not be listed on any securities exchange or quoted on an automated quotation system. Currently there is no public market for the Notes.

_______________________________________________

The underwriters expect to deliver the Notes through the facilities of The Depository Trust Company for the accounts of its participants, including Euroclear Bank S.A./N.V. (“Euroclear”) and Clearstream Banking, société anonyme (“Clearstream”), against payment in New York, New York on March 10, 2017.

_______________________________________________

|

|

|

|

|

|

|

|

Barclays

|

Wells Fargo Securities

|

|

Lloyds Securities

|

SunTrust Robinson Humphrey

|

|

nabSecurities, LLC

|

______________________

Prospectus Supplement dated March 7, 2017

TABLE OF CONTENTS

PROSPECTUS SUPPLEMENT

|

|

|

|

|

|

|

Page

|

|

ABOUT THIS PROSPECTUS SUPPLEMENT

|

|

|

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

|

|

|

PROSPECTUS SUPPLEMENT SUMMARY

|

|

|

RISK FACTORS

|

|

|

USE OF PROCEEDS

|

|

|

RATIO OF EARNINGS TO FIXED CHARGES

|

|

|

CAPITALIZATION

|

|

|

SELECTED FINANCIAL DATA

|

|

|

DESCRIPTION OF THE NOTES

|

|

|

MATERIAL TAX CONSIDERATIONS

|

|

|

UNDERWRITING (CONFLICTS OF INTEREST)

|

|

|

LEGAL MATTERS

|

|

|

WHERE YOU CAN FIND MORE INFORMATION

|

|

PROSPECTUS

|

|

|

|

|

|

|

Page

|

|

ABOUT THIS PROSPECTUS

|

|

|

THE COMPANY

|

|

|

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

|

|

|

RISK FACTORS

|

|

|

USE OF PROCEEDS

|

|

|

RATIO OF EARNINGS TO FIXED CHARGES

|

|

|

DESCRIPTION OF DEBT SECURITIES

|

|

|

PLAN OF DISTRIBUTION

|

|

|

LEGAL MATTERS

|

|

|

EXPERTS

|

|

|

WHERE YOU CAN FIND MORE INFORMATION

|

|

|

ENFORCEMENT OF CIVIL LIABILITIES UNDER U.S. FEDERAL SECURITIES LAWS AND OTHER MATTERS

|

|

We have not, and the underwriters have not, authorized anyone to provide any information other than that contained or incorporated by reference in this prospectus supplement or the accompanying prospectus or in any related free writing prospectus prepared by or on behalf of us or to which we have referred you. We and the underwriters take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We and the underwriters are not making an offer of the Notes in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained or incorporated by reference in this prospectus supplement is accurate as of any date other than the date on the front cover of this prospectus supplement or that the information contained or incorporated by reference in the accompanying prospectus is accurate as of any date other than the date on the front cover of such document. Our business, financial condition, results of operations and prospects may have changed since those dates.

ABOUT THIS PROSPECTUS SUPPLEMENT

This document has two parts. The first part consists of this prospectus supplement, which describes the specific terms of this offering and the Notes. The second part, the accompanying prospectus, provides more general information, some of which may not apply to this offering. This prospectus supplement and the accompanying prospectus are part of a registration statement on Form S-3 that we filed to register the Notes with the Securities and Exchange Commission (the “SEC”). As permitted by SEC rules, this prospectus supplement and the accompanying prospectus do not contain all of the information contained in the registration statement or the exhibits to the registration statement. You may refer to the registration statement and accompanying exhibits for more information about us and our securities. This prospectus supplement and the accompanying prospectus also incorporate by reference documents that are described under “Where You Can Find More Information.” If the description of this offering or the Notes varies between this prospectus supplement and the accompanying prospectus, you should rely on the information in this prospectus supplement.

The terms “Enstar,” “we,” “us,” “our,” “the Company” or similar references refer to Enstar Group Limited and its subsidiaries, unless otherwise stated or the context otherwise requires. References to “$” and “dollars” are to United States dollars.

Before purchasing any Notes, you should read both this prospectus supplement and the accompanying prospectus, together with the additional information about our Company to which we refer you in the section of this prospectus supplement entitled “Where You Can Find More Information.”

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement and the accompanying prospectus and the documents incorporated by reference herein and therein contain statements that constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), with respect to our financial condition, results of operations, business strategies, operating efficiencies, competitive positions, growth opportunities, plans and objectives of our management, as well as the markets for our securities and the insurance and reinsurance sectors in general. Statements that include words such as “estimate,” “project,” “plan,” “intend,” “expect,” “anticipate,” “believe,” “would,” “should,” “could,” “seek,” “may” and similar statements of a future or forward-looking nature identify forward-looking statements for purposes of the federal securities laws or otherwise. All forward-looking statements are necessarily estimates or expectations, and not statements of historical fact, reflecting the best judgment of our management and involve a number of risks and uncertainties that could cause actual results to differ materially from those suggested by the forward-looking statements. These forward looking statements should, therefore, be considered in light of various important factors, including those set forth in this prospectus supplement and the documents incorporated by reference herein.

Factors that could cause actual results to differ materially from those suggested by the forward-looking statements include, but are not limited to, the following:

|

|

|

|

•

|

risks associated with implementing our business strategies and initiatives;

|

|

|

|

|

•

|

risks that we may require additional capital in the future, which may not be available or may be available only on unfavorable terms;

|

|

|

|

|

•

|

the adequacy of our loss reserves and the need to adjust such reserves as claims develop over time;

|

|

|

|

|

•

|

risks relating to the availability and collectability of our reinsurance;

|

|

|

|

|

•

|

changes and uncertainty in economic conditions, including interest rates, inflation, currency exchange rates, equity markets and credit conditions, which could affect our investment portfolio, our ability to finance future acquisitions and our profitability;

|

|

|

|

|

•

|

the risk that ongoing or future industry regulatory developments will disrupt our business, affect the ability of our subsidiaries to operate in the ordinary course or to make distributions to us, or mandate changes in industry practices in ways that increase our costs, decrease our revenues or require us to alter aspects of the way we do business;

|

|

|

|

|

•

|

losses due to foreign currency exchange rate fluctuations;

|

|

|

|

|

•

|

increased competitive pressures, including the consolidation and increased globalization of reinsurance providers;

|

|

|

|

|

•

|

emerging claim and coverage issues;

|

|

|

|

|

•

|

lengthy and unpredictable litigation affecting assessment of losses and/or coverage issues;

|

|

|

|

|

•

|

the ability of our subsidiaries to distribute funds to us and the resulting impact on our liquidity;

|

|

|

|

|

•

|

our ability to comply with covenants in our debt agreements;

|

|

|

|

|

•

|

changes in our plans, strategies, objectives, expectations or intentions, which may happen at any time at management’s discretion;

|

|

|

|

|

•

|

operational risks, including system, data security or human failures and external hazards;

|

|

|

|

|

•

|

risks relating to our acquisitions, including our ability to continue to grow, successfully price acquisitions, evaluate opportunities, address operational challenges, support our planned growth and assimilate acquired companies into our internal control system in order to maintain effective internal controls, provide reliable financial reports and prevent fraud;

|

|

|

|

|

•

|

risks relating to our ability to obtain regulatory approvals, including the timing, terms and conditions of any such approvals, and to satisfy other closing conditions in connection with our acquisition agreements, which could affect our ability to complete acquisitions;

|

|

|

|

|

•

|

risks relating to our active underwriting businesses, including unpredictability and severity of catastrophic and other major loss events, failure of risk management and loss limitation methods, the risk of a ratings downgrade or withdrawal, cyclicality of demand and pricing in the insurance and reinsurance markets;

|

|

|

|

|

•

|

our ability to implement our strategies relating to our active underwriting businesses;

|

|

|

|

|

•

|

risks relating to our life and annuities business, including mortality and morbidity rates, lapse rates, the performance of assets to support the insured liabilities, and the risk of catastrophic events;

|

|

|

|

|

•

|

risks relating to our investments in life settlements contracts, including that actual experience may differ from our assumptions regarding longevity, cost projections, and risk of non-payment from the insurance carrier;

|

|

|

|

|

•

|

risks relating to our subsidiaries with liabilities arising from legacy manufacturing operations;

|

|

|

|

|

•

|

risks relating to the performance of our investment portfolio and our ability to structure our investments in a manner that recognizes our liquidity needs;

|

|

|

|

|

•

|

tax, regulatory or legal restrictions or limitations applicable to us or the insurance and reinsurance business generally;

|

|

|

|

|

•

|

changes in tax laws or regulations applicable to us or our subsidiaries, or the risk that we or one of our non-U.S. subsidiaries become subject to significant, or significantly increased, income taxes in the United States or elsewhere;

|

|

|

|

|

•

|

changes in Bermuda law or regulation or the political stability of Bermuda; and

|

|

|

|

|

•

|

changes in accounting policies or practices.

|

The factors listed above should be not construed as exhaustive and should be read in conjunction with the risks and uncertainties referred to in the “Risk Factors” section below and in the risk factors discussed in the documents incorporated herein by reference. We undertake no obligation to publicly update or review any forward looking statement, whether to reflect any change in our expectations with regard thereto, or as a result of new information, future developments or otherwise, except as required by law.

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights information contained or incorporated by reference in this prospectus supplement or the accompanying prospectus. This summary does not contain all of the information that you should consider before deciding whether to invest in the Notes. You should carefully read this entire prospectus supplement and the accompanying prospectus, including the information incorporated herein and therein by reference. See “Risk Factors.”

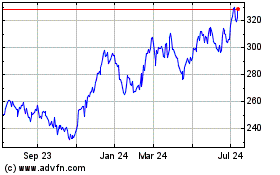

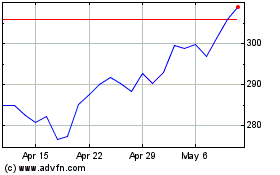

The Company

Enstar Group Limited is a Bermuda-based holding company, formed in 2001. Enstar is a multi-faceted insurance group that offers innovative capital release solutions and specialty underwriting capabilities through its network of group companies in Bermuda, the United States, the United Kingdom, Continental Europe, Australia, and other international locations. Our ordinary shares are listed on the NASDAQ Global Select Market under the ticker symbol "ESGR".

Our fundamental corporate objective is growing our net book value per share. We strive to achieve this primarily through growth in net earnings from both organic and accretive sources, including the completion of new acquisitions, the effective management of companies and portfolios of business acquired, and the execution of active underwriting strategies.

We acquire and manage insurance and reinsurance companies and portfolios of insurance and reinsurance business in run-off. Since formation, we have completed the acquisition of over 75 insurance and reinsurance companies and portfolios of business.

We also manage specialty active underwriting businesses:

|

|

|

|

•

|

Atrium Underwriting Group Limited and its subsidiaries ("Atrium"), which manage and underwrite specialist insurance and reinsurance business for Lloyd’s Syndicate 609; and

|

|

|

|

|

•

|

StarStone Insurance Bermuda Limited and its subsidiaries ("StarStone"), which is an A.M. Best A- rated global specialty insurance group with multiple underwriting platforms.

|

We have four segments of business that are each managed, operated and reported on separately: (i) Non-life Run-off; (ii) Atrium; (iii) StarStone; and (iv) Life and Annuities. For additional information and financial data relating to our segments, see "Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations - Results of Operations by Segment," "Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations - Investments" and "Note 24 - Segment Information" in the notes to our consolidated financial statements included within Item 8 of our Annual Report on Form 10-K for the year ended December 31, 2016 (our “Annual Report”) incorporated by reference into this prospectus supplement.

Our principal executive offices are located at Windsor Place, 3

rd

Floor, 22 Queen Street, Hamilton HM 11, Bermuda, and our telephone number is (441) 292-3645. We maintain a website at www.enstargroup.com where general information about us is available. We are not incorporating the contents of the website into this prospectus supplement or the accompanying prospectus.

The Offering

|

|

|

|

|

|

Issuer

|

Enstar Group Limited

|

|

|

|

|

Securities

|

4.500% Notes due 2022

|

|

|

|

|

Aggregate Principal Amount

|

$350,000,000

|

|

|

|

|

Maturity

|

March 10, 2022

|

|

|

|

|

Interest Rate

|

4.500% per annum

|

|

|

|

|

Interest Payment Dates

|

Interest will accrue from March 10, 2017 and will be payable semi-annually in arrears on March 10 and September 10 of each year, beginning on September 10, 2017.

|

|

|

|

|

Ranking

|

The Notes will be our senior unsecured obligations and will rank:

ž

senior in right of payment to any future indebtedness we incur that is expressly subordinated in right of payment to the Notes;

ž

equal in right of payment to our existing and future unsecured indebtedness that is not so subordinated;

ž

effectively subordinated to our existing and future secured indebtedness, to the extent of the value of the assets securing such indebtedness; and

ž

structurally subordinated to all existing and future liabilities of our subsidiaries.

See “Description of the Notes-Ranking.”

|

|

|

|

|

Use of Proceeds

|

We estimate that the net proceeds from this offering, after deducting the underwriting discount and estimated offering expenses payable by us, will be approximately $347.1 million. We intend to use these net proceeds to repay a portion of amounts outstanding under our revolving credit facility and our Sussex term loan facility. We intend to use any remaining net proceeds from this offering for general corporate purposes, including, but not limited to, funding for acquisitions, working capital and other business opportunities.

Affiliates of Barclays Capital Inc., Lloyds Securities Inc., SunTrust Robinson Humphrey, Inc. and nabSecurities, LLC are lenders under our revolving credit facility, and affiliates of Barclays Capital Inc. and nabSecurities, LLC are lenders under our Sussex term loan facility. Accordingly, affiliates of these underwriters will receive a portion of the net proceeds from this offering through the repayment of borrowings under these facilities. See “Underwriting (Conflicts of Interest).”

|

|

|

|

|

|

|

|

|

|

Listing

|

The Notes are a new issue of securities and there is currently no established trading market for the Notes. We do not intend to apply for listing of the Notes on any securities exchange or to arrange for quotation on any automated quotation system. Although we have been advised by the underwriters that they intend to make a market in the Notes, they are not obligated to do so and they may discontinue market making activities at any time without notice. No assurance can be given as to the liquidity of the trading market for the Notes. See “Underwriting (Conflicts of Interest).”

|

|

|

|

|

Optional Redemption

|

We may redeem any or all of the Notes at our option at any time prior to maturity. At any time prior to the date that is one month prior to the maturity of the Notes, we may redeem the Notes at a redemption price equal to the greater of:

ž

100% of the principal amount of the Notes being redeemed; and

ž

the sum of the present value of the remaining scheduled payments of principal and interest thereon (not including any portion of such payments of interest accrued as of the date of redemption), discounted to their present value as of such date of redemption on a semi-annual basis (assuming a 360-day year consisting of twelve 30-day months) at the Treasury Rate (as defined herein) plus 40 basis points.

On or after the date that is one month prior to the maturity of the Notes, we may redeem the Notes at a redemption price equal to 100% of the principal amount of the notes to be redeemed.

We will also pay the accrued and unpaid interest on the Notes to, but excluding, the redemption date. See “Description of the Notes-Optional Redemption.”

|

|

|

|

|

Covenants

|

The indenture governing the Notes contains limited covenants, including limitations on consolidations, mergers, amalgamations and sales of substantially all assets and limitations on liens on the capital stock of certain designated subsidiaries. These covenants are subject to important qualifications and limitations. See “Description of the Notes-Covenants” and “Description of Debt Securities-Terms and Conditions of the Series of Debt Securities” in the accompanying prospectus.

|

|

|

|

|

Denomination and Form

|

We will issue the Notes in the form of one or more fully registered global notes registered in the name of the nominee of The Depository Trust Company (“DTC”). Beneficial interests in the Notes will be represented through book-entry accounts of financial institutions acting on behalf of beneficial owners as direct and indirect participants in DTC, including the depositaries for Euroclear and Clearstream. Except in the limited circumstances described herein, owners of beneficial interests in the Notes will not be entitled to have Notes registered in their names and will not receive or be entitled to receive Notes in definitive form. The Notes will be issued only in minimum denominations of $2,000 and integral multiples of $1,000 in excess thereof.

|

|

|

|

|

Risk Factors

|

Investing in the Notes involves risks that are described or referred to under “Risk Factors” beginning on page

S-5

of this prospectus supplement.

|

|

|

|

|

Trustee

|

The Bank of New York Mellon

|

|

|

|

|

Governing Law

|

New York

|

|

|

|

|

|

|

|

|

|

Conflicts of Interest

|

Affiliates of Barclays Capital Inc., Lloyds Securities Inc., SunTrust Robinson Humphrey, Inc. and nabSecurities, LLC are lenders under our revolving credit facility, and affiliates of Barclays Capital Inc. and nabSecurities, LLC are lenders under our Sussex term loan facility. Accordingly, affiliates of these underwriters will receive a portion of the net proceeds from this offering through the repayment of borrowings under these facilities.

Because of these relationships, these underwriters are deemed to have a “conflict of interest” under Rule 5121 of the Financial Industry Regulatory Authority (“FINRA”). Under FINRA Rule 5121, because the Notes offered hereby are “investment grade rated,” as defined in FINRA Rule 5121, it is not required that a “qualified independent underwriter” participate in the preparation of this prospectus supplement or the accompanying prospectus. Accordingly, there is no qualified independent underwriter for this offering. See “Use of Proceeds” and “Underwriting (Conflicts of Interest).”

|

RISK FACTORS

Investing in the Notes involves risks. Before investing in the Notes, you should carefully consider the risks described below and other information contained in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein. The risks described below are not the only ones facing our Company. Additional risks not presently known to us or that we currently consider less significant may also impair our business operations. Our business, results of operations or financial condition could be materially adversely affected by any of these risks.

This prospectus supplement and the accompanying prospectus also contain or incorporate by reference forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in such forward-looking statements as a result of certain factors, including the risks faced by us described below and elsewhere in this prospectus supplement and the accompanying prospectus. See “Cautionary Statement Regarding Forward-Looking Statements” above and in the accompanying prospectus.

Risk Related to Our Business

For a discussion of risks related to our business and operations, please see “Item 1A. Risk Factors” and “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report. See “Where You Can Find More Information” in this prospectus supplement.

Risk Related to this Offering and the Notes

The Notes are unsecured, are effectively subordinated to any of our secured indebtedness (to the extent of the value of the assets securing that indebtedness) and are structurally subordinated to all liabilities of our subsidiaries.

The Notes are unsecured and effectively subordinated in right of payment to our secured indebtedness to the extent of the value of the assets securing that indebtedness and are structurally subordinated to all liabilities of our subsidiaries.

The Company and certain of our subsidiaries, as borrowers and guarantors, have entered into an unsecured revolving credit facility that permits us to borrow an aggregate of $665.0 million with an option to obtain additional commitments of up to $166.25 million. This credit facility originated on September 16, 2014 and was amended most recently on August 5, 2016. As of December 31, 2016, the Company and its subsidiaries had outstanding approximately $535.1 million (March 7, 2017: $591.1 million) aggregate principal amount of unsecured indebtedness under the revolving credit facility. The obligations of our subsidiaries in respect of the revolving credit facility are structurally senior to the Notes.

We also entered into a four-year term loan on December 24, 2014 in connection with the acquisition of Sussex Insurance Company, our indirect wholly owned subsidiary (“Sussex”), which was completed in January 2015. The Sussex term loan facility is secured by a first priority security interest in all of the assets and stock of Sussex. As of December 31, 2016, we had $63.5 million (unchanged as of March 7, 2017) aggregate principal amount of such secured indebtedness outstanding under the term loan, all of which would effectively rank senior to the Notes.

We, together with certain of our subsidiaries as guarantors, entered into a three-year, $75.0 million unsecured term loan on November 18, 2016 with an affiliate of Wells Fargo Securities, LLC. As of December 31, 2016, the full $75.0 million (unchanged as of March 7, 2017) of unsecured indebtedness was outstanding. The obligations of our subsidiaries in respect of the unsecured term loan are structurally senior to the Notes.

In the event of our insolvency, bankruptcy, liquidation, reorganization, dissolution or winding up, any of our assets that secure other indebtedness will be available to pay obligations on the Notes only after such secured indebtedness has been paid in full. We may not have sufficient assets to pay all or any of the amounts due on the Notes then outstanding. See “Description of the Notes-Ranking.” After giving effect to the issuance of the Notes and the application of the net proceeds therefrom, our total indebtedness as of December 31, 2016 would have been approximately $673.6 million.

We are a holding company, and we are dependent on the ability of our subsidiaries to distribute funds to us.

We are a holding company and conduct substantially all of our operations through subsidiaries. Our only significant assets are the capital stock of our subsidiaries. Because substantially all of our operations are conducted through our insurance subsidiaries, substantially all of our consolidated assets are held by our subsidiaries and most

of our cash flow, and consequently, our ability to pay any amounts due on the Notes, is dependent on the earnings of those subsidiaries and the transfer of funds by those subsidiaries to us in the form of distributions or loans. The Notes are exclusively Enstar Group Limited’s obligations, and are not guaranteed by any of our subsidiaries. Our subsidiaries are separate and distinct legal entities and have no obligation, contingent or otherwise, to pay holders any amounts due on the Notes or to make any funds available for payment on the Notes, whether by dividends, loans or other payments. In addition, the ability of our insurance and reinsurance subsidiaries to make distributions to us is limited by applicable insurance laws and regulations. These laws and regulations and the determinations by the regulators implementing them may significantly restrict such distributions, and, as a result, adversely affect our overall liquidity. The ability of all of our subsidiaries to make distributions to us may also be restricted by, among other things, other applicable laws and regulations and the terms of our bank loans and our subsidiaries’ bank loans.

We may not have the ability to raise the funds necessary to pay the principal of or interest on the Notes.

At maturity, the entire principal amount of the Notes then outstanding, plus any accrued and unpaid interest, will become due and payable. We must pay interest in cash on the Notes on March 10 and September 10 of each year, beginning on September 10, 2017. We may not have enough available cash or be able to obtain sufficient financing, on favorable terms or at all, at the time we are required to make these payments. Furthermore, our ability to make these payments may be limited by law, by regulatory authority or by agreements governing our future indebtedness. Our failure to pay interest when due, if uncured for 30 days, or our failure to pay the principal amount when due will constitute an event of default under the indenture governing the Notes. A default under the indenture could also lead to a default under agreements governing our existing or future indebtedness. If the repayment of that indebtedness is accelerated as a result, then we may not have sufficient funds to repay that indebtedness or to pay the principal of or interest on the Notes.

Increased leverage as a result of this offering may adversely affect our financial condition and results of operations.

After giving effect to the sale of the Notes and the application of the net proceeds therefrom, our total consolidated indebtedness as of December 31, 2016 would have been approximately $673.6 million. The indenture governing the Notes will not restrict our ability or the ability of our subsidiaries to incur additional unsecured indebtedness and will allow us and our subsidiaries to incur secured debt in certain circumstances. We may also incur additional indebtedness or obtain additional working capital lines of credit to meet future financing needs. Our indebtedness could have significant negative consequences for our business, financial condition and results of operations, including:

|

|

|

|

•

|

increasing our vulnerability to adverse economic and industry conditions;

|

|

|

|

|

•

|

limiting our ability to obtain additional financing on favorable terms or at all;

|

|

|

|

|

•

|

requiring the dedication of a substantial portion of the cash flow from our subsidiaries’ operations to service our indebtedness, thereby reducing the amount of cash flow available for other purposes;

|

|

|

|

|

•

|

limiting our flexibility in planning for, or reacting to, changes in our business; and

|

|

|

|

|

•

|

placing us at a possible competitive disadvantage with less leveraged competitors and competitors that may have better access to capital resources.

|

We cannot assure you that we will continue to maintain sufficient cash reserves or that our business will generate cash flow from operations at levels sufficient to permit us to pay principal, premium, if any, and interest on our indebtedness, or that our cash needs will not increase. If we are unable to generate sufficient cash flow or otherwise obtain funds necessary to make required payments, or if we fail to comply with the various requirements of our existing indebtedness, the Notes or any indebtedness that we may incur in the future, we would be in default, which would permit the holders of such indebtedness to accelerate the maturity of that indebtedness and could cause defaults under other indebtedness. Any default on our indebtedness would likely have a material adverse effect on our business, financial condition and results of operations.

The indenture under which the Notes will be issued will contain only limited protection for holders of the Notes if in the future we are involved in certain transactions, including a highly leveraged transaction, reorganization, restructuring, merger or similar transaction.

The indenture will not contain any provisions restricting our ability to:

|

|

|

|

•

|

incur additional unsecured debt, including debt senior in right of payment to the Notes;

|

|

|

|

|

•

|

pay dividends on or purchase or redeem capital stock;

|

|

|

|

|

•

|

sell assets (other than certain restrictions on our ability to consolidate, merge or sell all or substantially all of our assets);

|

|

|

|

|

•

|

enter into transactions with affiliates;

|

|

|

|

|

•

|

create liens (other than certain limitations on creating liens on the stock of certain subsidiaries) or enter into sale and leaseback transactions;

|

|

|

|

|

•

|

create restrictions on the payment of dividends or other amounts to us from our subsidiaries; or

|

|

|

|

|

•

|

issue equity securities.

|

Additionally, the indenture will not require us to offer to purchase the Notes in connection with a change of control or require that we adhere to any financial tests or ratios or specified levels of net worth. Our ability to recapitalize, incur additional debt and take a number of other actions that are not limited by the terms of the Notes could have the effect of diminishing our ability to make payments on the Notes when due.

If an active and liquid trading market for the Notes does not develop, the market price of the Notes may decline and you may be unable to sell your Notes prior to maturity.

The Notes are a new issue of securities with no established trading market. We do not intend to list the Notes on any securities exchange or to arrange for quotation of the Notes on any automated dealer quotation system. The underwriters have indicated to us that they intend to make a market for the Notes after this offering is completed as permitted by applicable law. However, the underwriters are not obligated to make a market in the Notes and may cease their market-making at any time without notice. In addition, the liquidity of the trading market in the Notes, and the market price quoted for the Notes, may be adversely affected by changes in the overall market for this type of security and by changes in our financial performance or prospects or in the prospects for companies in our industry generally. As a result, no assurance can be given:

|

|

|

|

•

|

that an active trading market will develop or be maintained for the Notes;

|

|

|

|

|

•

|

as to the liquidity of any market that does develop; or

|

|

|

|

|

•

|

as to your ability to sell any Notes you may own or the price at which you may be able to sell your Notes.

|

Credit ratings of the Notes may change and affect the market price and marketability of the Notes.

Credit ratings are limited in scope, and do not address all material risks relating to an investment in the Notes, but rather reflect only the view of each rating agency at the time the rating is issued. An explanation of the significance of such rating may be obtained from such rating agency. There can be no assurance that such credit ratings will remain in effect for any given period of time or that a rating will not be lowered, suspended or withdrawn entirely by the applicable rating agencies, if, in such rating agency’s judgment, circumstances so warrant. Agency credit ratings are not a recommendation to buy, sell or hold any security. Actual or anticipated changes or downgrades in our credit ratings, including any announcement that our ratings are under further review for a downgrade, could affect the market price or marketability of the Notes and increase our corporate borrowing costs.

We may redeem the Notes at our option, which may adversely affect your return.

We may redeem any or all of the Notes at our option at any time or from time to time prior to maturity. Prevailing interest rates at the time we redeem the Notes may be lower than the interest rate on the Notes. As a result, you may not be able to reinvest the redemption proceeds in a comparable security at an interest rate equal to or higher than the interest rate on the Notes. See “Description of the Notes-Optional Redemption.”

The Notes will initially be held in book-entry form and, therefore, you must rely on the procedures and relevant clearing systems to exercise your rights and remedies.

Unless certificated Notes are issued in exchange for book-entry interests in the Notes, owners of book-entry interests will not be considered owners or holders of the Notes. Instead, DTC, or its nominee, will be the sole holder of the Notes. Payments of principal, interest and other amounts owing on or in respect of the Notes in global form will be made to the paying agent, which will make payments to DTC. Thereafter, such payments will be credited to DTC participants’ accounts that hold book-entry interests in the Notes in global form and credited by such participants to indirect participants. Unlike holders of the Notes themselves, owners of book-entry interests will not have the direct

right to act upon our solicitations for consents or requests for waivers or other actions from holders of the Notes. Instead, if you own a book-entry interest, you will be permitted to act only to the extent you have received appropriate proxies to do so from DTC or, if applicable, a DTC participant. We cannot assure you that procedures implemented for the granting of such proxies will be sufficient to enable you to vote on any requested actions on a timely basis.

Management will have broad discretion to use the proceeds from this offering, and may not use them successfully.

After the repayment of amounts outstanding under our revolving credit facility and Sussex term loan facility, we intend to use any remaining net proceeds from this offering for general corporate purposes, which may include funding for acquisitions, working capital and other business opportunities. Accordingly, you will be relying on the judgment of our management and our board of directors with regard to the use of these proceeds and you will not have the opportunity, as part of your investment decision, to assess whether proceeds are being used appropriately. It is possible that the proceeds will be invested or used in a way that does not yield a favorable, or any, return for the Company.

We cannot assure you as to the market price for the Notes; therefore, you may suffer a loss.

We cannot assure you as to the market price for the Notes. If you are able to resell your Notes, the price you receive will depend on many other factors that may vary over time, including:

|

|

|

|

•

|

the number of potential buyers;

|

|

|

|

|

•

|

the level of liquidity of the Notes;

|

|

|

|

|

•

|

our credit ratings or the ratings of our insurance subsidiaries’ financial strength and claims paying ability published by major credit ratings agencies;

|

|

|

|

|

•

|

the credit ratings of the Notes;

|

|

|

|

|

•

|

our financial performance and financial condition;

|

|

|

|

|

•

|

the amount of total indebtedness we have outstanding;

|

|

|

|

|

•

|

the level, direction and volatility of market interest rates generally;

|

|

|

|

|

•

|

the market for similar securities;

|

|

|

|

|

•

|

the repayment and redemption features of the Notes; and

|

|

|

|

|

•

|

the time remaining until the Notes mature.

|

As a result of these and other factors, you may be able to sell your Notes only at a price below that which you believe to be appropriate, including a price below the price you paid for them.

U.S. persons who own our Notes may have more difficulty in protecting their interests than U.S. persons who are creditors of a U.S. corporation or U.S. person.

Creditors of a company in Bermuda such as Enstar may enforce their rights against the company by legal process in Bermuda, although enforcement in Bermuda may not be the only means of enforcement. Where a creditor seeks to use legal process in Bermuda, it would first have to obtain a judgment in its favor against Enstar by pursuing a legal action against Enstar in Bermuda. This would entail retaining attorneys in Bermuda and (in the case of a plaintiff who is a U.S. person) pursuing an action in a jurisdiction that would be foreign to the plaintiff. Pursuing such an action could be more costly than pursuing corresponding proceedings against a U.S. corporation or U.S. person.

Appeals from decisions of the Supreme Court of Bermuda (the first instance court for most civil proceedings in Bermuda) may be made in certain cases to the Court of Appeal for Bermuda. In turn, appeals from the decisions of the Court of Appeal may be made in certain cases to the English Privy Council. Rights of appeal in Bermuda may be more restrictive than rights of appeal in the United States.

In the event that we become insolvent, the rights of a creditor against us would be severely impaired.

In the event of our insolvent liquidation (or appointment of a provisional liquidator), a creditor may pursue legal action only upon obtaining permission to do so from the Supreme Court of Bermuda. The rights of unsecured creditors in an insolvent liquidation will extend only to proving a claim in the liquidation and receiving a distribution pro rata along with other unsecured creditors to the extent of our available assets (after the payment of costs of the liquidation and

the distribution of assets to creditors with higher priority, such as secured creditors and preferential creditors). However, creditors not subject to the Bermuda jurisdiction are not prevented from taking action against us in jurisdictions outside Bermuda unless there has been a stay or an injunction by the courts of that jurisdiction preventing them from doing so. In those circumstances, any judgment thus obtained may be capable of enforcement against our assets located outside Bermuda.

The impairment of the rights of an unsecured creditor may be more severe in an insolvent liquidation in Bermuda than would be the case where a U.S. person has a claim against a U.S. corporation that becomes insolvent. This is so mainly because in the event of an insolvency, Bermuda law may be more generous to secured creditors (and hence less generous to unsecured creditors) than U.S. law. The rights of secured creditors in an insolvent liquidation in Bermuda remain largely unimpaired, with the result that secured creditors will be paid in full to the extent of the value of the security they hold. Another possible consequence of the favorable treatment of secured creditors under Bermuda insolvency law is that a rehabilitation of an insolvent company in Bermuda may be more difficult to achieve than the rehabilitation of an insolvent U.S. corporation.

You may have difficulty effecting service of process on us or enforcing judgments against us in the United States.

We are a Bermuda exempted company. In addition, some of our directors and some of the named experts referred to in this prospectus supplement and the accompanying prospectus are not residents of the United States, and a substantial portion of our assets is located outside the United States. As a result, it may be difficult for investors to effect service of process on those persons in the United States or to enforce in the United States judgments obtained in U.S. courts against us or those persons based on the civil liability provisions of the U.S. securities laws. It is doubtful whether courts in Bermuda will enforce judgments obtained in other jurisdictions, including the United States, against us or our directors or officers under the securities laws of those jurisdictions or entertain actions in Bermuda against us or our directors or officers under the securities laws of other jurisdictions.

USE OF PROCEEDS

We estimate that the net proceeds to us from the sale of the Notes will be approximately $347.1 million, after deducting the underwriting discount and estimated offering expenses payable by us. We intend to use these net proceeds to repay a portion of amounts outstanding under our revolving credit facility and our Sussex term loan facility. We intend to use any remaining net proceeds from this offering for general corporate purposes, including, but not limited to, funding for acquisitions, working capital and other business opportunities. We may temporarily invest funds that are not immediately needed for these purposes in cash and investments.

Our revolving credit facility matures on September 16, 2019. The individual outstanding loans under our revolving credit facility are floating rate loans with an interest rate of LIBOR plus an applicable margin and utilization fee. As of March 7, 2017, the weighted average interest rate applicable to borrowings under our revolving credit facility was approximately 3.25% per annum (including the utilization fee). Borrowings under our revolving credit facility that are repaid with net proceeds from this offering may be reborrowed, subject to customary conditions.

Our Sussex term loan facility matures on December 24, 2018 and is a floating rate loan with an interest rate of LIBOR plus an applicable margin. As of March 7, 2017, the weighted average interest rate applicable to borrowings under our Sussex term loan facility was approximately 3.75% per annum. Borrowings under our Sussex term loan facility that are repaid with net proceeds from this offering may not be reborrowed.

Affiliates of Barclays Capital Inc., Lloyds Securities Inc., SunTrust Robinson Humphrey, Inc. and nabSecurities, LLC are lenders under our revolving credit facility, and affiliates of Barclays Capital Inc. and nabSecurities, LLC are lenders under our Sussex term loan facility.

Accordingly, affiliates of these underwriters will receive a portion of the net proceeds from this offering through the repayment of borrowings under these facilities. See “Underwriting (Conflicts of Interest).”

RATIO OF EARNINGS TO FIXED CHARGES

The following table sets forth our historical ratio of earnings to fixed charges for the periods indicated.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fiscal Year Ended December 31,

|

|

|

Pro

Forma

2016

(2)

|

|

2016

|

|

2015

|

|

2014

|

|

2013

|

|

2012

|

|

Ratio of earnings to fixed charges

(1)

|

|

9.0x

|

|

11.5x

|

|

10.5x

|

|

13.8x

|

|

17.5x

|

|

22.2x

|

________________________

(1) Data from certain prior years has been reclassified to reflect the results of Pavonia Holdings (US) Inc. as discontinued operations. See “Note 5 - Held-For-Sale Business” in the notes to our consolidated financial statements included within Item 8 of our Annual Report incorporated by reference into this prospectus supplement.

(2) The pro forma ratio of earnings to fixed charges was calculated on a pro forma basis after giving effect to the issuance of the Notes offered hereby and the use of proceeds therefrom to repay a portion of amounts outstanding under our revolving credit facility and our Sussex term loan facility. See “Use of Proceeds.”

CAPITALIZATION

The following table shows our capitalization on an actual and as adjusted basis, giving effect to the issuance of the Notes, as of December 31, 2016. See “Use of Proceeds.” This table should be read in conjunction with “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and notes in our Annual Report incorporated by reference into this prospectus supplement.

|

|

|

|

|

|

|

|

|

|

|

|

|

As of December 31, 2016

|

|

|

Actual

|

|

|

|

|

(In thousands, except share data)

|

|

Debt obligations

|

|

|

|

|

|

|

Loans payable

(1)

|

$

|

673,603

|

|

|

$

|

326,503

|

|

|

Senior Notes due 2022 offered hereby

|

|

—

|

|

|

$

|

347,100

|

|

|

Total debt obligations

|

|

673,603

|

|

|

|

673,603

|

|

|

|

|

|

|

|

|

|

Shareholders’ equity

|

|

|

|

|

|

|

Share capital authorized, issued and fully paid, par value $1 each (authorized: 156,000,000):

|

|

|

|

|

|

|

Ordinary shares (issued and outstanding: 16,175,250)

|

|

16,175

|

|

|

|

16,175

|

|

|

Non-voting convertible ordinary shares:

|

|

|

|

|

|

|

Series C (issued and outstanding: 2,792,157)

|

|

2,792

|

|

|

|

2,792

|

|

|

Series E (issued and outstanding: 404,771)

|

|

405

|

|

|

|

405

|

|

|

Series C Preferred Shares (issued and outstanding: 388,571)

|

|

389

|

|

|

|

389

|

|

|

Treasury shares at cost (Preferred shares: 388,571)

|

|

(421,559

|

)

|

|

|

(421,559)

|

|

|

Additional paid-in capital

|

|

1,380,109

|

|

|

|

1,380,109

|

|

|

Accumulated other comprehensive loss

|

|

(23,549

|

)

|

|

|

(23,549)

|

|

|

Retained earnings

|

|

1,847,550

|

|

|

|

1,847,550

|

|

|

Total Enstar Group Limited Shareholders’ Equity

|

|

2,802,312

|

|

|

|

2,802,312

|

|

|

Noncontrolling interest

|

|

8,520

|

|

|

|

8,520

|

|

|

Total Shareholders’ Equity

|

|

2,810,832

|

|

|

|

2,810,832

|

|

|

|

|

|

|

|

|

|

Total Capitalization

|

$

|

3,484,435

|

|

|

$

|

3,484,435

|

|

|

|

|

|

(1)

|

Does not give effect to the borrowing of approximately $90 million and repayment of approximately $34 million, in each case subsequent to December 31, 2016 under our revolving credit facility.

|

SELECTED FINANCIAL DATA

The following selected historical financial information for each of the past five full fiscal years ended December 31, 2016 has been derived from our audited consolidated historical financial statements included in our Annual Report. This information is only a summary and should be read in conjunction with "Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations" and our consolidated financial statements and notes thereto included in our Annual Report and incorporated by reference into this prospectus supplement. The results of operations for historical accounting periods are not necessarily indicative of the results to be expected for any future accounting period.

Since our inception, we have made numerous acquisitions of companies and portfolios of business that impact the comparability between periods of the information reflected below. In particular, our 2016 acquisition of Dana Companies LLC, our 2015 acquisitions of Alpha, the life settlement companies of Wilton Re Limited, and Sussex Insurance Company, our 2014 acquisition of StarStone and our 2013 acquisitions of SeaBright Insurance Company, Pavonia Holdings (US) and its subsidiaries (“Pavonia”), Arden Holdings Limited and its subsidiaries and Atrium impact comparability between periods, including with respect to net premiums earned. Our acquisitions and significant new business are described in "Item 1. Business - Recent Acquisitions and Significant New Business” and Notes 3 and 4 of our consolidated financial statements included in our Annual Report and incorporated by reference into this prospectus supplement. In addition, we have now classified our Pavonia operations as held-for-sale and its results of operations are included in discontinued operations. See Note 5 of our consolidated financial statements included in our Annual Report and incorporated by reference into this prospectus supplement.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Years Ended December 31,

|

|

|

2016

|

|

2015

|

|

2014

|

|

2013

|

|

2012

|

|

|

(in thousands of U.S. dollars, except share and per share data)

|

|

Statements of Earnings Data:

|

|

|

|

|

|

|

|

|

|

|

Net premiums earned

|

$

|

823,514

|

|

|

$

|

753,744

|

|

|

$

|

542,991

|

|

|

$

|

147,613

|

|

|

$

|

3,511

|

|

|

Fees and commission income

|

39,364

|

|

|

39,347

|

|

|

34,919

|

|

|

12,817

|

|

|

8,570

|

|

|

Net investment income

|

185,463

|

|

|

122,564

|

|

|

66,024

|

|

|

62,117

|

|

|

68,864

|

|

|

Net realized and unrealized gains (losses)

|

77,818

|

|

|

(41,523

|

)

|

|

51,991

|

|

|

78,394

|

|

|

73,612

|

|

|

Net incurred losses and loss adjustment expenses

|

(174,099

|

)

|

|

(104,333

|

)

|

|

(9,146

|

)

|

|

163,672

|

|

|

237,953

|

|

|

Life and annuity policy benefits

|

2,038

|

|

|

546

|

|

|

(84

|

)

|

|

1,523

|

|

|

300

|

|

|

Acquisition costs

|

(186,569

|

)

|

|

(163,716

|

)

|

|

(117,542

|

)

|

|

(14,436

|

)

|

|

—

|

|

|

Total other expenses, net

|

(475,079

|

)

|

|

(394,257

|

)

|

|

(347,456

|

)

|

|

(231,579

|

)

|

|

(201,291

|

)

|

|

Net earnings from continuing operations

|

292,450

|

|

|

212,372

|

|

|

221,697

|

|

|

220,121

|

|

|

191,519

|

|

|

Net earnings (losses) from discontinued operations

|

11,963

|

|

|

(2,031

|

)

|

|

5,539

|

|

|

3,701

|

|

|

—

|

|

|

Net earnings

|

304,413

|

|

|

210,341

|

|

|

227,236

|

|

|

223,822

|

|

|

191,519

|

|

|

Less: Net loss (earnings) attributable to noncontrolling interests

|

(39,606

|

)

|

|

9,950

|

|

|

(13,487

|

)

|

|

(15,218

|

)

|

|

(23,502

|

)

|

|

Net earnings attributable to Enstar Group Limited

|

$

|

264,807

|

|

|

$

|

220,291

|

|

|

$

|

213,749

|

|

|

$

|

208,604

|

|

|

$

|

168,017

|

|

|

Per Ordinary Share Data:

(1)

|

|

|

|

|

|

|

|

|

|

|

Earnings per common share attributable to Enstar Group Limited:

|

|

|

|

|

|

|

|

|

|

|

EARNINGS PER SHARE - BASIC

|

|

|

|

|

|

|

|

|

|

|

Net earnings from continuing operations

|

$

|

13.10

|

|

|

$

|

11.55

|

|

|

$

|

11.31

|

|

|

$

|

12.40

|

|

|

$

|

10.22

|

|

|

Net earnings (losses) from discontinued operations

|

$

|

0.62

|

|

|

$

|

(0.11

|

)

|

|

$

|

0.30

|

|

|

$

|

0.22

|

|

|

$

|

—

|

|

|

Net earnings per ordinary share attributable to Enstar Group Limited shareholders

|

$

|

13.72

|

|

|

$

|

11.44

|

|

|

$

|

11.61

|

|

|

$

|

12.62

|

|

|

$

|

10.22

|

|

|

EARNINGS PER SHARE - DILUTED

|

|

|

|

|

|

|

|

|

|

|

Net earnings from continuing operations

|

$

|

13.00

|

|

|

$

|

11.46

|

|

|

$

|

11.15

|

|

|

$

|

12.27

|

|

|

$

|

10.10

|

|

|

Net earnings (losses) from discontinued operations

|

$

|

0.62

|

|

|

$

|

(0.11

|

)

|

|

$

|

0.29

|

|

|

$

|

0.22

|

|

|

$

|

—

|

|

|

Net earnings per ordinary share attributable to Enstar Group Limited shareholders

|

$

|

13.62

|

|

|

$

|

11.35

|

|

|

$

|

11.44

|

|

|

$

|

12.49

|

|

|

$

|

10.10

|

|

|

Weighted average ordinary shares outstanding:

|

|

|

|

|

|

|

|

|

|

|

Basic

|

19,299,426

|

|

|

19,252,072

|

|

|

18,409,069

|

|

|

16,523,369

|

|

|

16,441,461

|

|

|

Diluted

|

19,447,241

|

|

|

19,407,756

|

|

|

18,678,130

|

|

|

16,703,442

|

|

|

16,638,021

|

|

________________________

(1) Earnings per share is a measure based on net earnings divided by weighted average ordinary shares outstanding. Basic earnings per share is defined as net earnings available to ordinary shareholders divided by the weighted average number of ordinary shares outstanding for the period, giving no effect to dilutive securities. Diluted earnings per share is defined as net earnings available to ordinary shareholders divided by the weighted average number of shares and share equivalents outstanding calculated using the treasury stock method for all potentially dilutive securities. When the effect of dilutive securities would be anti-dilutive, these securities are excluded from the calculation of diluted earnings per share.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31,

|

|

|

2016

|

|

2015

|

|

2014

|

|

2013

|

|

2012

|

|

|

(in thousands of U.S. dollars, except share and per share data)

|

|

Balance Sheet Data:

|

|

|

|

|

|

|

|

|

|

|

Total investments

|

$

|

6,042,672

|

|

|

$

|

6,340,781

|

|

|

$

|

4,844,352

|

|

|

$

|

4,279,542

|

|

|

$

|

3,352,875

|

|

|

Total cash and cash equivalents (inclusive of restricted)

|

1,318,645

|

|

|

1,295,169

|

|

|

1,429,622

|

|

|

958,999

|

|

|

954,855

|

|

|

Reinsurance balances recoverable

|

1,460,743

|

|

|

1,451,921

|

|

|

1,305,515

|

|

|

1,331,892

|

|

|

1,122,919

|

|

|

Total assets

|

12,865,744

|

|

|

11,772,534

|

|

|

8,622,147

|

|

|

7,236,289

|

|

|

5,878,261

|

|

|

Losses and loss adjustment expense liabilities

|

5,987,867

|

|

|

5,720,149

|

|

|

4,509,421

|

|

|

4,219,905

|

|

|

3,650,127

|

|

|

Policy benefits for life and annuity contracts

|

112,095

|

|

|

126,321

|

|

|

8,940

|

|

|

9,779

|

|

|

11,027

|

|

|

Loans payable

|

673,603

|

|

|

599,750

|

|

|

320,041

|

|

|

452,446

|

|

|

107,430

|

|

|

Total Enstar Group Limited shareholders’ equity

|

2,802,312

|

|

|

2,516,872

|

|

|

2,304,850

|

|

|

1,755,523

|

|

|

1,553,755

|

|

|

Book Value per Share:

(1)

|

|

|

|

|

|

|

|

|

|

|

Basic

|

$

|

144.66

|

|

|

$

|

130.65

|

|

|

$

|

120.04

|

|

|

$

|

106.21

|

|

|

$

|

94.29

|

|

|

Diluted

|

$

|

143.68

|

|

|

$

|

129.65

|

|

|

$

|

119.22

|

|

|

$

|

105.20

|

|

|

$

|

93.30

|

|

|

Shares Outstanding:

|

|

|

|

|

|

|

|

|

|

|

Basic

|

19,372,178

|

|

|

19,263,742

|

|

|

19,201,017

|

|

|

16,528,343

|

|

|

16,477,809

|

|

|

Diluted

|

19,645,309

|

|

|

19,714,810

|

|

|

19,332,864

|

|

|

16,707,115

|

|

|

16,653,120

|

|

________________________

(1) Basic book value per share is calculated as total Enstar Group Limited shareholders’ equity available to ordinary shareholders divided by the number of ordinary shares outstanding as at the end of the period, giving no effect to dilutive securities. Diluted book value per share is calculated as total Enstar Group Limited shareholders’ equity available to ordinary shareholders plus the assumed proceeds from the exercise of outstanding warrants divided by the sum of the number of ordinary shares and ordinary share equivalents and warrants outstanding at the end of the period.

DESCRIPTION OF THE NOTES

We will issue the notes under an indenture, to be dated as of March 10, 2017, between Enstar Group Limited, as issuer, and The Bank of New York Mellon, as trustee, as supplemented by a first supplemental indenture, to be dated as of March 10, 2017 (such indenture as so supplemented, the “indenture”). This description of the notes supplements, and to the extent inconsistent therewith replaces, the section entitled “Description of Debt Securities” in the accompanying prospectus.

The description of the notes in this prospectus supplement and the accompanying prospectus is a summary only, is not complete and is subject to, and qualified by reference to, all of the provisions of the indenture and the notes. We urge you to read the indenture and the notes because they define your rights as a holder of notes. A copy of the indenture, including the form of the notes, is available without charge upon request to us at the address provided under “Where You Can Find More Information.” Capitalized terms used in this “Description of the Notes” that are not defined in this prospectus supplement have the meanings given to them in the indenture.

As used in this description of the notes, “we,” “us,” “our,” the “Company” and “Enstar Group Limited” refer only to Enstar Group Limited and do not include any current or future subsidiaries of Enstar Group Limited.

General

The notes will mature on March 10, 2022. The notes will bear interest at a rate of 4.500% per year. The notes will be issued only in registered form in denominations of $2,000 and any integral multiples of $1,000 in excess thereof.

The trustee will initially act as our paying agent for the notes. The notes will be payable at the corporate trust office of the trustee, or an office or agency maintained by us for such purpose, in the Borough of Manhattan, The City of New York. We will pay principal of, premium, if any, and interest on, notes in global form registered in the name of or held by The Depository Trust Company (“DTC”) or its nominee in immediately available funds to DTC or its nominee, as the case may be, as the registered holder of such global note.

We will issue the notes as a new series of debt securities under the indenture initially in an aggregate principal amount of $350,000,000. We may, without the consent of the holders of the notes, issue an unlimited principal amount of additional notes having identical terms as the notes offered hereby other than issue date, issue price and the first interest payment date (the “additional notes”) and which will be deemed to be in the same series as the notes offered hereby. We will only be permitted to issue such additional notes if, at the time of such issuance, no event of default has occurred and is continuing under the indenture with respect to the notes. Any additional notes will be part of the same issue as the notes that we are currently offering and will vote on all matters with the holders of the notes; provided that if any additional notes are not fungible with the notes offered hereby for U.S. federal income tax purposes, they will be issued with a separate CUSIP number.

We do not intend to apply for listing of the notes on any securities exchange.

Interest

We will pay interest on the notes semi-annually in arrears on March 10 and September 10 of each year, beginning on September 10, 2017. We will make each interest payment to the holders of record at the close of business on the immediately preceding February 25 and August 25.

Interest on the notes will accrue from the date of original issuance or, if interest has already been paid, from the date it was most recently paid. Interest will be computed on the basis of a 360-day year comprised of twelve 30-day months.

If an interest payment date for the notes falls on a day that is not a business day, the interest payment date will be postponed to the next business day and no interest with respect to such interest payment shall accrue for the intervening period. If the maturity date of the notes falls on a day that is not a business day, we will pay principal and accrued and unpaid interest on the notes on the next business day. No interest on that payment will accrue from and after the maturity date.

Ranking

The notes will represent unsecured general obligations of the Company and will rank equally with all of our other existing and future unsecured unsubordinated indebtedness. The notes will rank senior to any future subordinated indebtedness we incur.

Because we are a holding company and a significant part of our operations is conducted through subsidiaries, a significant portion of our cash flow, and consequently our ability to service debt, including the notes, is dependent upon the earnings of our subsidiaries and the transfer of funds by those subsidiaries to us in the form of dividends or other transfers.

In addition, holders of the notes will have a junior position to claims of creditors against our subsidiaries, including policy holders, trade creditors, debtholders, secured creditors, taxing authorities, guarantee holders and any preferred shareholders, except to the extent that we are recognized as a creditor of the applicable subsidiary. Any claims of the Company as the creditor of such subsidiary would be subordinate to any security interest in the assets of such subsidiary and any indebtedness of such subsidiary that is structurally senior to that held by us. As of December 31, 2016, the total liabilities of our subsidiaries were approximately $9,107.2 million, including $185.5 million of outstanding indebtedness. In addition, as of December 31, 2016, certain of our subsidiaries guaranteed $488.1 million of Enstar Group Limited debt.