Cerus Corporation (NASDAQ:CERS) today announced financial

results for the fourth quarter and year ended December 31,

2016.

Recent developments include:

- The U.S. Food and Drug Administration's

Center for Biologics Evaluation and Research (CBER) intends to

release final guidance on bacterial contamination of platelets this

year, according to its recently published Guidance Document Agenda

for 2017.

- Cerus estimates that at least 7 U.S.

blood center customers, including the American Red Cross, have

submitted biologics license applications to the FDA to request

allowance for the interstate transport of INTERCEPT-treated

platelet components.

- Enrollment in SPARC, Cerus’ European

chronic anemia trial, reached its target of at least 70 evaluable

patients. Database lock is expected by the end of 2017 with data

readout expected in early 2018.

- Cerus’ planned INTERCEPT red blood cell

CE mark submission has been extended pending completion

of commercial lot release testing; optimization and

validation of the release assay method are in progress.

- Additional options totaling $10.8

million were exercised under Cerus’ contract with the Biomedical

Advanced Research and Development Authority (BARDA) for INTERCEPT

red blood cell development.

“We saw significant acceleration in U.S. blood center

illuminator installations in late 2016, with fourth quarter

installations accounting for roughly half of the total for the

year,” said William 'Obi' Greenman, Cerus’ president and chief

executive officer. “We are optimistic for our growth prospects over

the next several years based on the U.S. opportunity as well as

anticipated progress in major international markets such as France

and South Africa.”

Revenue

Product revenue for the fourth quarter of 2016 was $10.1

million, compared to $9.7 million recognized during the same period

in 2015. Revenue for the year ended December 31, 2016, was $37.2

million, compared to $34.2 million for the year ended December 31,

2015. The increase in reported product revenue was primarily driven

by a year-over-year increase in demand as U.S. blood banks began to

implement our INTERCEPT technology.

Revenue from our BARDA agreement was $1.8 million in the fourth

quarter and $2.1 million for the full year 2016. We did not

recognize any revenue from our BARDA agreement during the same time

periods in 2015.

Looking ahead, the Company expects 2017 global product revenue

in the range of $45 million to $50 million, with anticipated

product revenue growth contribution from both the U.S. and EMEA

markets. INTERCEPT disposable kit revenue is expected to be the

primary product growth driver, resulting from anticipated increased

penetration in EMEA markets and as U.S. customers who deployed the

technology in 2016 move into anticipated routine production and

product sales to their hospital customers.

Gross Margins

Gross margins on product revenue for the fourth quarter of 2016

were 45%, compared to 36% for the fourth quarter of 2015. Gross

margins for the year ended December 31, 2016, were 45%, compared

with 31% in the same period in 2015.

Gross margins on product revenue for the full-year 2016

increased due to the favorable impact of the Company’s disposable

kit manufacturing agreement with Fresenius Kabi AG, entered into

during the fourth quarter of 2015. In addition the Company realized

inventory management efficiencies, leading to lower losses and

period charges throughout 2016. Looking ahead, the Company expects

to achieve relatively stable and consistent gross margins on

product sales in 2017 relative to those it experienced in 2016.

Operating Expenses

Total operating expenses were $21.5 million and $80.4 million

for the quarter and year ended December 31, 2016, respectively,

compared to $18.5 million and $71.8 million for the quarter and

year ended December 31, 2015, respectively.

Selling, general and administrative expenses increased for the

three and twelve months ended December 31, 2016. The increase in

operating expenses was partially driven by selling, general and

administrative expenses incurred in support of the Company’s U.S.

commercialization efforts. In addition, research and development

costs increased as a result of activities under the Company’s BARDA

agreement, preparations for the planned CE mark submission for the

Company’s red blood cell system, and U.S. label claim expansion

activities.

Operating and Net Loss

Operating losses during the fourth quarter of 2016 were $15.1

million, compared to $15.0 million during the fourth quarter of

2015, and $61.4 million compared to $61.1 million for years ended

December 31, 2016 and 2015, respectively.

Net loss for the fourth quarter of 2016 was $13.5 million, or

$0.13 per diluted share, compared to a net loss of $14.8 million,

or $0.15 per diluted share, for the fourth quarter of 2015. Net

loss for the year ended December 31, 2016, was $62.9 million, or

$0.62 per diluted share, compared to a net loss of $55.9 million,

or $0.61 per diluted share, for the same period of 2015.

Net loss for the fourth quarter of 2016 was positively impacted

by non-cash income tax benefit of $1.2 million. Net losses for the

quarter and year ended December 31, 2015, were positively impacted

by non-cash income tax benefits of $1.8 million and $3.8 million.

These tax items are largely the result of changes in the fair value

of our investments, primarily Aduro Biotech, Inc.

Net loss for the fourth quarter of 2015 was also negatively

impacted by the mark-to-market adjustments of the Company’s

previously outstanding warrants, which resulted in non-cash losses

of $1.1 million during the quarter ended December 31, 2015. Net

loss for the year ended 2015 was positively impacted by the

mark-to-market adjustments of the Company’s previously outstanding

warrants, which resulted in non-cash gains of $3.6 million. At

December 31, 2016, the Company has no remaining outstanding

warrants and as such, does not expect mark-to-market adjustments

going forward.

Cash, Cash Equivalents and Investments

At December 31, 2016, the Company had cash, cash equivalents and

short-term investments of $71.6 million compared to $107.9 million

at December 31, 2015.

At December 31, 2016, the Company had approximately $19.4

million in outstanding debt under its loan agreement with Oxford

Finance and $62.3 million of common stock available to be sold

under its Controlled Equity OfferingSM Sales Agreement, dated

August 31, 2012, as amended, with Cantor Fitzgerald & Co.

QUARTERLY CONFERENCE CALL

The Company will host a conference call and webcast at 4:15 p.m.

Eastern time today to discuss its financial results and provide a

general business overview and outlook. To access the live webcast,

please visit the Investor Relations page of the Cerus website at

http://www.cerus.com/ir. Alternatively, you may access the live

conference call by dialing 866-235-9006 (U.S.) or 631-291-4549

(international).

A replay will be available on the Company’s website, or by

dialing 855-859-2056 (U.S.) or 404-537-3406 (international) and

entering conference ID number 95465206. The replay will be

available approximately three hours after the call through March

21, 2017.

ABOUT CERUS

Cerus Corporation is a biomedical products company focused in

the field of blood transfusion safety. The INTERCEPT Blood System

is designed to reduce the risk of transfusion-transmitted

infections by inactivating a broad range of pathogens such as

viruses, bacteria and parasites that may be present in donated

blood. The nucleic acid targeting mechanism of action of the

INTERCEPT treatment is designed to inactivate established

transfusion threats, such as hepatitis B and C, HIV, West Nile

virus and bacteria, as well as emerging pathogens such as

chikungunya, malaria and dengue. Cerus currently markets and sells

the INTERCEPT Blood System for both platelets and plasma in the

United States, Europe, the Commonwealth of Independent States, the

Middle East and selected countries in other regions around the

world. The INTERCEPT Red Blood Cell system is in clinical

development. See http://www.cerus.com for information about

Cerus.

INTERCEPT and the INTERCEPT Blood System are trademarks of Cerus

Corporation.

Forward Looking Statements

Except for the historical statements contained herein, this

press release contains forward-looking statements concerning Cerus’

products, prospects and expected results, including statements

concerning Cerus’ expectation that CBER will release final guidance

on bacterial contamination of platelets in 2017; the potential

allowance for the interstate transport of INTERCEPT-treated

platelet components by U.S. blood center customers that have

submitted biologics license applications (BLAs) to the FDA; Cerus’

expectation for data readout on SPARC near the start of 2018;

Cerus‘ planned INTERCEPT red blood cell CE Mark submission; Cerus’

2017 annual product revenue guidance and its expectation that

INTERCEPT disposable kit revenue will be the primary product growth

driver in 2017; Cerus’ expectation for growth over the next several

years based on the U.S. opportunity as well as anticipated progress

in major international markets; Cerus’ expectations for future

gross margins; potential premarket applications supplemental

approvals for the platelet and plasma systems; Cerus’ expectation

for the lack of mark-to-market adjustments going forward; and

potential sales of common stock under its Controlled Equity

OfferingSM Sales Agreement, dated August 31, 2012 as amended, with

Cantor Fitzgerald & Co., or the Sales Agreement. Actual results

could differ materially from these forward-looking statements as a

result of certain factors, including, without limitation: risks

associated with the commercialization and market acceptance of, and

customer demand for, the INTERCEPT Blood System, including the

risks that Cerus may not meet its revenue guidance for

2017, grow sales in its major international markets and/or realize

meaningful revenue contributions from U.S. customers for 2017 or

otherwise, particularly since Cerus cannot guarantee the

volume or timing of commercial purchases, if any, that its U.S.

customers may make under Cerus’ commercial agreements with these

customers; risks associated with Cerus’ lack of commercialization

experience in the U.S. and its ability to develop and maintain an

effective and qualified U.S.-based commercial organization, as well

as the resulting uncertainty of its ability to achieve market

acceptance of and otherwise successfully commercialize the

INTERCEPT Blood System for platelets and plasma in the U.S.,

including as a result of the potential inability of Cerus’ blood

center customers to obtain approvals of BLAs they have submitted to

the FDA allowing for interstate transport of blood components

processed using the INTERCEPT Blood System; risks related to Cerus’

ability to commercialize the INTERCEPT Blood System in the U.S.

without infringing on the intellectual property rights of others;

risks related to Cerus’ ability to demonstrate to the transfusion

medicine community and other health care constituencies that

pathogen reduction and the INTERCEPT Blood System is safe,

effective and economical; the uncertain and time-consuming

development and regulatory process, including the risks (a)

that Cerus may be unable to comply with the FDA’s

post-approval requirements for the INTERCEPT platelet and plasma

systems, including by successfully completing required

post-approval studies, which could result in a loss of U.S.

marketing approval for the INTERCEPT platelet and/or plasma

systems, (b) related to Cerus’ ability to expand the label claims

and product configurations for the INTERCEPT platelet and plasma

systems in the U.S., which will require additional regulatory

approvals, (c) that Cerus’ blood center customers may be unable to

obtain approvals by the FDA of BLAs they have submitted to the FDA

allowing for interstate transport of blood components processed

using the INTERCEPT Blood System in a timely manner or at all,

which could significantly delay or preclude Cerus’ ability to

successfully commercialize the INTERCEPT Blood System to those

customers for the portion of their business involved in interstate

commerce, (d) that Cerus may be unable to file for CE Mark approval

of the red blood cell system in Europe in the anticipated timeframe

or at all, and even if filed, Cerus may be unable to obtain CE Mark

approval, or any other regulatory approvals, of the red blood cell

system in a timely manner or at all and (e) that Cerus may be

unable to obtain data from or complete the SPARC trial in a timely

manner for at all; risks related to adverse market and economic

conditions, including continued or more severe adverse fluctuations

in foreign exchange rates and/or weakening economic conditions in

the markets where Cerus sells its products; Cerus’

reliance on third parties to market, sell, distribute and maintain

its products; Cerus’ ability to maintain an effective manufacturing

supply chain, including the ability of its manufacturers to comply

with extensive FDA and foreign regulatory agency

requirements; the impact of legislative or regulatory healthcare

reforms that may make it more difficult and costly

for Cerus to produce, market and distribute its products;

Cerus’ need for additional capital and its potential inability to

raise additional capital necessary to fund its operations,

including under the Sales Agreement; risks related to future

opportunities and plans, including the uncertainty of future

product revenues and growth, gross margins and other financial

performance and results, as well as other risks detailed in Cerus’

filings with the Securities and Exchange Commission, including

in Cerus‘ Quarterly Report on Form 10-Q for the quarter

ended September 30, 2016, filed with the

SEC on November 4, 2016. Cerus disclaims any

obligation or undertaking to update or revise any forward-looking

statements contained in this press release.

CERUS CORPORATION CONDENSED CONSOLIDATED UNAUDITED

STATEMENTS OF OPERATIONS (in thousands, except per share

information) Three Months Ended Twelve

Months Ended December 31, December 31,

2016 2015

2016 2015

Product revenue $ 10,125 $ 9,656 $ 37,183 $ 34,223 Cost of product

revenue

5,605 6,162

20,295 23,464

Gross profit on product revenue

4,520

3,494 16,888

10,759 Government

contracts revenue

1,831

- 2,092

- Operating expenses: Research and

development 8,815 7,160 31,322 25,643 Selling, general and

administrative 12,439 11,276 48,753 45,989 Amortization of

intangible assets 51 51 202 202 Impairment of long-lived assets

150 -

150 - Total

operating expenses

21,455

18,487 80,427

71,834 Loss from operations (15,104 ) (14,993 )

(61,447 ) (61,075 ) Non-operating income (expense), net

399 (1,513 )

(1,284 ) 1,536

Loss before income taxes (14,705 ) (16,506 ) (62,731 )

(59,539 ) (Benefit) provision for income taxes

(1,204 ) (1,750

) 175

(3,671 ) Net loss

$

(13,501 ) $

(14,756 ) $

(62,906 ) $

(55,868 ) Net loss per share:

Basic $ (0.13 ) $ (0.15 ) $ (0.62 ) $ (0.58 ) Diluted $ (0.13 ) $

(0.15 ) $ (0.62 ) $ (0.61 ) Weighted average shares

outstanding used for calculating net loss per share:

Basic 103,470 98,209 101,826 96,068 Diluted 103,470 98,209 101,826

96,905

CERUS CORPORATION CONDENSED

CONSOLIDATED UNAUDITED BALANCE SHEETS (in thousands)

December 31, December 31, 2016

2015 ASSETS Current assets: Cash and cash

equivalents $ 22,560 $ 71,018 Short-term investments and marketable

equity securities 49,068 36,861 Accounts receivable 6,868 5,794

Inventories 12,531 10,812 Prepaid expenses and other current assets

3,078 5,921 Total current

assets 94,105 130,406 Non-current assets: Property and equipment,

net 2,985 3,549 Goodwill and intangible assets, net 2,054 2,256

Restricted cash and other assets

4,332

3,191 Total assets

$ 103,476

$ 139,402 LIABILITIES AND

STOCKHOLDERS’ EQUITY Current liabilities: Accounts payable and

accrued liabilities $ 19,805 $ 15,070 Manufacturing and development

obligations – current - 3,282 Debt – current 6,934 2,956 Deferred

product revenue – current

149

554 Total current liabilities 26,888 21,862

Non-current liabilities: Debt – non-current 12,441 16,848 Deferred

income taxes 150 122 Manufacturing and development obligations –

non-current 4,770 4,542 Other non-current liabilities

1,440 1,263 Total liabilities

45,689 44,637 Stockholders’ equity

57,787

94,765 Total liabilities and stockholders’

equity

$ 103,476 $

139,402

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170307006309/en/

Cerus CorporationKevin Green, 925-288-6138Vice President,

Finance and Chief Financial Officer

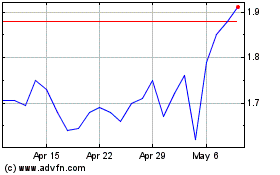

Cerus (NASDAQ:CERS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cerus (NASDAQ:CERS)

Historical Stock Chart

From Apr 2023 to Apr 2024