- Record Annual Revenues and

Earnings

- Acquisitions Contributed $97 Million to

Annual Revenues

- Management Optimistic 2017 Will Be Another

Strong Year

Installed Building Products, Inc. (the "Company" or "IBP")

(NYSE:IBP), an industry-leading installer of insulation and

complementary building products, today announced record results for

the fourth quarter and full year ended December 31, 2016.

Fourth Quarter 2016 Highlights

- Net revenue increased 22.2% to $234

million

- Net income increased 19.3% to $11

million

- Adjusted EBITDA* increased 26.9% to $30

million

- Net income per diluted share increased

16.7% to $0.35

- Adjusted net income per diluted share*

increased 29.4% to $0.44

- In October 2016, acquired East Coast

Insulators, a provider of installation service to residential and

commercial customers with two locations in Virginia, and

trailing-twelve month revenues of approximately $20 million

- In November 2016, acquired M.G.D. Inc.,

a provider of garage doors and services to residential and

commercial customers with one location in Indiana, and

trailing-twelve month revenues of approximately $1 million

- In November 2016, acquired 3R Products

& Services, LLC, an installer of shower doors, shelving, and

mirrors to residential homebuilders in the greater Indianapolis,

Indiana market, and trailing-twelve month revenues of approximately

$5 million

Recent Developments

- In January 2017, closed the previously

announced acquisition of Trilok Industries, Inc., Alpha Insulation

and Waterproofing, Inc., and Alpha Insulation and Waterproofing

Company, a provider of waterproofing, insulation, fireproofing, and

fire stopping services to commercial contractors with nine

locations throughout the southern U.S., and trailing-twelve month

revenues of approximately $89 million

“IBP achieved many milestones during 2016 including record

revenues and earnings, the addition of nearly $100 million in

acquired revenues, and the announcement of the acquisition of Alpha

Insulation and Waterproofing, the largest acquisition we have made

to date,” stated Jeff Edwards, Chairman and Chief Executive

Officer. “I am extremely pleased with these accomplishments, which

have improved our competitiveness and further enhanced our

residential and commercial growth opportunities. For the year,

total revenues increased 30.2% to a record $863 million driven by

single family sales growth of 28.2% and exceptionally strong

multi-family sales growth of 54.1%. This growth was due to our

nationwide presence in many of the country’s strongest housing

markets, our focus on customer service, outstanding customer

relations, and the dedication of our team.

“The New Year is off to a great start and I am happy we were

able to close the Alpha acquisition in early January. Alpha is an

accretive acquisition that allows us to quickly expand and

diversify our presence into the commercial end-market. Commercial

sales represented approximately 12% of IBP’s 2016 revenues and, as

2017 benefits from the addition of Alpha, we expect a greater

proportion of our revenues will be from this market. Our

residential and commercial markets are showing continued signs of

expansion and we are optimistic these trends will remain throughout

2017. As a result, we expect 2017 to be another strong year of

revenue and earnings growth.”

Fourth Quarter 2016 Results Overview

For the fourth quarter of 2016, net revenue was $234.0 million,

an increase of 22.2% from $191.5 million in the fourth quarter of

2015. On a same branch basis, net revenue improved 10.6% from the

prior year quarter, with approximately 52% of the increase

attributable to growth in the number of completed jobs, and the

remainder achieved through price gains and more favorable customer

and product mix.

Gross profit improved 25.5% to $68.4 million from $54.5 million

in the prior year quarter. Gross margin expanded to 29.2% from

28.4% in the prior year quarter, primarily due to higher revenue

and a more profitable mix of business.

Selling and administrative expense, as a percentage of net

revenue, was 19.8% compared to 19.4% in the prior year quarter. The

increase in selling and administrative expenses was primarily due

to higher costs needed to support the company’s organic and

acquisition growth. The company also incurred higher public company

compliance costs, primarily associated with the transition to a

large accelerated filer.

Net income was $11.1 million, or $0.35 per diluted share,

compared to $9.3 million, or $0.30 per diluted share in the prior

year quarter. Adjusted net income was $13.9 million, or $0.44 per

diluted share, compared to $10.7 million, or $0.34 per diluted

share in the prior year quarter. Adjusted net income adjusts for

the impact of non-core items in both periods, and includes an

addback for non-cash amortization expense related to

acquisitions.

Adjusted EBITDA was $29.8 million, a 26.9% increase from $23.5

million in the prior year quarter, largely due to higher gross

profit. Adjusted EBITDA, as a percentage of net revenue, grew 40

basis points to 12.7%, compared to 12.3% in the prior year

quarter.

Full Year 2016 Results Overview

For the year ended December 31, 2016, net revenue was $863.0

million, an increase of 30.2% from $662.7 million in 2015. On a

same branch basis, net revenue improved 15.6% from the prior year,

with approximately 56% of the increase attributable to growth in

the number of completed jobs and the remainder achieved through

price gains and more favorable customer and product mix. Same

branch residential revenue increased 15.3% as compared to a 9.5%

increase in total completions.

Gross profit improved 34.1% to $252.4 million from $188.3

million in the prior year. Gross margin expanded to 29.3% from

28.4% in the prior year. Selling, general and administrative

expense, as a percentage of net revenue, was 20.3% compared to

20.7% in the prior year.

Net income was $38.4 million, or $1.23 per diluted share,

compared to $26.5 million, or $0.85 per diluted share in the prior

year. Adjusted net income was $48.4 million, or $1.54 per diluted

share, compared to $31.9 million, or $1.02 per diluted share in the

prior year. Adjusted net income adjusts for the impact of non-core

items in both periods, and includes an addback for non-cash

amortization expense related to acquisitions.

For the full year of 2016, adjusted EBITDA was $104.8 million, a

47.3% increase from $71.2 million in the prior year. Adjusted

EBITDA, as a percentage of net revenue, improved to 12.1%, or 140

basis points, compared to 10.7% in the prior year. Operating income

was $66.1 million, a 46.9% increase from $45.0 million in the prior

year. The incremental Adjusted EBITDA margin on same branch revenue

growth was 22.2% (please refer to the Supplementary Tables at the

end of this Press Release).

Conference Call and Webcast

The Company will host a conference call and webcast on February

27, 2017 at 10:00 a.m. Eastern Time to discuss these results. To

participate in the call, please dial 877-407-0792 (domestic) or

201-689-8263 (international). The live webcast will be available at

www.installedbuildingproducts.com in the investor relations

section. A replay of the conference call will be available through

March 27, 2017, by dialing 844-512-2921 (domestic) or 412-317-6671

(international) and entering the passcode 13655039.

About Installed Building Products

Installed Building Products, Inc. is the nation's second largest

insulation installer for the residential new construction market

and is also a diversified installer of complementary building

products, including garage doors, rain gutters, shower doors,

closet shelving and mirrors, throughout the United States. The

Company manages all aspects of the installation process for its

customers, including direct purchases of materials from national

manufacturers, supply of materials to job sites and quality

installation. The Company offers its portfolio of services for new

and existing single-family and multi-family residential and

commercial building projects from its national network of branch

locations.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the federal securities laws, including with respect

to the demand for our services, expansion of our national

footprint, our ability to capitalize on the new home construction

recovery, our ability to strengthen our market position, our

ability to pursue value-enhancing acquisitions, our ability to

improve profitability and expectations for demand for our services

in 2017. Forward-looking statements may generally be identified by

the use of words such as "anticipate," "believe," "expect,"

"intends," "plan," and "will" or, in each case, their negative, or

other variations or comparable terminology. These forward-looking

statements include all matters that are not historical facts. By

their nature, forward-looking statements involve risks and

uncertainties because they relate to events and depend on

circumstances that may or may not occur in the future. Any

forward-looking statements that we make herein and in any future

reports and statements are not guarantees of future performance,

and actual results may differ materially from those expressed in or

suggested by such forward-looking statements as a result of various

factors, including, without limitation, the factors discussed in

the “Risk Factors” section of the Company’s Annual Report on Form

10-K for the year ended December 31, 2015, as the same may be

updated from time to time in our subsequent filings with the

Securities and Exchange Commission. Any forward-looking statement

made by the Company in this press release speaks only as of the

date hereof. New risks and uncertainties arise from time to time,

and it is impossible for the Company to predict these events or how

they may affect it. The Company has no obligation, and does not

intend, to update any forward-looking statements after the date

hereof, except as required by federal securities laws.

*Use of Non-GAAP Financial Measures

In addition to the financial measures prepared in accordance

with U.S. generally accepted accounting principles (“GAAP”), this

press release contains the non-GAAP financial measures of Adjusted

EBITDA, Adjusted EBITDA margin (i.e., Adjusted EBITDA divided by

net revenue), Adjusted Net Income and Adjusted Net Income per

diluted share. The reasons for the use of these measures of

Adjusted EBITDA and Adjusted Net Income, reconciliations of

Adjusted EBITDA, Adjusted Net Income and Adjusted Net Income per

diluted share to the most directly comparable GAAP measures and

other information relating to these measures are included below

following the unaudited condensed consolidated financial

statements. Non-GAAP financial measures have limitations as

analytical tools and should not be considered in isolation or as a

substitute for IBP’s financial results prepared in accordance with

GAAP.

INSTALLED BUILDING PRODUCTS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (unaudited, in

thousands, except share and per share amounts)

Three

months ended December 31, Twelve months ended December

31, 2016 2015 2016

2015 Net revenue $ 233,977 $ 191,499 $ 862,980 $ 662,719

Cost of sales 165,623 137,031 610,532

474,426 Gross profit 68,354 54,468 252,448 188,293

Operating expenses Selling 13,429 10,426 49,667 37,702

Administrative 32,794 26,769 125,472 99,375 Amortization

3,081 2,173 11,259 6,264

Operating income 19,050 15,100 66,050 44,952 Other expense Interest

expense 1,571 1,084 6,177 3,738 Other 15 (1,072 )

263 (716 ) Income before income taxes 17,464 15,088

59,610 41,930 Income tax provision 6,383 5,801

21,174 15,413 Net income $ 11,081 $ 9,287

$ 38,436 $ 26,517 Basic and diluted net income

per share $ 0.35 $ 0.30 $ 1.23 $ 0.85 Weighted

average shares outstanding: Basic 31,323,600 31,298,163 31,301,887

31,298,163 Diluted 31,396,857 31,334,569 31,363,290 31,334,569

INSTALLED BUILDING PRODUCTS, INC. CONDENSED

CONSOLIDATED BALANCE SHEETS (unaudited, in thousands, except share

and per share amounts) As of December 31, 2016

2015

ASSETS Current assets Cash $ 14,482 $ 6,818 Accounts

receivable (less allowance for doubtful accounts of $3,397 and

$2,486 at December 31, 2016 and 2015, respectively) 128,466 103,198

Inventories 40,229 29,337 Other current assets 9,214

10,879 Total current assets 192,391 150,232 Property

and equipment, net 67,788 57,592 Non-current assets Goodwill

107,086 90,512 Intangibles, net 86,317 67,218 Other non-current

assets 8,513 8,018 Total non-current

assets 201,916 165,748 Total assets $

462,095 $ 373,572

LIABILITIES AND

STOCKHOLDERS' EQUITY Current liabilities Current maturities of

long-term debt $ 17,192 $ 10,021 Current maturities of capital

lease obligations 6,929 8,411 Accounts payable 67,921 50,867

Accrued compensation 18,212 14,488 Other current liabilities

19,851 13,635 Total current liabilities

130,105 97,422 Long-term debt 134,235 113,214 Capital lease

obligations, less current maturities 8,364 12,031 Deferred income

taxes 14,239 14,582 Other long-term liabilities 21,175

21,840 Total liabilities 308,118 259,089

Commitments and contingencies Stockholders' equity Preferred Stock;

$0.01 par value: 5,000,000 authorized and 0 shares issued and

outstanding at December 31, 2016 and 2015, respectively - - Common

Stock; $0.01 par value: 100,000,000 authorized, 32,135,176 and

31,982,888 issued and 31,484,774 and 31,366,328 shares outstanding

at December 31, 2016 and 2015, respectively 321 320 Additional paid

in capital 158,581 156,688 Retained earnings (accumulated deficit)

7,294 (31,142 ) Treasury Stock; at cost: 650,402 and 616,560 shares

at December 31, 2016 and 2015, respectively (12,219 )

(11,383 ) Total stockholders' equity 153,977

114,483 Total liabilities and stockholders' equity $ 462,095

$ 373,572

INSTALLED BUILDING PRODUCTS, INC. CONDENSED CONSOLIDATED STATEMENTS

OF CASH FLOWS (unaudited, in thousands)

Twelve months

ended December 31, 2016 2015

Cash flows from operating activities Net income $ 38,436 $

26,517 Adjustments to reconcile net income to net cash provided by

operating activities: Depreciation and amortization of property and

equipment 23,571 16,975 Amortization of intangibles 11,259 6,264

Amortization of deferred financing costs and debt discount 383 264

Provision for doubtful accounts 2,928 919 Write-off of debt

issuance costs 286 - Gain on sale of property and equipment (254 )

(409 ) Gain on bargain purchase - (1,116 ) Noncash stock

compensation 1,894 2,116 Deferred income taxes (605 ) (1,515 )

Changes in assets and liabilities, excluding effects of

acquisitions Accounts receivable (18,760 ) (17,526 ) Inventories

(8,677 ) (2,846 ) Other assets 2,803 823 Accounts payable 12,400

(2,511 ) Income taxes payable/receivable 1,484 3,592 Other

liabilities 6,118 3,000 Net cash

provided by operating activities 73,266 34,547

Cash flows from investing activities Purchases of

property and equipment (27,013 ) (27,305 ) Acquisitions of

businesses, net of cash acquired of $2,181 and $926, respectively

(53,312 ) (84,274 ) Proceeds from sale of property and equipment

691 634 Other 37 (420 ) Net cash used in

investing activities (79,597 ) (111,365 )

Cash

flows from financing activities Proceeds from revolving line of

credit under credit agreement applicable to respective period

37,975 149,350 Payments on revolving line of credit under credit

agreement applicable to respective period (37,975 ) (149,350 )

Proceeds from term loan under credit agreement applicable to

respective period 100,000 50,000 Payments on term loan under credit

agreement applicable to respective period (51,875 ) (24,688 )

Proceeds from delayed draw term loan under credit agreement

applicable to respective period 12,500 50,000 Payments on delayed

draw term loan under credit agreement applicable to respective

period (50,000 ) - Proceeds from vehicle and equipment notes

payable 22,948 21,334 Debt issuance costs (1,238 ) (758 ) Principal

payments on long term debt (5,849 ) (4,088 ) Principal payments on

capital lease obligations (8,598 ) (9,674 ) Acquisition-related

obligations (3,057 ) (3,151 ) Repurchase of common stock - (6,100 )

Surrender of common stock by employees (836 ) -

Net cash provided by financing activities 13,995

72,875 Net change in cash 7,664 (3,943 ) Cash

at beginning of year 6,818 10,761 Cash

at end of year $ 14,482 $ 6,818 Supplemental

disclosures of cash flow information Net cash paid during the year

for: Interest $ 5,342 $ 3,287 Income taxes, net of refunds 18,929

13,493

Supplemental disclosure of noncash investing and

financing activities Vehicles capitalized under capital leases

and related lease obligations 3,737 3,379 Seller obligations in

connection with acquisition of businesses 4,459 13,180 Unpaid

purchases of property and equipment included in accounts payable

775 220

Non-GAAP Financial Measures

Adjusted EBITDA, Adjusted EBITDA margin and Adjusted Net Income

measure performance by adjusting EBITDA and GAAP net income,

respectively, for certain income or expense items that are not

considered part of our core operations. We believe that the

presentation of these measures provides useful information to

investors regarding our results of operations because it assists

both investors and us in analyzing and benchmarking the performance

and value of our business.

We believe the Adjusted EBITDA measure is useful to investors

and us as a measure of comparative operating performance from

period to period as it measures our changes in pricing decisions,

cost controls and other factors that impact operating performance,

and removes the effect of our capital structure (primarily interest

expense), asset base (primarily depreciation and amortization),

items outside our control (primarily income taxes) and the

volatility related to the timing and extent of other activities

such as asset impairments and non-core income and expenses.

Accordingly, we believe that this measure is useful for comparing

general operating performance from period to period. In addition,

we use various EBITDA-based measures in determining the achievement

of awards under certain of our incentive compensation programs.

Other companies may define Adjusted EBITDA differently and, as a

result, our measure may not be directly comparable to measures of

other companies. In addition, Adjusted EBITDA may be defined

differently for purposes of covenants contained in our revolving

credit facility or any future facility.

Although we use the Adjusted EBITDA measure to assess the

performance of our business, the use of the measure is limited

because it does not include certain material expenses, such as

interest and taxes, necessary to operate our business. Adjusted

EBITDA should be considered in addition to, and not as a substitute

for, GAAP net income as a measure of performance. Our presentation

of this measure should not be construed as an indication that our

future results will be unaffected by unusual or non-recurring

items. This measure has limitations as an analytical tool, and you

should not consider it in isolation or as a substitute for analysis

of our results as reported under GAAP. Because of these

limitations, this measure is not intended as an alternative to net

income as an indicator of our operating performance, as an

alternative to any other measure of performance in conformity with

GAAP or as an alternative to cash flow (used in) provided by

operating activities as a measure of liquidity. You should

therefore not place undue reliance on this measure or ratios

calculated using this measure.

We also believe the Adjusted Net Income measure is useful to

investors and us as a measure of comparative operating performance

from period to period as it measures our changes in pricing

decisions, cost controls and other factors that impact operating

performance, and removes the effect of certain non-core items such

as discontinued operations, acquisition related expenses,

amortization expense, the tax impact of these certain non-core

items, and the volatility related to the timing and extent of other

activities such as asset impairments and non-core income and

expenses. To make the financial presentation more consistent with

other public building products companies, beginning in the fourth

quarter 2016 we included an addback for non-cash amortization

expense related to acquisitions. Accordingly, we believe that this

measure is useful for comparing general operating performance from

period to period. Other companies may define Adjusted Net Income

differently and, as a result, our measure may not be directly

comparable to measures of other companies. In addition, Adjusted

Net Income may be defined differently for purposes of covenants

contained in our revolving credit facility or any future

facility.

The table below reconciles Adjusted Net Income to the most

directly comparable GAAP financial measure, net income, for the

periods presented therein.

INSTALLED BUILDING PRODUCTS, INC. RECONCILIATION OF

GAAP TO NON-GAAP MEASURES ADJUSTED NET INCOME CALCULATIONS

(unaudited, in thousands, except share and per share amounts)

Three months ended December 31, Twelve months

ended December 31, 2016 2015 2016

2015 Net income, as reported $ 11,081 $

9,287 $ 38,436 $ 26,517 Adjustments for adjusted net income:

Write-off of capitalized loan costs - - 286 - Share based

compensation expense 362 584 1,894 2,116 Acquisition related

expenses 989 460 2,320 1,149 Legal settlements and reserves - 104 -

104 Amortization expense 1 3,081 2,173 11,259 6,264 Gain on bargain

purchase - (1,116 ) - (1,116 ) Tax impact of adjusted items at

marginal tax rate 2 (1,640 ) (816 ) (5,831 )

(3,151 )

Adjusted net income $ 13,873 $ 10,676

$ 48,364 $ 31,883 Weighted average

shares outstanding (diluted) 31,396,857 31,334,569 31,363,290

31,334,569

Diluted net income per share, as reported

$ 0.35 $ 0.30 $ 1.23 $ 0.85 Adjustments for adjusted net income,

net of tax impact, per diluted share 3 0.09

0.04 0.31 0.17

Diluted

adjusted net income per share $ 0.44 $ 0.34 $

1.54 $ 1.02

1 Addback of all non-cash amortization resulting from business

combinations

2 Normalized tax rate of 37.0% applied to each period in 2016

and 2015

3 Includes adjustments related to the items noted above, net of

tax

The table below reconciles Adjusted EBITDA to the most directly

comparable GAAP financial measure, net income, for the periods

presented therein.

RECONCILIATION OF

GAAP TO NON-GAAP MEASURES ADJUSTED EBITDA CALCULATIONS (unaudited,

in thousands)

Three months ended December 31,

Twelve months ended December 31, 2016

2015 2016 2015 Adjusted EBITDA:

Net income (GAAP) $ 11,081 $ 9,287 $ 38,436 $ 26,517

Interest expense 1,571 1,084 6,177 3,738 Provision for income taxes

6,383 5,801 21,174 15,413 Depreciation and amortization 9,411 7,276

34,830 23,239 Gain on bargain purchase -

(1,116 ) - (1,116 ) EBITDA 28,446

22,332 100,617 67,791

Acquisition related expenses 989 460 2,320 1,149

Share based compensation expense 362 584 1,894 2,116 Legal

settlements and reserves - 104 -

104 Adjusted EBITDA $ 29,797 $ 23,480

$ 104,831 $ 71,160 Adjusted EBITDA

margin 12.7 % 12.3 % 12.1 % 10.7 % INSTALLED

BUILDING PRODUCTS, INC. SUPPLEMENTARY TABLE (unaudited)

Three months ended December 31, Twelve months ended

December 31, 2016 2015 2016

2015

Period-over-period

Growth

Sales Growth 22.2% 31.8% 30.2% 27.9% Same Branch Sales Growth 10.6%

14.8% 15.6% 11.7% Single-Family Sales Growth 21.4% 34.5%

28.2% 30.7% Single-Family Same Branch Sales Growth 7.7% 18.1% 13.5%

13.6% Residential Sales Growth 23.0% 32.8% 30.1% 29.9%

Residential Same Branch Sales Growth 9.9% 15.3% 15.3% 12.7%

U.S. Housing

Market 1

Total Completions Growth 13.2% 8.5% 9.5% 9.5% Single-Family

Completions Growth 15.3% 4.8% 14.0% 4.6%

Same Branch Sales

Growth

Volume Growth 5.5% 7.3% 8.8% 5.7% Price/Mix Growth 5.1% 7.5% 6.8%

6.0%

1 U.S. Census Bureau data, as revised

INSTALLED BUILDING PRODUCTS, INC. INCREMENTAL REVENUE

AND ADJUSTED EBITDA MARGINS (unaudited, in thousands)

Three months ended December 31, Twelve months ended

December 31, 2016 % Total

2015 % Total 2016 % Total

2015 % Total Revenue Increase

Same Branch $ 20,294 47.8% $ 21,464 46.4% $ 103,406 51.6% $

60,603 41.9% Acquired 22,184 52.2% 24,765 53.6%

96,855 48.4% 84,096 58.1% Total $ 42,478 100.0% $

46,229 100.0% $ 200,261 100.0% $ 144,699 100.0%

Adj EBITDA Adj EBITDA Adj EBITDA Adj EBITDA Contribution

Contribution Contribution Contribution

Adjusted EBITDA

Same Branch $ 4,054 20.0% $ 4,856 22.6% $ 22,983 22.2% $

14,116 23.3% Acquired 2,263 10.2% 3,387 13.7%

10,687 11.0% 13,032 15.5% Total $ 6,317 14.9% $ 8,243 17.8%

$ 33,670 16.8% $ 27,148 18.8%

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170227005188/en/

Installed Building Products, Inc.Investor Relations,

614-221-9944investorrelations@installed.net

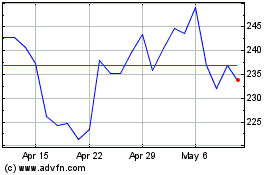

Installed Building Produ... (NYSE:IBP)

Historical Stock Chart

From Mar 2024 to Apr 2024

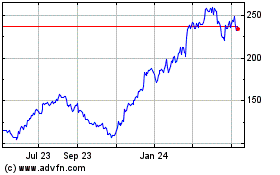

Installed Building Produ... (NYSE:IBP)

Historical Stock Chart

From Apr 2023 to Apr 2024