As

filed with the Securities and Exchange Commission on February 23, 2017

Registration

No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

FORM

S-3

Registration

Statement UNDER THE SECURITIES ACT OF 1933

ZION

OIL & GAS, INC.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

|

20-0065053

|

(State

or other jurisdiction of

incorporation or organization)

|

|

(I.R.S.

Employer

Identification Number)

|

12655

North Central Expressway, Suite 1000

Dallas,

Texas 75243

(214)

221-4610

(Address,

including zip code, and telephone number, including area code

of

registrant’s principal executive offices)

Victor

G. Carrillo

Chief

Executive Officer

12655

North Central Expressway, Suite 1000

Dallas,

Texas 75243

(214)

221-4610

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copies

to:

David

Aboudi

Pearl

Cohen Zedek Latzer Baratz LLP

1500

Broadway

New

York, New York 10036

(646)

878-0800

Approximate

date of commencement of proposed sale to the public:

From time to time after the Registration Statement becomes effective.

If

the only securities being registered on this form are being offered pursuant to dividend or interest reinvestment plans, please

check the following box. ☐

If

any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under

the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check

the following box. ☒

If

this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please

check the following box and list the Securities Act registration statement number of the earlier effective registration statement

for the same offering. ☐

If

this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list

the Securities Act registration statement number of the earlier effective registration statement for the same offering.

☐

If

this form is a registration statement pursuant to General Instruction 1.D. or a post-effective amendment thereto that shall become

effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If

this form is a post-effective amendment to a Registration Statement filed pursuant to General Instruction 1.D. filed to register

additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following

box. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller

reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b- 2 of the Exchange Act.

|

Large

accelerated filer ☐

|

Accelerated

filer

☐

|

|

Non-accelerated

filer ☐

(Do

not check if a smaller reporting company)

|

Smaller

reporting company ☒

|

CALCULATION

OF REGISTRATION FEE

|

|

|

Proposed

Maximum

|

|

|

|

|

|

Title of Class of Securities to be Registered (1)

|

|

Aggregate

Offering

Price (2)

|

|

|

Amount of

Registration

Fee (3)

|

|

|

Common Stock, par value $.01 per share

|

|

|

—

|

|

|

|

—

|

|

|

Debt Securities

|

|

|

—

|

|

|

|

—

|

|

|

Warrants

|

|

|

—

|

|

|

|

—

|

|

|

Units

|

|

|

—

|

|

|

|

—

|

|

|

Total

|

|

$

|

1

|

|

|

$

|

0

|

|

|

(1)

|

Pursuant

to Rule 415(a)(6), the issuer is filing this replacement registration statement covering approximately $102,350,000 in unsold

securities under the earlier registration statement effective March 31, 2014. Under the earlier registration statement,

there were registered thereunder such indeterminate number of shares of common stock, such indeterminate principal amount

of debt securities, such indeterminate number of warrants to purchase common stock or debt securities, and such indeterminate

number of units as shall have an aggregate initial offering price not to exceed $102,350,000. If any debt securities

are issued at an original issue discount, then the offering price of such debt securities shall be in such greater principal

amount as shall result in an aggregate initial offering price not to exceed $102,350,000, less the aggregate dollar amount

of all securities previously issued under the prior registration statement and hereunder. Any unsold securities continuing

to be registered hereunder may be sold separately or as units with other securities registered hereunder. The proposed maximum

initial offering price per unit will be determined, from time to time, by the registrant in connection with the issuance by

the registrant of the securities registered hereunder. The securities registered also include such indeterminate number

of shares of common stock and amount of debt securities as may be issued upon conversion of or exchange for debt securities

that provide for conversion or exchange, upon exercise of warrants or pursuant to the anti-dilution provisions of any

such securities. In addition, pursuant to Rule 416 under the Securities Act, the shares being registered hereunder include

such indeterminate number of shares of common stock as may be issuable with respect to the shares being registered hereunder

as a result of stock splits, stock dividends or similar transactions.

|

|

(2)

|

The

proposed maximum aggregate offering price per class of security will be determined from time to time by the registrant in

connection with the issuance by the registrant of the securities registered hereunder and is not specified as to each class

of security pursuant to General Instruction II.D. of Form S-3 under the Securities Act. Based on the reported sale price

of $1.29 of our common stock on the NASDAQ Global Market on February 17, 2017, the aggregate market value of our outstanding

common stock held by non-affiliates, or the public float, is approximately $53 million, calculated in accordance with General

Instruction I.B.6 of Form S-3. Pursuant to General Instructions I.B.6, we will not sell under this replacement

registration statement common stock or other securities with a market value exceeding one-third of our public float in any

12-month period; provided, however, if the aggregate market value of our public float equals or exceeds $75 million subsequent

to the date hereof, such General Instruction I.B.6 limitation shall not apply to sales made pursuant to this registration

statement on or subsequent to such date, and this registration statement shall be considered filed pursuant to General Instruction

I.B.1.

|

|

(3)

|

Calculated

pursuant to Rule 457(o) under the Securities Act of 1933, as amended.

|

The

Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until

the Registrant shall file a further amendment which states that this Registration Statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective

on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Subject

to Completion, Dated ___________, 2017

THE

INFORMATION IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. WE MAY NOT SELL THESE SECURITIES OR ACCEPT AN OFFER TO BUY

THESE SECURITIES UNTIL THE REGISTRATION STATEMENT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS PROSPECTUS

IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE OR JURISDICTION

WHERE THE OFFER OR SALE IS NOT PERMITTED.

PROSPECTUS

$102,350,000

ZION

OIL & GAS, INC.

Common

Stock, Debt Securities, Warrants and Units

This

prospectus is part of a replacement registration statement that we filed with the Securities and Exchange Commission (the “SEC”)

using a “shelf” registration process. From time to time, we may offer up to an aggregate of approximately $102,350,000

of any combination of the securities described in this prospectus, either individually or in units. We will not sell under this

registration statement and prospectus common stock or other securities with a market value exceeding one-third of the aggregate

market value of our outstanding common stock by non-affiliates, or the public float, in any 12-month period; provided, however,

if the aggregate market value of our public float equals or exceeds $75 million hereafter, such limitation shall not apply to

sales made pursuant to this registration statement and prospectus on or subsequent to such date.

This

prospectus provides a general description of the securities we may offer. Each time we sell securities, we will provide

specific terms of the securities offered in a supplement to this prospectus. The prospectus supplement may also add, update

or change information contained in this prospectus. You should read this prospectus and the applicable prospectus supplement

carefully before you invest in any securities.

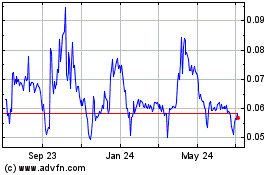

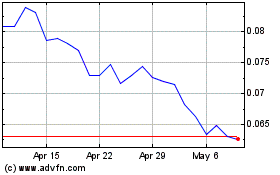

Our

common stock is quoted on the NASDAQ Global Market under the symbol “ZN.” The sale price of our common stock on the

NASDAQ Global Market on February 17, 2017 was $1.29 and our public float was approximately $53 million. Under our Dividend Reinvestment

and Common Stock Purchase Plan, we also have a common stock purchase warrant at an exercise price of $2.00, expiring January 31,

2020, that was issued and quoted on the NASDAQ Global Market under the symbol “ZNWAA.” On March 27, 2014, the Company

filed with the SEC the prospectus supplement dated as of March 27, 2014 and accompanying base prospectus relating to the Company’s

Dividend Reinvestment and Direct Stock Purchase Plan (the “DSPP”). The prospectus formed part of the Company’s

Registration Statement on Form S-3 (File No. 333-193336), which was declared effective by the SEC on March 31, 2014. The applicable

prospectus supplement will contain information, where applicable, as to the above and any other listing on the NASDAQ Global Market

or any securities market or other exchange of the securities, if any, covered by the prospectus supplement.

Investing

in our securities involves a high degree of risk. We urge you to carefully consider the risks that we have described on page 8 of

this prospectus under the caption “Risk Factors.” We may also include specific risk factors in supplements to this

prospectus under the caption “Risk Factors.” This prospectus may not be used to offer or sell our securities unless

accompanied by a prospectus supplement.

We

will sell these securities directly to investors, through agents designated from time to time or to or through underwriters or

dealers. For additional information on the methods of sale, you should refer to the section entitled “Plan of Distribution”

in this prospectus. If any underwriters are involved in the sale of any securities with respect to which this prospectus

is being delivered, the names of such underwriters and any applicable commissions or discounts will be set forth in a prospectus

supplement. The price to the public of such securities and the net proceeds we expect to receive from such sale will

also be set forth in a prospectus supplement.

NEITHER

THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR

PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The

date of this prospectus is __________, 2017.

Table

of Contents

ABOUT

THIS PROSPECTUS

This

prospectus is a part of a replacement registration statement that we filed with the Securities and Exchange Commission, or SEC,

utilizing a “shelf” registration process. Under this shelf registration process, we may sell any combination of the

securities described in this prospectus in one or more offerings up to a total dollar amount of approximately $102,350,000.

We will not sell under this registration statement and prospectus common stock or other securities with a market value exceeding

one-third of the aggregate market value of our outstanding common stock by non-affiliates, or the public float, in any 12-month

period; provided, however, if the aggregate market value of our public float equals or exceeds $75 million hereafter, such limitation

shall not apply to sales made pursuant to this registration statement and prospectus on or subsequent to such date. This

prospectus provides you with a general description of the securities we may offer. Each time we sell securities under this

shelf registration, we will provide a prospectus supplement that will contain specific information about the terms of that offering.

The prospectus supplement may also add, update or change information contained in this prospectus. You should read both

this prospectus and any prospectus supplement together with additional information described on page 29 under the heading “Where

You Can Find More Information.”

You

should rely only on the information provided or incorporated by reference in this prospectus or any prospectus supplement. We

have not authorized any dealer, salesman or other person to give any information or to make any representation other than those

contained or incorporated by reference in this prospectus and the accompanying supplement to this prospectus. You must not rely

upon any information or representation not contained or incorporated by reference in this prospectus or the accompanying prospectus

supplement. This prospectus and the accompanying supplement to this prospectus do not constitute an offer to sell or the solicitation

of an offer to buy any securities other than the registered securities to which they relate, nor do this prospectus and the

accompanying supplement to this prospectus constitute an offer to sell or the solicitation of an offer to buy securities in any

jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction. You should not assume

that the information contained in this prospectus and the accompanying prospectus supplement is accurate on any date subsequent

to the date set forth on the front of the document or that any information we have incorporated by reference is correct on any

date subsequent to the date of the document incorporated by reference, even though this prospectus and any accompanying prospectus

supplement is delivered or securities sold on a later date. In this prospectus and any prospectus supplement, unless otherwise

indicated, the terms “Company,” "we," "our" and "us" refer to Zion Oil & Gas,

Inc., a corporation incorporated in the State of Delaware.

THIS

PROSPECTUS MAY NOT BE USED TO OFFER AND SELL SECURITIES UNLESS IT IS ACCOMPANIED BY A PROSPECTUS SUPPLEMENT.

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus and the documents included or incorporated by reference in this prospectus contain statements concerning our expectations,

beliefs, plans, objectives, goals, strategies, future events or performance and underlying assumptions and other statements that

are not historical facts. These statements are "forward-looking statements" within the meaning of the Private Securities

Litigation Reform Act of 1995. You generally can identify our forward-looking statements by the words "anticipate,"

"believe," "budgeted," "continue," "could," "estimate," "expect,"

"forecast," "goal," "intend," "may," "objective," "plan," "potential,"

"predict," "projection," "scheduled," "should," "will" or other similar words.

These forward-looking statements include, among others, statements regarding:

|

|

●

|

our

liquidity and our ability to raise capital to finance our exploration and development activities;

|

|

|

●

|

our

ability to explore for and develop natural gas and oil resources successfully and economically;

|

|

|

●

|

local

(in Israel) as well as global demand for oil and natural gas;

|

|

|

●

|

our

estimates of the timing and number of wells we expect to drill and other exploration activities and planned expenditures;

|

|

|

●

|

changes

in our drilling plans and related budgets;

|

|

|

●

|

the

quality of our license area with regard to, among other things, the existence of reserves in economic quantities;

|

|

|

●

|

anticipated

trends in our business;

|

|

|

●

|

our

future results of operations;

|

|

|

●

|

our

capital expenditure program;

|

|

|

●

|

future

market conditions in the oil and gas industry; and

|

|

|

●

|

the

impact of governmental regulation.

|

More

specifically, our forward-looking statements include, among others, statements relating to our schedule, business plan, targets, estimates

or results of future drilling, including the number, timing and results of wells, the timing and risk involved in drilling follow-up

wells, planned expenditures, prospects budgeted and other future capital expenditures, risk profile of oil and gas exploration,

acquisition of seismic data (including number, timing and size of projects), planned evaluation of prospects, probability of prospects

having oil and natural gas, expected production or reserves, increases in reserves, acreage, working capital requirements, hedging

activities, the ability of expected sources of liquidity to implement our business strategy, future hiring, future exploration

activity, production rates, all and any other statements regarding future operations, financial results, business plans and cash

needs and other statements that are not historical facts.

Such

statements involve risks and uncertainties, including, but not limited to, those relating to our dependence on our exploratory

drilling activities, the volatility of oil and natural gas prices, the need to replace reserves depleted by production, operating

risks of oil and natural gas operations, our dependence on our key personnel, factors that affect our ability to manage our growth

and achieve our business strategy, risks relating to our limited operating history, technological changes, our significant capital

requirements, the potential impact of government regulations, adverse regulatory determinations, litigation, competition, the

uncertainty of reserve information and future net revenue estimates, property acquisition risks, industry partner issues, availability

of equipment, weather and other factors detailed herein and in our other filings with the SEC.

We

have based our forward-looking statements on our management's beliefs and assumptions based on information available to our management

at the time the statements are made. We caution you that assumptions, beliefs, expectations, intentions and projections about

future events may and often do vary materially from actual results. Therefore, we cannot assure you that actual results will not

differ materially from those expressed or implied by our forward-looking statements.

Some

of the factors that could cause actual results to differ from those expressed or implied in forward-looking statements are described

under "Risk Factors" in this prospectus (page 6) and described under "Risk Factors" and elsewhere in our Annual

Report on Form 10-K for the fiscal year ended December 31, 2015 and in our other periodic reports filed with the SEC. Should

one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual outcomes may

vary materially from those indicated. All subsequent written and oral forward-looking statements attributable to us or persons

acting on our behalf are expressly qualified in their entirety by reference to these risks and uncertainties. You should not place

undue reliance on our forward-looking statements. Each forward-looking statement speaks only as of the date of the particular

statement, and we undertake no duty to update any forward-looking statement.

SUMMARY

The

following is only a summary, and does not contain all of the information that you need to consider in making your investment decision.

We urge you to read this entire prospectus, including the more detailed financial statements, notes to the financial statements and

other information incorporated by reference into this prospectus under “Where You Can Find More Information” and “Incorporation

of Certain Information by Reference” from our other filings with the SEC, as well as any prospectus supplement applicable

to an offering of the securities registered pursuant to the registration statement of which this prospectus forms a part. Investing

in our securities involves risks. Therefore, please carefully consider the information provided under the heading "Risk Factors"

beginning on page 8.

Our

Company

Zion

Oil and Gas, Inc., a Delaware corporation, is an initial stage oil and gas exploration company with a history of over 16 years

of oil and gas exploration in Israel. We have no revenues or operating income. We were incorporated in Florida on April 6, 2000

and reincorporated in Delaware on July 9, 2003. We completed our initial public offering in January 2007. Our common stock currently

trades on the NASDAQ Global Market under the symbol “ZN” and our warrant trades on such market under the symbol “ZNWAA.”

We

currently hold one active petroleum exploration license onshore Israel, the Megiddo-Jezreel License (“MJL”), comprising

approximately 99,000 acres. The MJL was awarded on December 3, 2013 for a three-year primary term through December 2, 2016, with

the possibility of additional one-year extensions up to a maximum of seven years. The MJL is onshore, south and west of the Sea

of Galilee. On June 28, 2016, the Company submitted a third Application for Extension of Drilling Date, and on July 4, 2016, the

Petroleum Commissioner formally approved the application as follows:

|

No.

|

|

Activity Description

|

|

To be carried out by:

|

|

1

|

|

Sign a contract with drilling contractor and forward to Petroleum Commissioner

|

|

13 October 2016

|

|

2

|

|

Submit detailed Engineering Plan to carry out the drilling

|

|

13 October 2016

|

|

3

|

|

Spudding in the license area

|

|

1 December 2016

|

|

4

|

|

Submit a final report on the results of the drilling

|

|

1 May 2017

|

|

5

|

|

Submit a plan for continued work in the license area

|

|

29 June 2017

|

The

Petroleum Commissioner modified Zion’s work plan deadlines and awarded the Company a one-year extension to December 2, 2017,

on its Megiddo-Jezreel petroleum exploration license, subject to Zion signing a drilling contract and submitting a detailed engineering

plan by October 13, 2016 and spudding an exploratory well by December 1, 2016. The Company timely complied with two key Special

Conditions of our existing license terms established by the Israel Petroleum Commissioner, by providing on October 13, 2016 the

fully executed drilling contract with S.A. Daflog, S.R.L. (dated 6 October 2016) and a Detailed Drilling Engineering Plan for

the Megiddo-Jezreel #1 well. Zion entered into a drilling contract with S.A. DAFLOG S.R.L., an Israeli-registered related party

entity to DAFORA S.A.

As

previously reported, the Company needed authorization from the Israel land Authority (the “ILA”), the formal lessor

of the land to the kibbutz, to access and utilize the drill site. The Company received this authority on July 4, 2016. This is

in conjunction with our May 15, 2016, signed agreement with Kibbutz Sde Eliyahu on whose property the drilling pad will be situated.

While

Zion has successfully complied with the Special Conditions of the Company’s work program to date, the process of securing

an appropriate drilling rig and crew with which to drill our upcoming well has been long and complicated. As such, Zion submitted

a drilling date extension request to the Petroleum Commissioner on November 7, 2016. Key details of the extension request are

as outlined below:

|

NO.

|

|

ACTIVITY DESCRIPTION

|

|

TO

BE CARRIED OUT BY:

|

|

1

|

|

Begin

drilling / spud well

|

|

30

June 2017

|

|

2

|

|

Submit

final report on the results of drilling

|

|

1

November 2017

|

|

3

|

|

Submit

a plan for continued work in the license area

|

|

1

December 2017

|

On

November 29, 2016, the Company received notification from the State of Israel’s Petroleum Commissioner officially approving

the drilling date extension for the Company.

The

Company has prepared the specific drill pad to accommodate the DAFORA’s F-400 Rig. The drill site plan was prepared by the

Israeli company,

Y. Bazelet and Aggregatim LTD

. The access road and the drill site is almost finished and we hope to commence

rig mobilization to the MJ#1 location and to begin rig-up and acceptance testing within 60 days, assuming no weather or regulatory

delays.

We

hold 100% of the working interest in our licenses, which means we are responsible for 100% of the costs of exploration and, if

established, production. Our net revenue interest is 81.5%, which means we would receive 81.5% of the gross proceeds from the

sale of oil and gas from license areas upon their conversion to production leases, if there is any commercial production. The

18.5% to which we are not entitled comprises (i) a 12.5% royalty reserved by the State of Israel and (ii) an overriding royalty

interest (or equivalent net operating profits interest) of 6% of gross revenue from production given over to two charitable foundations.

No royalty would be payable to any landowner with respect to production from our license areas as the State of Israel owns all

the mineral rights. In addition, we may establish a key employee incentive plan that may receive an overriding royalty interest

(or equivalent net operating profits interest) of up to 1.5%. In that event, our effective net revenue interest

would be 80%. Effective March 2011, a special levy on income from oil and gas production was enacted in Israel. The new law provides

that royalties on hydrocarbon discoveries will remain at 12.5%, while taxation of profits will begin only after the developers

have reached payback on their investment plus a return. The levy will be 20% after a payback of 150% on the investment, and will

rise gradually, reaching 44.56% after a return of 230% on the investment. The Israeli government also repealed the percentage

depletion deduction and made certain changes to the rules for deducting tangible and intangible development. These rules will

only become germane to us when, and if, we commence production of oil and/or gas.

Our

ability to generate future revenues and operating cash flow will depend on the successful exploration and exploitation of our

current and any future petroleum rights or the acquisition of oil and/or gas producing properties, the volume and timing of our

production, as well as commodity prices for oil and gas. Such pricing factors are largely beyond our control, and may result in

fluctuations in our earnings.

Our

company’s vision, as exemplified by its Founder and Chairman, John Brown, of finding oil and/or natural gas in Israel, is

Biblically inspired. The vision is based, in part, on Biblical references alluding to the presence of oil and/or natural gas in

territories within the State of Israel that were formerly within certain ancient Biblical tribal areas. While John Brown provides

the broad vision and goals for Zion, the actions taken by the Company’s management as it actively explores for oil and gas

in Israel are based on modern science and good business practice. Zion’s oil and gas exploration activities are supported

by appropriate geological and other science based studies and surveys typically carried out by companies engaged in oil and gas

exploration activities.

Financing

Activities

To

date, we have funded our operations through the issuance of our securities. Our recent financing is discussed below.

On

March 27, 2014 under the current Form S-3, as amended, the Company filed its Dividend Reinvestment and Stock Purchase Plan (the

“DSPP”) pursuant to which stockholders and interested investors can purchase shares of the Company’s Common

Stock as well as units of the Company’s securities. The terms of the DSPP are described in the Prospectus Supplement originally

filed on March 27, 2014 (the “Original Prospectus Supplement”) with the Securities and Exchange Commission (“SEC”)

under the Company’s effective registration Statement on Form S-3, as thereafter amended. On January 13, 2015, the Company

amended the Original Prospectus Supplement (“Amendment No. 3”) to provide for a unit option (the “Unit Option”)

under the DSPP comprised of one share of Common Stock and three Common Stock purchase warrants with each unit priced at $4.00.

Each warrant afforded the investor or stockholder the opportunity to purchase the Company’s Common Stock at a warrant exercise

price of $1.00. Each of the three warrant series have different expiration dates that have been extended.

On December 28, 2015, Amendment

No. 6 to the Original Prospectus Supplement was filed extending the scheduled termination date of the Unit Option to March 31,

2016. On March 31, 2016, the Unit Option terminated. The warrants became first exercisable on May 2, 2016 and continue to be exercisable

through May 2, 2017 for ZNWAB (1 year), May 2, 2018 for ZNWAC (2 years) and May 2, 2019 for ZNWAD (3 years), respectively, at

a per share exercise price of $1.00. The Company issued approximately 120,000 shares of its Common Stock as of September 30, resulting

in cash proceeds of approximately $120,000.

For

the nine months ended September 30, 2016, approximately $2,680,000 has been raised under the DSPP program. As a result, the Company

issued approximately 1,578,000 shares of its Common Stock during the same period. Additionally, warrants for approximately 286,000

shares of Common Stock were issued during the nine months ended September 30, 2016 (approximately 95,000 each of ZNWAB, ZNWAC,

and ZNWAD). As of September 30, 2016, the number of outstanding warrants for each warrant issue is as approximately: 320,000 of

ZNWAB, 348,000 of ZNWAC, and 351,000 of ZNWAD. The total amount of funds received from the DSPP, including the exercise of warrants,

from the inception date through September 30, 2016 is approximately $11,488,000.

Rights

Offering -10% Senior Convertible Notes due May 2, 2021

On

October 21, 2015, the Company filed with the SEC a prospectus supplement for a rights offering. Under the rights offering, the

Company distributed at no cost, 360,000 non-transferable subscription rights to subscribe for, on a per right basis, two 10% Convertible

Senior Bonds par $100 due May 2, 2021 (the “Notes”), to persons who owned shares of the Company’s Common Stock

on October 15, 2015, the record date for the offering. Each whole subscription right entitled the participant to purchase two

convertible bonds at a purchase price of $100 per bond. Effective October 21, 2015, the Company executed a Supplemental Indenture,

as issuer, with the American Stock Transfer & Trust Company, LLC, a New York limited liability trust company (“AST”),

as trustee for the Notes (the “Indenture”). The offering was scheduled to terminate on January 15, 2016 but was extended

to March 31, 2016. On March 31, 2016, the rights offering terminated.

On

May 2, 2016, the Company issued approximately $3,470,000 aggregate principal amount of Notes in connection with the rights

offering. The Company received net proceeds of approximately $3,334,000, from the sale of the Notes, after deducting fees and

expenses of $136,000 incurred in connection with the offering. These costs have been discounted as deferred offering costs.

The

Notes contain a convertible option that gives rise to a derivative liability, which is accounted for separately from the Notes.

Accordingly, the Notes were initially recognized at fair value of approximately $1,844,000, which represents the principal amount

of $3,470,000 from which a debt discount of approximately $1,626,000 (which is equal to the fair value of the convertible option)

was deducted.

During

the nine months ended September 30, 2016, the Company recorded approximately $12,000 in amortization expense related

to the deferred financing costs, and approximately $65,000 in debt discount amortization, net. The Notes are governed by the terms

of the Indenture. The Notes are senior unsecured obligations of the Company and bear interest at a rate of 10% per year, payable

annually in arrears on May 2 of each year, commencing May 2, 2017. The Notes will mature on May 2, 2021, unless earlier redeemed

by the Company or converted by the holder.

Interest

and principal may be paid, at the Company’s option, in cash or in shares of the Company’s Common Stock. The number

of shares for the payment of interest in shares of Common Stock, in lieu of the cash amount, will be based on the average of the

closing prices of the Company’s Common Stock as reported by Bloomberg L.P. for the 30 trading days preceding the record

date for the payment of interest; such record date has been designated and will always be the 10

th

business day prior

to the interest payment date on May 2 of each year. The number of shares for the payment of principal, in lieu of the cash amount,

shall be based upon the average of the closing price of the Company’s Common Stock as reported by Bloomberg L.P. for the

30 trading days preceding the principal repayment date; such record date has been designated as the trading day immediately prior

to the 30-day period preceding the maturity date of May 2, 2021. Fractional shares will not be issued and the final number of

shares will be rounded up to the next whole share.

At

any time prior to the close of business on the business day immediately preceding April 2, 2021, holders may convert their notes

into Common Stock at the conversion rate of 44 shares per $100 bond (which is equivalent to a conversion rate of approximately

$2.27 per share). The conversion rate is subject to adjustment from time to time upon the occurrence of certain events, including,

but not limited to, the issuance of stock dividends and payment of cash dividends.

Beginning

May 3, 2018, the Company is entitled to redeem for cash the outstanding Notes at an amount equal to the principal and accrued

and unpaid interest, plus a 10% premium. No “sinking fund” is provided for the Notes due May 2021, which means that

the Company is not required to periodically redeem or retire the Notes due May 2021.

Through

the nine months ended September 30, 2016, approximately 125 convertible bonds of $100 each have been converted under this offering

at a conversion rate of approximately $2.27 per share. As a result, the Company issued approximately 5,500 shares of its Common

Stock during the same period.

|

|

|

September 30, 2016

|

|

|

December 31, 2015

|

|

|

|

|

US$

|

|

|

Total

|

|

|

US$

|

|

|

Total

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10% Senior Convertible Bonds, net of debt discount on derivative liability of $1,626,000 on the day of issuance

|

|

$

|

1,844,000

|

|

|

$

|

1,844,000

|

|

|

|

-

|

|

|

|

-

|

|

|

Debt discount amortization, net

|

|

$

|

65,000

|

|

|

$

|

316,000

|

|

|

|

-

|

|

|

|

-

|

|

|

Bonds converted to shares

|

|

$

|

(12,000

|

)

|

|

$

|

(12,000

|

)

|

|

|

-

|

|

|

|

-

|

|

|

Offering cost, net

|

|

$

|

(124,000

|

)

|

|

$

|

(124,000

|

)

|

|

|

-

|

|

|

|

-

|

|

|

10% senior Convertible bonds – Long Term Liability

|

|

$

|

1,773,000

|

|

|

$

|

2,024,000

|

|

|

|

-

|

|

|

|

-

|

|

For

the nine months ended September 30, 2016, the Company recognized interest expense of approximately $144,000 related to the Notes,

Payable for the first time and in arrears on May 2, 2017.

New

Unit Option under the Unit Program

On

November 1, 2016, the Company launched a unit offering (the “Unit Program”) under the Company’s DSPP pursuant

to which stockholders and interested investors can purchase units comprised of seven (7) shares of Common Stock and seven (7)

Common Stock purchase warrants, at a per unit purchase price of $10. The warrant shall have the symbol “ZNWAE,” but

no assurance can be provided that the warrant will be approved for listing on the NASDAQ Global Market. The Company’s new

Unit Program is scheduled to terminate on March 31, 2017.

The

warrants will first become exercisable on May 1, 2017, which is the 31

st

day following the scheduled Unit Program Termination

Date (i.e., on March 31, 2017) and continue to be exercisable through May 1, 2020 at a per share exercise price of $1.00. If the

Common Stock of the Company closes at or above $5.00 for fifteen (15) consecutive trading days at any time prior to the expiration

date of the warrant, the Company has the sole discretion to provide a notice to warrant holders of an early termination of the

warrant within sixty (60) days of the notice.

The

Securities We May Offer

We

may offer shares of our common stock, various series of debt securities and warrants to purchase any of such securities, either

individually or in units, with a total value of up to approximately $102,350,000 from time to time under this prospectus at prices

and on terms to be determined by market conditions at the time of offering. We will not sell under this registration statement

and prospectus common stock or other securities with a market value exceeding one-third of the aggregate market value of our outstanding

common stock by non-affiliates, or the public float, in any 12-month period; provided, however, if the aggregate market value

of our public float equals or exceeds $75 million hereafter, such limitation shall not apply to sales made pursuant to this registration

statement and prospectus on or subsequent to such date. This prospectus provides you with a general description of the securities

we may offer. Each time we offer a type or series of securities, we will provide a prospectus supplement that will describe

the specific amounts, prices and other important terms of the securities, including, to the extent applicable:

|

|

●

|

aggregate

principal amount or aggregate offering price;

|

|

|

●

|

maturity,

if applicable;

|

|

|

●

|

original

issue discount, if any;

|

|

|

●

|

rates

and times of payment of interest, if any;

|

|

|

●

|

redemption,

conversion, exchange or sinking fund terms, if any;

|

|

|

●

|

conversion

or exchange prices or rates, if any, and, if applicable, any provisions for changes to or adjustments in the conversion or

exchange prices or rates and in the securities or other property receivable upon conversion or exchange;

|

|

|

●

|

restrictive

covenants, if any;

|

|

|

●

|

voting

or other rights, if any; and

|

|

|

●

|

important

federal income tax considerations.

|

The

prospectus supplement also may add, update or change information contained in this prospectus or in documents we have incorporated

by reference into this prospectus. However, no prospectus supplement will offer a security that is not registered and described

in this prospectus at the time of the effectiveness of the registration statement of which this prospectus is a part.

We

may sell the securities directly to or through underwriters, dealers or agents. We, and our underwriters or agents, reserve

the right to accept or reject all or part of any proposed purchase of securities. Currently, we sell securities directly

through our Dividend Reinvestment and Common Stock Purchase Plan. If we do offer securities through underwriters or agents, we

will include in the applicable prospectus supplement:

|

|

●

|

the

names of those underwriters or agents;

|

|

|

●

|

applicable

fees, discounts and commissions to be paid to them;

|

|

|

●

|

details

regarding over-allotment options, if any; and

|

|

|

●

|

the

net proceeds to us.

|

The

following is a summary of the securities we may offer with this prospectus.

Common

Stock

. We currently have authorized 200,000,000 shares of common stock, par value $0.01 per share. We may offer

shares of our common stock either alone or underlying other registered securities convertible into or exercisable for our common

stock from time to time. Holders of our common stock are entitled to one vote per share for the election of directors and on all

other matters that require stockholder approval. In the event of our liquidation, dissolution or winding up, holders

of our common stock are entitled to share ratably in the assets remaining after payment of liabilities. Currently, we do

not pay any dividends. Our common stock does not carry any preemptive rights enabling a holder to subscribe for, or receive shares

of, any class of our common stock or any other securities convertible into shares of any class of our common stock, or any redemption

rights.

Debt

Securities

. We may offer debt securities from time to time, in one or more series, as either senior or subordinated

debt or as senior or subordinated convertible debt. The senior debt securities will rank equally with any other unsubordinated

debt that we may have and may be secured or unsecured. The subordinated debt securities will be subordinate and junior in

right of payment, to the extent and in the manner described in the instrument governing the debt, to all or some portion of our

indebtedness. Any convertible debt securities that we issue will be convertible into or exchangeable for our common stock

or other securities of ours. Conversion may be mandatory or at your option and would be at prescribed conversion rates.

Any

debt securities will be issued under one or more documents called indentures, which are contracts between us and a trustee for

the holders of the debt securities. In this prospectus, we have summarized certain general and standard features of the

debt securities we may issue. We urge you, however, to read the prospectus supplements related to the series of debt securities

being offered, as well as the complete indentures that contain the terms of the debt securities. We will file as exhibits to

the registration statement of which this prospectus is a part, or will incorporate by reference into such registration statement

from a Current Report on Form 8-K that we file with the SEC, the forms of indentures and any supplemental indentures and the forms

of debt securities containing the terms of debt securities we are offering before the issuance of any series of debt pursuant

to the Registration Statement of which this prospectus forms a part.

Warrants.

We may offer warrants for the purchase of our common stock, and/or debt securities in one or more series, from

time to time. We may issue warrants independently or together with common stock, and/or debt securities and the warrants

may be attached to or separate from those securities. Currently, warrants under the symbol “ZNWAE” to purchase an

additional share of the Company’s common stock at an exercise price of $1.00 per share for three years are being offered

by the Company until March 31, 2017 in accordance with the terms of the DSPP as described in the prospectus.

The

warrants will be evidenced by warrant certificates issued under one or more warrant agreements, which are contracts between us

and an agent for the holders of the warrants. In this prospectus, we have summarized certain general and standard features

of the warrants. We urge you, however, to read the prospectus supplements related to the series of warrants being offered,

as well as the warrant agreements and warrant certificates that contain the terms of the warrants. We will file as exhibits

to the registration statement of which this prospectus is a part, or will incorporate by reference into such registration

statement from a Current Report on Form 8-K that we file with the SEC, the form of warrant agreements and form of warrant certificates

relating to warrants for the purchase of common stock and debt securities we are offering before the issuance of any such warrants

pursuant to the Registration Statement of which this prospectus forms a part.

Units.

We may offer units consisting of common stock, debt securities and/or warrants to purchase any of such securities in one

or more series. We are currently offer a $10 unit, consisting of 7 shares of common stock and 7 warrants (ZNWAE) for a $1.00 exercise

price over a three year period until March 31, 2017. In this prospectus, we have summarized certain general and standard features

of the units. We urge you, however, to read the prospectus supplements related to the series of units being offered, as well as

the unit agreements that contain the terms of the units. We will file as exhibits to the registration statement of which this

prospectus is a part, or will incorporate by reference from a Current Report on Form 8-K that we file with the SEC, the form of

unit agreement and any supplemental agreements that describe the terms of the series of units we are offering before the issuance

of the related series of units pursuant to the Registration Statement of which this prospectus forms a part.

We

will evidence each series of units by unit certificates that we will issue under a separate agreement. We will enter into the

unit agreements with a unit agent. Each unit agent will be a bank or trust company that we select. We will indicate the name and

address of the unit agent in the applicable prospectus supplement relating to a particular series of units.

THIS

PROSPECTUS MAY NOT BE USED TO OFFER OR SELL ANY SECURITIES UNLESS ACCOMPANIED BY A PROSPECTUS SUPPLEMENT.

RISK

FACTORS

Before

making an investment decision, you should carefully consider the risks described under “Risks Related to our Business”

below and in the applicable prospectus supplement, together with all of the other information appearing in this prospectus or

incorporated by reference into this prospectus and any applicable prospectus supplement, in light of your particular investment

objectives and financial circumstances. Our business, financial condition or results of operations could be materially adversely

affected by any of these risks. The trading price of our securities could decline due to any of these risk factors, and you may

lose all or any part of your investment.

Risks

Related to our Business

We

are an oil and gas exploration company with no current source of revenue. Our ability to continue in business depends upon our

continued ability to obtain significant financing from external sources and the success of our exploration efforts, none of which

can be assured.

We

were incorporated in April 2000 and are still an oil and gas exploration company with no established production. Our operations

are subject to all of the risks inherent in exploration stage companies with no revenues or operating income. Our potential for

success must be considered in light of the problems, expenses, difficulties, complications and delays frequently encountered in

connection with a new business, especially the oil and gas exploration business, and in particular the deep, wildcat wells in

which we are engaged in Israel. We cannot warrant or provide any assurance that our business objectives will be accomplished.

We

have historically depended entirely upon capital infusions from the issuance of equity securities to provide the cash needed to

fund our operations. Between June 2009 and December 2016, we raised approximately $121 million in the public equity market from

rights offerings and our DSPP of our common stock, convertible bonds and warrants to our stockholders and bondholders. However,

we cannot assure you that we will be able to continue to raise funds in the public (or private) equity markets. Our ability to

continue in business depends upon our continued ability to obtain significant financing from external sources and the success

of our exploration efforts. Any reduction in our ability to raise equity capital in the future would force us to reallocate funds

from other planned uses and could have a significant negative effect on our business plans and operations, including our ability

to continue our current exploration activities.

The parent company of

our drilling contract party is in receivership in Romania and any failure on our contract party’s ability to perform under

the drilling contract will delay the progress of the drilling and have an adverse effect on our business.

Zion entered into a drilling contract with S.A. Daflog

S.R.L., an Israeli-registered related party entity to DAFORA S.A. DAFORA is the largest drilling company in Romania and has drilled

over 1,000 wells in Romania, Eastern Europe and East Africa. Zion intends to use DAFORA’s F-400 drilling rig which has a

3,000 HP capacity capable of drilling to over 7,000 meters. This provides sufficient horsepower and safety factor to drill our

planned well with a target depth of up to 4,500 meters. The DAFORA rig and most of its major components are currently stored in

Israel, at Givot Olam’s Meged-8 drill site.

Dafora

S.A., the parent to S.A.Daflog S.R.L., is in receivership in Romania (and party to the lease agreement of the Dafora equipment

to Daflog). The court appointed administrator/receiver of S.A. Daflog S.R.L. was a party to the drilling contract and has

approved the contractual relationship between Daflog and Zion. While we have taken all reasonable precautions to confirm

the ability of S.A Daflog to perform under the drilling contract, we cannot provide any assurance that the parent’s status

will not affect S.A Daflog’s ability to perform under the contract.

We will require substantial additional

funds to drill our next exploratory well to the desired depth.

Our

planned work program is expensive. We believe that our current cash resources are sufficient to allow us to accomplish the initial

drilling of the Megiddo-Jezreel No. 1 well and other exploratory operations on the Megiddo-Jezreel License. However, we currently

do not have the resources to drill the planned exploratory well to the desired depth and we have no commitments for any financing

and no assurance can be provided that we will be able to raise the needed funds when needed. We estimate that, when we are not

actively drilling a well, our monthly expenditure is approximately $450,000. However, when we are engaged in active drilling operations,

as we anticipate in the Megiddo-Jezreel License area, we estimate that there is an additional cost of approximately $60,000 per

day (equivalent to approximately $1,800,000 per month). If there is turmoil in the credit and equity markets, then our ability

to raise funds may be significant and adversely affected.

Additional

financing could cause your relative interest in our assets and potential earnings to be significantly diluted (unless you participated

in such financings). Even if we have exploration success, we may not be able to generate sufficient revenues to offset the cost

of dry holes and general and administrative expenses.

We

rely on independent experts and technical or operational service providers over whom we may have limited control.

The

success of our oil and gas exploration efforts is dependent upon the efforts of various third parties that we do not control.

These third parties provide critical engineering, geological, geophysical and other scientific analytical services, including

2-D seismic imaging technology to explore for and develop oil and gas prospects. Given our small size and limited resources, we

do not have all the required expertise on staff. As a result, we rely upon various companies and other third persons to

assist us in identifying desirable hydrocarbon prospects to acquire and to provide us with technical assistance and services.

In addition, we rely upon the owners and operators of drilling rigs and related equipment. If any of these relationships with

third-party service providers are terminated or are unavailable on commercially acceptable terms, we may not be able to execute

our business plan. Our limited control over the activities and business practices of these third parties, any inability on our

part to maintain satisfactory commercial relationships with them, their limited availability or their failure to provide

quality services could materially and adversely affect our business, results of operations and financial condition.

We

typically commence exploration drilling operations without undertaking extensive analytical testing thereby potentially increasing

the risk (and associated costs) of drilling a non-producing well.

Larger

oil and gas exploration companies typically conduct extensive analytical pre-drilling testing. These include 3-D seismic imaging,

the drilling of an expendable “pilot” well or “stratigraphic test” to collect data (logs, cores, fluid

samples, pressure data) to determine if drilling a well capable of producing oil or gas well (full completion with casing and

well testing) is justified. The use of pilot or stratigraphic tests is often used in areas where there is little or no offset

well data, like Israel, where our exploration license areas are located. While 3-D seismic imaging data is more useful than

2-D seismic data in identifying potential new drilling prospects, its acquisition and processing costs are many multiples greater

than that for 2-D data, and there are prohibitive Israel-specific logistical roadblocks to acquisition of onshore 3-D seismic

data in Israel. We believe that the additional months, delays and associated costs associated with more extensive pre-drilling

testing typically undertaken by larger oil and gas exploration companies is not necessarily justified when drilling vertical exploration

wells (as we have historically been doing). Nonetheless, the absence of more extensive pre-drilling testing may potentially increase

the risk of drilling a non-producing well, which would in turn result in increased costs and expenses. Additionally, Zion is typically

engaged in drilling deep onshore wildcat wells in Israel where only approximately 500 total wells have ever been drilled, the

vast majority of which are relatively shallow. As such, exploration risks are inherently very substantial.

A

substantial and extended decline in oil or natural gas prices could adversely impact our future rate of growth and the carrying

value of our unproved oil & gas assets.

Prices

for oil and natural gas fluctuate widely. Fluctuations in the prices of oil and natural gas will affect many aspects of our business,

including our ability to attract capital to finance our operations, our cost of capital, and the value of our unproved oil and

natural gas properties. Prices for oil and natural gas may fluctuate widely in response to relatively minor changes in the supply

of and demand for oil and natural gas, market uncertainty and a wide variety of additional factors (such as the current political

turmoil in the Middle East) that are beyond our control, such as the domestic and foreign supply of oil and natural gas, the ability

of members of the Organization of Petroleum Exporting Countries to agree to and maintain oil price and production controls, technological

advances affecting energy consumption, and domestic and foreign governmental regulations. Significant and extended reductions

in oil and natural gas prices could require us to reduce our capital expenditures and impair the carrying value of our assets.

If

we are successful in finding commercial quantities of oil and/or gas, our revenues, operating results, financial condition and

ability to borrow funds or obtain additional capital will depend substantially on prevailing prices for oil and natural gas. Declines

in oil and gas prices may materially adversely affect our financial condition, liquidity, ability to obtain financing and operating

results. Lower oil and gas prices also may reduce the amount of oil and gas that we could produce economically.

Historically,

oil and gas prices and markets have been volatile, with prices fluctuating widely, and they are likely to continue to be volatile,

making it impossible to predict with any certainty the future prices of oil and gas.

We

may continue to recognize substantial write-downs with respect to well impairment costs.

We

account for our oil and gas property costs using the full-cost method of accounting for oil and gas properties. Accordingly, all

costs associated with acquisition, exploration and development of oil and gas reserves, including directly related overhead costs,

are capitalized. We record an investment impairment charge when we believe an investment has experienced a decline in value that

is other than temporary.

Abandonment

of properties is accounted for as adjustments to capitalized costs. The net capitalized costs are subject to a “ceiling

test,” which limits such costs to the aggregate of the estimated present value of future net revenues from proved reserves

discounted at ten percent based on current economic and operating conditions, plus the lower of cost or fair market value of unproved

properties. The recoverability of amounts capitalized for oil and gas properties is dependent upon the identification of economically

recoverable reserves, together with obtaining the necessary financing to exploit such reserves and the achievement of profitable

operations.

We

review our unproved oil and gas properties periodically to determine whether they have been impaired. An impairment allowance

is provided on an unproved property when we determine that the property will not be developed. Any impairment charge incurred

is recorded in accumulated depletion, impairment and amortization to reduce our recorded basis in the asset.

Our

lack of diversification increases the risk of an investment in us, and our financial condition and results of operations may deteriorate

if we fail to diversify.

Our

business focus is on oil and gas exploration on a limited number of properties in Israel. As a result, we lack diversification,

in terms of both the nature and geographic scope of our business. We will likely be impacted more acutely by factors affecting

our industry or the regions in which we operate than we would if our business were more diversified. If we are unable to diversify

our operations, our financial condition and results of operations could deteriorate.

We

currently have no proved reserves or current production, and we may never have any.

We

do not have any proved reserves or current production of oil or gas. We cannot assure you that any wells will be completed or

produce oil or gas in commercially profitable quantities.

We

have a history of losses and we cannot assure you that we will ever be profitable.

We

incurred net losses of $7,306,000 for the year ended December 31, 2015 and $6,746,000 for the nine months ended September 30,

2016. We cannot provide any assurances that we will ever be profitable.

Oil

and gas exploration is an inherently risky business.

Exploratory

drilling involves enormous risks, including the risk that no commercially productive oil or natural gas reservoirs will be discovered.

Even when properly used and interpreted, seismic data analysis and other computer simulation techniques are only tools used to

assist geoscientists in trying to identify subsurface structures and potential hydrocarbon indicators. They do not allow the interpreter

to know conclusively if hydrocarbons are present or economically available. The risk analysis techniques we use in evaluating

potential drilling sites rely on subjective judgments of our personnel and consultants. Additionally, Zion is typically engaged

in drilling deep onshore wildcat wells in Israel where only approximately 500 total wells have ever been drilled, the vast majority

of which are relatively shallow. Consequently, our exploration risks are very substantial.

Operating

hazards and uninsured risks with respect to the oil and gas operations may have material adverse effects on our operations.

Our

exploration and, if successful, development and production operations are subject to all of the risks normally incident to the

exploration for and the development and production of oil and gas, including blowouts, cratering, uncontrollable flows of oil,

gas or well fluids, fires, pollution and other environmental and operating risks. These hazards could result in substantial losses

due to injury or loss of life, severe damage to or destruction of property and equipment, pollution and other environmental damage

and suspension of operations. While as a matter of practice we take out insurance against some or all of these risks, such insurance

may not cover the particular hazard and may not be sufficient to cover all losses. The occurrence of a significant event adversely

affecting any of the oil and gas properties in which we have an interest could have a material adverse effect on us, could materially

affect our continued operation and could expose us to material liability.

Political

risks may adversely affect our operations and/or inhibit our ability to raise capital.

Our

operations are concentrated in Israel and could be directly affected by political, economic and military conditions in Israel.

Efforts to secure a lasting peace between Israel and its Arab neighbors and Palestinian residents have been underway since Israel

became a country in 1948, and the future of these peace efforts is still uncertain.

Civil

unrest has continued to spread throughout the region and has involved other areas such as the Gaza Strip and nations such as Egypt,

Syria and Yemen. Such unrest, if it continues to spread or grow in intensity, could lead to civil wars; regime changes resulting

in governments that are hostile to the US and/or Israel, such as has previously occurred in the region; violations of the 1979

Egypt-Israel Peace Treaty; or regional conflict.

At

this time, we are uncertain of the outcome of these events. However, prolonged and/or widespread regional conflict in the Middle

East could have the following results, among others:

|

|

●

|

capital

market reassessment of risk and subsequent redeployment of capital to more stable areas making it more difficult for us to

obtain financing for potential development projects;

|

|

|

|

|

|

|

●

|

security

concerns in Israel, making it more difficult for our personnel or supplies to enter or exit the country;

|

|

|

|

|

|

|

●

|

security

concerns leading to evacuation of our personnel;

|

|

|

|

|

|

|

●

|

damage

to or destruction of our wells, production facilities, receiving terminals or other operating assets;

|

|

|

|

|

|

|

●

|

inability

of our service and equipment providers to deliver items necessary for us to conduct our operations in, resulting in

delays; and

|

|

|

|

|

|

|

●

|

lack

of availability of drilling rig and experienced crew, oilfield equipment or services if third party providers decide to exit

the region.

|

Loss

of property and/or interruption of our business plans resulting from hostile acts could have a significant negative impact on

our earnings and cash flow. In addition, we may not have enough insurance to cover any loss of property or other claims resulting

from these risks.

We

face various risks associated with the trend toward increased activism against oil and gas exploration and development activities.

Opposition

toward oil and gas drilling and development activity has been growing globally and is particularly pronounced in OECD countries

which include the US, the UK and Israel. Companies in the oil and gas industry, such as us, are often the target of activist

efforts from both individuals and non-governmental organizations regarding safety, human rights, environmental compliance and

business practices. Future activist efforts could result in the following:

|

|

●

|

delay

or denial of drilling permits;

|

|

|

|

|

|

|

●

|

shortening

of lease terms or reduction in lease size;

|

|

|

|

|

|

|

●

|

restrictions

on installation or operation of gathering or processing facilities;

|

|

|

|

|

|

|

●

|

restrictions

on the use of certain operating practices, such as hydraulic fracturing;

|

|

|

|

|

|

|

●

|

legal

challenges or lawsuits;

|

|

|

|

|

|

|

●

|

damaging

publicity about us;

|

|

|

|

|

|

|

●

|

increased

costs of doing business;

|

|

|

|

|

|

|

●

|

reduction

in demand for our products; and

|

|

|

|

|

|

|

●

|

other

adverse effects on our ability to develop our properties and expand production.

|

Our

need to incur costs associated with responding to these initiatives or complying with any resulting new legal or regulatory requirements

resulting from these activities that are substantial and not adequately provided for, could have a material adverse effect on

our business, financial condition and results of operations.

Economic

risks may adversely affect our operations and/or inhibit our ability to raise additional capital.

Economically,

our operations in Israel may be subject to:

|

|

●

|

exchange

rate fluctuations;

|

|

|

|

|

|

|

●

|

royalty

and tax increases and other risks arising out of Israeli State sovereignty over the mineral rights in Israel and its

taxing authority; and

|

|

|

|

|

|

|

●

|

changes

in Israel's economy that could cause the legislation of oil and gas price controls.

|

Consequently,

our operations may be substantially affected by local economic factors beyond our control, any of which could negatively affect

our financial performance and prospects.

Legal

risks could negatively affect Zion’s value.

Legally,

our operations in Israel may be subject to:

|

|

●

|

changes

in the Petroleum Law resulting in modification of license and permit rights;

|

|

|

●

|

adoption

of new legislation relating to the terms and conditions pursuant to which operations in the energy sector may be conducted;

|

|

|

●

|

changes

in laws and policies affecting operations of foreign-based companies in Israel; and

|

|

|

●

|

changes

in governmental energy and environmental policies or the personnel administering them.

|

The

Israeli Ministry of National Infrastructures has promulgated legislation relating to licensing requirements for entities engaged

in the fuel sector that may result in our having to obtain additional licenses to market and sell hydrocarbons that may be discovered

by us. We have been advised by the Ministry that they do not intend to deprive a holder of petroleum rights under the Petroleum

Law of its right under that law to sell hydrocarbons discovered and produced under its petroleum rights. We cannot now predict

the legislation’s possible impact on our operations.

Further,

in the event of a legal dispute in Israel, we may be subject to the exclusive jurisdiction of Israeli courts or we may not be

successful in subjecting persons who are not United States residents to the jurisdiction of courts in the United States, either

of which could adversely affect the outcome of a dispute.

The

Ministry of Environmental Protection is considering proposed legislation relating to polluted materials, including their production,

treatment, handling, storage and transportation, that may affect land or water resources. Persons engaged in activities

involving these types of materials will be required to prepare environmental impact statements and remediation plans either prior

to commencing activities or following the occurrence of an event that may cause pollution to land or water resources or endanger

public health. We do now know and cannot predict whether any legislation in this area will be enacted and, if so, in what

form and which of its provisions, if any, will relate to and affect our activities, how and to what extent.

In

March 2011, the Ministry of Environmental Protection issued initial guidelines relating to oil and gas drilling. This is the first

time that the Ministry has published specific environmental guidelines for oil and gas drilling operations, relating to on-shore

and off-shore Israel. The guidelines are subject to change.

The

guidelines are detailed and provide environmental guidelines for all aspects of drilling operations, commencing from when an application

for a preliminary permit is filed, and continuing through license, drilling exploration, production lease, petroleum production

and abandonment of the well. The guidelines address details that must be submitted regarding the drill site, surrounding area,

the actual drilling operations, the storage and removal of waste and the closing or abandoning of a well.

The

Company believes that these and other new regulations will significantly increase the expenditures associated with obtaining new

exploration rights and considerably increase the time needed to obtain all of the necessary authorizations and approvals prior

to drilling.

Our

petroleum rights (including licenses and permits) could be canceled, terminated or not extended, and we would not be able to successfully

execute our business plan.

Any

license or other petroleum right we hold or may be granted is granted for fixed periods and requires compliance with a work program

detailed in the license or other petroleum right. If we do not fulfill the relevant work program due to inadequate funding or

for any other reason, the Israeli government may terminate the license or any other petroleum right before its scheduled expiration

date. No assurance can be provided that we will be able to obtain an extension to this if in fact we are unable to begin drilling

by such date.

There

are limitations on the transfer of interests in our petroleum rights, which could impair our ability to raise additional funds

to execute our business plan

.

The

Israeli government has the right to approve any transfer of rights and interests in any license or other petroleum right we hold

or may be granted and any mortgage of any license or other petroleum rights to borrow money. If we attempt to raise additional

funds through borrowings or joint ventures with other companies and are unable to obtain required approvals from the government,

the value of your investment could be significantly diluted or even lost.

Our

dependence on the limited contractors, equipment and professional services available in Israel may result in increased costs and

possibly material delays in our work schedule

.

Due

to the lack of competitive resources in Israel, costs for our operations may be more expensive than costs for similar operations

in other parts of the world. We are also more likely to incur delays in our drilling schedule and be subject to a greater risk