GMS Announces Launch of Secondary Public Offering of Common Stock

February 21 2017 - 7:00AM

Business Wire

GMS Inc. (NYSE:GMS) (the “Company”), a leading North American

distributor of gypsum wallboard and suspended ceiling systems,

announced today the launch of an underwritten secondary public

offering of 6,000,000 shares of common stock by certain of the

Company’s existing stockholders, including certain affiliates of

AEA Investors LP (collectively, the “Selling Stockholders”).

Additionally, in connection with the offering, the Selling

Stockholders intend to grant to the underwriters a 30-day option to

purchase up to 900,000 additional shares of common stock.

The Company is not selling any shares in this offering and will

not receive any proceeds from the sale of shares being sold by the

Selling Stockholders in this offering.

Barclays Capital Inc., Credit Suisse Securities (USA) LLC and

RBC Capital Markets, LLC are acting as representatives of the

underwriters and joint book-running managers for the offering.

Robert W. Baird & Co. Incorporated and SunTrust Robinson

Humphrey, Inc. are acting as additional joint book-running managers

for the offering. Raymond James & Associates, Inc., Stephens

Inc. and Wells Fargo Securities are acting as co-managers for the

offering. The offering of these securities is being made only by

means of a prospectus. Copies of the prospectus may be obtained,

when available, from: Barclays Capital Inc., c/o Broadridge

Financial Solutions, 1155 Long Island Avenue, Edgewood, New York

11717, by telephone at (888) 603-5847 or by email at

barclaysprospectus@broadridge.com; Credit Suisse Securities (USA)

LLC, Attention: Prospectus Department, One Madison Avenue, New

York, New York 10010, by telephone at (800) 221-1037 or by email at

newyork.prospectus@credit-suisse.com; or RBC Capital Markets, LLC,

Attention: Equity Syndicate, 200 Vesey Street, 8th Floor, New York,

NY 10281-8098, by telephone at (877) 822-4089 or by email at

equityprospectus@rbccm.com.

A registration statement relating to these securities has been

filed with the Securities and Exchange Commission but has not yet

become effective. These securities may not be sold nor may offers

to buy be accepted prior to the time the registration statement

becomes effective. This press release shall not constitute an offer

to sell or the solicitation of an offer to buy these securities nor

shall there be any sale of these securities in any state or

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such state or jurisdiction.

About GMS:

Founded in 1971, GMS operates a network of more than 200

distribution centers across the United States. GMS’s extensive

product offering of wallboard, suspended ceilings systems and

complementary interior construction products is designed to provide

a comprehensive one-stop-shop for our core customer, the interior

contractor who installs these products in commercial and

residential buildings.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170221005790/en/

Investor Relations:GMS Inc.678-353-2883ir@gms.com

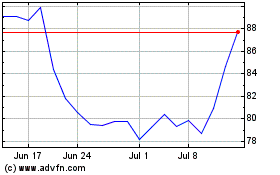

GMS (NYSE:GMS)

Historical Stock Chart

From Mar 2024 to Apr 2024

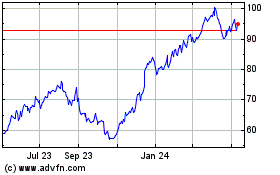

GMS (NYSE:GMS)

Historical Stock Chart

From Apr 2023 to Apr 2024