Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

February 07 2017 - 5:14PM

Edgar (US Regulatory)

|

|

|

|

|

Free Writing Prospectus

(To the Preliminary Prospectus

Supplement dated February 7, 2017)

|

|

Filed pursuant to Rule 433 under the Securities Act

Registration Statement Nos. 333-195864 and 333-195864-01

|

$350,000,000 5.875% Senior Notes due 2027

Term Sheet

February 7, 2017

|

|

|

|

|

|

|

Issuers:

|

|

Suburban Propane Partners, L.P. and

Suburban Energy Finance Corp.

|

|

|

|

|

Principal Amount:

|

|

$350,000,000

|

|

|

|

|

Title of Securities:

|

|

5.875% Senior Notes due 2027

|

|

|

|

|

Maturity:

|

|

March 1, 2027

|

|

|

|

|

Offering Price:

|

|

100.000%

|

|

|

|

|

Coupon:

|

|

5.875%

|

|

|

|

|

Yield to Maturity:

|

|

5.875%

|

|

|

|

|

Interest Payment Dates:

|

|

March 1 and September 1, commencing September 1, 2017

|

|

|

|

|

Record Dates:

|

|

February 15 and August 15

|

|

|

|

|

Optional Redemption:

|

|

Make-whole call at T+ 50 bps at any time prior to March 1, 2022.

On or after March 1, 2022, at the prices set forth below beginning on March 1 of the years set forth below, plus accrued and unpaid interest:

|

|

|

|

|

|

|

|

Year

|

|

Price

|

|

|

|

2022

|

|

102.938%

|

|

|

2023

|

|

101.958%

|

|

|

2024

|

|

100.979%

|

|

|

2025 and thereafter

|

|

100.000%

|

|

|

|

|

Equity Clawback:

|

|

Up to 35% at 105.875% prior to March 1, 2020

|

|

|

|

|

Joint Book-Running Managers:

|

|

Wells Fargo Securities, LLC

Merrill Lynch, Pierce, Fenner

& Smith Incorporated

Citizens Capital Markets, Inc.

Citigroup Global Markets Inc.

J.P. Morgan Securities

LLC

|

1 of 2

|

|

|

|

|

|

|

Co-Managers:

|

|

BNP Paribas Securities Corp.

Capital One Securities, Inc.

HSBC Securities (USA) Inc.

TD Securities (USA) LLC

BB&T Capital Markets, a division of BB&T Securities, LLC

|

|

|

|

|

Trade Date:

|

|

February 7, 2017

|

|

|

|

|

Settlement Date:

|

|

February 14, 2017 (T+5)

|

|

|

|

|

Distribution:

|

|

Registered Offering

|

|

|

|

|

Use of Proceeds:

|

|

The net proceeds, after deducting underwriting discounts and commissions and estimated offering expenses, to us from the sale of the notes offered hereby will be approximately $344.0 million, which we intend to use,

together with a combination of cash on hand and borrowings under its existing revolving credit facility, to fund the purchase price of the 7 3/8% senior notes due 2021 (the “2021 Notes”) in the cash tender offer commenced on February 7,

2017 (the “Offer”) (including estimated premiums, expenses and accrued interest). While we do not expect the net proceeds of this offering to exceed the purchase price for the amount of 2021 Notes tendered in the Offer, to the extent there

are any net proceeds remaining after funding the purchase price for those 2021 Notes, we intend to use them for general partnership purposes, which may include redemption of any outstanding 2021 Notes that are not purchased in the Offer.

|

|

|

|

|

|

CUSIP Number:

|

|

864486 AK1

|

|

|

|

|

|

|

|

ISIN Number:

|

|

US864486AK16

|

|

|

The issuers have filed a registration statement (including a prospectus) with the Securities and Exchange Commission for the

offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement, the preliminary prospectus supplement and other documents the issuers have filed with the SEC for more complete

information about the issuers and this offering. You may get these documents for free by visiting the Next-Generation EDGAR System on the SEC web site at

www.sec.gov

. Alternatively, the issuers or any underwriter will arrange to send you the

prospectus if you request it by calling Wells Fargo Securities, LLC at (800) 645-3751 Opt 5.

The information in this communication supersedes the

information in the preliminary prospectus supplement to the extent it is inconsistent with such information. Before you invest, you should read the preliminary prospectus supplement (including the documents incorporated by reference therein) for

more information concerning the issuers and the notes.

Any disclaimers or other notices that may appear below are not applicable to this communication

and should be disregarded. Such disclaimers or other notices were automatically generated as a result of this communication being sent via Bloomberg email or another communication system.

2 of 2

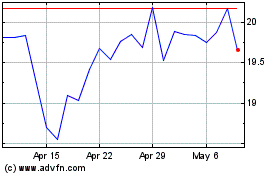

Suburban Propane (NYSE:SPH)

Historical Stock Chart

From Mar 2024 to Apr 2024

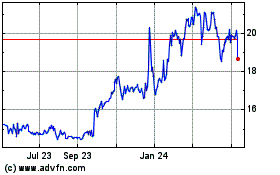

Suburban Propane (NYSE:SPH)

Historical Stock Chart

From Apr 2023 to Apr 2024