Current Report Filing (8-k)

February 01 2017 - 12:40PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities and Exchange Act of 1934 Date of Report

(Date of earliest event reported): February 1, 2017

CARDIFF

INTERNATIONAL, INC.

(Exact name of Registrant as

specified in its charter)

|

Florida

|

000-49709

|

84-1044583

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

401 E. Las Olas Blvd.

Suite 1400

Ft. Lauderdale, FL

33301

(Address of principal

executive offices, including zip code)

(844) 628-2100

(Registrant's telephone

number, including area code)

_________________________________

(Former name or former address, if changed

since last report)

Check the appropriate box below if the 8-K filing

is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

o

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)).

Completion of Acquisition or Disposition of Assets, Change

in Directors

Item 2.01 Completion of Acquisition or Disposition of Assets

Cardiff International, Inc. (OTCBB: CDIF) announced today they

entered into an LOI (Letter of Intent) to acquire Ride Today Acceptance, LLC (RTA).

Founded in January 2015, RTA capitalizes on a unique and profitable

financing opportunity in the U.S. sub-prime motorcycle financing market. RTA has spent the last two years building a financial

infrastructure and expanding its dealer footprint. As of January 1

st

, 2017, RTA has 204 dealers in 15 states. 2016 garnered

over $6.5MM in original loans, ending the year with a portfolio of over $7MM with losses of less than 1.6%. Acquisitions are subject

to completion of an independent audit.

Item 3.02 Unregistered Sales of Equity

Securities.

On January 24, 2017, the Company entered

into two separate Convertible Note agreements with Greentree Financial Group, Inc., consisting of a Line of Credit Agreement and

a Financial Advisory Agreement.

The Line of Credit Agreement allows for

the Company to borrow up to $250,000 and $80,000 in Financial Services both from Greentree, which will be evidenced by various

promissory notes, which will accrue interest at a rate of 15% per annum, and 10% per annum respectfully. In addition, the notes

will be convertible at a price equal to 50% of the lowest trading price during the 10 trading days immediately prior to a conversion

date. Greentree shall not be able to convert the promissory notes in an amount that would result in the beneficial ownership of

greater than 4.9% of the outstanding shares of the Company, with the exception that the limitation may be waived by Greentree with

61 days prior notice. There is a 20% prepayment penalty associated with each of the promissory notes. Each promissory note conversion

shall result in $1,500 being added to the principal of each promissory note converted.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

Cardiff International,

Inc.

By:

/s/ Daniel Thompson

Daniel Thompson

Title:

Chairman

Dated: 2/1/17

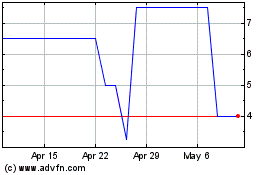

Cardiff Lexington (PK) (USOTC:CDIX)

Historical Stock Chart

From Mar 2024 to Apr 2024

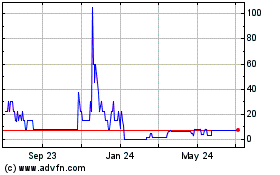

Cardiff Lexington (PK) (USOTC:CDIX)

Historical Stock Chart

From Apr 2023 to Apr 2024