Dow Chemical Swings to Loss

January 26 2017 - 8:43AM

Dow Jones News

By Imani Moise

Dow Chemical Co., looking to complete its merger with rival

DuPont Co., swung to a loss in the most recent quarter, though

adjusted earnings grew more than expected.

During the quarter the company opted to book a more than $1

billion pretax charge to account for future asbestos-related

expenses covering the next 40 years. Excluding this charge and

other items, the company's earnings grew 6%.

Sales in plastics, Dow's largest segment, grew 4% to $4.8

billion while the infrastructure solutions segment surged 41% to

$2.4 billion and performance material and chemical sales edged up

1% to $2.41 billion.

DuPont, which reported better-than-expected earnings earlier

this week, and Dow have said their aim is to unite to form an

industrial behemoth worth about $129 billion before breaking up

into companies agriculture, materials, and specialty products like

enzymes and electronic components.

The merger, initially said to close in late 2016, is now

expected to close after March as the companies await regulatory

approval.

Over all, Dow reported a loss of $33 million, or 3 cents a

share, compared with a profit of $3.53 billion, or $2.94 a share, a

year earlier. Excluding certain items, the company earned 99 cents

a share, up from 93 cents a year earlier.

Revenue jumped 14% to $13.02 billion.

Analysts polled by Thomson Reuters had forecast earnings of 88

cents on $12.38 billion in revenue.

Shares of Dow rose 1.9% to $61.35 in premarket trade. Dow closed

Wednesday at $60.01 and is up 12% over the past three months.

Write to Imani Moise at imani.moise@wsj.com

(END) Dow Jones Newswires

January 26, 2017 08:28 ET (13:28 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

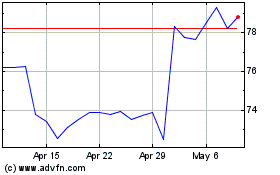

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

From Aug 2024 to Sep 2024

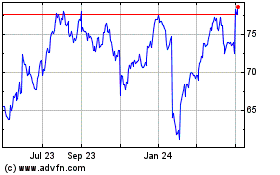

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

From Sep 2023 to Sep 2024