By Jennifer Maloney

PepsiCo Inc. plans to use this year's Super Bowl to go on the

offensive in the beverage industry's intensifying water war.

The Purchase, N.Y., company bought a 30-second spot to introduce

LIFEWTR, its first pricier "premium" water brand, which is

positioned to compete with Coca-Cola Co.'s smartwater.

The Super Bowl -- which this year is to be played on Feb. 5 --

has long been a battleground for the cola wars. In a 1995 Pepsi ad,

a truce between truck drivers for the two companies devolves into a

fistfight when the Coke driver sips his rival's can of Pepsi and

refuses to hand it back.

PepsiCo's opening salvo in the battle for a piece of the

premium-water market comes amid estimates that, by volume, annual

U.S. sales of bottled water exceeded soda sales for the first time

in 2016.

Sales of bottled water have surged more than 50% over the last

decade, while U.S. soda volumes have fallen over the same period as

Americans switch to water and other health and wellness drinks.

In response, Coke and Pepsi are turning more attention -- and

marketing dollars -- to water.

PepsiCo this month is beginning national distribution of

LIFEWTR, priced at around $2.70 for a 1-liter bottle. Pepsi already

has a lower-priced Aquafina brand, which is No. 2 by retail sales

in the $21 billion U.S. bottled-water market, according to

Euromonitor International, a market-research firm.

Confronted with rising obesity and diabetes concerns, the

soft-drink industry in 2014 pledged to cut beverage calories in the

American diet by 20% over a decade by promoting bottled water,

low-calorie drinks and smaller package sizes. In addition to the

LIFEWTR spot, PepsiCo will feature Pepsi Zero Sugar, a zero-calorie

soda, on screen during the Super Bowl's half-time show.

Coke hasn't announced its Super Bowl plans but a company

spokesman said it isn't planning ads for either Dasani or

smartwater, its two bottled-water brands. They occupy the No. 1 and

No. 5 spots, respectively, in the U.S. bottled-water market by

sales, according to Euromonitor. Coke said it would launch new

campaigns for both brands in a few months.

Coke's smartwater holds the top spot in the fast-growing

premium-water segment, with 44% of the market share in that

category by volume, according to Beverage Marketing Corp., a New

York consulting firm.

With more than $1 billion in retail sales in 2016, smartwater

has been a surprise hit for Coke, which acquired the brand when it

purchased Glacéau for $4.1 billion in 2007. Coke has positioned

smartwater as a premium product by adding electrolytes, likening

its vapor-distilled purification to the formation of clouds,

sponsoring fitness and fashion events and partnering with actress

Jennifer Aniston, an early smartwater investor, to promote it.

LIFEWTR is purified by reverse osmosis, and PepsiCo describes it

as "pH-balanced with electrolytes added for taste." The new brand's

most distinctive feature is its packaging: The clear plastic

bottles will feature textured labels by emerging artists, including

the street artist known as Momo, with new designs introduced every

few months.

"They're a little late, but it's a beautiful package," said

Michael Bellas, chairman of Beverage Marketing, which wasn't

involved in the product's development or launch.

PepsiCo hopes the revolving designs will prompt young people to

share images of the bottles on social media. There is demand for

"water that says something about the consumer as they're walking

around with it," said Seth Kaufman, PepsiCo's marketing chief.

The LIFEWTR ad, called "Inspiration Drops," shows art appearing

on buildings and sidewalks as raindrops fall, while an adapted

version of John Legend's "Love Me Now" plays. PepsiCo declined to

say how much it spent on the ad.

Fox is still selling ad time for the Super Bowl and has been

asking advertisers to fork over roughly $5 million for 30 seconds

worth of time. More than 100 million people are expected to tune in

to the broadcast.

The U.S. market leader for bottled water is Nestlé, maker of the

No. 3 and No. 4 brands Nestlé Pure Life and Poland Spring. Nestlé

doesn't have a Super Bowl ad planned but this year expects to

launch a new national ad campaign for its regional spring waters

including Poland Spring, which is distributed in the Northeast.

Antonio Sciuto, chief marketing officer for Nestlé Waters North

America, which also sells Perrier and S. Pellegrino, said there are

growth opportunities in the U.S. for the company's premium still

brand, Acqua Panna. Water, he said, "is the most exciting category

to work in right now."

Write to Jennifer Maloney at jennifer.maloney@wsj.com

(END) Dow Jones Newswires

January 24, 2017 05:44 ET (10:44 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

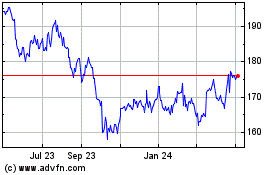

PepsiCo (NASDAQ:PEP)

Historical Stock Chart

From Mar 2024 to Apr 2024

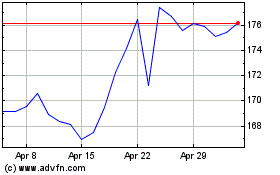

PepsiCo (NASDAQ:PEP)

Historical Stock Chart

From Apr 2023 to Apr 2024