Today's Top Supply Chain and Logistics News From WSJ

January 19 2017 - 7:12AM

Dow Jones News

By Paul Page

Sign up:With one click, get this newsletter delivered to your

inbox.

The next wave of container shipping consolidation may go through

China. Chinese conglomerate Cosco Group is in talks to acquire

smaller rival Hong Kong-based Orient Overseas Container Line Co.,

the WSJ's Costas Paris reports. The carriers already are lined up

under the Ocean Alliance grouping that will start operations this

spring, but the purchase would add new weight to the Chinese

operator in a business where scale is becoming an overriding

business imperative. With a 2.8% share of the global shipping

market, OOCL is the ninth-biggest carrier in the world but sits

outside the ring of dominant carriers that seem to be setting the

pricing and capacity agenda for container shipping. Cosco is

looking to move up the rankings to challenge the world's top three

shipping lines, a move that will carry a heavy cost. The

state-owned company is preparing a bid valued at more than $4

billion. But analysts at Alphaliner say market value would push the

purchase price closer to $4.7 billion if the two sides can strike a

deal.

Hunter Harrison is leaving Canadian Pacific Railway Ltd. but he

isn't done trying to reshape North American freight rail business.

Mr. Harrison is teaming up with an activist investor in a bid to

shake up management at U.S. carrier CSX Corp., just as he did at

the Canadian railroad, the WSJ's David Benoit and Jacquie McNish

report. Mr. Harrison is working with Paul Hilal, who left Bill

Ackman's Pershing Square Capital Management LP to launch his own

fund last year, and has raised more than $1 billion for a single

investment. Mr. Harrison came on board at CP in June 2012 after a

proxy battle waged by Mr. Ackman, and the two fought an

unsuccessful battle to revive rail consolidation with a takeover of

Norfolk Southern Corp. He's also led a turnaround at what was

viewed as one of the worst-performing railroad companies in North

America. The company's fourth-quarter results highlighted that

efficiency, with profits jumping sharply to $289 million despite a

slip in revenue to close out a tough year for freight rail

operators.

The breaking apart of Hanjin Shipping Co. is picking up steam. A

bankruptcy judge's approval of the hotly-contested sale of the

carrier's stake in a Long Beach, Calif., container terminal

operator removes the most visible part of Hanjin's U.S. operations,

the WSJ's Tom Corrigan and Erica E. Phillips report. The ruling

follows attempts by U.S. creditors to halt the sale in hopes of a

more lucrative deal and what the judge says were assurances that

the creditors will be treated fairly in South Korea's bankruptcy

court. The sale, for $78 million in cash and relief of $54 million

in debt and other obligations, gives Mediterranean Shipping Co.

full control of Total Terminals International LLC. MSC is following

up by selling a 20% stake in the terminal business to South Korea's

Hyundai Merchant Marine Co., stepping up the cooperation between

the two carriers. Meantime, Hanjin's retreat from the shipping

business now returns to Asia, where it looks like a full

liquidation is underway.

SUPPLY CHAIN STRATEGIES

The logistics field's quiet period in mergers-and-acquisitions

activity may be ending. Ridgemont Equity Partners is buying

Worldwide Express from another private-equity firm and blending the

business with the Unishippers Global Logistics operation it already

owns, WSJ Logistics Report's Erica E. Phillips writes. The

combination will create a business with more than $1 billion in

revenue, making the new Worldwide Express Global Logistics a top-30

freight broker in the U.S. The company will hold a significant

share of the less-than-truckload market, and has plans to expand

its truckload business. The deal will also pull together the only

two authorized resellers of United Parcel Service Inc. services to

small businesses. The deal is one of the biggest in several months

in the U.S. logistics arena, a sharp contrast with 2015 and the

first part of last year, when a series of splashy purchases

consolidated logistics operators.

QUOTABLE

IN OTHER NEWS

Rising global temperatures in 2016 set a record for the third

year in a row, as federal climate watchers rated it the warmest

year worldwide since modern record keeping began. (WSJ)

Overall U.S. industrial production rose at the fastest pace in

more than two years in December but factory output increased at a

more modest 0.2% pace. (WSJ)

A broad measure of inflation poked above 2% for the first time

in two-and-a-half years in December. (WSJ)

United Continental Holdings Inc.'s fourth-quarter net profit

declined sharply as cargo revenue increased 8.2% on a 16.1% gain in

cargo traffic. (WSJ)

Aircraft leasing companies are holding back plans to enter Iran

because of potential policy changes under the incoming Trump

administration. (WSJ)

Toshiba Corp. is weighing a spinoff of its profitable

semiconductor unit. (WSJ)

The Federal Trade Commission is suing Qualcomm Inc., alleging

the company unlawfully maintained a monopoly on a type of

semiconductor used in cellphones. (WSJ)

The U.S. launched a trade challenge against Canada's treatment

of U.S. wines in the British Columbia province. (WSJ)

The U.S. Merchant Marine Academy at Kings Point, N.Y., has

failed to correct persistent sexual harassment, assault and

pervasive sexism, according to reports on the maritime educational

institution. (Newsday)

Two-thirds of Americans surveyed in a poll oppose using tolls to

draw private investment for infrastructure. (Washington Post)

A.P. Moller-Maersk A/S Chief Executive Soren Skou says capacity

reduction by container lines is helping drive up shipping prices.

(CNBC)

Cargo ship owners are seeing charter rates fall to historic lows

as container shipping lines dispose of excess tonnage. (IHS

Fairplay)

Amazon.com Inc. plans to open a 1.2 million-square-foot

distribution center northeast of Baltimore. (Baltimore Sun)

Japan will subsidize installation of pickup lockers at various

sites to cut down on delivery of e-commerce purchases. (Nikkei

Asian Review)

Utah businesses want the state to back construction of a

container handling station, or inland port, in the northern part of

the state. (Salt Lake Tribune)

The owner of New Jersey trucking company was arrested while

boarding a flight to Aruba after racking up more than $1 million in

unpaid tolls for company trucks. (Philadelphia Inquirer)

ABOUT US

Paul Page is deputy editor of WSJ Logistics Report. Follow him

at @PaulPage, and follow the entire WSJ Logistics Report team:

@brianjbaskin, @jensmithWSJ and @EEPhillips_WSJ and follow the WSJ

Logistics Report on Twitter at @WSJLogistics.

Subscribe to this email newsletter by clicking here:

http://on.wsj.com/Logisticsnewsletter .

Write to Paul Page at paul.page@wsj.com

(END) Dow Jones Newswires

January 19, 2017 06:57 ET (11:57 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

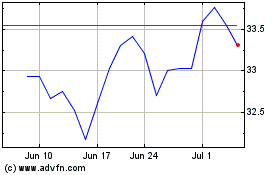

CSX (NASDAQ:CSX)

Historical Stock Chart

From Mar 2024 to Apr 2024

CSX (NASDAQ:CSX)

Historical Stock Chart

From Apr 2023 to Apr 2024