Diluted Earnings per Share of $0.54, up 25.9%

vs. 4Q15

Quarterly Shareholder Dividend Increase of 25%

to $0.15 per Share

Synovus Financial Corp. (NYSE: SNV) today reported financial

results for the quarter and year ended December 31, 2016.

Net income available to common shareholders for the fourth

quarter 2016 was $66.0 million or $0.54 per diluted share as

compared to $62.7 million or $0.51 per diluted share for the third

quarter 2016 and $55.8 million or $0.43 per diluted share for the

fourth quarter 2015. Adjusted earnings per diluted share for the

fourth quarter 2016 were $0.54, a 3.6% increase from the third

quarter 2016 and a 22.2% increase from the fourth quarter 2015.

2016 Highlights

- Net income available to common

shareholders for 2016 was $236.5 million or $1.89 per diluted share

as compared to $215.8 million or $1.62 per diluted share for 2015.

Diluted EPS grew 16.7% for 2016 compared to 2015.

- Total average loans1 for the year were

$23.10 billion, a $1.56 billion or 7.2% increase from 2015.

- Total loans1 ended the year at $23.86

billion, a $1.43 billion or 6.4% increase from 2015.

- Total average deposits for the year

were $23.88 billion, a $1.33 billion or 5.9% increase from

2015.

- Total revenues2 of $1.16 billion

increased $73.9 million or 6.8% from 2015.

- Efficiency ratio of 64.74% improved 87

basis points from 2015.

- Adjusted efficiency ratio of 61.06%

improved 87 basis points from 2015.

- Non-performing loans of $153.4 million

at December 31, 2016 declined 8.9% from December 31, 2015, and the

non-performing loan ratio declined 11 basis points from December

31, 2015 to 0.64% at December 31, 2016.

- Returned over $322 million in capital

to common shareholders during the year through common share

repurchases and dividends.

- Common Equity Tier 1 ratio was 9.96% at

December 31, 2016 compared to 10.37% at December 31, 2015.

- Completed the acquisition of Global One

effective October 1, 2016.

“We closed out 2016 with another quarter of improved

profitability demonstrated by diluted earnings per share of $0.54,

up 26 percent compared to the fourth quarter of 2015,” said Kessel

D. Stelling, Synovus Chairman and CEO. “We also achieved strong

earnings per share growth for the full year and returned more than

$300 million in capital to our shareholders. We are energized about

the opportunities in 2017 and beyond as we focus on exceptional and

efficient service delivery, understanding and meeting customer

needs, further balance sheet diversification, disciplined expense

management, and investing in our communities.”

Consolidated Fourth Quarter Financial Results

Balance Sheet

- Total loans1 ended the quarter at

$23.86 billion, up $593.5 million or 10.1% annualized from the

previous quarter and up $1.43 billion or 6.4% as compared to the

fourth quarter 2015.

- Commercial and industrial loans1 grew

by $536.0 million or 19.4% annualized from the previous quarter and

$779.8 million or 7.2% as compared to the fourth quarter 2015.

- Retail loans grew by $157.0 million or

13.0% annualized from the previous quarter and $671.7 million or

15.6% as compared to the fourth quarter 2015.

- Commercial real estate loans declined

by $99.6 million or 5.3% annualized from the previous quarter and

$28.8 million or 0.4% as compared to the fourth quarter 2015.

- Total average deposits for the quarter

were $24.66 billion, up $631.0 million or 10.4% annualized from the

previous quarter and $1.42 billion or 6.1% as compared to the

fourth quarter 2015.

- Average core transaction accounts3 grew

by $414.1 million or 9.5% annualized from the previous quarter and

$1.21 billion or 7.3% as compared to the fourth quarter 2015.

Core Performance

- Total revenues2 were $301.7 million, up

$7.5 million or 2.6% from the previous quarter and 8.2% from the

fourth quarter 2015.

- Net interest income was $233.5 million,

up $7.5 million or 3.3% from the previous quarter and 9.8% as

compared to the fourth quarter 2015.

- Net interest margin was 3.29%, up 2

basis points from the previous quarter. Yield on earning assets was

3.73%, up 2 basis points from the previous quarter, and the

effective cost of funds was 0.44%, unchanged from the previous

quarter.

- Total non-interest income was $74.0

million, up $5.9 million or 8.6% compared to the previous quarter

and 11.8% as compared to the fourth quarter 2015.

- Adjusted non-interest income was $68.1

million, unchanged from the previous quarter and up 3.0% as

compared to the fourth quarter 2015.

- Core banking fees4 were $35.5 million,

up $689 thousand or 2.0% from the previous quarter and 1.4% as

compared to the fourth quarter 2015.

- Gains from sale of GGL/SBA loans were

$2.2 million, up $878 thousand or 67.7% from the previous quarter

and 57.0% as compared to the fourth quarter 2015.

- Fiduciary and asset management fees,

brokerage revenue, and insurance revenues were $20.3 million, up

$787 thousand or 4.0% from the previous quarter and 7.9% as

compared to the fourth quarter 2015.

- Mortgage banking income was $5.5

million, down $1.8 million or 24.9% from the previous quarter and

up 33.1% as compared to the fourth quarter 2015.

- Total non-interest expense was $193.2

million, up $7.3 million or 3.9% from the previous quarter and 5.6%

as compared to the fourth quarter 2015.

- Fourth quarter 2016 total non-interest

expense includes a $4.7 million charge related to changes in the

valuation of the Visa derivative and $1.1 million in merger-related

expenses.

- Adjusted non-interest expense was

$187.0 million, up $3.1 million or 1.7% from the previous quarter

and 3.7% as compared to the fourth quarter 2015.

- Employment expense of $101.7 million

decreased $282 thousand or 0.3% from the previous quarter and

increased 6.4% as compared to the fourth quarter 2015.

- Occupancy and equipment expense of

$27.9 million decreased $253 thousand or 0.9% from the previous

quarter and increased 0.2% as compared to the fourth quarter

2015.

- Other operating expenses of $23.9

million increased $2.8 million or 13.4% from the previous quarter

and 5.1% as compared to the fourth quarter 2015.

- Efficiency ratio for the fourth quarter

was 63.98% as compared to 63.13% in the previous quarter and 65.59%

in the fourth quarter 2015.

- Adjusted efficiency ratio for the

fourth quarter was 60.32% as compared to 60.55% in the previous

quarter and 62.13% in the fourth quarter 2015.

Credit Quality

- Non-performing loans were $153.4

million at December 31, 2016, up $5.2 million or 3.5% from the

previous quarter and down $15.0 million or 8.9% from December 31,

2015. The non-performing loan ratio was 0.64% at December 31, 2016,

as compared to 0.64% at the end of the previous quarter and 0.75%

at December 31, 2015.

- Total non-performing assets were $175.7

million at December 31, 2016, down $3.4 million or 1.9% from the

previous quarter and down $39.7 million or 18.4% from December 31,

2015. The non-performing asset ratio was 0.74% at December 31,

2016, as compared to 0.77% at the end of the previous quarter and

0.96% at December 31, 2015.

- Net charge-offs were $8.3 million in

the fourth quarter 2016, up $1.4 million or 20.0% from $6.9 million

in the previous quarter. The annualized net charge-off ratio was

0.14% in the fourth quarter as compared to 0.12% in the previous

quarter.

- Total delinquencies (consisting of

loans 30 or more days past due and still accruing) remain low at

0.27% of total loans at December 31, 2016 as compared to 0.27% the

previous quarter and 0.21% at December 31, 2015.

Capital Ratios

- Common Equity Tier 1 ratio was 9.96% at

December 31, 2016 compared to 9.96% at September 30, 2016.

- Tier 1 Capital ratio was 10.08% at

December 31, 2016 compared to 10.05% at September 30, 2016.

- Total Risk Based Capital ratio was

12.01% at December 31, 2016 compared to 12.04% at September 30,

2016.

- Tier 1 Leverage ratio was 8.99% at

December 31, 2016 compared to 8.98% at September 30, 2016.

- Tangible Common Equity ratio was 9.09%

at December 31, 2016 compared to 9.28% at September 30, 2016.

Capital Management

- During the fourth quarter, the Company

completed the $300 million common stock repurchase program

announced in the fourth quarter 2015, which resulted in 9.9 million

total shares repurchased and reduced total share count by

7.6%.

- Additionally, during the fourth

quarter, the Board of Directors authorized a new share repurchase

program of up to $200 million of the Company’s common stock to be

executed during 2017.

- The Board of Directors also approved a

25% increase in the Company’s quarterly common stock dividend from

$0.12 to $0.15 per share, effective with the quarterly dividend

payable in April 2017.

Fourth Quarter Earnings Conference Call

Synovus will host an earnings highlights conference call at 8:30

a.m. EDT on January 17, 2017. The earnings call will be accompanied

by a slide presentation. Shareholders and other interested parties

may listen to this conference call via simultaneous Internet

broadcast. For a link to the webcast, go to

investor.synovus.com/event. The replay will be archived for 12

months and will be available 30-45 minutes after the call.

Synovus Financial Corp.

Synovus Financial Corp. is a financial services company based in

Columbus, Georgia, with approximately $30 billion in assets.

Synovus provides commercial and retail banking, investment, and

mortgage services to customers through 28 locally-branded

divisions, 248 branches, and 328 ATMs in Georgia, Alabama, South

Carolina, Florida, and Tennessee. Synovus Bank, a wholly owned

subsidiary of Synovus, was recognized as one of America's Most

Reputable Banks by American Banker and the Reputation Institute in

2016 and 2015, and was named “Best Regional Bank, Southeast” by

MONEY Magazine for 2016-2017. Synovus is on the web at synovus.com,

on Twitter @synovus, and on LinkedIn at

http://linkedin.com/company/synovus.

1 Include Global One acquisition effective October 1, 2016,

which added $357 million in loans.

2 Consist of net interest income and non-interest income

excluding net investment securities gains.

3 Consist of non-interest bearing, NOW/Savings, and money market

deposits excluding SCMs.

4 Include service charges on deposit accounts, bankcard fees,

letter of credit fees, ATM fee income, line of credit non-usage

fees, gains from sales of government guaranteed loans, and

miscellaneous other service charges.

Forward-Looking Statements

This press release and certain of our other filings with the

Securities and Exchange Commission contain statements that

constitute “forward-looking statements” within the meaning of, and

subject to the protections of, Section 27A of the Securities

Act of 1933, as amended, and Section 21E of the Securities

Exchange Act of 1934, as amended. All statements other than

statements of historical fact are forward-looking statements. You

can identify these forward-looking statements through Synovus’ use

of words such as “believes,” “anticipates,” “expects,” “may,”

“will,” “assumes,” “should,” “predicts,” “could,” “would,”

“intends,” “targets,” “estimates,” “projects,” “plans,” “potential”

and other similar words and expressions of the future or otherwise

regarding the outlook for Synovus’ future business and financial

performance and/or the performance of the banking industry and

economy in general. These forward-looking statements include, among

others, our expectations regarding deposits, loan growth and the

net interest margin; expectations on our growth strategy, expense

initiatives, capital management and future profitability;

expectations on credit trends and key credit metrics; and the

assumptions underlying our expectations. Prospective investors are

cautioned that any such forward-looking statements are not

guarantees of future performance and involve known and unknown

risks and uncertainties which may cause the actual results,

performance or achievements of Synovus to be materially different

from the future results, performance or achievements expressed or

implied by such forward-looking statements. Forward-looking

statements are based on the information known to, and current

beliefs and expectations of, Synovus’ management and are subject to

significant risks and uncertainties. Actual results may differ

materially from those contemplated by such forward-looking

statements. A number of factors could cause actual results to

differ materially from those contemplated by the forward-looking

statements in this press release. Many of these factors are beyond

Synovus’ ability to control or predict.

These forward-looking statements are based upon information

presently known to Synovus’ management and are inherently

subjective, uncertain and subject to change due to any number of

risks and uncertainties, including, without limitation, the risks

and other factors set forth in Synovus’ filings with the Securities

and Exchange Commission, including its Annual Report on Form 10-K

for the year ended December 31, 2015 under the captions “Cautionary

Notice Regarding Forward-Looking Statements” and “Risk Factors” and

in Synovus’ quarterly reports on Form 10-Q and current reports on

Form 8-K. We believe these forward-looking statements are

reasonable; however, undue reliance should not be placed on any

forward-looking statements, which are based on current expectations

and speak only as of the date that they are made. We do not assume

any obligation to update any forward-looking statements as a result

of new information, future developments or otherwise, except as

otherwise may be required by law.

Use of Non-GAAP Financial Measures

The measures entitled adjusted diluted earnings per share;

average core transaction deposit accounts; adjusted non-interest

income; adjusted non-interest expense; adjusted efficiency ratio;

tangible common equity ratio; and common equity Tier 1 (CET1) ratio

(fully phased-in) are not measures recognized under U.S. generally

accepted accounting principles (GAAP) and therefore are considered

non-GAAP financial measures. The most comparable GAAP measures are

diluted earnings per share; total average deposits; total

non-interest income; total non-interest expense; efficiency ratio

and total shareholders’ equity to total assets ratio,

respectively.

Synovus believes that these non-GAAP financial measures provide

meaningful additional information about Synovus to assist

management, investors, and bank regulators in evaluating Synovus’

capital strength and the performance of its core business. Adjusted

diluted earnings per share is a measure used by management to

evaluate operating results exclusive of items that are not

indicative of ongoing operations and impact period-to- period

comparisons. Average core transaction deposit accounts are a

measure used by management to evaluate organic growth of deposits

and the quality of deposits as a funding source. Adjusted

non-interest income is a measure utilized by management to measure

non-interest income exclusive of net investment securities gains.

Adjusted non-interest expense and the adjusted efficiency ratio are

measures utilized by management to measure the success of expense

management initiatives focused on reducing recurring controllable

operating costs. The tangible common equity ratio and common equity

Tier 1 (CET1) ratio (fully phased-in) are used by management and

bank regulators to assess the strength of our capital position.

These non-GAAP financial measures should not be considered as

substitutes for diluted earnings per share; total average deposits;

total non-interest income; total non-interest expense; efficiency

ratio; and total shareholders’ equity to total assets ratio

determined in accordance with GAAP and may not be comparable to

other similarly titled measures at other companies.

The computations of adjusted diluted earnings per share; average

core transaction deposit accounts; adjusted non-interest income;

adjusted non-interest expense; adjusted efficiency ratio; tangible

common equity ratio; and common equity Tier 1 (CET1) ratio (fully

phased-in) and the reconciliation of these measures to diluted

earnings per share; total average deposits; total non-interest

income; total non-interest expense; efficiency ratio; and total

shareholders’ equity to total assets ratio are set forth in the

tables below.

Reconciliation of Non-GAAP Financial Measures

(dollars in thousands) 4Q16 3Q16

4Q15

Adjusted

Diluted Earnings per Share Net income available to common

shareholders $ 65,990 62,686 55,839 Add: Litigation

contingency/settlement (recovery) expense* - (189 ) 710 Add:

Restructuring charges 42 1,243 69 Add: Merger-related expenses

1,086 550 - Add: Fair value adjustment to Visa derivative 4,716 360

371 Add: Loss on early extinguishment of debt - - 1,533 Subtract:

Investment securities gains, net (5,885 ) (59 ) (58 ) Tax effect of

adjustments

15 (697

) (961 ) Adjusted net income

available to common shareholders

$ 65,964

63,894 57,503

Weighted average common shares outstanding, diluted 123,187 123,604

131,197 Adjusted diluted earnings per share

$

0.54 0.52 0.44

Average Core Transaction Deposit Accounts

Total average deposits $ 24,661,265 24,030,330 23,244,256 Subtract:

Average brokered deposits (1,380,931 ) (1,409,740 ) (1,185,093 )

Subtract: Average time deposits excluding average SCM time deposits

(3,147,620 ) (3,153,366 ) (3,188,706 ) Subtract: Average state,

county, and municipal (SCM) deposits

(2,356,567

) (2,105,126 )

(2,303,278 ) Average core transaction

deposit accounts

$ 17,776,147

17,362,098 16,567,179

Adjusted Non-interest Income Total non-interest

income $ 74,006 68,155 66,175 Subtract: Investment securities

gains, net

(5,885 )

(59 ) (58 )

Adjusted non-interest income

$

68,121

68,096 66,117

Reconciliation of Non-GAAP Financial Measures,

continued (dollars in thousands)

4Q16

3Q16

4Q15

2016

2015

Adjusted Non-interest Expense Total non-interest

expense $ 193,209 185,871 183,033 755,925 717,655 Subtract:

Restructuring charges (42 ) (1,243 ) (69 ) (8,267 ) (36 ) Subtract:

Fair value adjustment to Visa derivative (4,716 ) (360 ) (371 )

(5,795 ) (1,463 )

Subtract: Litigation

contingency/settlement recovery (expense)*

- 189 (710 ) (2,511 ) (5,110 ) Subtract: Loss on early

extinguishment of debt - - - (4,735 ) (1,533 ) Subtract:

Merger-related expenses (1,086 ) (550 ) (1,533 ) (1,636 ) -

Subtract: Amortization of intangibles

(400

) - (123

) (521 ) (503

) Adjusted non-interest expense

$

186,965 183,907

180,227 732,460

709,010 Adjusted Efficiency Ratio

Adjusted non-interest expense $ 186,965 183,907 180,227 732,460

709,010

Subtract: Foreclosed real estate expense (2,840 ) (2,725 ) (4,454 )

(12,838 ) (22,804

)

Subtract: Other credit costs

(1,969

) (2,913 )

(2,410 ) (6,701

) (8,853 ) Adjusted non-interest expense

excluding total credit costs

$ 182,156

178,269 173,363

712,921 677,353 Net

interest income 233,530 226,007 212,620 899,180 827,318 Add: Tax

equivalent adjustment 322 330 311 1,286 1,304 Add: Total

non-interest income 74,006 68,155 66,175 273,194 267,920 Subtract:

Investment securities gains, net

(5,885

) (59 ) (58

) (6,011 )

(2,769 ) Total revenues

$

301,973 294,433

279,048 1,167,649

1,093,773 Adjusted efficiency ratio

60.32 % 60.55

62.13 61.06

61.93

Reconciliation of Non-GAAP Financial Measures, continued

(dollars in thousands) 4Q16 3Q16 4Q15

Tangible common

equity ratio Total assets $ 30,104,002 29,727,096 28,792,653

Subtract: Goodwill (59,678 ) (24,431 ) (24,431 ) Subtract: Other

intangible assets, net

(13,223 )

(225 ) (471 )

Tangible assets

$ 30,031,101

29,702,440 28,767,751

Total shareholders’ equity $ 2,927,924 2,906,659 3,000,196

Subtract: Goodwill (59,678 ) (24,431 ) (24,431 ) Subtract: Other

intangible assets, net (13,223 ) (225 ) (471 ) Subtract: Series C

Preferred Stock, no par value

(125,980

) (125,980 )

(125,980 ) Tangible common equity

$ 2,729,043 2,756,023

2,849,314 Total shareholders’ equity to

total assets ratio 9.73 % 9.78 10.42 Tangible common equity ratio

9.09 % 9.28 9.90

Common Equity Tier 1 (CET1) ratio (fully

phased-in) Common Equity Tier 1 (CET1) $ 2,654,286 2,596,233

2,660,016 Adjustment related to capital components

(94,386 ) (101,843

) (128,480 ) CET1 (fully

phased-in)

$ 2,559,900

2,494,390 2,531,536 Total

risk-weighted assets (fully phased-in) $ 26,900,331 26,323,936

25,915,650 Common Equity Tier 1 (CET1) ratio (fully phased-in) 9.52

% 9.48 9.77

* Amounts for other periods presented

herein are not reported separately as amounts are not material.

Synovus INCOME STATEMENT DATA

Twelve Months Ended

(Unaudited)

(Dollars in thousands, except per share data)

December 31,

2016 2015

Change Interest income

$

1,022,803 945,962 8.1 % Interest expense

123,623

118,644 4.2 Net interest income

899,180

827,318 8.7 Provision for loan losses

28,000 19,010 47.3

Net interest income after provision for loan losses

871,180 808,308 7.8 Non-interest income:

Service charges on deposit accounts

81,425 80,142 1.6

Fiduciary and asset management fees

46,594 45,928 1.5

Brokerage revenue

27,028 27,855 (3.0 ) Mortgage banking

income

24,259 24,096 0.7 Bankcard fees

33,318 33,172

0.4 Investment securities gains, net

6,011 2,769 117.1 Other

fee income

20,220 21,170 (4.5 ) Other non-interest income

34,339 32,788 4.7 Total non-interest income

273,194 267,920 2.0 Non-interest

expense: Salaries and other personnel expense

402,026

380,918 5.5 Net occupancy and equipment expense

109,347

107,466 1.8 Third-party processing expense

46,320 42,851 8.1

FDIC insurance and other regulatory fees

26,714 27,091 (1.4

) Professional fees

26,698 26,646 0.2 Advertising expense

20,264 15,477 30.9 Foreclosed real estate expense, net

12,838 22,803 (43.7 ) Merger-related expense

1,636 -

nm Amortization of intangibles

521 503 3.6 Fair value

adjustment to Visa derivative

5,795 1,464 295.8 Loss on

early extinguishment of debt

4,735 1,533 208.9 Litigation

settlement/contingency expense

2,511 5,110 (50.9 )

Restructuring charges, net

8,267 36 nm Other operating

expenses

88,251 85,757 2.9 Total non-interest

expense

755,923 717,655 5.3 Income

before income taxes

388,451 358,573 8.3 Income tax expense

141,667 132,491 6.9 Net income

246,784

226,082 9.2 Dividends on preferred stock

10,238

10,238 - Net income available to common

shareholders

$ 236,546 215,844 9.6 %

Net income per common share, basic

$ 1.90 1.63

16.7 % Net income per common share, diluted

1.89 1.62

16.7 Cash dividends declared per common share

0.48

0.42 14.3 Return on average assets

0.84 % 0.80 4 bp

Return on average common equity

8.41 7.46 95

Weighted average common shares outstanding, basic

124,389

132,423 (6.1 ) % Weighted average common shares outstanding,

diluted

125,078 133,201 (6.1 ) nm - not meaningful

bps - basis points

Synovus INCOME

STATEMENT DATA (Unaudited) (In thousands, except per

share data) 2016 2015

4th Quarter

Fourth Third

Second First Fourth

'16 vs. '15

Quarter Quarter

Quarter Quarter Quarter

Change Interest income

$

264,534 256,554 252,393 249,323 242,814 8.9 % Interest

expense

31,004 30,547 30,944 31,130 30,194 2.7

Net interest income

233,530 226,007 221,449

218,193 212,620 9.8 Provision for loan losses

6,259 5,671

6,693 9,377 5,021 24.7 Net interest

income after provision for loan losses

227,271 220,336

214,756 208,816 207,599 9.5

Non-interest income: Service charges on deposit accounts

20,653 20,822 20,240 19,710 20,522 0.6 Fiduciary and asset

management fees

11,903 11,837 11,580 11,274 11,206 6.2

Brokerage revenue

7,009 6,199 7,338 6,483 6,877 1.9 Mortgage

banking income

5,504 7,329 5,941 5,484 4,136 33.1 Bankcard

fees

8,330 8,269 8,346 8,372 8,262 0.8 Investment securities

gains, net

5,885 59 - 67 58 nm Other fee income

4,965

5,171 5,280 4,804 5,798 (14.4 ) Other non-interest income

9,757 8,469 9,161 6,953 9,316 4.7

Total non-interest income

74,006 68,155 67,886

63,147 66,175 11.8 Non-interest

expense: Salaries and other personnel expense

101,662

101,945 97,061 101,358 95,524 6.4 Net occupancy and equipment

expense

27,867 28,120 26,783 26,577 27,816 0.2 Third-party

processing expense

12,287 11,219 11,698 11,116 10,993 11.8

FDIC insurance and other regulatory fees

6,614 6,756 6,625

6,719 6,776 (2.4 ) Professional fees

6,904 6,486 6,938 6,369

8,265 (16.5 ) Advertising expense

4,905 5,597 7,351 2,410

3,680 33.3 Foreclosed real estate expense, net

2,840 2,725

4,588 2,684 4,454 (36.2 ) Merger-related expense

1,086 550 -

- - nm Amortization of intangibles

400 - - 121 123 nm Fair

value adjustment to Visa derivative

4,716 360 360 360 371 nm

Loss on early extinguishment of debt

- - - 4,735 1,533 -

Litigation contingency/settlement (recovery) expense

- (189

) - 2,700 710 (100.0 ) Restructuring charges, net

42 1,243

5,841 1,140 69 (39.1 ) Other operating expenses

23,886

21,059 21,366 21,944 22,720 5.1 Total

non-interest expense

193,209 185,871 188,611 188,233

183,034 5.6 Income before income taxes

108,068 102,620 94,031 83,730 90,741 19.1 Income tax expense

39,519 37,375 33,574 31,199 32,343 22.2

Net income

68,549 65,245 60,457 52,531 58,398 17.4

Dividends on preferred stock

2,559 2,559 2,559

2,559 2,559 - Net income available to common

shareholders

$ 65,990 62,686 57,898 49,972

55,839 18.2 % Net income per common share, basic

$ 0.54 0.51 0.46 0.39 0.43 25.9 % Net income

per common share, diluted

0.54 0.51 0.46 0.39 0.43 25.9

Cash dividends declared per common share

0.12 0.12

0.12 0.12 0.12 0.0 Return on average assets *

0.90 %

0.88 0.83 0.73 0.81 9 bps Return on average common equity *

9.42 8.89 8.26 7.06 7.67 175 Weighted average common

shares outstanding, basic

122,341 122,924 125,100 127,227

130,354 (6.1 ) % Weighted average common shares outstanding,

diluted

123,187 123,604 125,699 127,857 131,197 (6.1 )

nm - not meaningful bps - basis points * - ratios are

annualized

Synovus BALANCE SHEET DATA

December 31, 2016 September 30, 2016 December 31, 2015

(Unaudited) (In thousands, except share data)

ASSETS

Cash and cash equivalents

$ 395,175 367,342 367,092 Interest bearing funds with

Federal Reserve Bank

527,090 985,776 829,887 Interest

earning deposits with banks

18,720 18,375 17,387

Federal funds sold and securities

purchased under resale agreements

58,060

71,753 69,819 Trading account assets, at fair value

9,314

7,309 5,097 Mortgage loans held for sale, at fair value

51,545 95,769 59,275 Investment securities available for

sale, at fair value

3,718,195 3,603,153 3,587,818

Loans, net of deferred fees and costs

23,856,391 23,262,887

22,429,565 Allowance for loan losses

(251,758 )

(253,817 ) (252,496 ) Loans, net

23,604,633

23,009,070 22,177,069 Premises and equipment,

net

417,485 418,091 445,155 Goodwill

59,678 24,431

24,431 Intangible assets, net

13,223 225 471 Other real

estate

22,308 28,438 47,030 Deferred tax asset, net

395,356 395,795 511,948 Other assets

813,220

701,569 650,174 Total assets

$

30,104,002 29,727,096 28,792,653

LIABILITIES AND SHAREHOLDERS' EQUITY Liabilities: Deposits:

Non-interest bearing deposits

$ 7,085,804 7,059,059

6,732,970 Interest bearing deposits, excluding brokered deposits

16,183,273 15,817,596 15,434,171 Brokered deposits

1,378,983 1,315,348 1,075,520

Total deposits

24,648,060 24,192,003 23,242,661

Federal funds purchased and securities sold under repurchase

agreements

159,699 195,025 177,025 Long-term debt

2,160,881 2,160,985 2,186,893 Other liabilities

207,438 272,424 185,878 Total

liabilities

27,176,078 26,820,437 25,792,457

Shareholders' equity: Series C

Preferred Stock - no par value, 5,200,000 shares outstanding at

December 31, 2016, September 30, 2016, and December 31, 2015

125,980 125,980 125,980 Common stock - $1.00 par value.

122,266,106 shares outstanding at December 31, 2016, 121,453,772

shares outstanding at September 30, 2016, and 129,547,032 shares

outstanding at December 31, 2015

142,026 141,066 140,592

Additional paid-in capital

3,028,405 2,987,760 2,989,981

Treasury stock, at cost - 19,759,614 shares at December 31, 2016,

19,612,435 shares at September 30, 2016, and 11,045,377 shares at

December 31, 2015

(664,595 ) (654,014 ) (401,511 )

Accumulated other comprehensive (loss) gain

(55,659 )

5,165 (29,819 ) Retained earnings

351,767 300,702

174,973 Total shareholders' equity

2,927,924

2,906,659 3,000,196 Total liabilities

and shareholders' equity

$ 30,104,002

29,727,096 28,792,653

Synovus

AVERAGE BALANCES AND YIELDS/RATES (1)

(Unaudited) (Dollars in thousands)

2016 2015 Fourth

Third Second First Fourth

Quarter Quarter Quarter

Quarter Quarter Interest Earning Assets

Taxable investment securities (2)

$ 3,643,510

3,544,933 3,529,030 3,537,131 3,481,184 Yield

1.92 %

1.83 1.89 1.91 1.85 Tax-exempt investment securities (2) (4)

$ 2,824 2,943 3,491 4,091 4,352 Yield (taxable

equivalent)

5.82 % 5.96 6.08 6.37 6.16 Trading

account assets

$ 6,799 5,493 3,803 5,216 8,067 Yield

2.63 % 0.93 1.27 1.65 2.24 Commercial loans

(3) (4)

$ 18,812,659 18,419,484 18,433,638 18,253,169

17,884,661 Yield

4.05 % 4.03 4.04 4.03 3.97

Consumer loans (3)

$ 4,911,149 4,720,082 4,497,147

4,334,817 4,233,061 Yield

4.27 % 4.30 4.32 4.37 4.27

Allowance for loan losses

$ (253,713 )

(255,675 ) (251,101 )

(258,097 ) (252,049 ) Loans, net (3)

$ 23,470,095 22,883,891 22,679,684 22,329,889

21,865,673 Yield

4.14 % 4.14 4.15 4.15 4.08

Mortgage loans held for sale

$ 77,652 87,524 72,477

63,339 50,668 Yield

3.51 % 3.32 3.59 3.72 3.84

Federal funds sold, due from Federal

Reserve Bank, and other short-term investments

$

982,355

998,565 907,614 885,938 1,081,604 Yield

0.49 % 0.48

0.47 0.47 0.27 Federal Home Loan Bank and Federal Reserve

Bank stock (5)

$ 121,079 70,570 77,571 80,679 66,790

Yield

3.75 % 4.99 5.15 3.82 5.08

Total interest

earning assets

$ 28,304,314 27,593,919 27,273,670

26,906,283 26,558,338 Yield

3.73

% 3.71 3.73

3.73 3.63 Interest

Bearing Liabilities Interest bearing demand deposits

$ 4,488,135 4,274,117 4,233,310 4,198,738 4,117,116

Rate

0.16 % 0.16 0.18 0.17 0.17 Money market

accounts

$ 7,359,067 7,227,030 7,082,759 7,095,778

7,062,517 Rate

0.29 % 0.29 0.31 0.32 0.35

Savings deposits

$ 908,725 797,961 746,225 722,172

692,536 Rate

0.12 % 0.07 0.06 0.07 0.06 Time

deposits under $100,000

$ 1,229,809 1,248,294

1,262,280 1,279,811 1,307,601 Rate

0.64 % 0.64 0.64

0.65 0.65 Time deposits over $100,000

$

2,014,564 2,030,242 2,016,116 2,006,302 2,033,193 Rate

0.90 % 0.88 0.89 0.89 0.88 Non maturing

brokered deposits

$ 638,779 634,596 451,398 315,006

297,925 Rate

0.31 % 0.29 0.39 0.48 0.31

Brokered time deposits

$ 742,153 775,143 885,603

780,233 887,168 Rate

0.90 % 0.88

0.85 0.83

0.76 Total interest bearing deposits

$

17,381,232 16,987,383 16,677,691 16,398,040 16,398,056 Rate

0.37 % 0.37 0.39 0.39 0.40

Federal funds purchased and securities

sold under repurchase agreements

$ 219,429 247,378 221,276 177,921 158,810 Rate

0.08 % 0.09 0.09 0.10 0.08 Long-term debt

$ 2,190,716 2,114,193 2,279,043 2,361,973 2,007,924

Rate

2.65 % 2.71 2.55 2.55 2.63

Total interest

bearing liabilities

$ 19,791,377 19,348,954

19,178,010 18,937,934 18,564,790 Rate

0.62 % 0.63

0.65 0.66 0.65

Non-interest bearing demand deposits

$

7,280,033 7,042,908 6,930,336 6,812,223 6,846,200

Effective cost of funds

0.44 % 0.44 0.46 0.46 0.45

Net interest margin

3.29

% 3.27 3.27

3.27 3.18 Taxable

equivalent adjustment

$ 322 330 329 305 311

(1) Yields and rates are annualized. (2) Excludes net unrealized

gains and losses. (3) Average loans are shown net of unearned

income. Non-performing loans are included.

(4) Reflects taxable-equivalent

adjustments, using the statutory federal income tax rate of 35%, in

adjusting interest on tax-exempt loans and investment securities to

a taxable-equivalent basis.

(5) Included as a component of Other Assets on the consolidated

balance sheet

Synovus NON-PERFORMING

LOANS COMPOSITION (Unaudited) (Dollars in thousands)

Total Total

Total

Non-performing Non-performing 4Q16 vs. 3Q16

Non-performing 4Q16 vs. 4Q15 Loan Type

Loans Loans % change

(1) Loans % change

December 31, 2016 September 30,

2016 December 31, 2015 Multi-Family $

1,853 3,912 (209.4 ) % $ 223 nm Hotels

335 346 (12.6

) 381 (12.1 ) % Office Buildings

1,380 931 191.9 1,170 17.9

Shopping Centers

354 354 0.0 907 (61.0 ) Warehouses

592 1,108 (185.3 ) 208 184.6 Other Investment Property

922 2,233 (233.6 ) 20,151 (95.4 )

Total Investment Properties 5,436 8,884 (154.4

) 23,040 (76.4 ) 1-4 Family Construction

305

304 1.3 - nm 1-4 Family Investment Mortgage

8,809 7,658 59.8

7,708 14.3 Residential Development

8,994 9,190

(8.5 ) 9,130 (1.5 )

Total 1-4 Family

Properties 18,108 17,152 22.2 16,838 7.5

Land

Acquisition 7,071 6,672 23.8 17,768

(60.2 )

Total Commercial Real Estate

30,615 32,708 (25.5 ) 57,646 (46.9 )

Commercial, Financial, and Agricultural

59,074 49,874 73.4 49,137 20.2 Owner-Occupied

16,503

21,443 (91.7 ) 20,294 (18.7 )

Total

Commercial & Industrial 75,577 71,317

23.8 69,431 8.9 Home Equity Lines

21,551 19,815 34.9 16,480 30.8 Consumer Mortgages

22,681 21,284 26.1 22,248 1.9 Credit Cards

- - - - -

Other Retail Loans

2,954 3,031 (10.1 ) 2,565

15.2

Total Retail 47,186

44,130 27.5 41,293 14.3

Total $

153,378 148,155 14.0 % $

168,370 (8.9 ) % (1) Percentage change is annualized.

LOANS OUTSTANDING BY TYPE

COMPARISON (Unaudited) (Dollars in thousands)

Total

Loans Total Loans 4Q16 vs. 3Q16 Total Loans 4Q16 vs. 4Q15 Loan

Type

December 31, 2016 September 30, 2016 % change (1)

December 31, 2015 % change

Multi-Family $

1,568,234 1,553,275 3.8 % $

1,391,453 12.7 % Hotels

748,951 774,873 (13.3 ) 703,825 6.4

Office Buildings

1,568,328 1,575,190 (1.7 ) 1,495,247 4.9

Shopping Centers

964,325 917,284 20.4 956,394 0.8 Warehouses

486,300 522,170 (27.3 ) 563,217 (13.7 ) Other Investment

Property

596,481 626,674 (19.2 ) 641,495

(7.0 )

Total Investment Properties 5,932,619

5,969,466 (2.5 ) 5,751,631 3.1 1-4 Family Construction

190,477 193,791 (6.8 ) 187,545 1.6 1-4 Family Investment

Mortgage

696,830 727,897 (17.0 ) 786,797 (11.4 ) Residential

Development

136,514 149,366 (34.2 ) 154,814

(11.8 )

Total 1-4 Family Properties 1,023,821

1,071,054 (17.5 ) 1,129,156 (9.3 )

Land Acquisition

409,534 425,058 (14.5 ) 513,981 (20.3 )

Total Commercial Real Estate 7,365,974 7,465,578 (5.3

) 7,394,768 (0.4 ) Commercial, Financial, and Agricultural

6,915,927 6,544,629 22.6 6,453,180 7.2 Owner-Occupied

4,636,016 4,471,365 14.6 4,318,950

7.3

Total Commercial & Industrial

11,551,943 11,015,994 19.4 10,772,130 7.2 Home Equity

Lines

1,617,265 1,638,844 (5.2 ) 1,689,914 (4.3 ) Consumer

Mortgages

2,296,604 2,243,154 9.5 1,938,683 18.5 Credit

Cards

232,413 232,309 0.2 240,851 (3.5 ) Other Retail Loans

818,183 693,204 71.7 423,318

93.3

Total Retail 4,964,465 4,807,511 13.0

4,292,766 15.6

Unearned Income (25,991 )

(26,196 ) (3.1 ) (30,099 ) (13.6 )

Total $

23,856,391 23,262,887 10.1 % $

22,429,565 6.4 % (1) Percentage change

is annualized.

Synovus CREDIT

QUALITY DATA (Unaudited) (Dollars in thousands)

2016 2015

4th Quarter

Fourth Third

Second First Fourth '16 vs. '15

Quarter

Quarter Quarter Quarter Quarter Change Non-performing

Loans

$ 153,378 148,155 154,072 178,167 168,370 (8.9

) % Impaired Loans Held for Sale (1)

- 2,473 - - - - Other

Real Estate

22,308 28,438 33,289 38,462 47,030 (52.6 )

Non-performing Assets

175,686 179,066 187,361 216,629

215,400 (18.4 ) Allowance for loan losses

251,758

253,817 255,076 254,516 252,496 (0.3 ) Net Charge-Offs -

Quarter

8,319 6,930 6,133 7,357 3,425 142.9 Net Charge-Offs

- YTD

28,739 20,420 13,490 7,357 27,831 3.3 Net Charge-Offs

/ Average Loans - Quarter (2)

0.14 % 0.12 0.11 0.13

0.06 Net Charge-Offs / Average Loans - YTD (2)

0.12 0.12

0.12 0.13 0.13 Non-performing Loans / Loans

0.64 0.64

0.67 0.78 0.75 Non-performing Assets / Loans, Other Loans Held for

Sale & ORE

0.74 0.77 0.81 0.95 0.96 Allowance / Loans

1.06 1.09 1.11 1.12 1.13 Allowance / Non-performing

Loans

164.14 171.32 165.56 142.85 149.96 Allowance /

Non-performing Loans (3)

202.01 198.94 195.25 173.64 189.47

Past Due Loans over 90 days and Still Accruing $

3,135 5,358 5,964 3,214 2,621 19.6 As a Percentage of Loans

Outstanding

0.01 % 0.02 0.03 0.01 0.01 Total Past Due

Loans and Still Accruing $

65,106 61,781 55,716 63,852

47,912 35.9 As a Percentage of Loans Outstanding

0.27 % 0.27

0.24 0.28 0.21 Accruing Troubled Debt Restructurings (TDRs)

$

195,776 201,896 205,165 209,159 223,873 (12.6 ) (1)

Represent impaired loans that are intended to be sold. Held for

sale loans are carried at the lower of cost or fair value, less

costs to sell. (2) Ratio is annualized. (3) Excludes non-performing

loans for which the expected loss has been charged off.

SELECTED

CAPITAL INFORMATION (1) (Unaudited) (Dollars in

thousands)

December 31,2016

September 30,2016

December 31,2015

Tier 1 Capital

$ 2,685,880 2,620,379

2,660,016 Total Risk-Based Capital

3,201,268 3,139,465

3,255,758 Common Equity Tier 1 Ratio (transitional)

9.96

% 9.96 10.37 Common Equity Tier 1 Ratio (fully phased-in)

9.52 9.48 9.77 Tier 1 Capital Ratio

10.08 10.05 10.37

Total Risk-Based Capital Ratio

12.01 12.04 12.70 Tier 1

Leverage Ratio

8.99 8.98 9.43 Common Equity as a Percentage

of Total Assets (2)

9.31 9.35 9.98 Tangible Common Equity as

a Percentage of Tangible Assets (3)

9.09 9.28 9.90 Tangible

Common Equity as a Percentage of Risk Weighted Assets (3)

10.24 10.58 11.11 Book Value Per Common Share (4)

22.92 22.89 22.19 Tangible Book Value Per Common Share (3)

22.32 22.69 21.99 (1) Current quarter

regulatory capital information is preliminary. (2) Common equity

consists of Total Shareholders' Equity less Preferred Stock. (3)

Excludes the carrying value of goodwill and other intangible assets

from common equity and total assets

(4) Book Value Per Common Share consists

of Total Shareholders' Equity less Preferred Stock divided by total

common shares outstanding. impact of unexercised tangible equity

units (tMEDs).

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170117005616/en/

Synovus Financial Corp.Investor

ContactBob May, 706-649-3555Investor

RelationsorMedia ContactLee

Underwood, 706-644-0528Media Relations

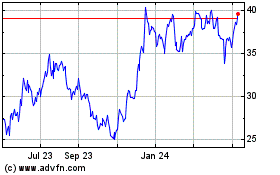

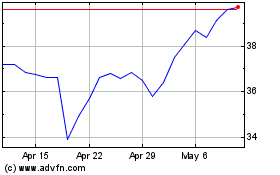

Synovus Financial (NYSE:SNV)

Historical Stock Chart

From Mar 2024 to Apr 2024

Synovus Financial (NYSE:SNV)

Historical Stock Chart

From Apr 2023 to Apr 2024