FuelCell Energy (Nasdaq:FCEL), a global leader in the design,

manufacture, operation and project development of ultra-clean,

efficient and reliable fuel cell power plants, today reported

financial results for its fourth quarter ended October 31, 2016 and

key business highlights.

Financial Results FuelCell Energy (the Company)

reported total revenues for the fourth quarter of 2016 of $24.5

million, compared to $51.5 million for the comparable prior year

period. Revenue components include:

- Product sales totaled $8.4 million for the current period

compared to $43.8 million for the fourth quarter of 2015.

During the fourth quarter of 2016, the Company retained two fuel

cell projects totaling 7 megawatts that will generate long term

recurring electricity sales rather than quarterly product

revenue. This transition to retaining select projects rather

than selling the projects at commissioning contributed to the

decrease in sales, combined with lower Asian sales in the current

quarter as Korean partner, POSCO Energy, is manufacturing locally

under license and royalty agreements.

- Service agreements and license revenues totaled $11.4 million

for the current period compared to $5.5 million for the comparable

prior year period, with the increase due to a number of service

agreements that commenced in 2016, a greater number of module

replacements under service contracts, and electricity sales from

power purchase agreements.

- Advanced Technologies contract revenues totaled $4.7 million

for the current period compared to $2.1 million for the comparable

prior year period.

A gross loss of ($0.5) million was incurred in the fourth

quarter of 2016, compared to gross profit of $3.1 million and gross

margin of 6.1 percent for the fourth quarter of 2015. The

decrease in gross profit was due to lower product sales and charges

in the service business, including charges for obsolete

sub-megawatt inventory. This decrease was partially offset by

improved Advanced Technology gross margin due to the mix of

contracts transitioning to private industry.

Operating expenses for the current period totaled $11.3 million

compared to $11.0 million for the prior year period.

Net loss attributable to common shareholders for the fourth

quarter of 2016 totaled $13.7 million, or $0.41 per basic and

diluted share, compared to $9.7 million or $0.38 per basic and

diluted share for the fourth quarter of 2015.

Adjusted earnings before interest, taxes, depreciation and

amortization (EBITDA) in the fourth quarter of 2016 totaled ($10.4)

million. Refer to the discussion of Non-GAAP financial measures

below regarding the Company’s calculation of Adjusted EBITDA.

Capital spending was $3.8 million and depreciation expense was $1.4

million.

On December 1, 2016 and subsequent to 2016 fiscal year end, the

Company announced a restructuring to align production levels with

the product sales and services backlog. A work force

reduction was undertaken with 96 positions or approximately 17

percent of the global workforce impacted. A personnel-related

restructuring charge of approximately $3 million will be incurred

in fiscal 2017, with approximately one half of the charge composed

of cash severance costs. The Company expects that operating

expenses (administrative and selling, research and development

expenses) will be approximately $6 million lower on an annualized

basis as a result of personnel reductions and related benefits, as

well as lower overhead spending.

Revenue BacklogTotal backlog was $432.3 million

as of October 31, 2016 compared to $381.4 million as of October 31,

2015.

- Services backlog totaled $347.3 million as of October 31, 2016

compared to $254.1 million as of October 31, 2015. Services

backlog includes future contracted revenue from routine

maintenance, scheduled module exchanges, and from power purchase

agreements.

- Product sales backlog totaled $24.9 million as of October 31,

2016 compared to $90.8 million as of October 31, 2015.

Product sales backlog reflects firm orders with executed

contracts for the sale of product.

- Advanced Technologies contracts backlog totaled $60.1 million

as of October 31, 2016 compared to $36.5 million as of October 31,

2015.

Cash, restricted cash and financing

availabilityCash, cash equivalents, restricted cash and

financing availability totaled $156.5 million as of October 31,

2016, including:

- $84.2 million of cash and cash equivalents, and $34.1 million

of restricted cash

- $38.2 million of borrowing availability under the NRG Energy

revolving project financing facility

On October 31, 2016, the Company entered into a financing

transaction with PNC Energy Capital (PNC) for a 5.6 megawatt fuel

cell installation that recently began commercial operations at a

Pfizer campus. A portion of proceeds were used to repay

construction borrowing from the debt facility extended by NRG

Energy, leading to a net increase of cash to the Company of $19.3

million.

Project Assets Long term project assets

consists of projects developed by the Company that are structured

with power purchase agreements (PPA), which generate recurring

monthly electricity sales, and projects the Company is developing

and expects to retain and operate. Long term project assets

totaled $47.1 million at October 31, 2016, consisting of four

projects totaling 9.8 megawatts, compared to $6.9 million at

October 31, 2015 that included one project.

Subsequent to fiscal year end, the Company acquired a 1.4

megawatt fuel cell project at a university, increasing the total

retained projects to five totaling 11.2 megawatts. In addition,

project assets include two power plant projects under construction

totaling 6.5 megawatts that the Company currently plans to

retain. In total, 7 projects are operating or under

construction at present, for a total of 17.7 megawatts.

Business Highlights

- Continuing development of multiple Connecticut fuel cell

parks

- Actively pursuing multi-megawatt fuel cell projects in New York

State including 40 megawatt fuel cell only RFP for Long

Island

- Installing 2.8 megawatt power plant with a repeat customer in

California

- Construction in process for 3.7 megawatt project to showcase an

enhanced efficiency fuel cell configuration

- Progressing fuel cell carbon capture with a site announcement

for a megawatt-class fuel cell plant to demonstrate both coal and

gas-fired carbon capture at a power station owned by a subsidiary

of Southern Company with support by ExxonMobil and the Department

of Energy

- Canadian oil sands engineering study progressing for carbon

capture at gas-fired bitumen processing plant

- Commissioning of 20 megawatt Asian fuel cell park completed by

partner, POSCO Energy

- Construction completed and commercial operations commenced for

2 installations, both of which were financed by PNC Energy Capital

under an existing financing facility. The Company retains the Power

Purchase Agreement and recognizes recurring electricity revenue and

margin over the term of the power purchase agreement.

“We are focused on developing and closing projects as we take

near-term actions to reduce spending and our cost structure,” said

Chip Bottone, President and Chief Executive Officer, FuelCell

Energy, Inc.

Cautionary Language This news release

contains forward-looking statements within the meaning of the safe

harbor provisions of the Private Securities Litigation Reform Act

of 1995, including, without limitation, statements with respect to

the Company’s anticipated financial results and statements

regarding the Company’s plans and expectations regarding the

continuing development, commercialization and financing of its fuel

cell technology and business plans. All forward-looking statements

are subject to risks and uncertainties that could cause actual

results to differ materially from those projected. Factors that

could cause such a difference include, without limitation, changes

to projected deliveries and order flow, changes to production rate

and product costs, general risks associated with product

development, manufacturing, changes in the regulatory environment,

customer strategies, unanticipated manufacturing issues that impact

power plant performance, changes in critical accounting policies,

potential volatility of energy prices, rapid technological change,

competition, and the Company’s ability to achieve its sales plans

and cost reduction targets, as well as other risks set forth in the

Company’s filings with the Securities and Exchange Commission. The

forward-looking statements contained herein speak only as of the

date of this press release. The Company expressly disclaims any

obligation or undertaking to release publicly any updates or

revisions to any such statement to reflect any change in the

Company’s expectations or any change in events, conditions or

circumstances on which any such statement is based.

Non-GAAP Financial MeasuresFinancial Results

are presented in accordance with accounting principles generally

accepted in the United States (“GAAP”). Management also uses

non-GAAP measures to analyze the business.

Earnings before interest, taxes, depreciation and amortization

(EBITDA) is an alternate measure of cash utilization. The

table below calculates Adjusted EBITDA and reconciles these figures

to the GAAP financial statement measure Net loss attributable to

FuelCell Energy, Inc.

| |

Three Months Ended October 31, |

| (Amounts in

thousands) |

2016 |

|

|

2015 |

|

Net loss attributable to FuelCell Energy, Inc. |

$ |

(12,862 |

) |

|

|

$ |

(8,860 |

) |

|

Depreciation |

1,366 |

|

|

|

1,101 |

|

|

Provision for income taxes |

117 |

|

|

|

95 |

|

|

Other (income)/expense, net (1) |

(732 |

) |

|

|

179 |

|

|

Interest expense |

1,758 |

|

|

|

765 |

|

|

Adjusted EBITDA |

$ |

(10,353 |

) |

|

|

$ |

(6,720 |

) |

| |

|

|

|

|

|

(1) Other income (expense), net includes gains and losses

from transactions denominated in foreign currencies, changes in

fair value of embedded derivatives, and other items incurred

periodically, which are not the result of the Company’s normal

business operations.

Adjusted EBITDA is a non-GAAP measure of financial performance

and should not be considered as an alternative to net income or any

other performance measure derived in accordance with GAAP, or as an

alternative to cash flows from operating activities. This

information is included to assist investors with understanding the

results of operations on a comparative basis.

About FuelCell EnergyDirect FuelCell® power

plants are generating ultra-clean, efficient and reliable power on

three continents, affordably providing continuous distributed power

generation to a variety of industries including utilities,

commercial and municipal customers. The Company’s power

plants have generated billions of kilowatt hours of ultra-clean

power using a wide variety of fuels including renewable biogas from

wastewater treatment and food processing, as well as clean natural

gas. For additional information, please visit

www.fuelcellenergy.com and follow us on Twitter.

Direct FuelCell, DFC, DFC/T, DFC-H2, DFC-ERG and FuelCell Energy

logo are all registered trademarks of FuelCell Energy, Inc.

Conference Call InformationFuelCell Energy

management will host a conference call with investors beginning at

10:00 a.m. Eastern Time on Thursday, January 12, 2017 to discuss

the fourth quarter 2016 results. An accompanying slide

presentation for the earnings call will be available at

http://fcel.client.shareholder.com/events.cfm immediately

prior to the

call.

Participants can access the live call via webcast on the Company

website or by telephone as follows:

- The live webcast of this call will be available at

www.fuelcellenergy.com. To listen to the call, select

‘Investors’ on the home page, then click on ‘Events &

presentations’ and then click on ‘Listen to webcast’

- Alternatively, participants can dial 678-809-1045

The replay of the conference call will be available via webcast

on the Company’s Investors’ page at www.fuelcellenergy.com

approximately two hours after the conclusion of the call.

|

Contact: |

FuelCell

Energy, Inc. |

| |

Kurt

Goddard, Vice President Investor Relations |

| |

203-830-7494 |

| |

ir@fce.com |

| |

|

| FUELCELL ENERGY, INC. |

| Consolidated Balance Sheets |

| (Amounts in thousands, except share and per

share amounts) |

| |

|

|

|

October 31,

2016Unaudited |

|

|

October 31,2015 |

|

ASSETS |

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

84,187 |

|

|

$ |

58,852 |

|

|

Restricted cash and cash equivalents – short-term |

|

9,437 |

|

|

|

6,288 |

|

|

Accounts receivable, net |

|

24,593 |

|

|

|

60,790 |

|

|

Inventories |

|

73,806 |

|

|

|

65,754 |

|

|

Project assets |

|

- |

|

|

|

5,260 |

|

|

Other current assets |

|

10,446 |

|

|

|

6,954 |

|

|

Total current assets |

|

202,469 |

|

|

|

203,898 |

|

| |

|

|

|

|

|

| Restricted cash and

cash equivalents – long-term |

|

24,692 |

|

|

|

20,600 |

|

| Long-term project

assets |

|

47,111 |

|

|

|

6,922 |

|

| Property, plant and

equipment, net |

|

36,640 |

|

|

|

29,002 |

|

| Goodwill |

|

4,075 |

|

|

|

4,075 |

|

| Intangible assets |

|

9,592 |

|

|

|

9,592 |

|

| Other assets, net |

|

17,558 |

|

|

|

3,142 |

|

|

Total assets |

$ |

342,137 |

|

|

$ |

277,231 |

|

| |

|

|

|

|

|

|

LIABILITIES AND EQUITY |

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

|

Current portion of long-term debt |

$ |

5,275 |

|

|

$ |

7,358 |

|

|

Accounts payable |

|

18,475 |

|

|

|

15,745 |

|

|

Accrued liabilities |

|

20,900 |

|

|

|

19,175 |

|

|

Deferred revenue |

|

6,811 |

|

|

|

31,787 |

|

|

Preferred stock obligation of subsidiary |

|

802 |

|

|

|

823 |

|

|

Total current liabilities |

|

52,263 |

|

|

|

74,888 |

|

| |

|

|

|

|

|

| Long-term deferred

revenue |

|

20,974 |

|

|

|

22,646 |

|

| Long-term preferred

stock obligation of subsidiary |

|

12,649 |

|

|

|

12,088 |

|

| Long-term debt and

other liabilities |

|

81,998 |

|

|

|

12,998 |

|

|

Total liabilities |

|

167,884 |

|

|

|

122,620 |

|

| Redeemable preferred

stock (liquidation preference of $64,020 at October 31, 2016 and

2015) |

|

59,857 |

|

|

|

59,857 |

|

| Total Equity: |

|

|

|

|

|

|

Shareholders’ equity |

|

|

|

|

|

|

Common stock ($.0001 par value; 75,000,000 and 39,583,333 shares

authorized at October 31, 2016 and 2015, respectively; 35,174,424

and 25,964,710 shares issued and outstanding at October 31, 2016

and 2015, respectively) |

|

4 |

|

|

|

3 |

|

|

Additional paid-in capital |

|

1,004,566 |

|

|

|

934,488 |

|

|

Accumulated deficit |

|

(889,630 |

) |

|

|

(838,673 |

) |

|

Accumulated other comprehensive loss |

|

(544 |

) |

|

|

(509 |

) |

|

Treasury stock, Common, at cost (21,527 and 5,845 shares at October

31, 2016 and 2015, respectively) |

|

(179 |

) |

|

|

(78 |

) |

|

Deferred compensation |

|

179 |

|

|

|

78 |

|

|

Total shareholders’ equity |

|

114,396 |

|

|

|

95,309 |

|

|

Noncontrolling interest in subsidiaries |

|

- |

|

|

|

(555 |

) |

|

Total equity |

|

114,396 |

|

|

|

94,754 |

|

|

Total liabilities and equity |

$ |

342,137 |

|

|

$ |

277,231 |

|

| |

| FUELCELL ENERGY, INC. |

| Consolidated Statements of Operations |

| Unaudited |

| (Amounts in thousands, except share and per share

amounts) |

| |

| |

Three Months EndedOctober

31, |

| |

2016 |

|

2015 |

| Revenues: |

|

|

|

|

|

| Product

sales |

$ |

8,385 |

|

|

$ |

43,826 |

|

| Service

agreements and license revenues |

|

11,385 |

|

|

|

5,506 |

|

| Advanced

technologies contract revenues |

|

4,703 |

|

|

|

2,119 |

|

| Total

revenues |

|

24,473 |

|

|

|

51,451 |

|

| |

|

|

|

|

|

| Costs of revenues: |

|

|

|

|

|

| Cost of

product sales |

|

10,227 |

|

|

|

41,222 |

|

| Cost of

service agreements and license revenues |

|

11,133 |

|

|

|

4,581 |

|

| Cost of

advanced technologies contract revenues |

|

3,581 |

|

|

|

2,504 |

|

| Total

cost of revenues |

|

24,941 |

|

|

|

48,307 |

|

| |

|

|

|

|

|

| Gross (loss)

profit |

|

(468 |

) |

|

|

3,144 |

|

| |

|

|

|

|

|

| Operating

expenses: |

|

|

|

|

|

|

Administrative and selling expenses |

|

6,211 |

|

|

|

6,224 |

|

|

Research and development expenses |

|

5,126 |

|

|

|

4,786 |

|

|

Total operating expenses |

|

11,337 |

|

|

|

11,010 |

|

|

|

|

|

|

|

|

| Loss from

operations |

|

(11,805 |

) |

|

|

(7,866 |

) |

| |

|

|

|

|

|

| Interest

expense |

|

(1,758 |

) |

|

|

(765 |

) |

| Other

income (expense), net |

|

732 |

|

|

|

(179 |

) |

| |

|

|

|

|

|

| Loss before provision

for income taxes |

|

(12,831 |

) |

|

|

(8,810 |

) |

| |

|

|

|

|

|

|

Provision for income taxes |

|

(117 |

) |

|

|

(95 |

) |

| |

|

|

|

|

|

| Net loss |

|

(12,948 |

) |

|

|

(8,905 |

) |

| |

|

|

|

|

|

|

Net loss attributable to noncontrolling interest |

|

86 |

|

|

|

45 |

|

| |

|

|

|

|

|

| Net loss attributable

to FuelCell Energy, Inc. |

|

(12,862 |

) |

|

|

(8,860 |

) |

| |

|

|

|

|

|

| Preferred

stock dividends |

|

(800 |

) |

|

|

(800 |

) |

| |

|

|

|

|

|

| Net loss to common

shareholders |

$ |

(13,662 |

) |

|

$ |

(9,660 |

) |

| |

|

|

|

|

|

| Loss per share basic

and diluted |

|

|

|

|

|

|

Basic |

$ |

(0.41 |

) |

|

$ |

(0.38 |

) |

|

Diluted |

$ |

(0.41 |

) |

|

$ |

(0.38 |

) |

|

|

|

|

|

|

|

| Weighted average shares

outstanding |

|

|

|

|

|

|

Basic |

|

33,029,247 |

|

|

|

25,111,368 |

|

|

Diluted |

|

33,029,247 |

|

|

|

25,111,368 |

|

|

|

|

|

|

|

|

|

|

| FUELCELL ENERGY, INC. |

| Consolidated Statements of Operations |

| (Amounts in thousands, except share and per share

amounts) |

| |

| |

Year Ended October

31, |

| |

2016Unaudited |

|

2015 |

| Revenues: |

|

|

|

|

|

| Product

sales |

$ |

62,563 |

|

|

$ |

128,595 |

|

| Service

agreements and license revenues |

|

32,758 |

|

|

|

21,012 |

|

| Advanced

technologies contract revenues |

|

12,931 |

|

|

|

13,470 |

|

| Total

revenues |

|

108,252 |

|

|

|

163,077 |

|

| |

|

|

|

|

|

| Costs of revenues: |

|

|

|

|

|

| Cost of

product sales |

|

63,474 |

|

|

|

118,530 |

|

| Cost of

service agreements and license revenues |

|

33,256 |

|

|

|

18,301 |

|

| Cost of

advanced technologies contract revenues |

|

11,879 |

|

|

|

13,470 |

|

| Total

cost of revenues |

|

108,609 |

|

|

|

150,301 |

|

| |

|

|

|

|

|

| Gross (loss)

profit |

|

(357 |

) |

|

|

12,776 |

|

| |

|

|

|

|

|

| Operating

expenses: |

|

|

|

|

|

|

Administrative and selling expenses |

|

25,150 |

|

|

|

24,226 |

|

|

Research and development expenses |

|

20,846 |

|

|

|

17,442 |

|

|

Total operating expenses |

|

45,996 |

|

|

|

41,668 |

|

|

|

|

|

|

|

|

| Loss from

operations |

|

(46,353 |

) |

|

|

(28,892 |

) |

| |

|

|

|

|

|

| Interest

expense |

|

(4,958 |

) |

|

|

(2,960 |

) |

| Other

income (expense), net |

|

622 |

|

|

|

2,442 |

|

| |

|

|

|

|

|

| Loss before provision

for income taxes |

|

(50,689 |

) |

|

|

(29,410 |

) |

| |

|

|

|

|

|

|

Provision for income taxes |

|

(519 |

) |

|

|

(274 |

) |

| |

|

|

|

|

|

| Net loss |

|

(51,208 |

) |

|

|

(29,684 |

) |

| |

|

|

|

|

|

|

Net loss attributable to noncontrolling interest |

|

251 |

|

|

|

325 |

|

| |

|

|

|

|

|

| Net loss attributable

to FuelCell Energy, Inc. |

|

(50,957 |

) |

|

|

(29,359 |

) |

| |

|

|

|

|

|

| Preferred

stock dividends |

|

(3,200 |

) |

|

|

(3,200 |

) |

| |

|

|

|

|

|

| Net loss to common

shareholders |

$ |

(54,157 |

) |

|

$ |

(32,559 |

) |

| |

|

|

|

|

|

| Loss per share basic

and diluted |

|

|

|

|

|

|

Basic |

$ |

(1.82 |

) |

|

$ |

(1.33 |

) |

|

Diluted |

$ |

(1.82 |

) |

|

$ |

(1.33 |

) |

|

|

|

|

|

|

|

| Weighted average shares

outstanding |

|

|

|

|

|

|

Basic |

|

29,773,700 |

|

|

|

24,513,731 |

|

|

Diluted |

|

29,773,700 |

|

|

|

24,513,731 |

|

[Source: FuelCell Energy]

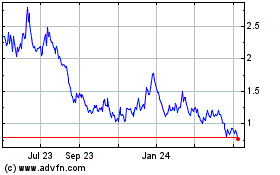

FuelCell Energy (NASDAQ:FCEL)

Historical Stock Chart

From Mar 2024 to Apr 2024

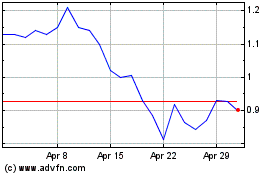

FuelCell Energy (NASDAQ:FCEL)

Historical Stock Chart

From Apr 2023 to Apr 2024