General Motors Says Earnings On Record Pace -- WSJ

January 11 2017 - 3:03AM

Dow Jones News

By Mike Colias

General Motors Co. said pretax earnings this year should beat

the record profit the auto maker expects to post for 2016, and its

board approved a $5 billion share repurchase based on the "strong

outlook."

GM said Tuesday the bright forecast is based on continued

strength in North America -- particularly strong sales of pickup

trucks, SUVs and crossover wagons -- as well as resilient demand in

China and cost cuts from better logistics and other moves.

The company forecasts 2017 pretax operating earnings, adjusted

for any special items, of $6 to $6.50 a share; that compares with

the $5.50 to $6 it expects to post in financial results due out

Feb. 7. The 2016 result should come in at the "high-end" of that

range," Chief Executive Mary Barra told reporters ahead of an

investor conference in Detroit.

The nation's largest auto maker is benefiting from strong U.S.

demand for pickup trucks and SUVs -- its biggest moneymakers --

stoked by low gasoline prices and interest rates. It has also

leveraged its strength in China, where a tax cut on some vehicles

last year helped increase GM's sales in its biggest market to a

record 3.9 million vehicles.

GM also said its results in South America -- hard hit by

recession and political instability -- should improve in 2017. But

executives expressed a cautious view in Europe due to the unfolding

impact of Brexit.

The company's stock repurchase pushes the total of its buyback

program, first announced in March 2015, to $14 billion. About $6

billion of that total has been completed.

GM shares were ahead 3.8% at $37.28 Tuesday afternoon after the

company issued its 2017 forecast.

Asked about uncertainty caused by President-elect Donald Trump's

recent threats of a tariff or border tax on imported vehicles, Ms.

Barra said it is too early to speculate on an eventual effect but

reiterated the complexity of GM's manufacturing footprint and the

long lead times of production decisions.

"We think there are many things we can do working with the

administration that are going to make America great again, that

will strengthen business, that will strengthen growth," she

said.

While Mr. Trump's policy intentions remain unclear, GM could be

more of a target for the president-elect than rival Ford Motor Co.

Ford made the equivalent of 95% of the vehicles it sold in the U.S.

at domestic plants, according to WardsAuto data for the first 11

months of 2016. That figure was 83% for GM and 69% for Fiat

Chrysler Automobiles NV.

Mr. Trump said in a Twitter message last week that GM should

face a "big border tax" for importing Chevrolet small cars from

Mexico. Ms. Barra has said GM doesn't plan to rejigger its

production plans.

Auto executives are on edge as Mr. Trump widens his criticism of

vehicle imports. Tweets going after GM and Toyota Motor Corp.

followed long-running criticism of Ford's plans to build a new

plant in Mexico. Ford scrapped that plan last week, though it

described the move as a business decision that it would have made

anyway.

GM said a fresher vehicle lineup globally will help its bottom

line in coming years, because newer cars typically command higher

purchase prices. The auto maker said 38% of its global sales volume

from 2017 to 2020 will be new or redesigned, versus 26% over the

last six years. The company said those vehicles will be more

heavily weighted toward trucks, which carry higher margins.

Stephen Wilmot contributed to this article.

(END) Dow Jones Newswires

January 11, 2017 02:48 ET (07:48 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

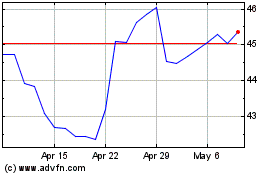

General Motors (NYSE:GM)

Historical Stock Chart

From Mar 2024 to Apr 2024

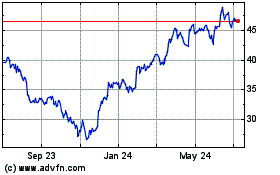

General Motors (NYSE:GM)

Historical Stock Chart

From Apr 2023 to Apr 2024