SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of December, 2016

Commission File Number: 001-12102

YPF Sociedad

Anónima

(Exact name of registrant as specified in its charter)

Macacha Güemes 515

C1106BKK Buenos Aires, Argentina

(Address of principal executive office)

Indicate by check mark whether

the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form

20-F ☒ Form 40-F ☐

Indicate by check mark if the

registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes ☐ No ☒

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ☐ No ☒

YPF Sociedád Anonima

TABLE OF CONTENTS

|

|

|

|

|

1

|

|

Translation of Vaca Muerta Field Trip December 2016 Presentation.

|

2

YPF

FOUR YEARS OF VACA MUERTA

The Value of our history and future vision.

Vaca Muerta Field Trip December 2016

Important Notice

Safe harbor statement under the

US Private Securities Litigation Reform Act of 1995.

This document contains statements that YPF believes

constitute forward-looking statements within the meaning of the US Private Securities Litigation Reform Act of 1995.

These forward-looking statements may include statements regarding the intent belief, plans, current expectations or objectives of YPF and its management, including statements with respect

to YPF’s future financial condition, financial, operating, reserve replacement and other ratios, results of operations, business strategy, geographic concentration, business concentration, production and marketed volumes and reserves, as well

as YPF’s plans, expectations or objectives with respect to future capital expenditures, investments, expansion and other projects, exploration activities, ownership interests, divestments, cost savings and dividend payout policies. These

forward-looking statements may also include assumptions regarding future economic and other conditions, such as future crude oil and other prices, refining and marketing margins and exchange rates. These statements are not guarantees of future

performance, prices, margins, exchange rates or other events and are subject to material risks, uncertainties, changes and other factors which may be beyond YPF’s control or may be difficult to predict.

YPF’s actual future financial condition, financial, operating, reserve replacement and other ratios, results of

operations, business strategy, geographic concentration, business concentration, production and marketed volumes, reserves, capital expenditures, investments, expansion and other projects, exploration activities, ownership interests, divestments,

cost savings and dividend payout policies, as well as actual future economic and other conditions, such as future crude oil and other prices, refining margins and exchange rates, could differ materially from those expressed or implied in any such

forward-looking statements. Important factors that could cause such differences include, but are not limited to, oil, gas and other price fluctuations, supply and demand levels, currency fluctuations, exploration, drilling and production results,

changes in reserves estimates, success in partnering with third parties, loss of market share, industry competition, environmental risks, physical risks, the risks of doing business in developing countries, legislative, tax, legal and regulatory

developments, economic and financial market conditions in various countries and regions, political risks, wars and acts of terrorism, natural disasters, project delays or advancements and lack of approvals, as well as those factors described in the

filings made by YPF and its affiliates with the Securities and Exchange Commission, in particular, those described in “Item 3. Key Information-Risk Factors” and “Item 5. Operating and Financial Review and Prospects” in YPF’s

Annual Report on Form

20-F

for the fiscal year ended December 31, 2015 filed with the US Securities and Exchange Commission. In light of the foregoing, the forward-looking statements included in this

document may not occur. Except as required by law, YPF does not undertake to publicly update or revise these forward-looking statements even if experience or future changes make it clear that the projected performance, conditions or events expressed

or implied therein will not be realized. These materials do not constitute an offer for sale of YPF S.A. bonds, shares or ADRs in the United States or otherwise.

|

|

|

|

YPF 2012 vision: Production decline and Portfolio

Oil Production

Gas Production

Portfolio

Tightgas

Opportunities

2012 Unconventional (Shale oill & Shale Gas)

YPF First four years of Vaca Muerta’s history: Exploration Phase

Exploratory Campaign in LC finished.

67

exploratory wells to VacaMuerta 920 MUSD

2012

2013

2014

2015

2016

YPF First four years of Vaca Muerta’s history: Partners

KEY PARTNERS

2012

2013

201

2015

2016

Chevron

Dow®

PETRONAS

YPF First four years of Vaca Muerta’s history: Partners

KEY PARTNERS

Loma

Campana.

CHEVRON

El Orejano.

DOW

La Amarga

Chica.

Petronas

2012

2013

2014

2015

2016

YPF First four years of Vaca Muerta’s history: Infrastructure

INFRASTRUCTURE

2012 2013 2014 2015 2016

NOC Office

Logistic Center

Water Network

EPFs

Proppant plant

Gas Pipeline RDM-LLL

Crontrol Rooms

Drilling Production

OilTreatment plant

YPF First four years of Vaca Muerta’s history: Infrastructure Noc Office

Infrastructure 2015

YPF First four years of Vaca Muerta’s history: Infrastructure Logistic Center

INFRASTRUCTURE 2015

YPF First four years of Vaca Muerta’s history: Infrastructure

Water Network

INFRASTRUCTURE 2015

VPF First four years of Vaca Muerta’s history: Infrastructure EPFs

INFRASTRUCTURE 2015

VPF First four years of Vaca Muerta’s history: Infrastructure

INFRASTRUCTURE 2015 Gas Pipeline RDM –LLL

YPF First four years of Vaca Muerta’s history: Infrastructure Control Room Production

INFRASTRUCTURE 2015

YPF First four years of Vaca Muerla’s history: Infrastructure

INFRASTRUCTURE 2015

Control Room Drilling

YPF First four years of Vaca Muerta’s history: Infrastructure

INFRASTRUCTURE 2015 Proppant Plant

|

|

|

7

|

Y P F First four years of Vaca Muerta’s history: Infrastructure

Capacity 8000 m3/d

INFRASTRUCTURE 2015 Oil

Treatment Plant

YPF First four years of Vaca Muerta’s history: LC Production

5000 4500 4000 3500 3000 ~ ~ 2500 2000 1500 1000 500 0

Loma Campana Oil Production (m3/d)–Drilling Rigs(#)

Ramp up Scale Optimization

YPF First four years of Vaca Muerta’s history: Initial Scale

Scale

Increase

Break the inertia of the industry and generate new infrastructure.

Establish VM in the world to attract investments.

First Unconventional Cluster outside North America, with more

than 60 Kboe/d produced from VM Formation.

Captured economies of scale.

The company obtained a social license.

YPF First four years of Vaca Muerta’s history: Factory # Scale

OPERATIONAL PLANNING

STANDARDIZATION

Factory# Scale

OPTIMIZATION

YPF First four years of Vaca Muerta’s history: Factory # Scale

OPERATIONAL PLANNING

Factory# Scale

STANDARDIZATION

OPTIMIZATION

• Advance in fronts

• Minimum secure distance between:

Drilling

Completion

Production

• Preventive shut ins due to interferences

YPF First four years of Vaca Muerta’s history: Factory Scale

OPERATIONAL PLANNING

STANDARDIZATION

Factory Scale

OPIMIZATION

Drilling Rigs

Well Pad Design

EPFs

YPF First four years of Vaca Muerta’s history: Factory Scale

OPERATIONAL PLANNING

STANDARDIZATION

OPTIMIZATION

Well Cost

Portfolio optimization

Development cost (USD/BOE)

continuous

improvement

• MM+RSS

• Soluble technology

• Sleeves

• National sand

YPF Unconventional YPF DNA: Factory Model

Development Strategy Drilling Completion Design Well Productivity Logistic Operational model

Unconventional

Factory

Model

YPF Unconventional YPF DNA: Factory Model

Operational model

Know how:

• Multi-wellpad design

• VM

Bottom-up

development strategy

• Preventive shut in interferences

Development strategy

Drilling

Completion design

Logistic

Well productivity

Batchdrilling operations

Offline operations

Remote monitoring

BHA MDF+RSS Geosteering

Longer laterals

Service integration

In-house

technical engineering staff:

UBD, mud, directional

Slim well design

Know how:

Fit for purpose fleet (skidding & walking rigs)

Ypf unconventional ypf dna: factory model

Development strategy

Drilling

Operational model

Completion design

Logistic

Well productivity

Ypf unconventional ypf dna: factory model

Know

how:

In-house

frac plan design

Ypf quality control in fracture set

Conductivity vs. complexity

Ypf’s own sand

supply

Ctu and wireline specialists

New technology

Diverters

Frac sleeves

Re-frac

Soluble plugs

Geosteering

Microseismic

Chemical tracers & plts

Development strategy

Drilling

Operational model

Completion design

Logistic

Well productivity

YPF Unconventional YPF DNA: Factory Model

Know

how:

Operational model

• Choke management policy

• Artificial

lift design

• Paraffin control (Flow assurance)

Development strategy

Drilling

Completion design

Logistic

Well productivity

YPF Unconventional YPF DNA: Factory Model

Drilling Development strategy Logistic well productivity completion design

Operational model

completion design

well productivity

• 24 hr logistic control room

• +400 trucks

• Installation of

watersupply: Centralized pool + water pipelines

• 100% flexipipe for fracture water

• Proppant Plant in core zone, 100% transportation in bulk sand trucks

development strategy

logistic

know how:

YPF Unconventional YPF DNA: Factory Model

Know

how:

• Telemetry and automation

• Real time optimization

• Facilities

standardization

• Lean Six Sigma as an optimization processes

Development Strategy Drilling Completion Design Well Productivity Logistic Operational model

YPF Unconventional YPF DNA: Factory Model

Continuous Improvement

Development Strategy Drilling Completion Design Well Productivity Logistic Operational model

YPF Unconventional YPF DNA: Development Cost Results

(MUSD)

$40 $ 35 $30 $ 25 $ 20 $l5 $l0 $5 $0

33,5 25.2 21.1 20.1 17.8

Q3-15 Q4-15 Q1-16 Q2-16 Q3-16

Loma Campana

Development Cost (USD/BOE)

47%

Development Cost (S/BOE)

CONTINUOUS IMPROVEMENT

YPF Unconventional YPF DNA: Well Cost Results MUSD 24 22 20 18 16 14 12 10 8 6 4 2

Fractures +15M USD 47% AVG QE: 9.5M USD

2015 2016

YPF Unconventional YPF DNA: Drilling Results 2015 / 2016 Loma Campana Drilling Days vs. Depth

LLL 1280 19 days 4707 m

LLL 1402 22 days 5737 m

AVG 2016 29 days 4800 m

AVG 2015 35 days 4697m

Q4 2016 26 days 5007m

AVG 2015 — Q42016

— LLL 1280 LLL 1402 — AVG2016

0.0 1000.0 2000.0 3000.0 4000.0 5000.0 6000.0

0.0 5.0 10.0 15.0 20.0 25.0 30.0 35.0 40.0

Days

YPF Unconventional YPF DNA: Productivity Results

Wells 2014

Wells 2015

Wells 2016

200 400 600 800 1000 1200

0 50 100 150 200 250 300 350

days

Wells 2014

Wells 2015

Wells 2016

days

70%

oil rate m3/d

oil cum m3

YPF Unconventional YPF DNA: THE FUTURE…

What

we look for? What we need? What we have?

Sustainable VM development at international prices Competitivity

Favorable investment conditions Well productivity well cost work efficiency

Organizational Capacity and Technical Teams with greater knowledge

Better prepared industry and available technologies in the Basin

Vaca Muerta positioned worldwide

YPF OUR ENERGY Thank you

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

YPF Sociedad Anónima

|

|

|

|

|

|

Date: December 19, 2016

|

|

By:

|

|

/s/ Diego Celaá

|

|

|

|

Name:

Title:

|

|

Diego Celaá

Market Relations

Officer

|

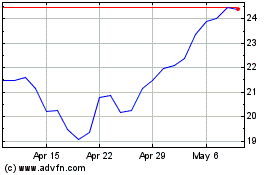

YPF Sociedad Anonima (NYSE:YPF)

Historical Stock Chart

From Aug 2024 to Sep 2024

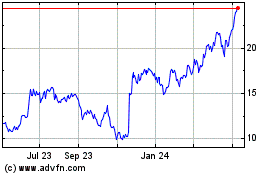

YPF Sociedad Anonima (NYSE:YPF)

Historical Stock Chart

From Sep 2023 to Sep 2024