21st Century Fox in Talks to Buy U.K.'s Sky -- Update

December 09 2016 - 1:21PM

Dow Jones News

By Austen Hufford

21st Century Fox Inc. is in late-stage discussions to buy the

rest of Sky PLC, the U.K.'s market-leading pay-TV provider, as Fox

again tries to consolidate its holdings years after its previous

attempt was thwarted by a phone-hacking scandal. Fox already owns

39.1% of the company.

The companies said Friday that they had reached a preliminary

agreement for GBP10.75 per share in cash ($13.52) but that certain

material offer terms remained under discussion. The $14 billion

offer was a 40% premium to Sky's Dec. 6 closing price. Its shares

were recently up 27%.

If completed, the deal would value all of Sky at about $23

billion. Fox has until Jan. 6 to say whether it will make a firm

offer.

In 2011, News Corp. dropped its bid to take full control of Sky

after a scandal over the reporting tactics at one of its U.K.

newspaper titles raised government and public outcry over the

deal.

News Corp. has since split into 21st Century Fox and News Corp,

parent company of The Wall Street Journal. Both News Corp and Fox

remain largely controlled by Rupert Murdoch and his family.

Recently, the Murdoch family has shown renewed interest in Sky.

In January, James Murdoch was appointed as Sky chairman, four years

after he had stepped down from the role. He is also the chief

executive of 21st Century Fox.

Fox said Friday that its minority holding is "not a natural end

position."

Fox's move Friday was driven in part by the opportunity to lower

its funding costs by taking advantage of the recent slide in the

British pound against the U.S. dollar, according to a person

familiar with the approach. The U.K. currency is down 16% against

the dollar since Britons voted in June to exit from the European

Union, amid concerns of slowdown in domestic economic growth.

The deal would combine Fox's content business with Sky's

direct-to-consumer access in Europe. Sky is a paid-television and

internet-service provider. It also creates and licenses television

shows and has sports and news arms. It licenses shows from both HBO

and Showtime for its European customers.

The company was created in 1990 when Rupert Murdoch's

then-year-old Sky Television merged with British Satellite

Broadcasting to create the U.K.'s biggest digital-subscription

pay-TV provider. It was known as British Sky Broadcasting, or

BSkyB, until 2015, when it changed its name to simply Sky to

reflect its growing European footprint.

Sky initially distinguished itself through its news service,

which offered a commercial competitor to the publicly funded

British Broadcasting Corp, and sports broadcasts, airing the

popular English Premier League's soccer games. In the late 1990s,

the broadcaster started focusing on producing and commissioning

more in-house TV shows.

After 21st Century Fox predecessor News Corp. dropped its bid

for Sky in 2011, Chase Carey, News Corp.'s chief operating officer

said in a statement at the time that while News Corp. believed the

proposed acquisition would have benefited both companies, "it has

become clear that it is too difficult to progress in this

climate."

Since then, Sky has expanded in Europe, buying its sister

companies in Germany and Italy from Fox in a deal worth about $9

billion and creating a pan-European pay-TV giant with 21.8 million

customers across Germany, Italy, Austria, the U.K. and Ireland.

Analysts speculated that Fox would try another takeover once the

political climate settled and the stock price was low. At the end

of trading on Thursday, the day before Fox announced its new bid,

Sky shares had fallen about 27% from a year earlier.

Sky CEO Jeremy Darroch, who has held the post since 2007, said

at a Morgan Stanley conference last month that the company would

focus on growing in Germany and Italy while expanding its U.K.

offerings. Mr. Darroch said Sky would launch a mobile service and

continue to produce original television content.

In the U.K., Sky has faced increased competition in sports

broadcasting from BT Group PLC, which in 2015 was the surprise

winner of a three-year, GBP900 million contract to televise UEFA

Champions League's soccer games. Concerns are mounting globally

over how much consumers are willing to pay for television and live

sports content. Analysts are also questioning the value of

increasingly expensive sports deals as a protection against

so-called cord-cutters, who drop their premium television

subscribers in favor of streaming services like Netflix Inc.

Mr. Darroch said that as rights to sports broadcasts have gotten

more expensive, Sky would have to make "harder choices about what

we invest in.

"We'll seek to win the most important things of course, but

we'll be happy or willing to let other things go," Mr. Darroch

said.

--Stu Woo, Shalini Ramachandran and Ben Dummett contributed to

this article.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

December 09, 2016 13:06 ET (18:06 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

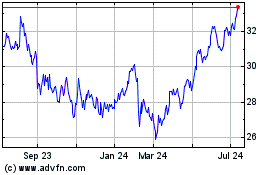

Fox (NASDAQ:FOX)

Historical Stock Chart

From Mar 2024 to Apr 2024

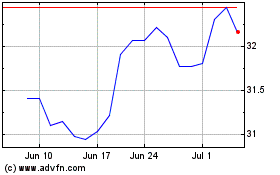

Fox (NASDAQ:FOX)

Historical Stock Chart

From Apr 2023 to Apr 2024