Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

December 07 2016 - 3:34PM

Edgar (US Regulatory)

Filed Pursuant to Rule 433

Supplementing the Preliminary Prospectus Dated December 5, 2016

Registration No. 333-195182

December 7, 2016

Term Sheet

$75,000,000

5.25%

Fixed-to-Floating Rate Subordinated Notes due December 2026

This term sheet relates only to the securities described below and supplements and should

be read together with the preliminary prospectus supplement dated December 5, 2016 and the accompanying prospectus (including the documents incorporated by reference therein) relating to those securities. Capitalized terms used in this term

sheet but not defined have the meanings given to them in such preliminary prospectus supplement.

|

|

|

|

|

Issuer:

|

|

Flushing Financial Corporation, a Delaware corporation (the “Company”)

|

|

|

|

|

Securities Offered:

|

|

5.25% Fixed-to-Floating Rate Subordinated Notes due December 2026 (the “Notes”)

|

|

|

|

|

Aggregate Principal Amount:

|

|

$75,000,000

|

|

|

|

|

Rating:

|

|

Kroll Bond Rating Agency: BBB

A rating reflects only the view of a rating agency, and it is not a recommendation to buy, sell or hold the Notes. Any rating can be revised upward or downward

or withdrawn at any time by a rating agency if such rating agency decides that circumstances warrant that change. Each rating should be evaluated independently of any other rating.

|

|

|

|

|

Trade Date:

|

|

December 7, 2016

|

|

|

|

|

Settlement Date:

|

|

December 12, 2016

|

|

|

|

|

Final Maturity (if not previously redeemed):

|

|

December 15, 2026

|

|

|

|

|

Interest Rate:

|

|

From and including the original issue date to, but excluding December 15, 2021 a fixed per annum rate of 5.25%, payable semi-annually in

arrears.

From and including December 15, 2021, through the maturity date or the date

of earlier redemption, a floating per annum rate equal to three-month LIBOR (provided, however, that in the event three-month LIBOR is less than zero, three-month LIBOR shall be deemed to be zero) plus 344 basis points, payable quarterly in

arrears.

|

|

|

|

|

|

Issue Price to Investors:

|

|

100%

|

|

|

|

|

Interest Payment Dates:

|

|

Interest on the Notes will be payable on June 15 and December 15 of each year through, but not including, December 15, 2021, and thereafter on March 15, June 15, September 15 and December 15 of each year to, but excluding the

maturity date or earlier redemption. The first interest payment will be made on June 15, 2017.

|

|

|

|

|

Day Count Convention:

|

|

30/360 to but excluding December 15, 2021, and, thereafter, a 360-day year and the number of days actually elapsed.

|

|

|

|

|

Optional Redemption:

|

|

The Company may, at its option, beginning with the Interest Payment Date of December 15, 2021 and on any scheduled Interest Payment Date thereafter, redeem the Notes, in whole or in part, at a redemption price equal to 100% of

the principal amount of the Notes to be redeemed plus accrued and unpaid interest to, but excluding, the date of redemption.

|

|

|

|

|

Special Event Redemption:

|

|

The Notes may not be redeemed prior to December 15, 2021, except that the Company may redeem the Notes at any time, at its option, in whole but not in part, subject to obtaining any required regulatory approvals, if (i) a change

or prospective change in law occurs that could prevent the Company from deducting interest payable on the Notes for U.S. federal income tax purposes, (ii) a subsequent event occurs that precludes the Notes from being recognized as Tier 2 capital for

regulatory capital purposes, or (iii) the Company is required to register as an investment company under the Investment Company Act of 1940, as amended, in each case, at a redemption price equal to 100% of the principal amount of the Notes plus any

accrued and unpaid interest through, but excluding, the redemption date. For more information, see ‘‘Description of the Notes – Redemption” in the preliminary prospectus supplement dated December 5, 2016.

|

|

|

|

|

Denomination:

|

|

$1,000 denominations and integral multiples of $1,000

|

|

|

|

|

Listing and Trading Markets:

|

|

The Company does not intend to list the Notes on any securities exchange or to have the Notes quoted on a quotation system. Currently there is no public market for the Notes and there can be no assurances that any public market

for the Notes will develop.

|

|

|

|

|

Underwriters’ Discount:

|

|

1.25%

|

|

|

|

|

Proceeds to the Company (after underwriting

discount, but before expenses):

|

|

$74,062,500

|

|

|

|

|

|

Use of Proceeds:

|

|

The Company expects to use the net proceeds from the sale of the Notes for general corporate purposes, which may include advances to subsidiaries to finance their activities.

|

|

|

|

|

CUSIP / ISIN:

|

|

343873 AA3 / US343873AA30

|

|

|

|

|

Book Running Manager:

|

|

Sandler O’Neill + Partners, L.P.

|

|

|

|

|

Co-Manager:

|

|

Keefe, Bruyette & Woods, A Stifel Company

|

The Company has filed a shelf registration statement (File No. 333-195182) (including a base prospectus) and a related

preliminary prospectus supplement dated December 5, 2016 with the Securities and Exchange Commission (the “SEC”) for the offering to which this communication relates. Before you invest, you should read the prospectus in that

registration statement, and the related preliminary prospectus supplement and any other documents that the Company has filed with the SEC for more information about the Company and the offering. You may get these documents for free by visiting EDGAR

on the SEC website at www.sec.gov. Alternatively, the Company, the Underwriters or any dealer participating in the offering will arrange to send you the prospectus and the related preliminary prospectus supplement if you request it by calling

Sandler O’Neill + Partners, L.P. toll-free at 866-805-4128 or Keefe, Bruyette & Woods, A Stifel Company, toll-free at 800-966-1559.

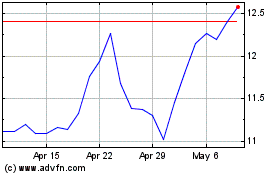

Flushing Financial (NASDAQ:FFIC)

Historical Stock Chart

From Mar 2024 to Apr 2024

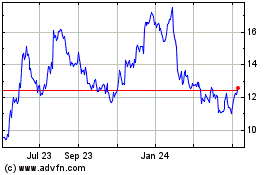

Flushing Financial (NASDAQ:FFIC)

Historical Stock Chart

From Apr 2023 to Apr 2024