UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________

FORM 6-K

__________________

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of December, 2016

Commission File Number: 001-36619

__________________________________

Affimed N.V.

__________________________________

Im Neuenheimer Feld 582,

69120 Heidelberg,

Germany

(Address of principal executive offices)

__________________________________

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form

40-F ☐

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

On November 30, 2016, Affimed GmbH, a subsidiary

of Affimed N.V. (“Affimed” and, together with Affimed GmbH, the “Company”), entered into a loan agreement

(the “Loan Agreement”) with Silicon Valley Bank, a California corporation, as lender (“SVB”). The obligations

under the Loan Agreement are fully guaranteed by Affimed pursuant to a Deed of Guaranty and Indemnity between Affimed and SVB (the

“Deed”).

The Loan Agreement provides the Company

with a senior secured term loan facility (the “Loan Facility”) for up to €10.0 million. The Company expects to

fully draw down the initial tranche of €5.0 million (“Tranche 1”) under the Loan Facility. Up to an additional

€5.0 million (“Tranche 2a”) or €2.5 million (“Tranche 2b”) may be drawn by the Company on or

before May 31, 2017, in the case of each tranche, contingent on the satisfaction by such date of certain conditions as set forth

in the Loan Agreement, including with respect to the raising of additional funds from a cash equity injection or an upfront milestone

payment in specified amounts and evidence in form and substance reasonably satisfactory to SVB as to the continued progress of

Affimed’s clinical trials.

In connection with its entry into the Loan

Agreement, the Company has repaid all outstanding amounts under that certain term loan facility, dated July 24, 2014, between the

Company and an affiliate of Perceptive Advisors LLC, as lender (the “Existing Loan Agreement”), and paid related fees

and expenses. Upon the repayment in full of loans under the Existing Loan Agreement, the Existing Loan Agreement was terminated

and any security interests in connection therewith were released.

The interest rate on amounts borrowed under

the Loan Facility is calculated as the sum of (i) one-month EURIBOR plus (ii) an applicable margin of 5.5%, with EURIBOR deemed

to equal zero percent if EURIBOR is less than zero percent. The Loan Facility has a maturity date of (i) May 31, 2020, if the Company

draws down only under Tranche 1 or under Tranche 2a as well, with an interest-only period through (a) June 1, 2017 if only Tranche

1 is drawn down, or (b) December 1, 2017 if Tranche 2a is drawn down as well, in each case with amortized payments of principal

and interest thereafter in equal monthly installments; or (ii) November 30, 2020, if the Company draws down under Tranche 2b, with

an interest-only period through March 1, 2018, with amortized payments of principal and interest thereafter in equal monthly installments.

The Company may optionally prepay all or

a portion of the outstanding borrowed amounts by paying such amounts and all accrued and unpaid interest thereon together with

a Prepayment Charge (as defined below). If the borrowed amounts are prepaid on or prior to the second anniversary of the date on

which Tranche 1 is drawn, the prepayment charge will be 3.00% of the amount being prepaid. If the borrowed amounts are prepaid

after the second anniversary of the date on which Tranche 1 is drawn, but on or prior to the third anniversary of such date, the

prepayment charge will be 2.00% of the amount being prepaid. Thereafter, the prepayment charge will be 1.00% of the amount being

prepaid. Such prepayment charges are collectively referred to in this Report on Form 6-K as the “Prepayment Charges.”

In addition, the Company will be required to prepay all such outstanding amounts, together with the applicable Prepayment Charge

and the Final Payment Fee (as defined below), upon the occurrence of a change in control of the Company.

Pursuant to the Loan Agreement, the Company

is also obligated to grant SVB warrants to purchase Affimed’s Common Shares, with a nominal value of €0.01 per share

(the “Common Shares”). Upon the drawdown of Tranche 1, the Company will issue SVB a warrant (the “Tranche 1 Warrant”)

to purchase such number of Common Shares equal to 9.5% of the amount drawn under Tranche 1 divided by the price per Common Share,

as determined pursuant to the Loan Agreement. If and when the Company draws down on either Tranche 2a or Tranche 2b, the Company

will issue SVB an additional warrant (the “Tranche 2 Warrant” and, together with the Tranche 1 Warrant, the “Warrants”)

to purchase such number of Common Shares equal to 9.5% of the amount drawn under Tranche 2a or Tranche 2b, as the case may be,

divided by the price per Common Share, as determined pursuant to the Loan Agreement. The exercise price for the Common Shares underlying

each Warrant will be the price per Common Share at the time such Warrant is issued, as determined pursuant to the Loan Agreement.

The aggregate number of Common Shares underlying the Warrants shall in no event exceed 0.5% of the outstanding share capital of

Affimed at the time of the drawdown of the relevant tranche. The exercise price and the number of Common Shares underlying the

Warrants are subject to adjustment upon a subdivision or combination of the Common Shares, a reclassification of the Common Shares

or certain other corporate reorganizations. In the event that any of Affimed’s Common Shares are proposed to be registered

under the Securities Act of 1933, Affimed has granted SVB the right to cause Affimed to effect the registration of the Common Shares

issued upon exercise of the Warrants.

The Loan Facility is secured by a pledge

of 100% of Affimed’s shares in Affimed GmbH, all intercompany accounts receivables owed by Affimed’s subsidiaries to

Affimed and a security assignment of all of the Company’s bank accounts, inventory, trade receivables and payment claims

as specified in (i) the Omnibus Deed of Pledge between Affimed and SVB (the “Deed of Pledge”), (ii) the Share Pledge

Agreement between Affimed and SVB (the “Share Pledge Agreement”), (iii) the Account Pledge Agreement between Affimed

and SVB, (the “Parent Account Pledge Agreement”), (iv) the Account Pledge Agreement between Affimed GmbH and SVB (the

“Subsidiary Account Pledge Agreement”), (v) the Security Assignment

Agreement between Affimed GmbH and SVB (the “Security

Assignment Agreement”) and (vi) the Security Transfer Agreement between Affimed GmbH and SVB (the “Security Transfer

Agreement”).

The Loan Agreement includes customary representations,

warranties and restrictive covenants, including restrictions on certain mergers, acquisitions, dispositions, distributions (including

the payment of dividends) and the incurrence of indebtedness or liens, and sets out those events which would constitute an event

of default thereunder (“Events of Default”). Under the terms of the Loan Agreement, upon and during the continuance

of any one or more Events of Default, SVB may, at its option and in addition to other remedies under the Loan Agreement, accelerate

and demand payment of all or any part of the Company’s secured obligations together with a Prepayment Charge and declare

them to be immediately due and payable. Additionally, upon and during the continuance of any one or more Events of Default, the

interest rate on amounts borrowed under the Loan Facility will bear interest at a rate 3.0% above the applicable interest rate.

Fees and expenses payable to SVB include SVB’s expenses incurred in negotiating the Loan Agreement and related documents

as well as a final payment fee equal to 10% of the total principal amount advanced to Affimed by SVB, which is due upon the final

repayment of the loans (the “Final Payment Fee”).

The foregoing description of the Loan Agreement,

the Deed, the Deed of Pledge, the Share Pledge Agreement, the Parent Account Pledge Agreement, the Subsidiary Account Pledge Agreement,

the Security Assignment Agreement and the Security Transfer Agreement does not purport to be complete and is qualified in its entirety

by reference to the full text of such documents, copies of which are filed as Exhibits 10.1, 10.2, 10.3, 10.4, 10.5, 10.6, 10.7

and 10.8 to this Report on Form 6-K, respectively, and are incorporated herein by reference.

INCORPORATION BY REFERENCE

This Report on Form 6-K and exhibits 10.1, 10.2, 10.3, 10.4,

10.5, 10.6, 10.7 and 10.8 to this Report on Form 6-K shall be deemed to be incorporated by reference into the registration statements

on Form F-3 (Registration Number 333-207235) and Form S-8 (Registration Numbers 333-198812) of Affimed N.V. and to be a part thereof

from the date on which this report is filed, to the extent not superseded by documents or reports subsequently filed or furnished.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly

authorized, in Heidelberg, Germany, December 6, 2016.

|

|

AFFIMED N.V.

|

|

|

|

|

|

By:

|

/s/ Adi Hoess

|

|

|

|

Name:

|

Adi Hoess

|

|

|

|

Title:

|

Chief Executive Officer

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Florian Fischer

|

|

|

|

Name:

|

Florian Fischer

|

|

|

|

Title:

|

Chief Financial Officer

|

EXHIBIT INDEX

|

Exhibit

|

Description of Exhibit

|

|

10.1

|

Loan Agreement between Affimed GmbH and Silicon Valley Bank

|

|

10.2

|

Deed of Guaranty and Indemnity between Affimed N.V. and Silicon Valley Bank

|

|

10.3

|

Omnibus Deed of Pledge between Affimed N.V.and Silicon Valley Bank

|

|

10.4

|

Share Pledge Agreement between Affimed N.V.and Silicon Valley Bank

|

|

10.5

|

Account Pledge Agreement between Affimed N.V.and Silicon Valley Bank

|

|

10.6

|

Account Pledge Agreement between Affimed GmbH and Silicon Valley Bank

|

|

10.7

|

Security Assignment Agreement between Affimed GmbH and Silicon Valley Bank

|

|

10.8

|

Security Transfer Agreement between Affimed GmbH and Silicon Valley Bank

|

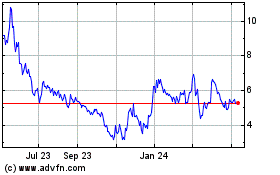

Affimed NV (NASDAQ:AFMD)

Historical Stock Chart

From Mar 2024 to Apr 2024

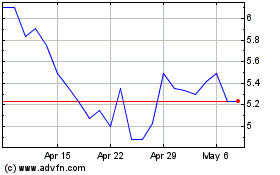

Affimed NV (NASDAQ:AFMD)

Historical Stock Chart

From Apr 2023 to Apr 2024