United

States

Securities

and Exchange Commission

Washington, D.C. 20549

SCHEDULE

14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION

14(A) OF

THE SECURITIES EXCHANGE ACT OF 1934

Filed by Registrant

x

Filed by a Party other than the Registrant

¨

Check the appropriate box:

|

|

¨

|

Preliminary Proxy Statement

|

|

|

¨

|

Confidential, for Use of the Commission Only (as permitted

by Rule 14a-6(e)(2))

|

|

|

x

|

Definitive Proxy Statement

|

|

|

¨

|

Definitive Additional Materials

|

|

|

¨

|

Soliciting Material Under Rule 14a-12

|

Aqua

Metals, Inc.

(Name of Registrant as Specified

In Its Charter)

(Name of Person(s) Filing Proxy Statement,

if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

¨

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1)

and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

(5)

|

Total fee paid:

|

|

|

|

|

|

|

¨

|

Fee paid previously with preliminary materials:

|

|

|

¨

|

Check box if any part of the fee is offset as provided

by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous

filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

(3)

|

Filing Party:

|

|

|

(4)

|

Date Filed:

|

November 23, 2016

Dear Stockholder:

You are cordially invited

to attend the 2016 Annual Meeting of Stockholders (which we refer to as the “Annual Meeting”) of Aqua Metals, Inc.,

a Delaware corporation (which we refer to as “we,” “us,” “our,” or the “Company”),

to be held at the Waterfront Hotel, 10 Washington Street, Oakland, California 94607, at 10:00 a.m. local time, on Wednesday,

December 21, 2016.

At the Annual Meeting,

you will be asked to consider and vote upon the following proposals to: (1) elect five (5) directors to serve for the ensuing

year as members of the Board of Directors of the Company; (2) ratify the appointment of Armanino LLP as our independent registered

public accounting firm for the fiscal year ending December 31, 2016; and (3) transact such other business as may properly

come before the Annual Meeting or at any continuation, postponement or adjournment thereof. The accompanying Notice of Annual Meeting

of Stockholders and Proxy Statement describe these matters in more detail. We urge you to read this information carefully.

The

Board of Directors recommends a vote:

FOR

each of the five (5) nominees for director named in the Proxy Statement,

and

FOR

the ratification of the appointment of Armanino LLP as our independent registered public accounting firm

for the fiscal year ending December 31, 2016

.

Whether or not you

attend the Annual Meeting in person, and regardless of the number of shares of Aqua Metals, Inc. that you own, it is important

that your shares be represented and voted at the Annual Meeting. Therefore, I urge you to vote your shares of common stock via

the Internet, or by promptly marking, dating, signing, and returning the proxy card. Voting over the Internet, or by written proxy,

will ensure that your shares are represented at the Annual Meeting.

On behalf of the Board of Directors of Aqua Metals, Inc., we

thank you for your participation.

|

|

Sincerely,

|

|

|

|

|

|

Dr. Stephen R. Clarke

|

|

|

Chairman of the Board of Directors,

President and Chief Executive Officer

|

Aqua

Metals, Inc.

1010 Atlantic Avenue

Alameda, California 94501

(510) 479-7635

NOTICE

OF 2016 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON DECEMBER 21, 2016

The 2016

Annual Meeting of Stockholders (which we refer to as the “Annual Meeting”) of Aqua Metals, Inc., a Delaware corporation

(which we refer to as “we,” “us,” “our,” or the “Company”), will be held on Wednesday,

December 21, 2016 at 10:00 a.m. local time, at the Waterfront Hotel, 10 Washington Street, Oakland, California 94607. We will

consider and act on the following items of business at the Annual Meeting:

|

|

1.

|

To elect five (5) directors to serve as members of the Board of Directors of the Company (which

we refer to as our “Board”) until the next annual meeting of stockholders and until their successors are duly elected

and qualified. The director nominees named in the Proxy Statement for election to our Board are: Dr. Stephen R. Clarke, Thomas

Murphy, Vincent L. DiVito, Mark Slade and Mark Stevenson;

|

|

|

2.

|

To ratify the appointment of Armanino LLP as the Company’s independent registered public

accounting firm for the year ending December 31, 2016; and

|

|

|

3.

|

To transact such other business as may properly come before the Annual Meeting or at any continuation,

postponement or adjournment thereof.

|

The

Proxy Statement accompanying this Notice describes each of these items of business in detail. Our Board recommends a vote:

FOR

each of the five (5) nominees for director named in the Proxy Statement, and

FOR

the ratification of the appointment

of Armanino LLP as our independent registered public accounting firm

for the fiscal year ending December 31, 2016

.

Only

stockholders of record at the close of business on November 23, 2016 are entitled to notice of, to attend, and to vote at, the

Annual Meeting or any continuation, postponement or adjournment thereof.

A list of stockholders

eligible to vote at the Annual Meeting will be available for inspection, for any purpose germane to the Annual Meeting, at the

principal executive office of the Company during regular business hours for a period of no less than ten (10) days prior to the

Annual Meeting.

All stockholders are

cordially invited to attend the Annual Meeting in person. To ensure your representation at the Annual Meeting, you are urged to

vote your shares of common stock via the Internet, or by promptly marking, dating, signing, and returning the proxy card. Any stockholder

attending the Annual Meeting may vote in person even if he or she previously submitted a proxy. If your shares of common stock

are held by a bank, broker or other agent, please follow the instructions from your bank, broker or other agent to have your shares

voted.

|

|

Sincerely,

|

|

|

|

|

|

Dr. Stephen R. Clarke

Chairman of the Board of Directors,

President and Chief Executive Officer

|

Alameda, California

November 23, 2016

TABLE OF CONTENTS

Page

Aqua

Metals, Inc.

1010 Atlantic Avenue

Alameda, California 94501

(510) 479-7635

PROXY

STATEMENT

FOR ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON DECEMBER 21, 2016

INFORMATION ABOUT THE ANNUAL MEETING

General

Your

proxy is solicited on behalf of the Board of Directors (which we refer to as our “Board”) of Aqua Metals, Inc., a Delaware

corporation (which we refer to as “we,” “us,” “our,” or the “Company”), for use

at our 2016 Annual Meeting of Stockholders (which we refer to as the “Annual Meeting”) to be held on Wednesday, December

21, 2016, at 10:00 a.m. local time, at the Waterfront Hotel, 10 Washington Street, Oakland, California 94607, or at any continuation,

postponement or adjournment thereof, for the purposes discussed in this Proxy Statement and in the accompanying Notice of Annual

Meeting. Proxies are solicited to give all stockholders of record an opportunity to vote on matters properly presented at the Annual

Meeting. We expect that this Proxy Statement, the proxy and Notice of Annual Meeting will first be mailed to our stockholders on

or about November 28, 2016.

Who Can Vote,

Outstanding Shares

Record holders

of our common stock as of the close of business on November 23, 2016, the record date for the Annual Meeting, are entitled to vote

at the Annual Meeting on all matters to be voted upon. As of the record date, there were 17,878,725 shares of our common stock

outstanding, each entitled to one vote.

Voting of Shares

You

may vote by attending the Annual Meeting and voting in person or you may vote by submitting a proxy. The method of voting by proxy

differs for shares held as a record holder and shares held in “street name.” If you hold your shares of common

stock as a record holder, you may vote your shares by completing, dating and signing the proxy card that was included with the

Proxy Statement and promptly returning it, or by submitting a proxy over the Internet by following the instructions on the proxy

card. If you hold your shares of common stock in street name, which means that your shares are held of record by a broker, bank

or other nominee, you will receive a notice from your broker, bank or other nominee that includes instructions on how to vote your

shares. In addition, you may request paper copies of the Proxy Statement and proxy card from your broker by following the instructions

on the notice provided by your broker.

The

Internet voting facilities will close at 11:59 p.m. EST on December 20, 2016. If you vote over the Internet, then you

need not return a written proxy card by mail.

YOUR

VOTE IS VERY IMPORTANT.

You should submit your proxy even if you plan to attend the Annual Meeting. If you properly give your

proxy and submit it to us in time to vote, one of the individuals named as your proxy will vote your shares as you have directed.

Any stockholder attending the Annual Meeting may vote in person even if he or she previously submitted a proxy.

All

shares entitled to vote and represented by properly submitted proxies (including those submitted electronically and in writing)

received before the polls are closed at the Annual Meeting, and not revoked or superseded, will be voted at the Annual Meeting

in accordance with the instructions indicated on those proxies. If no direction is indicated on a proxy, your shares will be voted

as follows:

FOR

each of the five (5) nominees for director named in the Proxy

Statement, and

FOR

the ratification of the appointment of Armanino LLP as our independent registered public accounting firm

for the fiscal year ending December 31, 2016. With respect to any other matter that properly comes before the Annual Meeting or

any continuation, postponement or adjournment thereof, the proxy-holders will vote as recommended by our Board, or if no recommendation

is given, in their own discretion.

Revocation

of Proxy

If

you are a stockholder of record, you may revoke your proxy at any time before your proxy is voted at the Annual Meeting by taking

any of the following actions:

|

|

•

|

delivering to our corporate secretary a signed written notice of revocation, bearing a date later

than the date of the proxy, stating that the proxy is revoked;

|

|

|

•

|

signing and delivering a new proxy card, relating to the same shares and bearing a later date than

the original proxy card;

|

|

|

•

|

submitting another proxy over the Internet (your latest Internet voting instructions are followed);

or

|

|

|

•

|

attending the Annual Meeting and voting in person, although attendance at the Annual Meeting will

not, by itself, revoke a proxy.

|

Written

notices of revocation and other communications with respect to the revocation of Company proxies should be addressed to:

Aqua Metals, Inc.

1010 Atlantic Avenue

Alameda, California

94501

Attention: Corporate

Secretary

If

your shares are held in “street name,” you may change your vote by submitting new voting instructions to your broker,

bank or other nominee. You must contact your broker, bank or other nominee to find out how to do so. See below regarding how to

vote in person if your shares are held in street name.

Voting in Person

If

you plan to attend the Annual Meeting and wish to vote in person, you will be given a ballot at the Annual Meeting. Please note,

however, that if your shares are held in “street name,” which means your shares are held of record by a broker, bank

or other nominee, and you wish to vote at the Annual Meeting, you must bring to the Annual Meeting a legal proxy from the record

holder of the shares, which is the broker or other nominee, authorizing you to vote at the Annual Meeting.

Stockholders

who wish to attend the Annual Meeting will be required to present verification of ownership of our common stock, such as a bank

or brokerage firm account statement, and will be required to present a valid government-issued picture identification, such as

a driver’s license or passport, to gain admittance to the Annual Meeting. No cameras, recording equipment, electronic devices,

large bags, briefcases or packages will be permitted in the Annual Meeting.

Quorum and

Votes Required

The

inspector of elections appointed for the Annual Meeting will tabulate votes cast by proxy or in person at the Annual Meeting. The

inspector of elections will also determine whether a quorum is present. In order to constitute a quorum for the conduct of business

at the Annual Meeting, a majority in voting power of all of the shares of the stock entitled to vote at the Annual Meeting must

be present in person or represented by proxy at the Annual Meeting. Shares that abstain from voting on any proposal, or that are

represented by broker non-votes (as discussed below), will be treated as shares that are present and entitled to vote at the Annual

Meeting for purposes of determining whether a quorum is present.

A

broker non-vote occurs when a broker, bank or other agent holding shares for a beneficial owner has not received instructions from

the beneficial owner and does not have discretionary authority to vote the shares for certain non-routine matters. Shares represented

by proxies that reflect a broker non-vote will be counted for purposes of determining the presence of a quorum. The election of

directors (Proposal 1) is considered a non-routine matter and broker non-votes, if any, will not be counted as votes cast and will

have no effect on the result of the vote. The ratification of the appointment of Armanino LLP as our independent registered public

accounting firm (Proposal 2) is considered a routine matter on which a broker, bank or other agent has discretionary authority

to vote, so there will not be any broker non-votes in connection with this proposal.

Proposal

No. 1

:

Election of Directors.

A plurality of the votes cast by the holders of shares entitled to vote in the

election of directors at the Annual Meeting is required for the election of directors. Accordingly, the five (5) director

nominees receiving the highest number of votes will be elected. Abstentions and broker non-votes are not treated as votes cast,

and, therefore, will not have any effect on the outcome of the election of directors.

Proposal

No. 2

:

Ratification of Independent Registered Public Accounting Firm.

The affirmative vote of the holders of

a majority of the votes cast and entitled to vote at the Annual Meeting is required for the ratification of the appointment of

Armanino LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2016. Abstentions

will not be counted either for or against this proposal. Brokers generally have discretionary authority to vote on the ratification

of our independent registered public accounting firm, and thus, broker non-votes are generally not expected to result from the

vote on Proposal No. 2. However, in the event of any broker non-votes or abstentions in connection with Proposal No. 2, such broker

non-votes and abstentions will be counted as not present and these shares will be deducted from the total shares of which a majority

is required.

We

will also consider any other business that properly comes before the annual meeting, or any adjournment or postponement thereof.

As of the record date, we are not aware of any other matters to be submitted for consideration at the annual meeting. If any other

matters are properly brought before the annual meeting, the persons named on the enclosed proxy card will vote the shares they

represent using their best judgment.

Solicitation

of Proxies

Our

Board is soliciting proxies for the Annual Meeting from our stockholders. We will bear the entire cost of soliciting proxies from

our stockholders. In addition to the solicitation of proxies by delivery of the Notice or this Proxy Statement by mail, we will

request that brokers, banks and other nominees that hold shares of our common stock, which are beneficially owned by our stockholders,

send Notices, proxies and proxy materials to those beneficial owners and secure those beneficial owners’ voting instructions.

We will reimburse those record holders for their reasonable expenses. We do not intend to hire a proxy solicitor to assist in the

solicitation of proxies. We may use several of our regular employees, who will not be specially compensated, to solicit proxies

from our stockholders, either personally or by Internet, facsimile or special delivery letter.

Stockholder

List

A

list of stockholders eligible to vote at the Annual Meeting will be available for inspection, for any purpose germane to the Annual

Meeting, at the principal executive office of the Company during regular business hours for a period of no less than ten (10) days

prior to the Annual Meeting.

Forward-Looking

Statements

This

Proxy Statement contains “forward-looking statements” (as defined in the Private Securities Litigation Reform Act of

1995). These statements are based on our current expectations and involve risks and uncertainties, which may cause results to differ

materially from those set forth in the statements. The forward-looking statements may include statements regarding actions to be

taken by us. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information,

future events or otherwise. Forward-looking statements should be evaluated together with the many uncertainties that affect our

business, particularly those mentioned in the risk factors in Item 1A of our 2015 Annual Report on Form 10-K and in our Quarterly

Reports on Form 10-Q and our Current Reports on Form 8-K.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Board Nominees

Our

Board currently consists of four (4) members, two (2) of whom are independent under the listing standards for independence of the

NASDAQ and Rule 10A-3 under the Securities Exchange Act of 1934, as amended (which we refer to as the “Exchange Act”).

Based upon the recommendation of the Nominating and Corporate Governance Committee of our Board (which we refer to as the “Nominating

and Corporate Governance Committee”), our Board determined to nominate each of the Company’s current directors for

re-election at the Annual Meeting and to nominate Mark Stevenson for election at the Annual Meeting. Our Board has determined Mr.

Stevenson to be independent under the NASDAQ listing standards and Rule 10A-3 under the Exchange Act.

Our Board and the Nominating

and Corporate Governance Committee believe the directors nominated collectively have or will have the experience, qualifications,

attributes and skills to effectively oversee the management of the Company, including a high degree of personal and professional

integrity, an ability to exercise sound business judgment on a broad range of issues, sufficient experience and background to have

an appreciation of the issues facing the Company, a willingness to devote the necessary time to Board duties, a commitment to representing

the best interests of the Company and our stockholders and a dedication to enhancing stockholder value.

Each director elected

at the Annual Meeting will serve a one (1)-year term until the Company’s next annual meeting and until his or her successor

is duly elected and qualified or until his or her earlier death, resignation or removal. Unless otherwise instructed, the proxy-holders

will vote the proxies received by them for the five (5) nominees named below. If any of the nominees is unable, or declines to

serve as a director at the time of the Annual Meeting, the proxies will be voted for any nominee designated by the present Board

to fill the vacancy. It is not presently expected that any of the nominees named below will be unable or will decline to serve

as a director. If additional persons are nominated for election as directors, the proxy-holders intend to vote all proxies received

by them in a manner to assure the election of as many of the nominees listed below as possible. In such event, the specific nominees

to be voted for will be determined by the proxy-holders.

Set forth below are

the names, ages and positions of our director nominees as of the date of this Proxy Statement:

|

Name

|

|

Age

|

|

Position with the Company

|

|

Dr. Stephen R. Clarke

|

|

59

|

|

President, Chief Executive Officer and Chairman of the Board

|

|

Thomas Murphy

|

|

64

|

|

Chief Financial Officer and Director

|

|

Vincent L. DiVito

(a), (b), (c)

|

|

57

|

|

Independent Director

|

|

Mark Slade

(a), (b), (c)

|

|

55

|

|

Independent Director

|

|

Mark Stevenson

|

|

54

|

|

Director Nominee

|

(a) Member of the Audit Committee of our Board.

(b) Member of the Compensation Committee of our Board.

(c) Member of the Nominating and Corporate Governance

Committee of our Board.

Board Recommendation

Our

Board recommends a vote “FOR” each of the five (5) nominees for director

named

in this Proxy Statement.

Vacancies on our Board, including any vacancy created by an

increase in the size of our Board, may be filled only by a majority of the directors remaining in office (even though less than

a quorum of our Board) or a sole remaining director, and not by stockholders. A director elected by our Board to fill a vacancy

will serve until the next annual meeting of stockholders and until such director’s successor is elected and qualified, or

until such director’s earlier retirement, resignation, disqualification, removal or death.

If any nominee should become unavailable

for election prior to the Annual Meeting, an event that currently is not anticipated by our Board, the proxies will be voted in

favor of the election of a substitute nominee or nominees proposed by our Board. Each nominee has agreed to serve if elected and

our Board has no reason to believe that any nominee will be unable to serve.

Information about Director Nominees

Set forth below is

biographical information for each nominee and a summary of the specific qualifications, attributes, skills and experiences which

led our Board to conclude that each nominee should serve on our Board at this time. There are no family relationships among any

of the directors or executive officers of the Company.

Stephen R. Clarke

is

a co-founder of our company and has served as our president, chief executive officer and chairman of our board directors since

inception in June 2014. From May 2013 to June 2014, Dr. Clarke, along with Mr. Mould and others, engaged in research and development

that ultimately lead to their development of the AquaRefining process. From 2008 to May 2013, Dr. Clarke was employed as the chief

executive officer of Applied Intellectual Capital, Ltd., an Isle of Jersey company co-founded by Dr. Clarke in 1999 to engage in

the business of incubating and developing electro-chemical technologies. Dr. Clarke holds a Ph.D. in computer simulation and manufacturing

management from The University of Aston, UK, a BSc in mechanical engineering from Nottingham Trent University, UK and an MSc/MBA

in engineering enterprise management from The University of Warwick, UK.

Dr. Clarke has extensive

knowledge of the battery industry and electro-chemical technologies from his senior management position with Applied Intellectual

Capital, Ltd. As a result of these and other professional experiences, our board of directors has concluded that Dr. Clarke is

qualified to serve as a director.

Thomas Murphy

is

a co-founder of our company and has served as our chief financial officer and a member of our board directors since inception in

June 2014. From May 2013 to June 2014, Mr. Murphy worked alongside Mr. Clarke and Mr. Mould in the development of the AquaRefining

process and our current business. From September 2009 to May 2013, Mr. Murphy served as chief financial officer of Applied Intellectual

Capital, Ltd. In addition Mr. Murphy has over 30 years’ experience in senior financial positions working in publishing, construction

and aviation industries.

Mr. Murphy has extensive

knowledge of accounting issues and business operations in the markets in which we operate from his experience as chief financial

officer of Applied Intellectual Capital, Ltd. As a result of these and other professional experiences, our board of directors has

concluded that Mr. Murphy is qualified to serve as a director.

Vincent L. DiVito

has

served as a member of our board of directors since May 2015. Since April 2010, Mr. DiVito has served as the owner and chief executive

officer of Vincent L. DiVito, Inc., a financial and management consulting firm. From January 2008 to April 2010, Mr. DiVito served

as president of Lonza America, Inc., a global life sciences chemical business headquartered in Allendale, New Jersey, and also

served as chief financial officer and treasurer of Lonza America, Inc. from September 2000 to April 2010. Lonza America, Inc. is

part of Lonza Group, whose stock is traded on the Swiss Stock Exchange. From 1990 to September 2000, Mr. DiVito was employed by

Algroup Wheaton, a global pharmaceutical and cosmetics packaging company, first as its director of business development and later

as its vice president and chief financial officer. Mr. DiVito is a certified public accountant and certified management accountant

and is a National Association of Corporate Directors Board Leadership Fellow. He has served on the board of directors and chairman

of the audit committee of Entertainment Gaming Asia Inc., a Nasdaq listed company gaming company, since October 2005 and also served

as a member of the board of directors of Riviera Holdings Corporation, formerly an AMEX listed gaming and resort company, from

July 2002 until the consummation of a change in control of the corporation in March 2011.

Mr. DiVito has extensive

knowledge of accounting and corporate governance issues from his experience serving on various corporate boards of directors and

has extensive operational knowledge as a result of his experience as a senior executive officer of major corporations. As a result

of these and other professional experiences, our board of directors has concluded that Mr. DiVito is qualified to serve as a director.

Mark Slade

has

served as a member of our board of directors since June 2015. Mr. Slade was the chief executive officer and founder of Marex Financial

Ltd, one of Europe’s leading independent commodity brokers, from January 2006 to January 2011. Marex was a member of the

London Metal Exchange, Intercontinental Exchange, The London International Financial Futures and Options Exchange and Eurex Exchange,

with offices in London, Geneva and New York. Since leaving Marex Financial, Mr. Slade has held a number of advisory and executive

roles. From December 2011 to December 2012, he was an advisor on international business development to the Hong Kong Mercantile

Exchange. From January 2013 to July 2013, Mr. Slade was chief executive officer of London Capital Group. Since January 2015, Mr.

Slade has served as an advisor on strategy and business development to Tower Trading Group Ltd. In addition to his corporate roles,

Mr. Slade also held a number of board and committee appointments within the commodity futures industry, including being a board

member of the London Metal Exchange (1999 – 2006) and the Futures and Options Association (2005-2008).

Mr. Slade has extensive

knowledge of the metals and other commodity markets from his experience serving as a senior executive officer and consultant to

commodity trading and brokerage firms. As a result of these and other professional experiences, our board of directors has concluded

that Mr. Slade is qualified to serve as a director.

Mark Stevenson

is a nominee to serve as a member of our board of directors. Mr. Stevenson was the technical marketing director – Asia for

Ecobat Technologies Ltd., a global company that produces and recycles lead, from March 2010 to April 2016. He currently serves

as Technical Director for Global Lead Technologies and is a non-executive director for Metallic Waste Solutions, trading as Metsol

Pty Ltd, a start-up company. He also serves as chairman and organizer of the two Asian battery and international secondary lead

conferences held biennially across Asia.

Mr. Stevenson has extensive

knowledge of the metals and other commodity markets from his experience serving as an executive officer, director and consultant

to businesses in the lead industry. As a result of these and other professional experiences, our board of directors has concluded

that Mr. Stevenson is qualified to serve as a director.

CORPORATE GOVERNANCE

Board Composition

Our board of directors

may establish the authorized number of directors from time to time by resolution. Our board of directors currently consists of

four authorized members.

Generally, under the

listing requirements and rules of the Nasdaq Stock Market, independent directors must comprise a majority of a listed company’s

board of directors. Our board of directors has undertaken a review of its composition, the composition of its committees and the

independence of each director. Our board of directors has determined that, other than Mr. Clarke and Mr. Murphy, by virtue of their

executive officer positions, none of our director nominees has a relationship that would interfere with the exercise of independent

judgment in carrying out the responsibilities of a director and that each is “independent” as that term is defined

under the applicable rules and regulations of the SEC and the listing requirements and rules of the Nasdaq Stock Market. In making

this determination, our board of directors considered the current and prior relationships that each nonemployee director nominee

has with our company and all other facts and circumstances our board of directors deemed relevant in determining their independence,

including the beneficial ownership of our capital stock by each nonemployee director nominee. Accordingly, while only 50% of our

directors are independent, as required under applicable Nasdaq Stock Market rules, as of the date of this proxy statement, upon

the appointment of the directors nominated for election at the Annual Meeting, a majority of our board will be independent under

the Nasdaq Stock Market Rules.

Committees of the Board of Directors

Our board of directors

has established an audit committee, a compensation committee, and a nominating and corporate governance committee. Our board of

directors may establish other committees to facilitate the management of our business. The composition and functions of each committee

are described below. Members serve on these committees until their resignation or until otherwise determined by our board of directors.

Audit Committee

Our audit committee

consists of Vincent DiVito and Mark Slade, with Mr. DiVito serving as Chairperson. The composition of our audit committee meets

the requirements for independence under current Nasdaq Stock Market listing standards and SEC rules and regulations, except that

standards and regulations require that we have three members, on our audit committee whereas we currently only have two members.

We intend to appoint Mark Stevenson to our audit committee upon his election to the Board. Each member of our audit committee and

Mr. Stevenson meets the financial literacy requirements of the Nasdaq Stock Market listing standards. Mr. DiVito is an audit committee

financial expert within the meaning of Item 407(d) of Regulation S-K under the Securities Act of 1933, as amended, or the Securities

Act. Our audit committee will, among other things:

|

|

•

|

select a qualified firm to serve as the independent registered public accounting firm to audit our financial statements;

|

|

|

•

|

discuss the scope and results of the audit with the independent registered public accounting firm, and review, with management and the independent registered public accounting firm, our interim and year-end operating results;

|

|

|

•

|

develop procedures for employees to submit concerns anonymously about questionable accounting or audit matters;

|

|

|

•

|

review our policies on risk assessment and risk management;

|

|

|

•

|

review related-party transactions; and

|

|

|

•

|

approve (or, as permitted, pre-approve) all audit and all permissible nonaudit services, other than de minimis nonaudit services, to be performed by the independent registered public accounting firm.

|

Our audit committee

operates under a written charter that satisfies the applicable rules of the SEC and the listing standards of the Nasdaq Stock Market.

Compensation Committee

Our compensation committee

consists of Mark Slade and Vincent DiVito, with Mr. Slade serving as Chairperson. The composition of our compensation committee

meets the requirements for independence under the Nasdaq Stock Market listing standards and SEC rules and regulations. Each member

of the compensation committee is also a nonemployee director, as defined pursuant to Rule 16b-3 promulgated under the Exchange

Act, and an outside director, as defined pursuant to Section 162(m) of the Internal Revenue Code of 1986, as amended, or the Code.

The purpose of our compensation committee is to discharge the responsibilities of our board of directors relating to compensation

of our executive officers. Our compensation committee will, among other things:

|

|

•

|

review, approve and determine the compensation of our executive officers;

|

|

|

•

|

administer our stock and equity incentive plans;

|

|

|

•

|

make recommendations to our board of directors regarding the establishment and terms of incentive compensation and equity plans; and

|

|

|

•

|

establish and review general policies relating to compensation and benefits of our employees.

|

Our compensation committee

operates under a written charter that satisfies the applicable rules of the SEC and the listing standards of the Nasdaq Stock Market.

Nominating and Corporate Governance

Committee

Our nominating and

corporate governance committee consists of Vincent DiVito and Mark Slade. The composition of our nominating and corporate governance

committee meets the requirements for independence under Nasdaq Stock Market listing standards and SEC rules and regulations. Our

nominating and corporate governance committee will, among other things:

|

|

•

|

identify, evaluate and make recommendations to our board of directors regarding nominees for election to our board of directors and its committees;

|

|

|

•

|

evaluate the performance of our board of directors and of individual directors;

|

|

|

•

|

consider and make recommendations to our board of directors regarding the composition of our board of directors and its committees;

|

|

|

•

|

review developments in corporate governance practices;

|

|

|

•

|

evaluate the adequacy of our corporate governance practices and reporting; and

|

|

|

•

|

develop and make recommendations to our board of directors regarding corporate governance guidelines and matters.

|

The nominating and

corporate governance committee operates under a written charter that satisfies the applicable listing requirements and rules of

the Nasdaq Stock Market.

Compensation Committee Interlocks and

Insider Participation

None of our independent

directors, Vincent L. DiVito or Mark Slade, or Mark Stevenson is currently or has been at any time one of our officers or employees.

None of our executive officers currently serves, or has served during the last year, as a member of the board of directors or compensation

committee of any entity that has one or more executive officers serving as a member of our board of directors.

Code of Conduct

We have adopted a code

of conduct for all employees, including the chief executive officer, principal financial officer and principal accounting officer

or controller, and/or persons performing similar functions, which is available on our website, under the link entitled “Code

of Conduct”.

PROPOSAL NO. 2

RATIFICATION OF APPOINTMENT OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee

has appointed Armanino LLP (which we refer to as “Armanino”) as our independent registered public accounting firm for

the year ending December 31, 2016, and our Board has directed that management submit the appointment of Armanino as our independent

registered public accounting firm for ratification by the stockholders at the Annual Meeting. A representative of Armanino is expected

to be present at the Annual Meeting and will have an opportunity to make a statement if he or she so desires and will be available

to respond to appropriate questions.

Stockholder ratification

of the selection of Armanino as our independent registered public accountants is not required by our Bylaws or otherwise. However,

our Board is submitting the appointment of Armanino to the stockholders for ratification as a matter of corporate practice. If

the stockholders fail to ratify the appointment, the Audit Committee will reconsider whether or not to retain Armanino. Even if

the selection is ratified, the Audit Committee, in its discretion, may direct the appointment of a different independent registered

public accountant at any time during the year if the Audit Committee determines that such a change would be in the Company’s

and our stockholders’ best interests.

Board Recommendation

OUR BOARD RECOMMENDS A VOTE “FOR”

THE RATIFICATION OF Armanino LLP

AS

OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

FOR

the fiscal year ending December 31, 2016.

Fees Incurred for Services by Principal Accountant

The following table

sets forth the aggregate fees billed to us for services rendered to us for the year ended December 31, 2015 and the period from

inception (June 20, 2014) to December 31, 2014 by our independent registered public accounting firm, Armanino LLP, for the audit

of our consolidated financial statements for the years ended December 31, 2015 and 2014, and assistance with the reporting

requirements thereof, the review of our condensed consolidated financial statements included in our quarterly reports on Form 10-Q,

the filing of our Form 8-K, and preparation of (Federal and State) Income Tax returns.

|

|

|

2015

|

|

|

2014

|

|

|

Audit Fees

|

|

$

|

203,250

|

|

|

$

|

37,461

|

|

|

Audit - Related Fees

|

|

|

7,826

|

|

|

|

-

|

|

|

Tax Fees

|

|

|

15,536

|

|

|

|

20,345

|

|

|

|

|

$

|

226,612

|

|

|

$

|

57,806

|

|

Pre-Approval Policies and Procedures

The Audit Committee

has responsibility for selecting, appointing, evaluating, compensating, retaining and overseeing the work of the independent registered

public accounting firm. In recognition of this responsibility, the Audit Committee has established policies and procedures in its

charter regarding pre-approval of any audit and non-audit service provided to the Company by the independent registered public

accounting firm and the fees and terms thereof.

The Audit Committee

considered the compatibility of the provision of other services by its registered public accountant with the maintenance of their

independence. The Audit Committee approved all audit and non-audit services provided by Armanino in 2015 and 2014.

Audit Committee Report

The Audit Committee

issued the following report for inclusion in this Proxy Statement and our 2015 Annual Report.

|

|

1.

|

The Audit Committee has reviewed and discussed the audited consolidated financial statements for

the year ended December 31, 2015 with management of Aqua Metals, Inc. and with Aqua Metals, Inc.’s independent registered

public accounting firm, Armanino LLP.

|

|

|

2.

|

The Audit Committee has discussed with Armanino LLP those matters required by Statement on Auditing

Standards No. 16, “Communications with Audit Committee,” as adopted by the Public Company Accounting Oversight Board

(“PCAOB”).

|

|

|

3.

|

The Audit Committee has received and reviewed the written disclosures and the letter from Armanino

LLP required by the PCAOB regarding Armanino LLP’s communications with the Audit Committee concerning the accountant’s

independence, and has discussed with Armanino LLP its independence from Aqua Metals, Inc. and its management.

|

|

|

4.

|

Based on the review and discussions referenced to in paragraphs 1 through 3 above, the Audit Committee

recommended to our Board that the audited consolidated financial statements for the year ended December 31, 2015 be included

in the Annual Report on Form 10-K for that year for filing with the SEC.

|

|

|

AUDIT COMMITTEE

|

|

|

Vincent L. DiVito

|

|

|

Mark Slade

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL

OWNERS AND MANAGEMENT

AND RELATED STOCKHOLDER MATTERS

The following table

sets forth certain information regarding the beneficial ownership of our common stock as of November 23, 2016 by:

|

|

•

|

each person who is known by us to be the beneficial owner of more than five percent (5%) of our issued and outstanding shares of common stock;

|

|

|

•

|

each of our directors, director nominees and executive officers; and

|

|

|

•

|

all directors, director nominees and executive officers as a group.

|

The beneficial ownership

of each person was calculated based on 17,878,725 common shares issued and outstanding as of November 23, 2016. The SEC has defined

“beneficial ownership” to mean more than ownership in the usual sense. For example, a person has beneficial ownership

of a share not only if he owns it, but also if he has the power (solely or shared) to vote, sell or otherwise dispose of the share.

Beneficial ownership also includes the number of shares that a person has the right to acquire within 60 days, pursuant to the

exercise of options or warrants or the conversion of notes, debentures or other indebtedness. Two or more persons might count as

beneficial owners of the same share. Unless otherwise indicated, the address for each reporting person is 1010 Atlantic Avenue,

Alameda, California 94501.

|

Name of Director, Executive Officer or Director Nominees

|

|

Number of

Shares

|

|

|

Percentage

Owned

|

|

|

|

|

|

|

|

|

|

|

|

|

Stephen R. Clarke

|

|

|

1,786,115

|

(1)

|

|

|

10.0

|

%

|

|

|

Selwyn Mould

|

|

|

807,703

|

(2)

|

|

|

4.5

|

%

|

|

|

Thomas Murphy

|

|

|

807,703

|

(2)

|

|

|

4.5

|

%

|

|

|

Stephen Cotton

|

|

|

222,824

|

(3)

|

|

|

1.2

|

%

|

|

|

Vincent L. DiVito

|

|

|

22,247

|

(4)

|

|

|

*

|

%

|

|

|

Mark Slade

|

|

|

45,796

|

(5)

|

|

|

*

|

%

|

|

|

Mark Stevenson

|

|

|

—

|

|

|

|

—

|

%

|

|

|

Directors, nominees and executive officers as a group

|

|

|

3,515,793

|

|

|

|

19.7

|

%

|

|

* Less than 1%.

|

Name and Address of 5% + Holders

|

|

Number of

Shares

|

|

|

Percentage

Owned

|

|

|

|

|

|

|

|

|

|

|

|

|

Interstate Emerging Investments, LLC

|

|

|

3,711,872

|

(6)

|

|

|

17.8

|

%

|

|

Jeff Feinberg Personal Trust

|

|

|

1,156,102

|

|

|

|

6.5

|

%

|

|

AWM Investment Co.

|

|

|

1,453,350

|

|

|

|

8.1

|

%

|

|

1

|

Includes 24,918 shares underlying a presently exercisable option. Also, includes 732,560 common shares held by AIC Nevada, Inc. Mr. Clarke is a director and 19% shareholder of AIC Nevada, Inc. and, therefore, is considered to be the beneficial owner of all AIC Nevada shares under the SEC reporting rules. However, Mr. Clarke disclaims beneficial ownership of the AIC Nevada shares except to the extent of his pecuniary interest therein.

|

|

2

|

Includes 22,248 shares underlying a presently exercisable option.

|

|

3

|

Includes 117,703 shares underlying a presently exercisable option and excludes 190,909 shares underlying options subject to vesting.

|

|

4

|

Includes 22,247 shares underlying a presently exercisable option and excludes 14,569 shares underlying an outstanding option subject to vesting.

|

|

5

|

Includes 18,296 shares underlying a presently exercisable option and excludes 11,655 shares underlying an outstanding option subject to vesting.

|

|

6

|

Consists of (i) 702,247 shares of common stock, (ii) 2,307,378 shares of common stock underlying presently exercisable warrants, and (iii) 702,247 shares of common stock underlying a presently convertible term note.

|

EXECUTIVE OFFICERS AND COMPENSATION

Executive Officers

The following sets

forth information regarding the current executive officers of the Company. Biographical information pertaining to Stephen R. Clarke

and Thomas Murphy, each of whom is both a director and an executive officer of the Company, may be found in the section above entitled

“Proposal No. 1, Election of Directors—Information About Director Nominees.”

|

Name

|

|

Age

|

|

Position

|

|

|

|

|

|

|

|

Stephen R. Clarke

|

|

59

|

|

President, Chief Executive Officer and Chairman of the Board

|

|

Thomas Murphy

|

|

64

|

|

Chief Financial Officer and Director

|

|

Selwyn Mould

|

|

56

|

|

Chief Operating Officer

|

|

Stephen Cotton

|

|

50

|

|

Chief Commercial Officer

|

Selwyn Mould

is a co-founder of our company and has served as our chief operating officer since inception in June 2014. From May 2013 to June

2014, Mr. Mould, along with Mr. Clarke and others, engaged in research and development that ultimately lead to their development

of the AquaRefining process. From 2008 to May 2013, Mr. Mould served as chief operating officer of Applied Intellectual Capital,

Ltd. From 1999 to 2007, Mr. Mould served as head of supply chain for Group Lotus Plc, the sports car manufacturer and engineering

consultant. Prior to that he was head of logistics for Pilkington Plc. In his earlier career, Mr. Mould was a production manager

for Chloride Industrial Batteries Ltd. Mr. Mould holds an MA in natural sciences from the University of Cambridge with a major

in chemistry.

Stephen Cotton

has served as our chief commercial officer since January 2015. Mr. Cotton co-founded Canara, Inc. in December 2001 and served as

its chief executive officer through the sale of the company to a private equity firm in June 2012, after which he served as executive

chairman until April 2014. Canara is a global provider of stationary battery systems with integrated monitoring systems and cloud-based

monitoring services to many of the largest data center operators. From April 2014 to January 2015, Mr. Cotton managed his private

investments.

Summary Compensation Table

The following table

sets forth the compensation awarded to, earned by or paid to, our executive officers for the years ended December 31, 2015 and

2014. In reviewing the table, please note that:

|

|

•

|

We commenced operations in June 2014 and commenced paying compensation to our executive officers in August 2014; and

|

|

|

•

|

Mr. Cotton commenced his employment with us in January 2015.

|

Name and

Principal

Position

|

|

Year

|

|

|

Salary

|

|

|

Bonus

|

|

|

Stock

Awards

|

|

|

Option

Awards

|

|

|

All Other

Compensation

|

|

|

Total

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stephen Clarke,

CEO

|

|

|

2015

|

|

|

$

|

280,000

|

|

|

$

|

70,000

|

|

|

|

|

|

|

$

|

70,000

|

|

|

|

|

|

|

$

|

420,000

|

|

|

|

|

|

2014

|

|

|

$

|

131,167

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

$

|

131,167

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selwyn Mould,

COO

|

|

|

2015

|

|

|

$

|

250,000

|

|

|

$

|

62,500

|

|

|

|

|

|

|

$

|

62,500

|

|

|

|

|

|

|

$

|

375,000

|

|

|

|

|

|

2014

|

|

|

$

|

119,167

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

$

|

119,167

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Thomas Murphy,

CFO

|

|

|

2015

|

|

|

$

|

250,000

|

|

|

$

|

62,500

|

|

|

|

|

|

|

$

|

62,500

|

|

|

|

|

|

|

$

|

375,000

|

|

|

|

|

|

2014

|

|

|

$

|

106,667

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

$

|

106,667

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stephen Cotton,

CCO

|

|

|

2015

|

|

|

$

|

239,583

|

|

|

$

|

62,500

|

|

|

|

|

|

|

$

|

629,526

|

|

|

|

|

|

|

$

|

931,609

|

|

|

|

|

|

2014

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

The dollar amounts in the Option Awards

column above reflect the values of options as of the grant date for the years ended December 31, 2015 and 2014, in accordance with

ASC 718,

Compensation-Stock Compensation

and, therefore, do not necessarily reflect actual benefits received by the individuals.

Assumptions used in the calculation of these amounts are included in Note 12 to our audited financial statements for the year ended

December 31, 2015.

Narrative Disclosure to Summary Compensation Table

We have entered into

executive employment agreements with each of our executive officers. Pursuant to the employment agreements, effective as of July

2016, we compensate our executive officers at the annual rate of $410,000 for Dr. Clarke, $400,000 for Mr. Mould and $380,000

for Messrs. Murphy and Cotton. The employment agreements entitle each officer to reasonable and customary health insurance and

other benefits, at our expense, and a severance payment in the amount of two-times their then annual salary and related benefits

in the event of our termination of their employment without cause or their resignation for good reason. Each employment agreement

provides for intellectual property assignment and confidentiality provisions that are customary in our industry.

In April 2015, we granted

Mr. Cotton options to purchase 286,364 shares of our common stock over a five-year period at an exercise price of $3.56 per share.

Mr. Cotton’s options vest and first become exercisable over a three-year period commencing on the first anniversary of the

date of grant. Mr. Cotton’s options were granted pursuant to our 2014 Stock Incentive Plan.

In December 2015, the

compensation committee of our board of directors approved performance-based bonuses for each of our executive officers in the amount

of 50% of their base annual salary, of which 50% was paid in cash and 50% payable in option grants under our 2014 Stock Incentive

Plan. Pursuant to the compensation committee’s determination, we awarded:

|

|

·

|

Dr. Clarke a bonus in the amount of $140,000, consisting of $70,000 of cash and an option to purchase 24,918 shares of our common stock at an exercise price of $5.07 per share; and

|

|

|

·

|

Messrs. Murphy, Mould and Cotton, each, a bonus in the amount of $125,000, consisting of $62,500 of cash and an option to purchase 22,248 shares of our common stock at an exercise price of $5.07 per share.

|

The number of option

shares for each officer was calculated pursuant to a Black-Scholes Merton calculation of 50% of the bonus amount as of December

17, 2015, however the options were not formally granted until January 8, 2016. The options have a term of five years and first

become exercisable on July 30, 2016.

Outstanding Equity Awards at December 31, 2015

|

Option Awards

|

|

Name (a)

|

|

|

Number of

Securities

Underlying

Unexercised

Options (#)

Exercisable

(b)

|

|

|

|

Number of

Securities

Underlying

Unexercised

Options (#)

Unexercisable

(c)

|

|

|

|

Equity

Incentive

Plan

Awards:

Number of

Securities

Underlying

Unexercised

Unearned

Options (#)

(d)

|

|

|

|

Option

Exercise

Price

(e)

|

|

|

Option

Expiration

Date

(mm/dd/yyyy)

(f)

|

|

Steve Cotton

|

|

|

95,455

|

|

|

|

190,909

|

|

|

|

—

|

|

|

$

|

3.56

|

|

|

04/01/2020

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Compensation of Directors

We do not compensate

any of our executive directors for their service as a director and we have not adopted any policies or plans with regard to the

compensation of our independent directors. However, in connection with the appointment of our current independent directors, we

agreed to compensate each of the independent directors as follows:

|

|

•

|

We have granted Vincent DiVito options to purchase 21,853 shares of our common stock over a five-year period at an exercise price of $3.56 per share and agreed to pay him annually cash in the amount of $60,000, which was increased to $120,000 effective as of July 2016;

|

|

|

•

|

We have granted Mark Slade and a former director, Stan Kimmel, options to purchase 17,482 shares of our common stock over a five-year period at an exercise price of $3.56 per share and agreed to pay each annually cash in the amount of $50,000, which was increased to $100,000 for Mr. Slade effective as of July 2016; and

|

|

|

|

We have agreed to make an annual grant to Mr DiVito and Mr. Slade of options to purchase a number of shares of our common shares equal to $60,000 and $50,000, respectively, based on a Black Scholes valuation, at an exercise price equal to the fair market value of our common stock on the date of grant.

|

The directors’

options were granted pursuant to our 2014 Stock Incentive Plan. The options vest and first become exercisable over a three-year

period commencing one year from the date of grant. The above-described cash payments are in lieu of attendance fees, however we

intend to reimburse our independent directors for their reasonable expenses incurred in connection with attending meetings of our

board of directors.

The following table

sets forth the compensation we paid to our independent directors during the year ended December 31, 2015

|

Name

|

|

Cash

Compensation

|

|

|

Option

Awards

|

|

|

Total

|

|

|

Vincent DiVito

|

|

$

|

40,000

|

|

|

$

|

43,382

|

|

|

$

|

83,382

|

|

|

Stan Kimmel

|

|

$

|

34,233

|

|

|

$

|

34,704

|

|

|

$

|

68,937

|

|

|

Mark Slade

|

|

$

|

27,500

|

|

|

$

|

34,827

|

|

|

$

|

62,327

|

|

Mr. Kimmel served on our board of directors

from May 2015 until his passing in March 2016. The dollar amounts in Option Awards column above reflect the values of options as

of the grant date in accordance with ASC 718,

Compensation-Stock Compensation

and, therefore, do not necessarily reflect

actual benefits received by the individuals. Assumptions used in the calculation of these amounts are included in Note 12 to our

audited financial statements for the year ended December 31, 2015.

Upon his appointment

to the board, we intend to compensate Mark Stevenson with a grant of options to purchase a number of shares of our common shares

equal to $50,000, based on a Black Scholes valuation, at an exercise price equal to the fair market value of our common stock on

the date of grant. We also intend to pay him annually cash in the amount of $100,000.

CERTAIN RELATIONSHIPS AND RELATED PARTY

TRANSACTIONS

Related Party Transactions, Promoters and Director Independence

We have not entered

into any transactions with any of our directors, officers, beneficial owners of five percent or more of our common shares, any

immediate family members of the foregoing or entities of which any of the foregoing are also officers or directors or in which

they have a material financial interest, other than the compensatory arrangements described elsewhere in this proxy statement.

We have adopted a policy

that any transactions with directors, officers, beneficial owners of five percent or more of our common shares, any immediate family

members of the foregoing or entities of which any of the foregoing are also officers or directors or in which they have a financial

interest, will only be on terms consistent with industry standards and approved by a majority of the disinterested directors of

our board.

OTHER MATTERS

Section 16(A) Beneficial Ownership Reporting Compliance

Rules adopted by the

SEC under Section 16(a) of the Securities Exchange Act of 1934, or the Exchange Act, require our officers and directors, and persons

who own more than 10% of the issued and outstanding shares of our equity securities, to file reports of their ownership, and changes

in ownership, of such securities with the SEC on Forms 3, 4 or 5, as appropriate. Such persons are required by the regulations

of the SEC to furnish us with copies of all forms they file pursuant to Section 16(a).

Based solely upon a

review of Forms 3, 4 and 5 and amendments thereto furnished to us during our most recent fiscal year, and any written representations

provided to us, we believe that all of the officers, directors, and owners of more than 10% of the outstanding shares of our common

stock complied with Section 16(a) of the Exchange Act for the year ended December 31, 2015.

Stockholder Proposals and Director Nominations for 2017 Annual

Meeting

For any proposal to

be considered for inclusion in our proxy statement and form of proxy for submission to the stockholders at our 2017 annual meeting,

it must be submitted in writing and comply with the requirements of Rule 14a-8 of the Securities Exchange Act of 1934. Such proposals

must be received by the Company at its offices at 1010 Atlantic Avenue, Alameda, California 94501 within a reasonable time before

we print and mail the proxy materials. Our board of directors will review any proposals from eligible stockholders that it receives

by that date and will make a determination whether any such proposals will be included in our proxy materials. Any proposal received

after that date shall be considered untimely and shall not be made a part of our proxy materials.

A stockholder who

wishes to make a proposal at the next annual meeting without including the proposal in our proxy statement must also notify us

within a reasonable time before we print and mail the proxy materials. If a stockholder fails to give reasonable advance notice,

then the persons named as proxies in the proxies solicited by us for the next annual meeting will have discretionary authority

to vote on the proposal.

Householding of Proxy Materials

The SEC has adopted

rules that permit companies and intermediaries (such as banks and brokers) to satisfy the delivery requirements for proxy statements

and annual reports with respect to two or more stockholders sharing the same address by delivering a single proxy statement addressed

to those stockholders. This process, which is commonly referred to as “householding,” potentially means extra convenience

for stockholders and cost savings for companies.

This year, a number

of banks and brokers with account holders who are our stockholders will be householding our proxy materials. A single proxy statement

will be delivered to multiple stockholders sharing an address unless contrary instructions have been received from the affected

stockholders. Once you have received notice from your bank or broker that it will be householding communications to your address,

householding will continue until you are notified otherwise or until you revoke your consent. If, at any time, you no longer wish

to participate in householding and would prefer to receive a separate proxy statement and annual report, please notify your bank

or broker, direct your written request to Aqua Metals, Inc., 1010 Atlantic Avenue, Alameda, California 94501, Attention: Investor

Relations, or contact Investor Relations by telephone at (303) 268-8398. Stockholders who currently receive multiple copies of

the proxy statement at their address and would like to request householding of their communications should contact their bank or

broker.

Other Matters

We

will also consider any other business that properly comes before the annual meeting, or any adjournment or postponement thereof.

As of the record date, we are not aware of any other matters to be submitted for consideration at the annual meeting. If any other

matters are properly brought before the annual meeting, the persons named on the enclosed proxy card will vote the shares they

represent using their best judgment.

Incorporation by Reference

Notwithstanding anything

to the contrary set forth in any of our previous filings under the Securities Act of 1933, as amended, or the Exchange Act, which

might incorporate future filings made by us under those statutes, the preceding Audit Committee Report will not be incorporated

by reference into any of those prior filings, nor will any such report be incorporated by reference into any future filings made

by us under those statutes. In addition, information on our website, other than our proxy statement, notice and form of proxy,

is not part of the proxy soliciting materials and is not incorporated herein by reference.

|

|

By Order of the Board of Directors

|

|

|

|

|

|

Dr. Stephen R. Clarke

|

|

|

Chairman of the Board of Directors,

|

|

|

President and Chief Executive Officer

|

Alameda, California

November 23, 2016

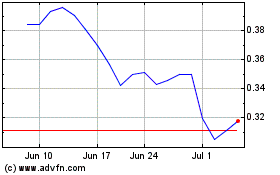

Aqua Metals (NASDAQ:AQMS)

Historical Stock Chart

From Mar 2024 to Apr 2024

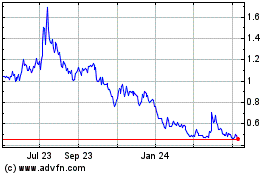

Aqua Metals (NASDAQ:AQMS)

Historical Stock Chart

From Apr 2023 to Apr 2024