Current Report Filing (8-k)

November 15 2016 - 4:33PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) November 15, 2016

U.S. AUTO PARTS NETWORK, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

001-33264

|

|

68-0623433

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

16941 Keegan Avenue, Carson, CA 90746

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code (310) 735-0085

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 1.01. Entry into a Material Definitive Agreement.

Amendment to Credit Agreement and Security Agreement

On November 15, 2016, U.S. Auto Parts Network, Inc. (the “

Company

”), certain of its domestic subsidiaries and JPMorgan Chase Bank, N.A. (“

JPMorgan

”) entered into a Tenth Amendment to Credit Agreement and Fourth Amendment to Pledge and Security Agreement (the “

Amendment

”), which amended the Credit Agreement previously entered into by the Company, certain of its domestic subsidiaries and JPMorgan on April 26, 2012 (as amended, the “

Credit Agreement

”) and the Pledge and Security Agreement previously entered into by the Company, certain of its domestic subsidiaries and JPMorgan on April 26, 2012 (as amended, the “

Security Agreement

”).

Pursuant to the Amendment, the maturity date of the Credit Agreement was extended from April 26, 2017 through April 26, 2020. The following amendments to the Credit Agreement and Security Agreement were also made:

|

|

|

|

•

|

The aggregate principal amount of indebtedness that is permitted related to capital leases was increased from $2,000,000 to $3,500,000.

|

|

|

|

|

•

|

The Company’s letters of credit exposure was increased from $15,000,000 to $20,000,000.

|

|

|

|

|

•

|

Under the terms of the Security Agreement, cash receipts are deposited into a lock-box, which are at the Company’s discretion unless the “cash dominion period” is in effect, during which cash receipts will be used to reduce amounts owing under the Credit Agreement. The cash dominion period is triggered in an event of default or if excess availability is less than the $3,600,000 for three consecutive business days, and will continue until, during the preceding 60 consecutive days, no event of default existed and excess availability has been greater than $3,600,000 at all times (with the trigger subject to adjustment based on the Company’s revolving commitment).

|

|

|

|

|

•

|

The Company’s required excess availability related to the “Covenant Testing Trigger Period” (as defined under the Credit Agreement) under the revolving commitment under the Credit Agreement is less than $2,400,000 for the period commencing on any day that excess availability is less than $2,400,000 for three consecutive business days, and continuing until excess availability has been greater than or equal to $2,400,000 at all times for 45 consecutive days (with the trigger subject to adjustment based on the Company’s revolving commitment).

|

|

|

|

|

•

|

The trigger, requiring the Company to provide certain reports under the Credit Agreement, relating to excess availability under the revolving commitment under the Credit Agreement is less than $3,600,000 for the period commencing on any day that excess availability is less than $3,600,000 for three consecutive business days, and continuing until excess availability has been greater than or equal to $3,600,000 at all times for 45 consecutive days (with the trigger subject to adjustment based on the Company’s revolving commitment).

|

The foregoing description of the terms of the Amendment is qualified in its entirety by reference to the Amendment, which is attached hereto as Exhibit 10.1.

Item 7.01. Regulation FD Disclosure.

On November 15, 2016, the Company also issued a press release reporting that the Company entered into the Amendment to the Credit Agreement and that its Board of Directors approved a share repurchase program which authorizes the Company to purchase up to $5,000,000 of its outstanding shares of common stock. Purchases under the Company’s repurchase program may be made from time to time in the open market, in negotiated transactions off the market, or in such other manner as determined by the Company, including through plans complying with Rule 10b5-1 under the Securities Exchange Act of 1934, as amended. The share repurchase program will expire on March 4, 2017, unless extended or shortened by the Board of Directors.

A copy of the press release is attached hereto as Exhibit 99.1 to this Current Report and is incorporated herein by reference.

|

|

|

|

|

|

Item 9.01

|

Financial Statements and Exhibits

|

(d) Exhibits

|

|

|

|

|

|

|

|

|

|

10.1

|

|

Tenth Amendment to Credit Agreement and Fourth Amendment to Pledge and Security Agreement, dated November 15, 2016, by and among U.S. Auto Parts Network, Inc., certain of its domestic subsidiaries and JPMorgan Chase Bank, N.A.

|

|

99.1

|

|

Press release, dated November 15, 2016, issued by U.S. Auto Parts Network, Inc.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dated: November 15, 2016

|

|

|

|

U.S. AUTO PARTS NETWORK, INC.

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ SHANE EVANGELIST

|

|

|

|

|

|

Name:

|

|

Shane Evangelist

|

|

|

|

|

|

Title:

|

|

Chief Executive Officer

|

EXHIBIT INDEX

|

|

|

|

|

|

|

10.1

|

|

Tenth Amendment to Credit Agreement and Fourth Amendment to Pledge and Security Agreement, dated November 15, 2016, by and among U.S. Auto Parts Network, Inc., certain of its domestic subsidiaries and JPMorgan Chase Bank, N.A.

|

|

99.1

|

|

Press Release, dated November 15, 2016, issued by U.S. Auto Parts Network, Inc.

|

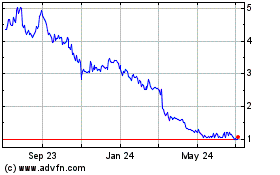

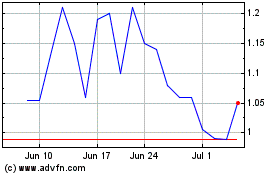

CarParts com (NASDAQ:PRTS)

Historical Stock Chart

From Mar 2024 to Apr 2024

CarParts com (NASDAQ:PRTS)

Historical Stock Chart

From Apr 2023 to Apr 2024