Amended Statement of Beneficial Ownership (sc 13d/a)

November 14 2016 - 6:14AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 13D

(Rule 13d-101)

INFORMATION TO BE INCLUDED IN STATEMENTS

FILED PURSUANT

TO §240.13d-1(a) AND AMENDMENTS THERETO FILED PURSUANT TO

§240.13d-2(a)

(Amendment No. 1)*

Lucas

Energy, Inc.

(Name of Issuer)

Common

Stock, par value $0.001

(Title of Class of Securities)

549333300

(CUSIP Number)

Alan W. Dreeben

200 Patterson, #1008

San Antonio, Texas 78209

Telephone: (210) 824-2507

(Name, Address and Telephone Number of

Person Authorized to

Receive Notices and Communications)

November

4, 2016

(Date of Event which Requires Filing of

this Statement)

If the filing person

has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing

this schedule because of Rule 13d-1(e), 13d-1(f) or 13d-1(g), check the following box: ☐

Note

: Schedules

filed in paper format shall include a signed original and five copies of the schedule, including all exhibits.

See

Rule

13d-7 for other parties to whom copies are to be sent.

________________

*

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to

the subject class of securities, and for any subsequent amendment containing information which would alter the disclosures provided

in a prior cover page.

The information required in the remainder

of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of

1934 or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act

(however,

see

the

Notes

).

CUSIP: 549333300

|

1.

|

NAMES OF REPORTING PERSONS

Alan W. Dreeben

|

|

2.

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS)

|

(a)

|

☐

|

|

(b)

|

☐

|

|

3.

|

SEC USE ONLY

|

|

4.

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

OO

|

|

5.

|

Check box if disclosure of legal proceedings is required

pursuant to item 2(

d

) or 2(

e

)

|

|

6.

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United States

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7.

|

SOLE VOTING POWER

|

2,109,794 shares of Common Stock (includes 314,160 shares issuable upon conversion of Series B Redeemable Convertible Preferred Stock)

|

|

8.

|

SHARED VOTING POWER

|

0

|

|

9.

|

SOLE DISPOSITIVE POWER

|

2,109,794 shares of Common Stock (includes 314,160 shares issuable upon conversion of Series B Redeemable Convertible Preferred Stock)

|

|

10.

|

SHARED DISPOSITIVE POWER

|

0

|

|

11.

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,109,794 shares of Common Stock (includes 314,160 shares issuable upon conversion of Series B Redeemable Convertible Preferred Stock)

|

|

12.

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES

CERTAIN SHARES (SEE INSTRUCTIONS)

|

☐

|

|

13.

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

11%

|

|

14.

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

IN

|

|

|

|

|

|

|

|

|

|

CUSIP: 549333300

Item 1.

Security and Issuer.

This Amendment No. 1 to Schedule 13D

(“Amendment No. 1”) relates to the shares of common stock, par value $0.001 per share (“Common Stock”),

of Lucas Energy, Inc., a Nevada corporation (the “Issuer”), and amends the Schedule 13D filed on September 7, 2016

(the ”Schedule 13D”). The principal executive offices of the Issuer are 450 Gears Road, Suite 860, Houston, Texas

77067.

This Amendment No. 1 is being filed by

Alan W. Dreeben (the “Reporting Person”) to furnish the additional information set forth herein. Except as specifically

provided herein, this Amendment No. 1 does not modify any of the information previously reported in the Schedule 13D.

Item 2.

Identity and Background.

All information in Item 2 of the Schedule

13D remains the same.

Item 3.

Source and Amount of Funds or Other Consideration.

Item 3 of the Schedule 13D is hereby

amended by adding the following:

The shares acquired by the Reporting

Person since the Schedule 13D was filed were acquired in a private purchase.

Item 4.

Purpose of the Transaction.

All information in Item 4 of the Schedule 13D remains the

same.

Item 5.

Interest in Securities of the Issuer.

Item 5 of the Schedule 13D is hereby amended and restated

in its entirety as follows:

|

|

(a)

|

The Reporting Person is the beneficial owner of 2,109,794 shares of Common Stock which represents

11% of the Common Stock. This amount includes 314,160 shares issuable upon conversion of Series B Redeemable Convertible Preferred

Stock (the “Series B Preferred Stock”).

|

The Series B Preferred Stock

has a face value of $25 per share and is convertible into Common Stock at a rate of 7.14:1, at the option of the holder thereof,

or, at the option of the holder thereof, or automatically as to 25% of the Series B Preferred Stock shares if the Common Stock

trades above $6.125 per share for at least 20 consecutive trading days, and trades with at least 75,000 shares of average volume

per day (the “Trading Requirements”); an additional 50% if the Common Stock trades above $7.00 per share and meets

the Trading Requirements; and as to the remaining Series B Preferred Stock shares, if the Common Stock trades above $7.875 per

share and meets the Trading Requirements. Each outstanding share of Series B Preferred Stock is entitled to one vote per share

on all stockholder matters. The Series B Preferred Stock is redeemable at any time by the Issuer upon the payment by the Issuer

of the face amount of the Series B Preferred Stock ($25 per share) plus any and all accrued and unpaid dividends thereon

CUSIP: 549333300

|

|

(b)

|

The Reporting Person has the sole power to vote or to direct the vote of and the sole power to

dispose of or to direct the disposition of 2,109,794 shares of Common Stock. The Reporting Person shares the power to vote or to

direct the vote of or to dispose or to direct the disposition of zero shares of Common Stock.

|

|

|

(c)

|

Except as noted herein, the Reporting Person has not engaged in any transaction involving the Common

Stock during the past 60 days.

|

|

|

(d)

|

No other person has the right to receive or the power to direct the receipt of dividends from or

the proceeds from the sale of the securities beneficially owned by the Reporting Person.

|

Item 6.

Contracts, Arrangements,

Understandings or Relationships with Respect to Securities of the Issuer.

All information in Item 6 of the Schedule 13D remains the

same.

Item 7.

Material to be Filed as Exhibits.

None.

SIGNATURE

After reasonable inquiry and to the best

of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Date: November 14, 2016

|

|

/s/ Alan W. Dreeben

|

|

|

Alan W. Dreeben

|

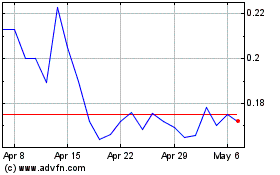

Camber Energy (AMEX:CEI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Camber Energy (AMEX:CEI)

Historical Stock Chart

From Apr 2023 to Apr 2024