SunLink Health Systems, Inc. (NYSE MKT: SSY) today announced net

earnings of $3,023,000 or $0.32 per fully diluted share for its

first fiscal quarter ended September 30, 2016 compared to a net

loss of $1,668,000, or a loss of $0.18 per fully diluted share, for

the quarter ended September 30, 2015. The net earnings in the

current year’s quarter are due to the gain on the previously

announced sale of a subsidiary hospital, Chestatee Regional

Hospital in Dahlonega, GA. The company had a loss from continuing

operations for its first fiscal quarter ended September 30, 2016 of

$1,250,000 or a loss of $0.13 per fully diluted share, compared to

a loss from continuing operations of $1,133,000 or a loss of $0.12

per fully diluted share, for the quarter ended September 30,

2015.

Consolidated net revenues from continuing operations for the

quarters ended September 30, 2016 and 2015 were $13,046,000 and

$16,584,000, respectively, a decrease of 21% in the current year’s

first quarter. Healthcare Facilities Segment net revenues in the

quarter ended September 30, 2016 of $5,455,000 decreased $3,340,000

in the current year’s quarter primarily as a result of the closure

one hospital in June 2016. The Specialty Pharmacy Segment revenues

of $7,341,000 in the quarter ended September 30, 2016 decreased

$226,000, or 5.2%, over the comparable quarter of the prior year

due primarily to lower durable medical equipment revenues.

The company had an operating loss from continuing operations for

the quarter ended September 30, 2016 of $953,000, compared to an

operating loss from continuing operations for the quarter ended

September 30, 2015 of $1,166,000. Despite the lower net revenues

this year, the operating loss decreased due to the closure of an

unprofitable hospital last fiscal year.

Earnings from discontinued operations were $4,273,000 ($0.45 per

fully diluted share) for the quarter ended September 30, 2016

compared to a loss from discontinued operations of $535,000 ($0.06

per fully diluted share) for the quarter ended September 30, 2015,

respectively. The earnings from discontinued operations for the

current year result from a pre-tax gain of $7,246,000 on the August

2016 sale of a subsidiary’s Chestatee Regional Hospital in

Dahlonega, GA.

SunLink Health Systems, Inc. is the parent company of

subsidiaries that own and operate healthcare facilities in the

Southeast and a pharmacy company in Louisiana. Each of the

company’s healthcare facilities is operated locally with a strategy

of linking patients’ needs with dedicated physicians and healthcare

professionals. For additional information on SunLink Health

Systems, Inc., please visit the company’s website at

www.sunlinkhealth.com.

This press release may contain certain statements of a

forward-looking nature. The statements contained herein which are

not historical facts are considered forward-looking statements

under federal securities laws. Such forward-looking statements are

based on the beliefs of our management as well as assumptions made

by and information currently available to them. The company has no

obligation to update such forward-looking statements. Actual

results may vary significantly from these forward-looking

statements.

Adjusted earnings before income taxes,

interest, depreciation and amortization

Earnings before income taxes, interest, depreciation and

amortization (“EBITDA”) represent the sum of income before income

taxes, interest, depreciation and amortization. We understand that

certain industry analysts and investors generally consider EBITDA

to be one measure of the liquidity of the company, and it is

presented to assist analysts and investors in analyzing the ability

of the company to generate cash, service debt and to satisfy

capital requirements. We believe increased EBITDA is an indicator

of improved ability to service existing debt and to satisfy capital

requirements. EBITDA, however, is not a measure of financial

performance under accounting principles generally accepted in the

United States of America and should not be considered an

alternative to net income as a measure of operating performance or

to cash liquidity. Because EBITDA is not a measure determined in

accordance with accounting principles generally accepted in the

United States of America and is thus susceptible to varying

calculations, EBITDA, as presented, may not be comparable to other

similarly titled measures of other corporations. Net cash used in

operations for the three months ended September 30, 2016 and 2015,

respectively, is shown below. Healthcare Facilities Adjusted EBITDA

and Specialty Pharmacy Adjusted EBITDA is the EBITDA for those

facilities without any allocation of corporate overhead, impairment

charges and gains on sale of businesses.

Three Months Ended September

30, 2016 2015

Healthcare Facilties Adjusted EBITDA $ 251,000 $ (317,000 )

Specialty Pharmacy Adjusted EBITDA 62,000 119,000 Corporate

overhead costs (822,000 ) (541,000 ) Taxes and interest expense

(365,000 ) 32,000 Other non-cash expenses and net change in

operating assets and liabilities (2,316,000 )

(108,000 ) Net cash used in operations $ (3,190,000 ) $ (815,000 )

SUNLINK HEALTH SYSTEMS, INC.

ANNOUNCES FISCAL 2017 FIRST QUARTER RESULTS Amounts

in 000's, except per share and volume amounts

CONSOLIDATED STATEMENTS OF EARNINGS

Three Months Ended September

30,

2016

2015 % of Net % of Net Amount

Revenues Amount Revenues

Operating revenues (net of contractual allowances) $ 13,079 100.3 %

$ 17,300 104.3 % Less provision for bad debts of Healthcare

Facilities Segment 33 0.3 % 716

4.3 % Net Revenues 13,046 100.0 % 16,584 100.0 % Costs and

Expenses: Cost of goods sold 4,636 35.5 % 4,597 27.7 % Salaries,

wages and benefits 5,845 44.8 % 8,317 50.2 % Provision for bad

debts of Specialty Pharmacy Segment 91 0.7 % 222 1.3 % Supplies 436

3.3 % 916 5.5 % Purchased services 708 5.4 % 869 5.2 % Other

operating expenses 1,710 13.1 % 2,201 13.3 % Rents and leases 129

1.0 % 201 1.2 % Depreciation and amortization 444

3.4 % 427 2.6 % Operating Loss (953 ) -7.3 %

(1,166 ) -7.0 % Interest Expense - net (221 ) -1.7 % (217 )

-1.3 % Gain on extinguishment of debt 46 0.4 % - 0.0 % Gain (loss)

on sale of assets 22 0.2 % 1 0.0

% Loss from Continuing Operations before Income Taxes (1,106

) -8.5 % (1,382 ) -8.3 % Income Tax Expense (Benefit) 144

1.1 % (249 ) -1.5 % Loss from Continuing

Operations (1,250 ) -9.6 % (1,133 ) -6.8 % Earnings (Loss) from

Discontinued Operations, net of tax 4,273 32.8

% (535 ) -3.2 % Net Earnings (Loss) $ 3,023

23.2 % $ (1,668 ) -10.1 % Loss Per Share from Continuing

Operations: Basic $ (0.13 ) $ (0.12 ) Diluted $ (0.13 ) $ (0.12 )

Earnings (Loss) Per Share from Discontinued Operations: Basic $

0.45 $ (0.06 ) Diluted $ 0.45 $ (0.06 ) Net Earnings

(Loss) Per Share: Basic $ 0.32 $ (0.18 ) Diluted $ 0.32

$ (0.18 ) Weighted Average Common Shares Outstanding: Basic

9,443 9,443 Diluted 9,443

9,443

HEALTHCARE FACILITIES VOLUME

STATISTICS Admissions 124 269 Nursing Home Patient Days

14,433 14,521

SUMMARY BALANCE SHEETS Sept. 30,

June 30, 2016 2016 ASSETS Cash and Cash

Equivalents $ 12,801 $ 3,261 Accounts Receivable - net 5,906 6,166

Other Current Assets 5,331 8,465 Property Plant and Equipment, net

10,692 12,994 Long-term Assets 5,933 13,219

$ 40,663 $ 44,105 LIABILITIES AND

SHAREHOLDERS' EQUITY Current Liabilities $ 14,364 $ 20,051

Long-term Debt and Other Noncurrent Liabilities 3,738 4,565

Shareholders' Equity 22,561 19,489 $

40,663 $ 44,105

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161110006491/en/

SunLink Health Systems, Inc.Robert M. Thornton, Jr.,

770-933-7004Chief Executive Officer

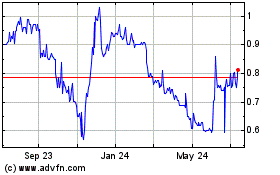

Sunlink Health Systems (AMEX:SSY)

Historical Stock Chart

From Aug 2024 to Sep 2024

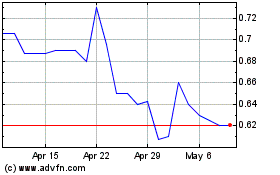

Sunlink Health Systems (AMEX:SSY)

Historical Stock Chart

From Sep 2023 to Sep 2024