Gap October Same-Store Sales Down 1% Due to Fire--Update

November 07 2016 - 6:30PM

Dow Jones News

By Josh Beckerman

Gap Inc., for the second straight month, reported a strong

customer response in October to its Old Navy clothing lines but

weakness at its namesake chain because of a recent warehouse

fire.

In all, the retailer's total same-store sales fell 1% in

October, reflecting a negative effect of about 3 percentage points

from the August fire at its Fishkill, N.Y., distribution

center.

Gap said in prepared remarks, "October merchandise margin rates

actualized significantly higher than previously expected, which

more than offset the estimated earnings impact from lost sales and

increased logistics costs" resulting from the fire.

Gap, which lowered its full-year earnings forecast in August, on

Monday said it expects to report third-quarter earnings excluding

items of 59 cents to 60 cents a share. The company said

third-quarter net sales fell to $3.8 billion from $3.86

billion.

Analysts polled by Thomson Reuters expected earnings of 53 cents

a share on revenue of $3.73 billion.

Gap shares rose 2% to $27.50 in after-hours trading.

In October, the Old Navy chain had a 3% same-store sales

increase, with declines of 7% at Gap and 4% at Banana Republic.

Gap and other established fashion retailers have been hurt by

the popularity of newer brands, such as H&M and Uniqlo, and the

move toward online shopping. Gap has responded to a tough

environment with store-closing plans and merchandise changes.

Last week, Gap said Chief Financial Officer Sabrina Simmons

would leave the company at the end of its fiscal year, after nearly

a decade in the role.

Write to Josh Beckerman at josh.beckerman@wsj.com

(END) Dow Jones Newswires

November 07, 2016 18:15 ET (23:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

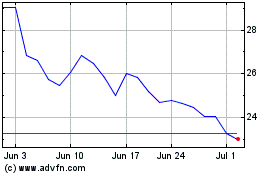

Gap (NYSE:GPS)

Historical Stock Chart

From Aug 2024 to Sep 2024

Gap (NYSE:GPS)

Historical Stock Chart

From Sep 2023 to Sep 2024