By Bradley Olson

Exxon Mobil Corp., under investigation for how it values its oil

and gas wells, on Friday said it may be forced to recognize that

nearly one fifth of its reserves are no longer profitable to

produce, a sign of the toll that low prices are taking on the

giants of the energy industry.

The disclosure came as the as the largest publicly traded oil

producer reported a 38% decline in quarterly profit, the company's

eighth straight quarter of year-over-year declines. Exxon shares

were down 1% to $86.04 late Friday morning.

Some of the world's other big oil companies, including Chevron

Corp. and Statoil ASA, also reported third quarter earnings that

fell well below the same period last year, further evidence that

they face a long recovery as crude trades around $50 a barrel.

Exxon said as much as 4.6 billion barrels of its reserves may

now be unprofitable to produce, according to reserves rules set by

the U.S. Securities and Exchange Commission.

The vast majority of the holdings under scrutiny are in Canada's

oil sands, an area that has been devastated by low prices and

environmental concerns as countries around the world seek to reduce

high-emitting forms of energy -- and where Exxon is believed to be

among the lowest-cost producers. The company also said it plans to

examine its assets to test whether their value should be written

down.

The SEC and New York Attorney General Eric Schneiderman are

investigating Exxon over its accounting practices and how the value

of its future oil and gas wells could be impacted by government

action from climate change.

Rex Tillerson, Exxon's chief executive, said the company's

"operating environment remains challenging," although he and other

big oil executives recently have begun to point to signs of

improvement.

Some environmentalists cheered the news that Exxon was being

forced to re-examine the viability of oil-sands development, which

they have criticized as especially questionable in a world of

rising climate change concerns.

"For the oil sands, this is a tipping point," said Andrew Logan,

director of the oil and gas program at Ceres, a Boston-based

nonprofit that has pushed Exxon and other companies for better

disclosure on the potential impact of climate change on the energy

business.

"Why would any company invest billions of dollars in a new

oil-sands project now, given the near certainty that the world will

be transitioning away from fossil fuels during the decades it will

take for that project to pay back?" he added.

Quarterly profits disclosed this week by Exxon, Chevron, Statoil

and others were generally lower than those in the same period a

year ago. For the last 12-month stretch, they were among the lowest

for the industry in more than 15 years.

Exxon reported a 38% profit decline from the same period last

year, as revenue slid more than expected amid the prolonged swoon

in oil prices. Its third-quarter earnings fell to $2.65 billion, or

63 cents a share, from $4.24 billion, or $1.01 a share, a year

earlier.

The company was hurt by declining profits in its downstream

division, which had previously been a boon amid lower prices for

oil and gas. In the latest quarter, refining and marketing, or

downstream, earnings were $1.2 billion, down from about $2 billion

a year earlier. Exxon slashed its quarterly capital and exploration

spending by 45% from a year ago to $4.19 billion, bringing the

year-to-date decline to 39%.

Chevron, meanwhile, said its quarterly profit fell 35% from a

year earlier to $1.3 billion. Chief Executive John Watson said

third-quarter results, though down from a year ago, improved from

the first two quarters of the year.

The company has cut capital spending and operating and

administrative expenses by more than $10 billion from the first

nine months of 2015 "as a result of a series of deliberate actions

we have taken," he said.

French oil giant Total SA was a positive outlier among the major

oil companies, saying Friday that its third-quarter net profit

nearly doubled from the same period a year earlier, thanks to deep

cost cuts and rising output. Its net profit rose 81% to $1.95

billion over the period, while overall revenue contracted 8% to

$37.41 billion.

"Cost cuts have been accelerated and we will work more on it,"

said Total Chief Financial Officer Patrick de La Chevardière.

Many of the big oil companies are now close to generating enough

cash to pay for dividends and new investment. That is an inflection

point that has been closely watched by investors as a barometer for

a market turnaround.

Further spending reductions have emerged as a peculiar form of

bragging rights, with one company after another rallying after

revealing the success of cost-cutting efforts. ConocoPhillips

shares rose 5% Thursday after the company disclosed plans to cut

spending by an additional $300 million.

Oil giants are looking ahead to 2017 for signs of a modest

recovery. The Organization of the Petroleum Exporting Countries is

weighing an agreement that could continue to prop up prices. Deal

talks are picking up. Several major discoveries have added to

positive sentiment, including a recent Exxon find in Nigeria that

could hold up to a billion barrels.

"The worst is over for the sector," said Brian Youngberg, an

energy analyst with Edward Jones in St. Louis. "It doesn't mean oil

is going to go way up, but conditions are gradually improving as

markets rebalance and the companies reduce spending.

Anne Steele and Selina Williams contributed to this article

Write to Bradley Olson at Bradley.Olson@wsj.com

(END) Dow Jones Newswires

October 28, 2016 13:01 ET (17:01 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

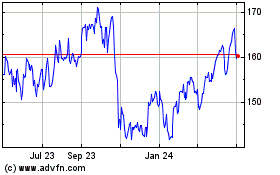

Chevron (NYSE:CVX)

Historical Stock Chart

From Mar 2024 to Apr 2024

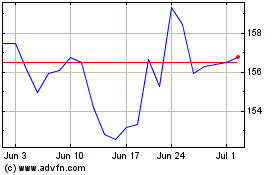

Chevron (NYSE:CVX)

Historical Stock Chart

From Apr 2023 to Apr 2024