- 2016 Group cumulated revenue up 1.3% at

€39.2 billion1 at constant exchange rate

- Continued improvement of pricing power

in Europe

- Start of the product offensive: launch

of Peugeot Expert and Citroën Jumpy in June, Peugeot 3008 in

October and Citroën C3 in November

- Faster international expansion:

partnerships signed in Iran with Iran Khodro for Peugeot and Saipa

for Citroën

- Enlarge customer base: online

multi-brand used vehicle sales and rollout of mobility

services

Regulatory News:

PSA Group (Paris:UG):

Group Q3 2016 revenue totalled €11,404 million,

compared with €12,016 million in Q3 2015. In the first nine months,

Group revenue reached €39,183 million, compared with €40,052

million in 2015, up 1.3% at constant exchange rates.

Automotive division revenue was €7,542 million, compared

with €8,052 million in Q3 2015. Negative exchange rate effects

(-4.7%) were partially offset by the positive price impact (+1.8%),

reflecting the policy of improving the price positioning of the

three brands, Peugeot, Citroën and DS.

Consolidated worldwide sales were up 10.6%2. Ahead of

major product launches in the fourth quarter, which are not yet

visible in registrations, sales volumes declined in Europe (-4.3%)

and China (-16.5%). In Latin America, they were up 22.6%. In Africa

Middle East, volumes increased, driven by sales of vehicles

manufactured in Iran under Peugeot licence2.

As of end-September 2016, inventories totalled 400,000

vehicles3 (382,000 in the same period last year).

Jean-Baptiste de Chatillon, Chief Financial Officer of the PSA

Group and member of the Managing Board, said: “The levers of the

Back in the Race plan, especially pricing power and cost reduction,

make us confident that we will achieve the objectives of the Push

to Pass plan, despite a more challenging external environment,

particularly in respect of exchange rates.”

Market outlook

For 2016, the Group expects the automotive market to grow by

about 6% in Europe and 15% in China, and to shrink by around 6% in

Latin America and 15% in Russia.

Operational targets

The Push to Pass plan, has set the following targets:

- Reach an average 4% automotive

recurring operating margin in 2016-2018, and target 6% by

2021;

- Deliver 10% Group revenue growth by

20184 vs 2015, and target additional 15% by 20214.

Financial Calendar – 23 February 2017: 2016 Annual Results

About PSA Group

With sales and revenue of €54 billion in 2015, the PSA Group

designs unique automotive experiences and delivers mobility

solutions that provide freedom and enjoyment to customers around

the world. The Group leverages the models from its three brands,

Peugeot, Citroën and DS, as well as a wide array of mobility

services including the Free2Move brand, to meet the evolving needs

and expectations of automobile users. PSA is the European leader in

terms of CO2 emissions, with average emissions of 104.4 grams of

CO2 per kilometre in 2015, and an early innovator in the field of

autonomous and connected cars, with 1.8 million such vehicles

worldwide. It is also involved in financing activities through

Banque PSA Finance and in automotive equipment via Faurecia. Find

out more at groupe-psa.com/en.

1 As of 30 September 2016, growth at constant exchange rates

(2015) versus cumulated revenue as of 30 September 2015.

2 O/w 105 kunits produced in Iran under Peugeot licence

3 Excluding China, including independent dealers.

4 At constant (2015) exchange rates

Appendix

Revenue YTD September 2016 versus YTD

September 2015

In million euros 9M 2015* 9M 2016

Change Automotive 27,461 26,732 -729 Faurecia

13,811 13,773 -38 Other businesses and

eliminations** (1,220) (1,322) -102 Group

revenue 40,052 39,183 -869

Revenue Q3 2016 versus Q3 2015

In million euros Q3 2015* Q3 2016

Change Automotive 8,052 7,542 -510 Faurecia

4,323 4,241 -82 Other businesses and

eliminations** (359) (379) -20 Group revenue

12,016 11,404 -612

* restated according to IFRS5 (Faurecia Exteriors division)

** Including remaining activities of PSA Finance

AppendixWorldwide unit sales*

Consolidated World Sales(in thousands)

Q3

2015

2015YTD Sept.

Q3

2016

2016YTD Sept. Δ 16/15Q3 Δ

16/15YTD Sept.

China - South

East Asia Peugeot 84,2

291,7 70,1

232,6 -16.8% -20,2% Citroën

60,8 210,6

52,5 177,7 -13.7% -15,6%

DS 5,7 16,4

3,3 12,0 -42.0%

-26,8%

China - South East Asia PSA

150,7 518,7

125,9 422,4

-16,5% -18,6%

Eurasia Peugeot 2,1

5,0 1,2

3,9 -42.5% -20.4% Citroën

1,7 4,0 1,0

3,4 -41.7% -15.5%

DS 0,0 0,1

0,0 0,1 120.0% 48.2%

Eurasia PSA 3,9

9,0 2,3

7,4 -41.5%

-17.8%

Europe

Peugeot 214,4

771,6 213,0 814,3

-0.7% 5.5% Citroën 154,9

540,6 144,2

557,8 -6.9% 3.2% DS

15,2 55,9

11,0 51,9 -27.8% -7.1%

Europe PSA 384,6

1 368,1

368,2 1 424,0

-4.3% 4.1%

India - Pacific Peugeot 2,6

13,0 2,7

10,7 6.5% -17.7% Citroën

1,0 3,0 1,1

2,7 8.6% -8.9% DS

0,3 0,8

0,3 1,1 5.9% 38.0%

India - Pacific PSA

3,8 16,8

4,1 14,5 7.0%

-13.6%

Latin

America Peugeot 23,6

70,6 30,1 89,5

27.6% 26.7% Citroën

12,6 41,3 14,4

43,4 13.7% 5.1% DS

0,3 0,9

0,3 0,8 7.0% -20.4%

Latin America PSA

36,6 112,8

44,8 133,6 22.6%

18.4%

Middle

East - Africa Peugeot 24,4

86,1 124,2

181,6 408.8% 110.9% Citroën

11,5 49,9

11,4 40,5 -0.8% -18.7%

DS 0,4 1,2

0,3 1,3 -17.4%

4.6%

Middle East - Africa PSA

36,3 137,2

136,0 223,4

274.3% 62.8%

Total Consolidated World Sales Peugeot

351,4 1 238,0

441,3 1 332,7 25.6% 7.6%

Citroën 242,6

849,4 224,6 825,5

-7.4% -2.8% DS

21,9 75,3 15,2

67,2 -30.3% -10.8%

Total CWS

(AV+CKD) PSA 615,8

2 162,7

681,1 2 225,3

10.6% 2.9%

* Assembled vehicles, CKD’s and vehicles sold under licence

** Including vehicles produced in Iran under Peugeot licence :

105kunits in Q3 2016, 115,5 kunits YTD

Communications Division - www.groupe-psa.com -

+33 1 40 66 42 00 - @GroupePSA

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161025006920/en/

PSA GroupMedia : 01 40 66 42 00

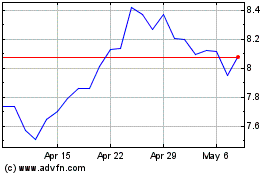

United Guardian (NASDAQ:UG)

Historical Stock Chart

From Aug 2024 to Sep 2024

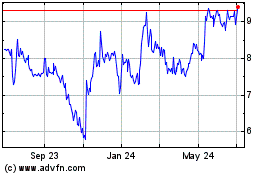

United Guardian (NASDAQ:UG)

Historical Stock Chart

From Sep 2023 to Sep 2024