SAP

Guidance Rises Despite Drop in Net

FRANKFURT -- SAP SE on Friday raised its guidance for 2016, even

after it reported a 19% slide in net profit for the third

quarter.

The German business-software provider said it now expects

full-year operating profit to be in a range of EUR6.5 billion to

EUR6.7 billion ($7.1 billion to $7.3 billion), compared with

EUR6.35 billion in 2015. That estimate, based on calculations not

recognized under international financial-reporting standards, is up

from a previous forecast of EUR6.4 billion to EUR6.7 billion.

SAP said it also now expects non-IFRS cloud subscription and

support revenue to be in a range of EUR3 billion to EUR3.05

billion, compared with EUR2.3 billion in 2015, in the latest sign

of Chief Executive Bill McDermott's efforts to center the company

around internet cloud-based software.

Net profit for the period ended Sept. 30 was EUR730 million,

compared with EUR898 million during the same period a year prior,

weighed down by higher share-based compensation expenses.

"This is a perfect reflection of how the share price has

increased for shareholders," Mr. McDermott said of the in an

interview Friday of the nearly EUR300 million in compensation

expenses. "We have a very happy company today," he added.

SAP's share price has risen almost 20% over the past year,

closing at EUR79.31 on Oct 20.

Mr. McDermott said capital markets had started to value the

company as a leading cloud player, rather than just an on-premise

software company.

"Investors have said these guys are doing what they said they

would do, and there has been a consistent growth trajectory in the

cloud," he said.

SAP performed "quite well in terms of profitability and growth"

in the third quarter and is on a "good course" to continue growing,

according to Harald Schnitzer, an analyst at Germany's DZ Bank.

Revenue increased 8% to EUR5.38 billion, driven by a solid

uptake of the company's cloud-based offerings. Cloud subscriptions

and support revenue climbed 28%, to EUR769 million. But the

company's traditionally core on-premise software licenses also

continued to grow, with licensing and support revenue rising 5%, to

EUR3.67 billion.

"We kept our core business strong and still got a really strong

cloud number," Chief Executive Bill McDermott said.

--Christopher Alessi

HONEYWELL INTERNATIONAL

Weak September Depresses Profit

Honeywell International Inc. issued the downbeat earnings report

it had forecast earlier this month, saying an unexpectedly weak

September and lackluster performance in the aerospace segment hurt

profit.

Honeywell shares had dropped 7.5% On Oct. 7,after the company

lowered its sales and profit outlooks and preannounced the

third-quarter results.

Chief Executive Dave Cote told investors at the time that sales

had "failed to materialize" in the third quarter. Friday, the

company reported results largely in line with those forecasts.

For the year, Honeywell expects sales of $39.4 billion to $39.6

billion, with core organic sales, which exclude currency

fluctuations and deals, falling between 1% and 2%. Analysts had

expected $39.63 billion in sales.

During the quarter, the industrial conglomerate reported an

overall profit of $1.24 billion, down from $1.26 billion. On a

per-share basis, earnings were flat at $1.60. When excluding

restructuring and other costs, earnings per share for the quarter

were $1.67.

Revenue grew 2% to $9.8 billion as core organic sales fell

3%.

Analysts polled by Thomson Reuters had expected earnings per

share of $1.60 on $9.79 billion in sales.

In the company's aerospace segment, organic revenue and

unadjusted revenue fell about 6% due to the impact of sales

incentives, lower volumes in business and aviation, weakness in

commercial helicopters and the completion of space and

international defense programs.

For the fourth quarter, Honeywell expects aerospace sales to

fall 7% to 9% due to weakness in the business jets, defense and

space areas.

Revenue in its safety and productivity solutions unit fell 2.2%.

Core sales dropped 8% due to lower volume associated with a

completed U.S. Postal Service contract and lower volumes in its

safety business.

Revenue in its performance materials and technologies unit grew

2.2% as core sales declined 3% due to declines in gas processing,

licensing and engineering. During this quarter, the company expects

sales to fall 4% to 5% while core sales are expected to increase 2%

to 4% on stabilizing oil prices.

In its home and building technologies unit sales increased 17%

and 5% on a core-organic basis due to positive results in the

distribution and business solutions unit and growth in

environmental and energy solutions.

--Austen Hufford

(END) Dow Jones Newswires

October 24, 2016 02:48 ET (06:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

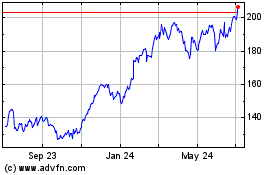

SAP (NYSE:SAP)

Historical Stock Chart

From Aug 2024 to Sep 2024

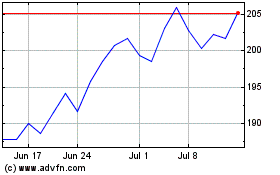

SAP (NYSE:SAP)

Historical Stock Chart

From Sep 2023 to Sep 2024