SAP SE 3Q 2016 -- Forecast

October 18 2016 - 7:53AM

Dow Jones News

FRANKFURT--The following is a summary of analysts' forecasts for

SAP SE (SAP) third-quarter results, based on a poll of 13 analysts

conducted by Dow Jones Newswires (figures in million euros, EPS,

dividend and target price in euro, according to IFRS). Earnings

figures are based on Non-IFRS and scheduled to be released October

21.

===

Revenue Revenue

Total C & S Software CSS

3rd Quarter revenue (a) licenses (b)

AVERAGE 5,312 4,433 1,013 781

Prev. Year 4,987 4,124 1,015 600

+/- in % +6.5 +7.5 -0.2 +30

MEDIAN 5,318 4,441 1,013 782

Maximum 5,399 4,493 1,066 794

Minimum 5,092 4,272 913 750

Amount 12 12 12 13

Baader-Helvea 5,373 4,493 1,066 780

Barclays 5,399 -- 1,053 782

Bernstein 5,379 4,476 1,034 792

Bryan Garnier 5,287 4,406 1,009 787

Commerzbank -- 4,481 1,041 783

DZ Bank 5,302 4,430 1,000 780

Haitong Securities 5,092 4,272 913 750

HSBC 5,349 4,468 1,004 794

LBBW 5,323 4,447 1,045 780

Morgan Stanley 5,370 4,483 1,016 791

Pacific Crest 5,309 4,429 970 774

UBS 5,252 4,376 -- 770

Warburg Research 5,313 4,435 1,000 794

Net

Operating attrib.

3rd Quarter profit profit EPS

AVERAGE 1,689 1,174 0.99

Prev. Year 1,616 1,176 0.98

+/- in % +4.5 -0.2 +0.9

MEDIAN 1,691 1,199 1.00

Maximum 1,829 1,241 1.09

Minimum 1,562 1,046 0.87

Amount 13 9 12

Baader-Helvea 1,691 -- 1.00

Barclays 1,829 -- 1.09

Bernstein 1,692 1,108 0.92

Bryan Garnier 1,711 1,211 0.99

Commerzbank 1,646 -- --

DZ Bank 1,683 1,200 1.00

Haitong Securities 1,562 1,046 0.87

HSBC 1,699 1,223 1.02

LBBW 1,744 1,199 1.00

Morgan Stanley 1,758 1,241 1.03

Pacific Crest 1,634 1,162 0.97

UBS 1,670 1,176 0.98

Warburg Research 1,639 -- 0.99

Target price Rating DPS 2016

AVERAGE 90.88 positive 9 AVERAGE 1.24

Prev. Quarter 81.83 neutral 0 Prev. Year 1.15

+/- in % +11 negative 0 +/- in % +7.8

MEDIAN 91.50 MEDIAN 1.22

Maximum 95.00 Maximum 1.40

Minimum 85.00 Minimum 1.15

Amount 8 Amount 5

Baader-Helvea 85.00 Buy --

Barclays 95.00 Overweight 1.22

Commerzbank 95.00 Buy 1.26

DZ Bank -- Buy 1.17

HSBC 93.00 Buy --

JP Morgan 95.00 Overweight --

Morgan Stanley 88.00 Overweight --

UBS 90.00 Buy 1.15

Warburg Research 86.00 Buy 1.40

===

Year-earlier figures are as reported by the company.

(a) Cloud & Software

(b) Cloud-subscriptions and -support

DJG/voi

(END) Dow Jones Newswires

October 18, 2016 07:38 ET (11:38 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

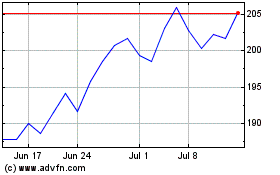

SAP (NYSE:SAP)

Historical Stock Chart

From Aug 2024 to Sep 2024

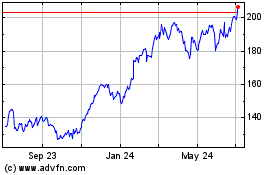

SAP (NYSE:SAP)

Historical Stock Chart

From Sep 2023 to Sep 2024