Current Report Filing (8-k)

October 14 2016 - 12:51PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington

, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

October 10, 2016

|

PREMIER BIOMEDICAL, INC.

|

|

(Exact name of registrant as specified in its charter)

|

|

Nevada

|

|

000-54563

|

|

27-2635666

|

|

(State or other

jurisdiction of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

P.O. Box 31374

El Paso, Texas 79930

(Address of principal executive offices) (zip code)

|

|

|

|

(814) 786-8849

(Registrant’s telephone number, including area code)

|

|

|

|

_________________________________________________

|

|

(Former name or former address, if changed since last report.)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Section 1 – Registrant’s Business and Operations

Item 1.01 – Entry into a Material Definitive Agreement

Typenex Co-Investment, LLC

As disclosed in prior filings, Typenex Co-Investment, LLC (“

Typenex

”) was awarded a default judgment against us in the amount of $340,647, pursuant to a dispute over the number of warrants (the “

Warrant

”) that Typenex was awarded with their convertible note entered into on November 25, 2014.

While we still believe their dispute is without merit, to resolve Typenex’s default judgment we entered into discussions with Redwood Management, LLC (“

Redwood

”) to buy the Warrant from Typenex. Redwood has been a key investor and was willing to help resolve the matter. As described further below, with Redwood’s assistance we have resolved this dispute with Typenex.

Warrant Purchase and Exchange

On October 10, 2016, we entered into a Warrant Purchase Agreement by and among Redwood, the Company and Typenex whereby Redwood will purchase the Warrant from Typenex. Redwood will pay the purchase price in four installments. These installment payments will be $300,000 in the aggregate with the last payment due on October 31, 2016. The Warrant and the Assignment Agreement between Redwood and Typenex will be held in escrow until the last payment is made. Redwood has been granted a limited waiver of the Writ of Garnishment (the “Writ”) held by Typenex to receive shares of our common stock as long as it is current in its payments under the Warrant Purchase Agreement. Currently, shares of our common stock may only be issued to Redwood.

Also on October 10, 2016, we entered into an Exchange Agreement by and between the Company and Redwood. Pursuant to the Exchange Agreement, we exchanged a 10% Convertible Promissory Note (the “

Note

”) for the Warrant which will be delivered to us when released from escrow. The Note has a principal amount of $300,000, an interest rate of 10% and matures on October 10, 2017 unless earlier converted into shares of our common stock. The Note may be converted to common stock at any time after January 8, 2017. The Conversion Price for the Note is equal to 60% of the lowest traded price of our common stock in the 15 Trading Days prior to the Conversion Date. If any shares of our common stock are sold at an effective price per share that is lower than the Conversion Price, the Conversion Price will be adjusted down to match the lower price. We have instructed our transfer agent to reserve 150,000,000 shares of our common stock for conversions pursuant to the Note. This reserve will stay in place until the Note and any interest due thereunder is satisfied in full.

Once Redwood makes the final payment to Typenex under the Warrant Purchase Agreement, Redwood will receive a Satisfaction of Judgment and Release of Garnishment from Typenex. We will then take possession of the Warrant, and Redwood will forward to us the Satisfaction of Judgment and Release of Garnishment to release the Writ and finally settle the dispute with Typenex.

Copies of the Warrant Purchase Agreement, Exchange Agreement and the Note are attached hereto as Exhibits 10.1, 10.2 and 10.3, respectively, and are incorporated herein by this reference.

Section 3 – Securities and Trading Markets

Item 3.02 Unregistered Sale of Equity Securities

The disclosure under item 1.01 above is incorporated herein by reference. The Note and Warrant exchange was a transaction exempt from registration under Section 4(a)(2) of the Securities Act of 1933. No general solicitation was made either by the Company or any person acting on its behalf, and the investor is an accredited, sophisticated investor.

Section 9 – Financial Statement and Exhibits

Item 9.01 Financial Statements and Exhibits.

|

10.1

|

Warrant Purchase Agreement by and among Typenex Co-Investment, LLC, Redwood Management, LLC and Premier Biomedical, Inc., dated October 10, 2016.

|

|

|

|

|

10.2

|

Exchange Agreement by and between Redwood Management, LLC and Premier Biomedical, Inc., dated October 10, 2016.

|

|

|

|

|

10.3

|

10% Convertible Promissory Note in the principal amount of $300,000, due October 10, 2017, issued to Redwood Management, LLC by Premier Biomedical, Inc., dated October 10, 2016.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

Premier Biomedical, Inc.

|

|

|

|

|

|

|

|

Dated: October 13, 2016

|

By:

|

/s/ William Hartman

|

|

|

|

Name:

|

William Hartman

|

|

|

|

Its:

|

President and Chief Executive Officer

|

|

EXHIBIT INDEX

|

Exhibit No.

|

|

Description

|

|

10.1

|

|

Warrant Purchase Agreement by and among Typenex Co-Investment, LLC, Redwood Management, LLC and Premier Biomedical, Inc., dated October 10, 2016.

|

|

|

|

|

|

10.2

|

|

Exchange Agreement by and between Redwood Management, LLC and Premier Biomedical, Inc., dated October 10, 2016.

|

|

|

|

|

|

10.3

|

|

10% Convertible Promissory Note in the principal amount of $300,000, due October 10, 2017, issued to Redwood Management, LLC by Premier Biomedical, Inc., dated October 10, 2016.

|

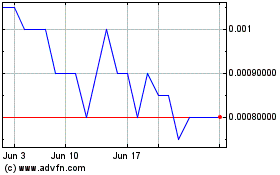

Premier Biomedical (PK) (USOTC:BIEI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Premier Biomedical (PK) (USOTC:BIEI)

Historical Stock Chart

From Apr 2023 to Apr 2024