As filed with the Securities and Exchange

Commission on October 11, 2016

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

EVINE

Live Inc.

(Exact name of registrant as specified

in its charter)

|

Minnesota

|

|

41-1673770

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification Number)

|

6740 Shady Oak Road

Eden Prairie, MN 55344-3433

(952)

943-6000

(Address, including zip code, and telephone

number, including area code, of registrant’s principal executive offices)

Damon E. Schramm

Senior Vice President, General Counsel

and Secretary

EVINE Live Inc.

6740 Shady Oak Road

Eden Prairie, MN 55344-3433

(Address, including zip code, and telephone number, including area code, of agent for service)

Copies to

:

J.C. Anderson, Esq.

Gray, Plant, Mooty, Mooty & Bennett,

P.A.

500 IDS Center

80 South Eighth Steet

Minneapolis, MN 55402

(612)

632-3002

APPROXIMATE DATE OF COMMENCEMENT

OF PROPOSED SALE TO THE PUBLIC:

From time to time after the effective date of this registration statement.

If the only securities being registered on this Form are being

offered pursuant to dividend or interest reinvestment plans, please check the following box.

¨

If any of the securities being registered on this Form are

to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered

only in connection with dividend or interest reinvestment plans, check the following box.

x

If this Form is filed to register additional

securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering.

¨

If this Form is a post-effective amendment

filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering.

¨

If this Form is a registration statement

pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective on filing with the Commission

pursuant to Rule 462(e) under the Securities Act, check the following box.

¨

If this Form is a post-effective amendment

to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes

of securities pursuant to Rule 413(b) under the Securities Act, check the following box.

¨

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated

filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check

one):

|

Large accelerated filer

¨

|

Accelerated filer

x

|

Non-accelerated

filer

¨

|

Smaller

reporting company

¨

|

|

|

|

(Do not check if a smaller

reporting

company)

|

|

CALCULATION OF

REGISTRATION FEE

|

Title of each class of securities to be registered

|

Amount to be

Registered (1) (2)

|

Proposed

Maximum offering price

per unit (3)

|

Proposed

maximum aggregate

offering price (3)(4)

|

Amount of

registration fee (3)

|

|

Common Stock, par value $0.01 per share

|

14,376,939

|

$2.16

|

$31,054,188.24

|

$3,599.18

|

|

(1)

|

An estimated number of securities is being registered as may from time to time be offered at unspecified prices. Includes common stock sold to the selling shareholders in the Private Placement, in addition to rights to acquire common stock of the Company under the Warrants, Options, and Option Warrants, all as further described in the sections titled “Description of Securities” and “Use of Proceeds.”

|

|

(2)

|

Pursuant to Rule 416 under the Securities Act of 1933, as amended, this registration statement registers such indeterminate number of additional shares of common stock as may be issued in connection with stock splits, stock dividends or similar transactions.

|

|

(3)

|

Estimated solely for the purpose of calculating the amount of the registration fee in accordance with Rule 457(c), based on the average of the high and low prices for shares of the registrant’s common stock as reported on The NASDAQ Global Market on October 6, 2016.

|

|

(4)

|

No separate consideration will be received for shares of common stock that are sold hereunder. However, the Company will receive proceeds upon exercise of the Warrants, Options, and Option Warrants; provided that such proceeds will depend on the number of Warrants, Options and Option Warrants that are exercised, and the final exercise price of the Options and Option Warrants. For more information, see the sections title “Description of Securities” and “Use of Proceeds.”

|

The registrant hereby amends this registration statement

on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which

specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities

Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said

Section 8(a), may determine.

The

information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement

filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it

seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject

to Completion, dated October 11, 2016.

PROSPECTUS

EVINE Live Inc.

14,376,939 Shares of Common Stock

This prospectus relates

to the sale by the selling shareholders identified in this prospectus, including their transferees, pledgees, donees, transferees

or successors-in-interest, of up to an aggregate of 14,376,939 shares of our common stock, par value $0.01 per share, which includes

(i) 5,952,381 shares issued to the selling shareholders; (ii) 2,976,190 shares issuable upon the exercise of warrants (“Warrants”);

and (iii) an estimated 5,448,368 shares, of which two-thirds are issuable pursuant to the exercise of options (“Options”)

and one-third is issuable upon exercise of additional warrants issuable upon exercise of the Options (“Option Warrants”).

See the section titled “Description of Securities” beginning on page 9 of this prospectus for more information.

The number of shares of common stock registered hereby that is issuable pursuant to the Options and underlying the Option Warrants

is based on the Company’s common stock outstanding as of October 6, 2016. The common stock offered hereby was issued, or

is issuable to the selling shareholders pursuant to Warrants or Options issued, in a private placement (the “Private Placement”)

completed on September 19, 2016.

We are registering

these securities on behalf of the selling shareholders, to be offered and sold by them from time to time. We are not selling any

shares of common stock under this prospectus and will not receive any proceeds from the sale of the common stock offered by this

prospectus. Any proceeds we receive from the exercise of Warrants, Options and Option Warrants will be used for general corporate

purposes and debt repayment. It is anticipated that the selling shareholders will sell their shares of common stock from time to

time in one or more transactions, in negotiated transactions or otherwise, at prevailing market prices or at prices otherwise negotiated

(see the section titled “Plan of Distribution” beginning on page 14 of this prospectus). All expenses

of registration incurred in connection with this offering are being borne by us, but all selling and other expenses incurred by

the selling shareholders will be borne by the selling shareholders.

We may amend or supplement

this prospectus from time to time by filing amendments or supplements as required. You should read the entire prospectus and any

amendments or supplements carefully before you make your investment decision.

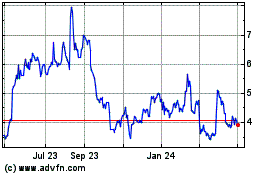

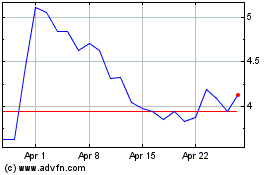

Our common stock trades on the Nasdaq

Global Market under the ticker symbol “EVLV.” On October 6, 2016, the closing price of our common stock was $2.14

per share.

Investing in these

securities involves a high degree of risk. See “

Risk Factors

” beginning on

page 7 of this prospectus, any prospectus supplement relating to an offer of securities and any document incorporated

by reference herein or therein.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the

adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this

prospectus is October 11, 2016.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

When we refer to “we,” “us”

or the “Company,” we mean EVINE Live Inc. and its subsidiaries unless the context indicates otherwise.

You should rely only on the information

provided in this prospectus, any prospectus supplement and any free writing prospectus, including the information incorporated

herein or therein by reference. Neither we nor the selling shareholders have authorized anyone to provide you with different information.

You should not assume that the information in this prospectus, any prospectus supplement and any free writing prospectus is accurate

at any date other than the date indicated on the cover page of such documents.

The distribution of this prospectus, any

prospectus supplement and any free writing prospectus and the offering of the securities in certain jurisdictions may be restricted

by law. Persons into whose possession this prospectus, any prospectus supplement and any free writing prospectus come should inform

themselves about and observe any such restrictions. This prospectus, any prospectus supplement and any free writing prospectus

does not constitute, and may not be used in connection with, an offer or solicitation by anyone in any jurisdiction in which such

offer or solicitation is not authorized or in which the person making such offer or solicitation is not qualified to do so or to

any person to whom it is unlawful to make such offer or solicitation.

This prospectus, any prospectus supplement

and any free writing prospectus may include trademarks, service marks and trade names owned by us or other companies. All trademarks,

service marks and trade names included in this prospectus, any prospectus supplement and any free writing prospectus are the property

of their respective owners.

WHERE YOU CAN FIND MORE INFORMATION;

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

We file annual, quarterly and current reports,

proxy statements and other information with the SEC. Our SEC filings are available over the Internet at the SEC’s web site

at www.sec.gov. You may also read and copy any document we file with the SEC at its Public Reference Room located at 100 F Street,

N.E., Washington, D.C. 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330.

We maintain a web site at www.evine.com. The information on our web site is not incorporated by reference in this prospectus, any

prospectus supplement and any free writing prospectus, and you should not consider it a part of this prospectus, any prospectus

supplement or any free writing prospectus.

The SEC allows us to “incorporate

by reference” the information we file with them, which means that we can disclose important information to you by referring

you to separate documents. The information incorporated by reference is considered to be part of this prospectus, any prospectus

supplement and any free writing prospectus, and later information filed with the SEC will update and supersede this information.

We incorporate by reference the documents listed below (other than information deemed furnished and not filed in accordance with

SEC rules):

|

|

·

|

Annual Report on Form 10-K for the fiscal year ended January 30, 2016;

|

|

|

·

|

The portions of our Definitive Proxy Statement on Schedule 14A for the 2016 annual meeting that are incorporated by reference

in our Annual Report on Form 10-K for the fiscal year ended January 30, 2016;

|

|

|

·

|

Our Quarterly Reports on Form 10-Q for the three months ended April 30, 2016, filed on

May 26, 2016, and for the three and six months ended July 30, 2016, filed on August 26, 2016;

|

|

|

·

|

Current Reports on Form 8-K dated February 18, 2016; March 10, 2016; March 17, 2016; April 12, 2016; April 29, 2016; May 25,

2016; June 22, 2016; July 7, 2016; July 25, 2016; August 18, 2016; September 1, 2016; and September 14, 2016;

|

|

|

·

|

The description of our common stock contained in the Registration Statement on Form 8-A filed with the SEC on May 22,

1992, as the same may be amended from time to time;

|

|

|

·

|

The description of our Series A Junior Participating Cumulative Preferred Stock and the Shareholder Rights Agreement contained

in our Registration Statement on Form 8-A, filed with the SEC on July 13, 2015, as the same may be amended from time to time;

|

|

|

·

|

All documents filed by us with the SEC pursuant to Sections 13(a), 13(c), 14, or 15(d) of the Securities Exchange Act

of 1934, or the “Exchange Act,” after the date of the initial registration statement and prior to effectiveness of

the registration statement shall be deemed to be incorporated by reference into the prospectus (except for information filed pursuant

to Items 2.02 and 7.01 unless specifically deemed filed and not furnished in accordance with SEC rules); and

|

|

|

·

|

All documents filed by us with the SEC pursuant to Sections 13(a), 13(c), 14, or 15(d) of the Exchange Act subsequent

to the date of this prospectus and prior to the termination of this offering (except for information deemed furnished and not filed

in accordance with SEC rules).

|

Copies of these filings are available

at no cost on our website, www.evine.com. You may request a copy of these filings (other than an exhibit to a filing unless that

exhibit is specifically incorporated by reference into that filing) at no cost, by writing to or telephoning us at the following

address:

Corporate Secretary

EVINE Live Inc.

6740 Shady Oak Road

Eden Prairie, Minnesota 55344

(952) 943-6000

SPECIAL NOTE REGARDING FORWARD-LOOKING

STATEMENTS

This prospectus, any prospectus supplement

delivered with this prospectus and the documents incorporated by reference herein and therein, may contain statements that constitute

“forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, and Section 21E

of the Securities Exchange Act of 1934. All statements other than statements of historical fact, including statements regarding

guidance, industry prospects or future results of operations or financial position made in this prospectus are forward-looking.

We often use words such as “may,”

“will,” “could,” “estimates”, “continue,” “anticipates,” “believes,”

“expects,” “intends” and similar expressions to identify forward-looking statements. These statements are

based on management’s current expectations based on information currently available to us and accordingly are subject to

uncertainty and changes in circumstances. Actual results may vary materially from the expectations contained herein. Factors that

could cause or contribute to such differences include, but are not limited to, those described in the “Risk Factors”

section of our annual report on Form 10-K for the year ended January 30, 2016, our quarterly reports made after such

date and other filings we have made with the SEC. These include, without limitation:

|

|

·

|

macroeconomic issues, including, but not limited to, the general economic and the credit environment;

|

|

|

·

|

risks relating to stagnant or decreased consumer spending and the level of consumer debt levels;

|

|

|

·

|

the impact of increasing interest rates;

|

|

|

·

|

risks relating to seasonal variations in consumer purchasing activities;

|

|

|

·

|

risks relating to changes in the mix of products sold by us;

|

|

|

·

|

competitive pressures on our sales, as well as pricing and sales margins;

|

|

|

·

|

the level of cable and satellite distribution for our programming and the associated fees or estimated cost savings from contract

renegotiations;

|

|

|

·

|

our ability to continue to manage our cash, cash equivalents and investments to meet our liquidity needs;

|

|

|

·

|

our ability to manage our operating expenses successfully and our working capital levels;

|

|

|

·

|

our management and information systems infrastructure;

|

|

|

·

|

changes in governmental or regulatory requirements;

|

|

|

·

|

litigation or governmental proceedings affecting our operations;

|

|

|

·

|

significant public events that are difficult to predict, such as widespread weather catastrophes or other significant

television-covering events causing an interruption of television coverage or that directly compete with the viewership of our

programming;

|

|

|

·

|

our ability to obtain and retain key executives and employees;

|

|

|

·

|

our ability to establish and maintain acceptable commercial terms with third-party vendors and other third parties with whom

we have contractual relationships, and to successfully manage key vendor relationships and develop key partnerships and proprietary

brands;

|

|

|

·

|

our ability to successfully manage our new branding strategies related to our new EVINE Live brand and execute marketing initiatives,

as well as customer acceptance of our new brand;

|

|

|

·

|

our ability to attract new customers and retain existing customers;

|

|

|

·

|

changes in shipping costs;

|

|

|

·

|

our ability to offer new or innovative products and customer acceptance of the same;

|

|

|

·

|

changes in customer viewing habits or television programming;

|

|

|

·

|

our ability to remain compliant with our long-term credit facility covenants;

|

|

|

·

|

the market demand for television station sales; and

|

|

|

·

|

challenges to our data and information security.

|

Investors are cautioned that all forward-looking

statements involve risk and uncertainty. The facts and circumstances that exist when any forward-looking statements are made and

on which those forward-looking statements are based may significantly change in the future, thereby rendering the forward-looking

statements obsolete. We are under no obligation (and expressly disclaim any obligation) to update or alter our forward-looking

statements whether as a result of new information, future events or otherwise.

SUMMARY

The following summary contains basic

information about us and this offering. It does not contain all of the information that you should consider in making your investment

decision. You should read and consider carefully all of the information in this prospectus, including the information set forth

under “Risk Factors,” any applicable prospectus supplement, as well as the more detailed financial information, including

the consolidated financial statements and related notes thereto, appearing elsewhere or incorporated by reference in this prospectus,

before making an investment decision. Unless the context indicates otherwise, all references in this prospectus to “EVINE,”

“our,” “us” and “we” refer to EVINE Live Inc. and its subsidiaries as a combined entity.

Our Company

We are a digital commerce company that markets,

sells and distributes products to consumers through TV, online, mobile and social media. We operate a 24-hour television shopping

network, which is distributed primarily through cable and satellite affiliation agreements, through which we offer brand name and

private label products in the categories of jewelry & watches; home & consumer electronics; beauty, health &

fitness; and fashion & accessories. We also operate evine.com, a comprehensive digital commerce platform that sells products

which appear on our television shopping channel as well as an extended assortment of online-only merchandise. Our programming and

products are also marketed via mobile devices - including smartphones and tablets, and through the leading social media channels.

Our investor relations website address is

evine.com/ir. Our goal is to maintain the investor relations website as a way for investors to easily find information about us,

including press releases, announcements of investor conferences, investor and analyst presentations and corporate governance. We

also make available free of charge our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on

Form 8-K, proxy statements and all amendments to these filings as soon as practicable after that material is electronically

filed with or furnished to the SEC. The information found on our website is not part of this or any other report we file with,

or furnish to, the SEC.

On November 18, 2014, we announced

that we had changed our corporate name to EVINE Live Inc. Effective November 20, 2014, our NASDAQ trading symbol also changed

from VVTV to EVLV. On February 14, 2015, we officially began using the new EVINE Live brand name and logo across television,

online, mobile and social platforms.

EVINE Live Inc. is a Minnesota corporation

with principal and executive offices located at 6740 Shady Oak Road, Eden Prairie, Minnesota 55344-3433. Our telephone number

is (952) 943-6000.

The Offering

|

Common stock outstanding as of October 6, 2016

|

|

|

63,496,095

|

|

|

|

|

|

|

|

|

Common

stock offered by selling shareholders:

|

|

|

|

|

|

Currently issued and outstanding

|

|

|

5,952,381

|

|

|

Issuable upon exercise of Warrants

|

|

|

2,976,190

|

|

|

Issuable upon exercise of Options

|

|

|

3,632,245*

|

|

|

Issuable upon exercise of Option Warrants

|

|

|

1,816,123*

|

|

|

|

|

|

|

|

|

Total

|

|

|

14,376,939*

|

|

|

Common

stock outstanding assuming all Warrants, Options and Option Warrants are exercised

|

|

|

71,920,653*

|

|

|

|

|

|

|

|

|

*Shares

issuable upon exercise the Options and Option Warrants are subject to change, as determined by the terms of the Option. Amounts

listed are based on the number of common shares outstanding as of October 6, 2016.

|

|

|

|

|

|

|

|

|

|

|

|

Use of Proceeds

|

|

|

We

will not receive any proceeds from the sale of the common stock by the selling shareholders. To

the extent proceeds are received upon the exercise of the Warrants, Options and Option

Warrants, we intend to use such proceeds for general working capital and debt repayment

purposes.

|

|

|

|

|

|

|

|

|

NASDAQ Symbol

|

|

|

Shares

of our common stock are listed on the NASDAQ Global Market under the symbol “EVLV”.

|

|

|

|

|

|

|

|

|

Risk Factors

|

|

|

See

the section of this prospectus titled "Risk Factors" and the risk factors set

forth in our most recent quarterly report on Form 10-Q and annual report on Form 10-K.

You should carefully read and consider these risk factors together with all of the other

information included in or incorporated by reference into this prospectus before you

decide to purchase shares of our common stock.

|

|

RISK FACTORS

An investment

in our common stock involves risks. Before purchasing any shares of our common stock, consider carefully the risks together with

all of the other information contained or incorporated by reference in this prospectus, including the risks described under the

caption “Risk Factors” included in each of Part I, Item 1A of our Annual Report on Form 10-K for the fiscal year ended

January 30, 2016 and Part II, Item 1A of our Quarterly Report on Form 10-Q for the fiscal quarter ended July 30, 2016 and any subsequent

Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q or Current Reports on Form 8-K we file after the date of this prospectus,

and all other information contained or incorporated by reference into this prospectus, as updated by our subsequent filings under

the Securities Exchange Act of 1934, as amended, and the risk factors and other information contained in any applicable prospectus

supplements before acquiring any of our common stock.

We caution you that the risks and uncertainties

we have described, among others, could cause our actual results to differ materially from those expressed in forward-looking statements

made by us or on our behalf in filings with the SEC, press releases, communications with investors and oral statements. We undertake

no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

USE OF PROCEEDS

We

will receive none of the proceeds from any sale or other disposition of the common stock covered by this prospectus. We would receive

proceeds upon the cash exercise of the Warrants, Options and Option Warrants for which the underlying shares of common stock are

being registered hereunder, although we cannot predict when or if such securities will be exercised. Assuming full cash exercise

of the Warrants at the exercise price of $2.90 per share of common stock, the Options at an assumed exercise price of $2.22 per

share and Option Warrants at an assumed exercise price of $3.21 per share (the exercise price for the Options and the Option Warrants

is subject to change and has been calculated based on the stock prices current as of October 6, 2016, as further described in the

section titled “Description of Securities” beginning

on page 9 of this prospectus

),

we will receive proceeds of approximately $22.5 million. We currently intend to use the cash proceeds from any Warrant, Option

or Option Warrant exercise for general working capital and debt repayment purposes.

The

amount and timing of our actual use of proceeds may vary significantly depending on the actual amount of proceeds we receive and

the timing of when we receive such proceeds. In addition, the terms of the Warrants and Option Warrants provide that following

January 17, 2016, they may be exercised on a cashless basis if at the time of exercise, the shares of common stock underlying the

warrants are not subject to a registration statement or there has been a failure to maintain the effective registration of such

shares. We will receive no cash proceeds from Warrants or Option Warrants that are exercised on a cashless basis under such terms

of the Warrants and Option Warrants.

SELLING SHAREHOLDERS

The common stock being

offered by each selling shareholder was issued to, or upon satisfaction of applicable exercise provisions will become issuable

pursuant to the Warrants, Options and Option Warrants issued to, the selling shareholders on September 19, 2016, when we completed

the Private Placement pursuant to separate securities purchase agreements with each selling shareholder dated as of September 14,

2016 (the “Purchase Agreements”). As set forth in the Purchase Agreements, we sold to certain “accredited investors”

as defined in Rule 501(a) under the Securities Act pursuant to an exemption from registration under the Securities Act (the “selling

shareholders”) an aggregate of (a) 5,952,381 shares of our common stock at a price of $1.68 per share, (b) Warrants to purchase

2,976,190 shares of common stock at an exercise price of $2.90 per share and (c) Options to purchase an assumed 3,632,245 shares

of common stock at an assumed exercise price of $2.22 and to purchase Option Warrants to purchase an additional assumed 1,816,123

shares of common stock at an assumed exercise price of $3.21. The number of shares of common stock issuable upon exercise of an

Option or Option Warrant, and the exercise price thereof, are to be determined in accordance with the terms of the Option or Option

Warrant at the time of its exercise. Accordingly, the assumed number of shares issuable upon exercise of the Options and Option

Warrants, and the assumed exercise price of the Options and Option Warrants, set forth above is an estimate based upon current

assumptions as further described in t

he section titled “Description of Securities”

beginning

on page 9 of this prospectus. We received total gross proceeds from the sale of the common stock, Warrants

and Options to the selling shareholders of $10,000,000.

Each of the transactions

by which the selling shareholders acquired their securities from us was exempt under the registration provisions of the Securities

Act. Accordingly, the securities may not be offered or resold in the United States absent registration or an applicable exemption

from registration. We are registering the common stock (including the common stock issuable pursuant to the exercise of the Warrants,

Options and Option Warrants) pursuant to the registration statement of which this prospectus forms a part in order to permit the

selling shareholders to offer such common stock for resale from time to time in accordance with the registration rights covenants

set forth in their respective Purchase Agreements.

Upon closing of the

Private Placement, Tommy Hilfiger (who is affiliated with TH Media Partners, LLC) and Thomas D. Mottola became members of the Company’s

new Brand Building Advisory Committee, which is a non-board committee that will advise the Board of Directors, including on matters

related to brand strategy. Except for such service, and the ownership of the shares of common stock, Warrants, Options and Option

Warrants, the selling shareholders have not, within the past three years, had any other position, office or other material relationship

with us.

The information in the table below with respect to the selling shareholders has

been obtained from the selling shareholders. When we refer to the “selling shareholders” in this prospectus, we mean

the selling shareholders listed in the table below as offering securities, as well as their respective pledgees, donees, transferees

or other successors-in-interest.

We

do not know if, when or in what amounts the selling shareholders may offer their shares of common stock for sale. The selling shareholders

may sell some, all or none of the shares offered by this prospectus. Because the number of shares the selling shareholders may

offer and sell is not presently known, we cannot estimate the number of securities that will be held by each selling shareholder

after completion of this offering. This table, however, presents the maximum number of shares of common stock that the selling

stockholders may offer pursuant to this prospectus and the number of shares of common stock that would be beneficially owned after

the sale of the maximum number of shares of common stock by each selling stockholder.

Beneficial ownership

is determined under the rules of the SEC

, and includes voting or investment power with respect

to shares. In calculating the number of shares beneficially owned by an individual or entity and the percentage ownership of that

individual or entity, shares underlying options or warrants that are either currently exercisable or exercisable within 60 days

from the date of this prospectus are deemed outstanding. These shares, however, are not deemed outstanding for the purpose of computing

the percentage ownership of any other individual or entity. In addition, unless otherwise indicated below, to our knowledge, each

selling shareholder named in the table has sole voting and investment power with respect to the shares of common stock beneficially

owned by it. The inclusion of any shares in this table does not constitute an admission of beneficial ownership for any selling

shareholder named below.

|

|

|

Number of

Shares of Common Stock Owned Prior to Offering

|

|

|

Maximum Number

of Shares of Common Stock to be Sold Pursuant to this Prospectus

|

|

|

Shares

of Common Stock Owned After Offering

|

|

|

Name of Selling Shareholder

|

|

Number (1)

|

|

|

Percent (2)

|

|

|

Number (3)

|

|

|

Percent (3)

|

|

|

Number (4)

|

|

|

Percent (4)

|

|

|

Thomas D. Mottola

|

|

|

1,984,127

|

|

|

|

3.12

|

%

|

|

|

4,792,313

|

|

|

|

6.666

|

%

|

|

|

0

|

|

|

|

0

|

%

|

|

TH Media Partners, LLC

|

|

|

1,984,127

|

|

|

|

3.12

|

%

|

|

|

4,792,313

|

|

|

|

6.666

|

%

|

|

|

0

|

|

|

|

0

|

%

|

|

Morris Goldfarb

|

|

|

1,412,392

|

|

|

|

2.22

|

%

|

|

|

2,923,311

|

|

|

|

4.066

|

%

|

|

|

202,074

|

|

|

|

*

|

%

|

|

Tower View LLC

|

|

|

595,238

|

|

|

|

*%

|

|

|

|

1,437694

|

|

|

|

2.000

|

%

|

|

|

0

|

|

|

|

0

|

%

|

|

Sammy Aaron

|

|

|

178,571

|

|

|

|

*%

|

|

|

|

431,308

|

|

|

|

0.600

|

%

|

|

|

0

|

|

|

|

0

|

%

|

|

*Less than 1%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

The number of shares reported in this column includes only shares beneficially owned by the selling shareholders and their affiliates prior to the date of this prospectus, including those shares sold in the Private Placement, but not including shares underlying the Warrants, Options, and Option Warrants.

|

|

(2)

|

Based on 63,496,095 shares of our common stock outstanding on October 6, 2016.

|

|

(3)

|

This number includes and assumes the maximum number of (a) those shares issuable upon exercise of the Warrants, (b) those shares issuable upon exercise of the Options and (c) those shares issuable upon exercise of the Option Warrants, all without regard to any limitation on exercise. Accordingly, the shares issuable upon exercise of the Warrants and the Option Warrants are not beneficially owned by the selling shareholders as of the date of this prospectus.

|

|

(4)

|

This number assumes the sale of all the shares offered by the selling shareholders and is calculated on a post-exercise basis.

|

DESCRIPTION OF SECURITIES

Our articles of incorporation provide that

we may issue up to 100,000,000 shares of capital stock, par value $0.01 per share in the case of common stock, and having a par

value as determined by the board of directors in the case of preferred stock. As of October 6, 2016, there were outstanding (i)

63,496,095 shares of common stock, (ii) Warrants to purchase an aggregate of 2,976,190 shares of common stock, and (iii) Options

to purchase an assumed 3,632,245 shares of common stock and to purchase Option Warrants to purchase an additional assumed 1,816,123

shares of common stock (with the number of shares issuable pursuant to the Options and the Option Warrants based on the number

of shares outstanding as of October 6, 2016, and therefore subject to change). In addition, as of October 6, 2016, there were 5,455,524

shares of common stock that may be issued upon the exercise of outstanding stock options (number includes both vested and non-vested

stock options) issued pursuant to the Company’s 2011, 2004 and 2001 Incentive Stock Option Plans, and rights to purchase

up to 400,000 shares of Series A Junior Participating Cumulative Preferred Stock.

Pursuant to

the Purchase Agreement, we are required to register the shares of common stock sold in the Private Placement, as well as the shares

of common stock issuable upon exercise of the Warrants, Options and Option Warrants (collectively, the “registrable securities”)

for resale or other disposition. Specifically, we agreed to

(i) file with the SEC a shelf

registration statement with respect to the resale of the registrable securities as soon as practicable after the closing of the

Private Placement but within 30 days after the date of the Purchase Agreements; (ii) cause the shelf registration statement to

be declared effective by the SEC as soon as possible after the initial filing, and in any event no later than 90 days after the

closing date (or 120 days in the event of a full review of the shelf registration statement by the SEC); and (iii) keep the shelf

registration statement effective until the earlier of the second anniversary of the closing, such time as all registrable securities

may be sold pursuant to Rule 144 under the Securities Act of 1933 during any three-month period without the need for the Company

to be in compliance with the current public information requirement of Rule 144 or such time as all registrable securities have

been sold pursuant to an effective registration statement or Rule 144. If we are unable to comply with any of the above covenants,

we will be required to pay liquidated damages to the selling shareholders in the amount of 1% of the selling shareholders’

purchase price for every 30 days until such non-compliance is cured (subject to a 12% cap), with such liquidated damages payable

in cash.

A description of the material terms and

provisions of our capital stock is set forth below. The description is intended as a summary and is qualified in its entirety by

reference to our articles of incorporation and bylaws incorporated herein by reference. We have filed our articles of incorporation

and bylaws as exhibits to the registration statement of which this prospectus is a part. You should read our articles of incorporation

and bylaws for additional information before you buy any capital stock.

The following is a summary of the material

features of our capital stock:

Common Stock

Holders of our common stock are entitled

to one vote per share in the election of directors and on all other matters on which shareholders are entitled or permitted to

vote. Holders of common stock are not entitled to cumulative voting rights. Subject to the terms of any outstanding series of preferred

stock, the holders of common stock are entitled to dividends in amounts and at times as may be declared by the board of directors

out of funds legally available therefor. Upon our liquidation or dissolution, holders of common stock are entitled to share ratably

in all net assets available for distribution to shareholders after payment of any liquidation preferences to holders of preferred

stock. Holders of common stock have no redemption, conversion or preemptive rights.

Pursuant to standstill agreements entered

into by each selling shareholder as required by the Purchase Agreement, each of the selling shareholders agreed that for a period

of 1 year from the closing date, such selling shareholder would not, individually or in concert with any group, purchase or otherwise

acquire securities of the Company which would cause such selling shareholder, or the group with which such selling shareholder

became associated, to beneficially own greater than 19.999% of the Company’s outstanding common stock.

Preferred Stock

Our articles

of incorporation permit us to issue shares of preferred stock, from time to time, in one or more series and with such designation

and preferences for each series as are stated in the resolutions providing for the designation and issue of each such series adopted

by our board of directors. Our articles of incorporation authorize our board of directors to determine the number of shares, voting,

dividend, redemption and liquidation preferences and limitations pertaining to such series. The board of directors, without shareholder

approval, may issue preferred stock with voting rights and other rights that could adversely affect the voting power of the holders

of our common stock and outstanding preferred stock could have certain anti-takeover effects. The ability of the board of directors

to issue preferred stock without shareholder approval could have the effect of delaying, deferring or preventing a change in control

of our company or the removal of existing management. We currently do not have shares of preferred stock outstanding; however,

we have authorized up to 400,000

Series A Junior Participating Cumulative

Preferred Stock,

$0.01

par

value, in connection with

the Shareholder Rights Plan described below, and pursuant

to which we granted rights to purchase shares of the

Series A Junior Participating

Cumulative Preferred Stock

. A description of the

Series A Junior

Participating Cumulative Preferred Stock can be found in our registration statement on Form 8-A filed on July 13, 2015.

Description of Warrants, Options and Option Warrants to Purchase

Common Stock Pursuant to Which Common Stock May Be Issued

The Warrants entitle the holders to purchase

up to an aggregate of 2,976,190 shares of common stock; provided, however, that such number is subject to adjustment due to the

fact that each of the Warrants contains a limitation on the number of shares of common stock that a selling shareholder may purchase

through the Private Placement. This limitation varies by selling shareholder, but the aggregate limitation, including all selling

shareholders, prevents the securities offered in the Private Placement from exceeding 19.999% (including all common stock issued

at the closing and the common stock issued following the exercise of all Warrants, Options and Option Warrants) of the sum of (i)

the common stock outstanding prior to the Private Placement, plus (ii) the shares of common stock, and shares of common stock underlying

the Warrants, purchased by all selling shareholders in the Private Placement, plus (iii) the shares of common stock underlying

the Options and Option Warrants, purchased by all selling shareholders and assuming full exercise thereof.

The Warrants have an exercise price of $2.90

per share, which exercise price is subject to adjustment for stock splits, stock dividends, combinations or similar events. The

Warrants will not be exercisable until March 20, 2017 and are exercisable until September 19, 2021.

The Options entitle the holders to purchase

shares of common stock and to purchase Option Warrants pursuant to which shares of common stock are issuable. Such Options were

not issued for a specific number of shares or Option Warrants; rather, each may be exercised for a combination, comprised of two-thirds

shares of common stock and one-third Option Warrants, sufficient to increase such selling shareholder’s holdings in the Company,

on a post-exercise basis, to a specific beneficial ownership percentage. This number varies by selling shareholder, but the aggregate

of common stock issued at the closing and the Options and Option Warrants, if exercised in full by all selling shareholders, may

not increase the holdings of all selling shareholders, collectively, to more than 19.999% of the Company’s 57,543,714shares

of issued and outstanding common stock immediately prior to the Private Placement. The final number of shares of common stock each

holder of an Option or an Option Warrant is entitled to purchase and the corresponding exercise price will be as described in the

applicable prospectus supplement.

Each Option may only be exercised once,

in whole or in part. The exercise price of an Option will be based on a per-share exercise price equal to the five-day volume weighted

average price per share of the Company’s common stock as of the trading day immediately prior to exercise. For estimation

purposes, assuming an exercise date of October 6, 2016, the exercise price of an Option would be $2.22 per share, subject to adjustment

for stock splits, stock dividends, combinations or similar events. The term of each Option ends on March 19, 2017; provided, however,

that each Option may not be exercised until October 19, 2016.

Each Option Warrant would be substantially

in the form of Warrant issued in the Private Placement. The exercise price of an Option Warrant will be a price per share equal

to a 50% premium to the Company’s closing stock price on the Nasdaq Global Market on the trading day most recently ended

prior to the announcement of the exercise of the corresponding Option pursuant to which such Option Warrant was issued, subject

to adjustment for stock splits, stock dividends, combinations or similar events. For estimation purposes, assuming that the corresponding

Option exercise date was as of October 6, 2016, the exercise price of an Option Warrant would be $3.21. The term of each Option

Warrant would be five years from the date of issuance and an Option Warrant may not be exercised for the first six months after

issuance.

Provisions Regarding Aliens

Except as otherwise provided by law, not

more than 20% of the aggregate voting power of all shares outstanding entitled to vote on any matter shall be at any time voted

by or for the account of aliens as defined in the Communications Act of 1934, or their representatives, or by or for the account

of a foreign government or representative thereof, or by or for the account of any corporation organized under the laws of a foreign

country.

Except as otherwise provided by law, aliens,

foreign governments, or corporations organized under the laws of a foreign country, or the representatives of such aliens, foreign

governments, or corporations organized under the laws of a foreign country, shall not own, directly or through a third party who

holds the stock for the account of such alien, foreign government, or corporation organized under the laws of a foreign country:

(1) more than 20% of the number of shares of our outstanding stock, or (2) shares representing more than 20% of the aggregate

voting power of all of our outstanding shares of voting stock.

Shares of stock shall not be transferable

on our books to aliens, foreign governments, or corporations organized under the laws of foreign countries, or to the representatives

of, or persons holding for the account of, such aliens, foreign governments, or corporations organized under the laws of foreign

countries, unless, after giving effect to such transfer, the aggregate number of shares of stock owned by or for the account of

aliens, foreign governments, and corporations organized under the laws of foreign countries, and any representatives thereof, will

not exceed 20% of the number of shares of outstanding stock, and the aggregate voting power of such shares will not exceed twenty

percent 20% of the aggregate voting power of all outstanding shares of our voting stock.

If, notwithstanding these restrictions on

transfer, the aggregate number of shares of stock owned by or for the account of aliens, foreign governments, and corporations

organized under the laws of foreign countries, exceed 20% of our shares of outstanding stock, or if the aggregate voting power

of such shares exceed 20% of the aggregate voting power of all outstanding shares of our voting stock, we have the right to redeem

shares of all classes of capital stock, at their then fair market value, on a pro rata basis, owned by or for the account of all

aliens, foreign governments, and corporations organized under the laws of foreign countries, in order to reduce the number of shares

and/or percentage of voting power held by or for the account of aliens, foreign governments, and corporations organized under the

laws of foreign countries, and their representatives to the maximum number or percentage allowed under our articles of incorporation

or as otherwise required by applicable federal law.

The board of directors shall make such rules and regulations

as it deems necessary or appropriate to enforce the provisions of this section.

Anti-Takeover Provisions Contained in Our Articles of Incorporation,

Shareholder Rights Plan and the Minnesota Business Corporation Act

Our shareholder rights plan, as well as

certain provisions of our articles of incorporation and of Minnesota law described below could have an anti-takeover effect. These

provisions are intended to provide management flexibility, to enhance the likelihood of continuity and stability in the composition

of our board of directors and in the policies formulated by our board of directors and to discourage an unsolicited takeover of

our company, if our board of directors determines that such a takeover is not in our best interests or the best interests of our

shareholders. However, these provisions could have the effect of discouraging certain attempts to acquire us that could deprive

our shareholders of opportunities to sell their shares of our stock at higher values.

Shareholder Rights Plan

During the second quarter of fiscal 2015,

we adopted a shareholder rights plan to preserve the value of certain deferred tax benefits, including those generated by net operating

losses. On July 10, 2015, we declared a dividend distribution of one purchase right (a “Right”) for each outstanding

share of our common stock to shareholders of record as of the close of business on July 23, 2015 and issuable as of that date,

and on July 13, 2015, we entered into a shareholder rights plan (the “Rights Plan”) with Wells Fargo Bank, N.A., a

national banking association, with respect to the Rights. Except in certain circumstances set forth in the Rights Plan, each Right

entitles the holder to purchase from us one onethousandth of a share of Series A Junior Participating Cumulative Preferred Stock,

$0.01 par value, of the Company (“Preferred Stock” and each one onethousandth of a share of Preferred Stock, a “Unit”)

at a price of $9.00 per Unit.

The Rights initially trade together with

the common stock and are not exercisable. Subject to certain exceptions specified in the Rights Plan, the Rights will separate

from the common stock and become exercisable following (i) the tenth calendar day after a public announcement or filing that a

person or group has become an “Acquiring Person,” which is defined as a person who has acquired, or obtained the right

to acquire, beneficial ownership of 4.99% or more of the common stock then outstanding, subject to certain exceptions, or (ii)

the tenth calendar day (or such later date as may be determined by the board of directors) after any person or group commences

a tender or exchange offer, the consummation of which would result in a person or group becoming an Acquiring Person. If a person

or group becomes an Acquiring Person, each Right will entitle its holders (other than such Acquiring Person) to purchase one Unit

at a price of $9.00 per Unit. A Unit is intended to give the shareholder approximately the same dividend, voting and liquidation

rights as would one share of common stock, and should approximate the value of one share of common stock. At any time after a person

becomes an Acquiring Person, the board of directors may exchange all or part of the outstanding Rights (other than those held by

an Acquiring Person) for shares of common stock at an exchange rate of one share of common stock (and, in certain circumstances,

a Unit) for each Right. We will promptly give public notice of any exchange (although failure to give notice will not affect the

validity of the exchange).

The Rights will expire upon certain events

described in the Rights Plan, including the close of business on the date of the third annual meeting of shareholders following

the last annual meeting of our shareholders at which the Rights Plan was most recently approved by shareholders, unless the Rights

Plan is re-approved by shareholders at that third annual meeting of shareholders. However, in no event will the Rights Plan expire

later than the close of business on July 13, 2025. Until the close of business on the tenth calendar day after the day a public

announcement or a filing is made indicating that a person or group has become an Acquiring Person, we may in our sole and absolute

discretion amend the Rights or the Rights Plan agreement without the approval of any holders of the Rights or shares of common

stock in any manner, including without limitation, amendments that increase or decrease the purchase price or redemption price

or accelerate or extend the final expiration date or the period in which the Rights may be redeemed. We may also amend the Rights

Plan after the close of business on the tenth calendar day after the day such public announcement or filing is made to cure ambiguities,

to correct defective or inconsistent provisions, to shorten or lengthen time periods under the Rights Plan or in any other manner

that does not adversely affect the interests of holders of the Rights. No amendment of the Rights Plan may extend its expiration

date.

Statutory Provisions

Section 302A.671 of the Minnesota Business

Corporation Act applies, with certain exceptions, to any acquisitions of our voting stock from a person other than us, and other

than in connection with certain mergers and exchanges to which we are a party and certain tender offers or exchange offers approved

in advance by a disinterested board committee, resulting in the beneficial ownership of 20% or more of the voting power of our

then outstanding stock. Section 302A.671 requires approval of the granting of voting rights for the shares received pursuant

to any such acquisitions by a vote of our shareholders holding a majority of the voting power of our outstanding shares and a majority

of the voting power of our outstanding shares that are not held by the acquiring person, our officers or those non-officer employees,

if any, who are also our directors. Similar voting requirements are imposed for acquisitions resulting in beneficial ownership

of 33-1/3% or more or a majority of the voting power of our then outstanding stock. In general, shares acquired without this approval

are denied voting rights in excess of the 20%, 33-1/3% or 50% thresholds and, to that extent, can be called for redemption at their

then fair market value by us within 30 days after the acquiring person has failed to deliver a timely information statement to

us or the date our shareholders voted not to grant voting rights to the acquiring person’s shares.

Section 302A.673 of the Minnesota Business

Corporation Act generally prohibits any business combination by us, or any subsidiary of ours, with any shareholder that beneficially

owns 10% or more of the voting power of our outstanding shares (an “interested shareholder”) within four years following

the time the interested shareholder crosses the 10% stock ownership threshold, unless the business combination is approved by a

committee of disinterested members of our board of directors before the time the interested shareholder crosses the 10% stock ownership

threshold.

Section 302A.675 of the Minnesota Business

Corporation Act generally prohibits an offeror from acquiring our shares within two years following the offeror’s last purchase

of our shares pursuant to a takeover offer with respect to that class, unless our shareholders are able to sell their shares to

the offeror upon substantially equivalent terms as those provided in the earlier takeover offer. This statute will not apply if

the acquisition of shares is approved by a committee of disinterested members of our board of directors before the purchase of

any shares by the offeror pursuant to the earlier takeover offer.

Authorized But Unissued Shares of Common Stock and Preferred

Stock

Our authorized but unissued shares of common

stock and preferred stock are available for our board of directors to issue without shareholder approval. We may use these additional

shares for a variety of corporate purposes, including future public offerings to raise additional capital, corporate acquisitions

and employee benefit plans. In addition, our articles of incorporation permit us to issue shares of preferred stock, from time

to time, in one or more series and with such designation and preferences for each series as are stated in the resolutions providing

for the designation and issue of each such series adopted by our board of directors. Our articles of incorporation authorize our

board of directors to determine the number of shares, voting, dividend, redemption and liquidation preferences and limitations

pertaining to such series. The board of directors, without shareholder approval, may issue common stock or preferred stock with

voting rights and other rights that could adversely affect the voting power of the holders of our common stock could have certain

anti-takeover effects. We currently do not have any shares of preferred stock outstanding and have no present plans to issue any

shares of preferred stock. The ability of the board of directors to issue common stock or preferred stock without shareholder approval

could have the effect of delaying, deferring or preventing a change in control of our company or the removal of existing management.

Transfer Agent and Registrar

Wells Fargo Shareowner Services has been

appointed as the transfer agent and registrar for our common stock.

Listing

Our common stock is quoted on the Nasdaq

Global Market under the symbol “EVLV.”

Limitation of Liability and Indemnification Matters

We are subject to Minnesota Section 302A.521,

which provides that a corporation shall indemnify any person made or threatened to be made a party to a proceeding by reason of

the former or present official capacity (as defined in Section 302A.521 of the Minnesota Statutes) of that person against

judgments, penalties, fines, including, without limitation, excise taxes assessed against such person with respect to an employee

benefit plan, settlements and reasonable expenses, including attorneys’ fees and disbursements, incurred by such person in

connection with the proceeding, if, with respect to the acts or omissions of that person complained of in the proceeding, that

person:

|

|

·

|

has not been indemnified therefor by another organization or employee benefit plan;

|

|

|

·

|

received no improper personal benefit and Section 302A.255 (with respect to director conflicts of interest), if applicable,

has been satisfied;

|

|

|

·

|

in the case of a criminal proceeding, had no reasonable cause to believe the conduct was unlawful; and

|

|

|

·

|

in the case of acts or omissions occurring in such person’s performance in an official capacity, such person must have

acted in a manner such person reasonably believed was in the best interests of the corporation or, in certain limited circumstances,

not opposed to the best interests of the corporation.

|

In addition, Section 302A.521, subdiv. 3

requires payment by the registrant, upon written request, of reasonable expenses in advance of final disposition in certain instances.

A decision as to required indemnification is made by a majority of the disinterested board of directors present at a meeting at

which a disinterested quorum is present, or by a designated committee of disinterested directors, by special legal counsel, by

the disinterested shareholders, or by a court.

Our bylaws provide that we will indemnify

any of our officers, directors, employees, and agents to the fullest extent permitted by Minnesota law and we have indemnification

agreements with our directors and officers.

We have a director and officer liability

insurance policy to cover us, our directors and our officers against certain liabilities.

PLAN OF DISTRIBUTION

We

are registering for resale the shares of common stock issued to the selling shareholders and issuable upon exercise of the Warrants,

Options and Option Warrants issued to the selling shareholders and certain transferees. We will not receive any of the proceeds

from the sale by the selling shareholders of the shares of common stock, although we may receive proceeds upon the exercise of

the Warrants, Options and Option Warrants by the selling shareholders. We will bear all fees and expenses incident to our obligation

to register the shares of common stock. If the shares of common stock are sold through broker-dealers or agents, the selling shareholder

will be responsible for any compensation to such broker-dealers or agents.

The

selling shareholders may pledge or grant a security interest in some or all of the shares of common stock owned by them and, if

they default in the performance of their secured obligations, the pledgees or secured parties may offer and sell the shares of

common stock from time to time pursuant to this prospectus.

The

selling shareholders also may transfer and donate the shares of common stock in other circumstances in which case the transferees,

donees, pledgees or other successors in interest will be the selling beneficial owners for purposes of this prospectus.

The

selling shareholders will sell their shares of common stock subject to the following:

|

|

·

|

all of a portion of the shares of common stock beneficially owned by the selling shareholders or their perspective pledgees,

donees, transferees or successors in interest, may be sold on the OTC Bulletin Board Market, any national securities exchange or

quotation service on which the shares of our common stock may be listed or quoted at the time of sale, in the over-the counter

market, in privately negotiated transactions, through the writing of options, whether such options are listed on an options exchange

or otherwise, short sales or in a combination of such transactions;

|

|

|

·

|

each sale may be made

at market price prevailing at the time of such sale, at negotiated prices, at fixed prices or at carrying prices determined at

the time of sale;

|

|

|

·

|

some or all of the shares

of common stock may be sold through one or more broker-dealers or agents and may involve crosses, block transactions or hedging

transactions. The selling shareholders may enter into hedging transactions with broker-dealers or agents, which may in turn engage

in short sales of the common stock in the course of hedging in positions they assume. The selling shareholders may also sell shares

of common stock short and deliver shares of common stock to close out short positions or loan or pledge shares of common stock

to broker-dealers or agents that in turn may sell such shares;

|

|

|

·

|

in connection with such

sales through one or more broker-dealers or agents, such broker-dealers or agents may receive compensation in the form of discounts,

concessions or commissions from the selling shareholders and may receive commissions from the purchasers of the shares of common

stock for whom they act as broker-dealer or agent or to whom they sell as principal (which discounts, concessions or commissions

as to particular broker-dealers or agents may be in excess of those customary in the types of transaction involved). Any broker-dealer

or agent participating in any such sale may be deemed to be an “underwriter” within the meaning of the Securities Act

and will be required to deliver a copy of this prospectus to any person who purchases any share of common stock from or through

such broker-dealer or agent. We have been advised that, as of the date hereof, none of the selling shareholders have made any arrangements

with any broker-dealer or agent for the sale of their shares of common stock; and

|

|

|

·

|

in

connection with any other sales or transfers of common stock not prohibited by law.

|

The

selling shareholders and any broker-dealer participating in the distribution of the shares of common stock may be deemed to be

“underwriters” within the meaning of the Securities Act, and any profits realized by the selling shareholders and any

commissions paid, or any discounts or concessions allowed to any such broker-dealer may be deemed to be underwriting commissions

or discounts under the Securities Act. In addition, any shares of common stock covered by this prospectus which qualify for sale

pursuant to Rule 144 may be sold under Rule 144 rather than pursuant to this prospectus. A selling shareholder may also transfer,

devise or gift the shares of common stock by other means not covered in this prospectus in which case the transferee, devisee or

giftee will be the selling shareholder under this prospectus.

If

required at the time a particular offering of the shares of common stock is made, a prospectus supplement or, if appropriate, a

post-effective amendment to the shelf registration statement of which this prospectus is a part, will be distributed which will

set forth the aggregate amount of shares of common stock being offered and the terms of the offering, including the name or names

of any broker-deals or agents, any discounts, commissions or concessions allowed or reallowed or paid to broker-dealers.

Under

the securities laws of some states, the shares of common stock may be sold in such states only through registered or licensed brokers

or dealers. In addition, in some states the shares of common stock may not be sold unless such shares have been registered or qualified

for sale in such state or an exemption from registration or qualification is available and is complied with. There can be no assurance

that any selling shareholder will sell any or all of the shares of common stock registered pursuant to the shelf registration statement,

of which this prospectus forms a part.

The

selling shareholders and any other person participating in such distribution will be subject to applicable provisions of the Exchange

Act and the rules and regulations thereunder, including, without limitation, Regulation M of the Exchange Act, which may limit

the timing of purchases and sales of any of the shares of common stock by the selling shareholders and any other participating

person. Regulation M may also restrict the ability of any person engaged in the distribution of the shares of common stock to engage

in market-making activities with respect to the shares of common stock. All of the foregoing may affect the marketability of the

shares of common stock and the ability of any person or entity to engage in market-making activities with respect to the shares

of common stock.

We will bear all expenses of the registration

of the shares of common stock including, without limitation, Securities and Exchange Commission filing fees and expenses of compliance

with the state securities of “blue sky” laws. The selling shareholders will pay all underwriting discounts and selling

commissions and expenses, brokerage fees and transfer taxes, as well as the fees and disbursements of counsel to and experts for

the selling shareholders, if any. We will indemnify the selling shareholders against liabilities, including some liabilities under

the Securities Act, in accordance with the registration rights agreement or the selling shareholder will be entitled to contribution.

We will be indemnified by the selling shareholders against civil liabilities, including liabilities under the Securities Act that

may arise from any written information furnished to us by the selling shareholders for use in this prospectus, in accordance with

the related securities purchase agreement or will be entitled to contribution. Once sold under this shelf registration statement,

of which this prospectus forms a part, the shares of common stock will be freely tradable in the hands of persons other than our

affiliates.

LEGAL MATTERS

Gray, Plant, Mooty, Mooty & Bennett,

P.A, Minneapolis, Minnesota, will issue an opinion about the legality of the securities offered under this prospectus. Any underwriters

will be represented by their own legal counsel.

EXPERTS

The consolidated financial

statements, and the related consolidated financial statement schedule, incorporated in this prospectus by reference from our Annual

Report on Form 10-K for the year ended January 30, 2016, and the effectiveness of our internal control over financial

reporting have been audited by Deloitte & Touche LLP, an independent registered public accounting firm, as stated in

their reports, which are incorporated herein by reference. Such financial statements and financial statement schedule have been

so incorporated in reliance upon the reports of such firm given upon their authority as experts in accounting and auditing.

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14.

Other

Expenses of Issuance and Distribution

The

following table sets forth the various expenses to be incurred in connection with the sale and distribution of the securities being

registered hereby, all of which will be borne by the Company (except any underwriting discounts and commissions and expenses incurred

by the selling shareholders for brokerage or legal services or any other expenses incurred by the selling stockholders in disposing

of the shares). All amounts shown are estimates except the SEC registration fee.

|

SEC registration fee

|

|

$

|

3,599.18

|

|

|

Legal fees and expenses

|

|

$

|

25,000

|

|

|

Accounting fees and expenses

|

|

$

|

5,000

|

|

|

Miscellaneous

|

|

$

|

2,000

|

|

|

Total

|

|

$

|

35,599.18

|

|

Item 15.

Indemnification

of Directors and Officers

We are subject to

the Minnesota Business Corporation Act (the “MBCA”). Section 302A.521 of the MBCA provides that we shall indemnify

a person made or threatened to be made a party to a proceeding by reason of the former or present official capacity of such person

against judgments, penalties, fines, including, without limitation, excise taxes assessed against such person with respect to any

employee benefit plan, settlements and reasonable expenses, including attorneys’ fees and disbursements, incurred by such

person in connection with the proceeding, if, with respect to the acts or omissions of such person complained of in the proceeding,

such person:

|

|

·

|

has not been indemnified by another organization or employee benefit plan for the same judgments,

penalties, fines, including, without limitation, excise taxes assessed against the person with respect to an employee benefit plan,

settlements, and reasonable expenses, including attorneys’ fees and disbursements, incurred by the person in connection with

the proceeding with respect to the same acts or omissions;

|

|

|

·

|

received no improper personal benefit and Section 302A.255 of the MBCA, if applicable, has been

satisfied;

|

|

|

·

|

in the case of a criminal proceeding, had no reasonable cause to believe the conduct was unlawful;

and

|

|

|

·

|

in the case of acts or omissions occurring in such person’s performance in an official capacity,

such person must have acted in a manner such person reasonably believed was in our best interests, or, in certain limited circumstances,

not opposed to our best interests.

|

In addition,

Section 302A.521, subdivision 3 requires payment by the registrant, upon written request, of reasonable expenses in advance

of final disposition in certain instances. A decision as to required indemnification is made by a majority of the disinterested

board of directors present at a meeting at which a disinterested quorum is present, or by a designated committee of disinterested

directors, by special legal counsel, by the disinterested shareholders, or by a court.

Our bylaws provide

that we will indemnify any of our officers, directors, employees, and agents to the fullest extent permitted by Minnesota law and

we have indemnification agreements with our directors and officers.

We have a director

and officer liability insurance policy to cover us, our directors and our officers against certain liabilities.

Item 16.

Exhibits

(a)

Exhibits