Oracle to Call Off NetSuite Deal Unless Shareholder Support Increases--Update

October 07 2016 - 10:57AM

Dow Jones News

By Jay Greene

Oracle Corp. is extending the deadline to complete its $9.3

million deal to buy NetSuite Inc., having received only about a

quarter of the shares necessary from the cloud-computing pioneer's

stockholders.

Concerns by NetSuite's largest institutional shareholder, T.

Rowe Price Group Inc., that the price of $109 a share undervalued

the company, are apparently derailing the deal.

On Friday, Oracle announced that it extended the expiration data

of its tender offer for NetSuite to Nov. 4, having already extended

the date to Oct. 6 last month "to facilitate the completion of

outstanding antitrust reviews." In September, Oracle received the

final antitrust clearance needed, from the U.S. Department of

Justice.

Oracle, which wants to buy NetSuite to extend its cloud-software

offerings, a market segment where Oracle widely has been perceived

as a laggard and is racing to add new services, said the Nov. 4

deadline would be the final extension.

"In the event that a majority of NetSuite's unaffiliated

shareholders do not tender sufficient shares to reach the minimum

tender condition, Oracle will respect the will of NetSuite's

unaffiliated shareholders and terminate its proposed acquisition,"

the company said in a news release.

Oracle needs 20.4 million shares to be tendered to close the

deal. As of Thursday, only 4.6 million shares had been

tendered.

NetSuite shares fell 2.6% to $106.45 in morning trading in New

York, while Oracle shares rose 0.4% to $38.89.

Both companies provide business applications that help automate

operations in areas including finance and human resources,

collectively called enterprise-resource planning.

The deal has been complicated by Oracle executive chairman Larry

Ellison's substantial stake in NetSuite, raising the issue of

conflicts of interest. In a September regulatory filing, NetSuite

said Mr. Ellison had an "indirect beneficial ownership of

approximately 39.5%" of NetSuite's common stock, making him the

company's largest investor.

From an Oracle shareholder's point of view, Mr. Ellison's

majority stake in NetSuite may influence him to support Oracle

overpaying for the acquisition. From a NetSuite shareholder's point

of view, his holdings may scare off other bidders.

To address such concerns, Oracle appointed a committee of

independent directors to oversee its side of the deal. Moreover,

the two companies agreed that the transaction must be approved by

owners of a majority of NetSuite shares not held by Mr. Ellison and

his family, giving independent NetSuite shareholders more clout in

approving the deal.

Last month, T. Rowe notified the company that it wouldn't tender

its 14.5 million shares in favor of the deal. The firm has

increased its stake since a June 30 regulatory filing, when it held

nearly 12.2 million shares that accounted for slightly more than

15% of NetSuite's outstanding stock at the time.

In a letter to NetSuite's board, T. Rowe said the $109 per share

offered by Oracle undervalued the company, in part because

"potential synergies" in cloud computing could be realized by

Oracle when the deal is completed.

At the time, Oracle declined to comment on T. Rowe's concerns

and NetSuite didn't respond to a request for comment. But in a

regulatory filing, NetSuite noted that its board "unanimously

reaffirmed its recommendation that stockholders accept Oracle's

offer and tender their shares."

Write to Jay Greene at Jay.Greene@wsj.com

(END) Dow Jones Newswires

October 07, 2016 10:42 ET (14:42 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

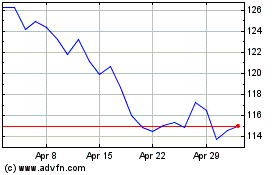

Oracle (NYSE:ORCL)

Historical Stock Chart

From Mar 2024 to Apr 2024

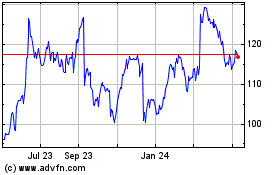

Oracle (NYSE:ORCL)

Historical Stock Chart

From Apr 2023 to Apr 2024