Advanced Drainage Systems, Inc. (NYSE:WMS) (“ADS” or the

“Company”), a leading global manufacturer of water management

products and solutions for commercial, residential, infrastructure

and agricultural applications, today announced financial results

for the fiscal first quarter ended June 30, 2016.

First Fiscal Quarter 2017

Highlights

- Quarterly net sales increased 2.4%

to $358 million

- Net income increased 96% to $25

million

- Adjusted EBITDA (Non-GAAP) increased

34% to $72 million

- Cash flow from operating activities

went from a use of $18 million to flat

- Free cash flow (Non-GAAP) improved

from a use of $30 million to a use of $13 million

Joe Chlapaty, Chairman and Chief Executive Officer of ADS

commented, “We are very pleased with our performance for the first

fiscal quarter, which reflected solid execution of our conversion

strategy as well as strong growth in HP Pipe and Allied Products.

Our growth was particularly strong in our nonresidential end

market, which grew 11% versus the prior year. This performance was

partially offset by a weaker-than-expected agriculture end market

and continued softness in Mexico. In addition, Adjusted EBITDA

increased 34% over the prior year period to $72 million for the

quarter.

Chlapaty continued, “The underlying fundamentals of our business

remain strong as we continue to execute on our strategies. We

anticipate that for the remainder of fiscal year 2017, we will

continue to face headwinds in our agriculture end market and in

Mexico. In addition, like many of our peers in the construction

market, we are seeing domestic growth moderate slightly from

previous expectations. That said, we remain optimistic about our

ability to continue generating above-market growth and healthy

profitability for fiscal year 2017 and beyond.”

First Fiscal Quarter 2017

Results

Gross profit increased $22.2 million, or 29.8%, to $96.7 million

for the fiscal first quarter 2017, compared to $74.5 million in the

prior fiscal year. As a percentage of net sales, gross profit was

27.0%, compared to 21.3%, in the prior fiscal first quarter. The

increase in gross profit was largely attributed to lower raw

material costs, increased sales of Allied Products and lower diesel

costs.

The Company reported Adjusted EBITDA (Non-GAAP) of $71.8 million

in the fiscal first quarter 2017 compared to Adjusted EBITDA of

$53.7 million in the prior fiscal year, an increase of 33.7%. As a

percentage of net sales, Adjusted EBITDA was 20.1% for the fiscal

first quarter 2017 compared to 15.4% in the prior fiscal year. The

increase in Adjusted EBITDA was largely attributed to the same

factors mentioned above.

Adjusted Earnings Per Fully Converted Share (Non-GAAP) for the

fiscal first quarter 2017 was $0.37 per share based on weighted

average fully converted shares of 73.7 million, improved from an

Adjusted Earnings Per Fully Converted Share of $0.20 per share for

the prior fiscal first quarter.

A reconciliation of GAAP to Non-GAAP financial measures for

Adjusted EBITDA, Free Cash Flow and Adjusted Earnings Per Fully

Converted Share has been provided in the financial statement tables

included in this press release. An explanation of these measures is

also included below under the heading “Non-GAAP Financial

Measures.”

For the fiscal first quarter 2017, the Company recorded net cash

provided by operating activities of $(0.1) million compared to

$(18.1) million for the same period last year. Net debt (total debt

and capital lease obligations net of cash) was $445.9 million as of

June 30, 2016, a decrease of $61.2 million from June 30, 2015.

Fiscal Year 2017 Outlook

Based on current visibility, backlog of existing orders and

business trends, the Company has revised its net sales target for

fiscal year 2017. Net sales for fiscal year 2017 are now forecast

to be in the range of $1.270 billion to $1.310 billion. The revised

guidance is predicated on the belief that end market performance

will be slightly lower than previously expected for the remainder

of fiscal year 2017. The table below illustrates the expected

change in end market performance.

End Market

Previous Outlook Current

Outlook Domestic Construction

Up 4% to 7% Up 0% to 4%

Agriculture Down

5% to 12% Down 15% to 25%

International Down 1% to 6%

Down 5% to 15%

With the revised net sales guidance, the Company is adjusting

its Adjusted EBITDA (Non-GAAP) expectations to $200 million to $225

million for the full fiscal year.

Scott Cottrill, Executive Vice President and Chief Financial

Officer of ADS, commented, “Our revised expectations for end market

performance is based in part on the trends we saw during the first

half of the fiscal year, in particular slower market growth in our

domestic construction markets and continued weakness in our

agriculture and Mexican markets as we moved into the second fiscal

quarter. Although we cannot control the macro environment, we will

continue to strive for performance above the market. In fact, we

believe we will generate growth of mid-single digits in our core

domestic construction markets for the full fiscal year, which we

believe would outpace our revised market growth expectations. In

addition, our adjusted EBITDA performance remains strong, as we

continue to operate in a favorable cost environment and effectively

manage our operations. As such, we are only slightly lowering our

full year adjusted EBITDA guidance to $200 million to $225

million.”

Webcast Information

The Company will host an investor conference call and webcast on

Thursday, October 6, 2016 at 10:00 a.m. Eastern Time. The live call

can be accessed by dialing 1-866-450-8367 (US toll-free) or

1-412-317-5465 (international) and asking to be connected to the

Advanced Drainage Systems, Inc. call. The live webcast will also be

accessible via the "Events Calendar” section of the Company’s

Investor Relations website, www.investors.ads-pipe.com. An archived

version of the webcast will be available for 90 days following the

call.

About ADS

Advanced Drainage Systems (ADS) is the leading manufacturer of

high performance thermoplastic corrugated pipe, providing a

comprehensive suite of water management products and superior

drainage solutions for use in the construction and infrastructure

marketplace. Its innovative products are used across a broad range

of end markets and applications, including non-residential,

residential, agriculture and infrastructure applications. The

Company has established a leading position in many of these end

markets by leveraging its national sales and distribution platform,

its overall product breadth and scale and its manufacturing

excellence. Founded in 1966, the Company operates a global network

of 61 manufacturing plants and 31 distribution centers. To learn

more about the ADS, please visit the Company’s website at

www.ads-pipe.com.

Forward Looking

Statements

Certain statements in this press release may be deemed to be

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. These statements are

not historical facts but rather are based on the Company’s current

expectations, estimates and projections regarding the Company’s

business, operations and other factors relating thereto. Words such

as “may,” “will,” “could,” “would,” “should,” “anticipate,”

“predict,” “potential,” “continue,” “expects,” “intends,” “plans,”

“projects,” “believes,” “estimates,” “confident” and similar

expressions are used to identify these forward-looking statements.

Factors that could cause actual results to differ from those

reflected in forward-looking statements relating to our operations

and business include: fluctuations in the price and availability of

resins and other raw materials and our ability to pass any

increased costs of raw materials on to our customers in a timely

manner; volatility in general business and economic conditions in

the markets in which we operate, including, without limitation,

factors relating to availability of credit, interest rates,

fluctuations in capital and business and consumer confidence;

cyclicality and seasonality of the non-residential and residential

construction markets and infrastructure spending; the risks of

increasing competition in our existing and future markets,

including competition from both manufacturers of high performance

thermoplastic corrugated pipe and manufacturers of products using

alternative materials; our ability to continue to convert current

demand for concrete, steel and PVC pipe products into demand for

our high performance thermoplastic corrugated pipe and Allied

Products; the effect of weather or seasonality; the loss of any of

our significant customers; the risks of doing business

internationally; the risks of conducting a portion of our

operations through joint ventures; our ability to expand into new

geographic or product markets; our ability to achieve the

acquisition component of our growth strategy; the risk associated

with manufacturing processes; our ability to manage our assets; the

risks associated with our product warranties; our ability to manage

our supply purchasing and customer credit policies; the risks

associated with our self-insured programs; our ability to control

labor costs and to attract, train and retain highly-qualified

employees and key personnel; our ability to protect our

intellectual property rights; changes in laws and regulations,

including environmental laws and regulations; our ability to

project product mix; the risks associated with our current levels

of indebtedness; our ability to meet future capital requirements

and fund our liquidity needs; the risk that additional information

may arise that would require the Company to make additional

adjustments or revisions or to restate the financial statements and

other financial data for certain prior periods and any future

periods, any further delay in the filing of any filings with the

SEC; the review of potential weaknesses or deficiencies in the

Company’s disclosure controls and procedures, and discovering

further weaknesses of which we are not currently aware or which

have not been detected and the other risks and uncertainties

described in the Company’s filings with the Securities and Exchange

Commission. New risks and uncertainties emerge from time to time

and it is not possible for the Company to predict all risks and

uncertainties that could have an impact on the forward-looking

statements contained in this press release. In light of the

significant uncertainties inherent in the forward-looking

information included herein, the inclusion of such information

should not be regarded as a representation by the Company or any

other person that the Company’s expectations, objectives or plans

will be achieved in the timeframe anticipated or at all. Investors

are cautioned not to place undue reliance on the Company’s

forward-looking statements and the Company undertakes no obligation

to publicly update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise,

except as required by law.

Financial

Statements

ADVANCED DRAINAGE SYSTEMS, INC. AND

SUBSIDIARIESCONSOLIDATED STATEMENTS OF

INCOME(unaudited)

Three Months Ended June 30, (Amounts in thousands,

except per share data) 2016 2015 Net sales

$ 357,576 $ 349,124 Cost of goods sold 260,870 274,647 Gross profit

96,706 74,477 Operating expenses: Selling 23,930 21,227 General and

administrative 26,284 18,286 Loss on disposal of assets or

businesses 202 866 Intangible amortization 2,187 2,526 Income from

operations 44,103 31,572 Other (income) expense: Interest expense

4,784 4,286 Derivative (gains) losses and other (income) expense,

net (3,037) 6,580 Income before income taxes 42,356 20,706 Income

tax expense 16,909 8,148 Equity in net loss (income) of

unconsolidated affiliates 96 (354) Net income 25,351 12,912 Less

net income attributable to noncontrolling interest 1,148 1,088 Net

income attributable to ADS 24,203 11,824 Accretion of Redeemable

noncontrolling interest (362) - Dividends to Redeemable convertible

preferred stockholders (426) (371) Dividends paid to unvested

restricted stockholders (3) (6) Net income available to common

stockholders and participating securities 23,412 11,447

Undistributed income allocated to participating securities (2,142)

(982)

Net income available to common stockholders

$

21,270 $ 10,465 Weighted average

common shares outstanding: Basic 54,534 53,623 Diluted 55,437

54,775

Net income per share: Basic $ 0.39 $ 0.20 Diluted $

0.38 $ 0.19

Cash dividends declared per share $ 0.06 $ 0.05

ADVANCED DRAINAGE SYSTEMS, INC. AND

SUBSIDIARIESCONSOLIDATED BALANCE

SHEETS(unaudited)

As of (Amounts in thousands)

June 30,2016

March 31,2016

ASSETS Current assets: Cash $ 9,168 $

6,555 Receivables 212,167 186,883 Inventories 238,718

230,466 Other current assets 8,460

12,859 Total current assets 468,513 436,763 Property,

plant and equipment, net 401,822 391,744

Other assets:

Goodwill 100,857 100,885 Intangible assets, net 57,822 59,869 Other

assets 45,614 45,256

Total assets $ 1,074,628

$ 1,034,517 LIABILITIES, MEZZANINE

EQUITY AND STOCKHOLDERS’ EQUITY Current liabilities:

Current maturities of debt obligations $ 35,880 $ 35,870 Current

maturities of capital lease obligations 20,872 19,231 Accounts

payable 112,646 119,606 Other accrued liabilities 64,806 65,099

Accrued income taxes 2,380

1,822 Total current liabilities 236,584 241,628 Long-term

debt obligation 335,130 312,214 Long-term capital lease obligations

63,231 56,809 Deferred tax liabilities 55,075 63,683 Other

liabilities 30,684 30,803

Total liabilities 720,704 705,137 Commitments and contingencies

Mezzanine equity: Redeemable convertible preferred stock

307,513 310,240 Deferred compensation — unearned ESOP shares

(203,836) (205,664) Redeemable noncontrolling interest in

subsidiaries 7,794 7,171

Total mezzanine equity 111,471 111,747

Stockholders’ equity:

Common stock 12,393 12,393 Paid-in capital 720,389 715,859 Common

stock in treasury, at cost (439,009) (440,995) Accumulated other

comprehensive loss (22,881) (21,261) Retained deficit

(42,858)

(63,396)

Total ADS stockholders’ equity 228,034 202,600 Noncontrolling

interest in subsidiaries 14,419

15,033 Total stockholders’ equity

242,453 217,633

Total liabilities,

mezzanine equity and stockholders’ equity $

1,074,628 $

1,034,517

ADVANCED DRAINAGE SYSTEMS, INC. AND

SUBSIDIARIESCONSOLIDATED STATEMENTS OF CASH

FLOWS(unaudited)

Three Months Ended June 30, (Amounts in

thousands) 2016 2015 Cash Flow

from Operating Activities $ (132) $

(18,142)

Cash Flows from Investing Activities

Capital expenditures (12,595) (11,535) Issuance of

note receivable to related party - (3,854) Other investing

activities (200) (172)

Net cash used in investing activities (12,795)

(15,561)

Cash Flows from Financing

Activities Proceeds from Revolving Credit Facility 114,000

130,400 Payments from Revolving Credit Facility (88,700) (90,100)

Payments on Term Loan (2,500) (1,875) Proceeds from notes,

mortgages, and other debt - 6,926 Payments from notes, mortgages,

and other debt (215) (3,217) Payments on capital lease obligation

(5,358) (4,192) Cash dividends paid (3,665) (3,784) Other financing

activities 2,640 587 Net

cash provided by financing activities 16,202

34,745 Effect of exchange rates changes on

cash (662) 182 Net change in cash 2,613 1,224 Cash at beginning of

period 6,555 3,623

Cash at end of period $ 9,168

$ 4,847

Non-GAAP Financial Measures

This press release contains financial information determined by

methods other than in accordance with accounting principles

generally accepted in the United States of America (“GAAP”). ADS

management uses non-GAAP measures in its analysis of the Company’s

performance. Investors are encouraged to review the reconciliation

of non-GAAP financial measures to the comparable GAAP results

available in the accompanying tables.

Reconciliation of Non-GAAP Financial Measures

This press release includes references to Adjusted EBITDA, Free

Cash Flow and Adjusted Earnings Per Fully Converted Share, all

non-GAAP financial measures. These non-GAAP financial measures are

used in addition to and in conjunction with results presented in

accordance with GAAP. These measures are not intended to be

substitutes for those reported in accordance with GAAP. Adjusted

EBITDA, Free Cash Flow, and Adjusted Earnings per Fully Converted

Share may be different from non-GAAP financial measures used by

other companies, even when similar terms are used to identify such

measures.

Adjusted EBITDA is a non-GAAP financial measure that comprises

net income before interest, income taxes, depreciation and

amortization, stock-based compensation, non-cash charges and

certain other expenses. The Company’s definition of Adjusted EBITDA

may differ from similar measures used by other companies, even when

similar terms are used to identify such measures. Adjusted EBITDA

is a key metric used by management and the Company’s board of

directors to assess financial performance and evaluate the

effectiveness of the Company’s business strategies. Accordingly,

management believes that Adjusted EBITDA provides useful

information to investors and others in understanding and evaluating

our operating results in the same manner as the Company’s

management and board of directors. In order to provide investors

with a meaningful reconciliation, the Company has provided below

reconciliations of Adjusted EBITDA to net income.

Free Cash Flow is a non-GAAP financial measure that comprises

cash flow from operating activities less capital expenditures. Free

Cash Flow is a measure used by management and the Company’s board

of directors to assess the Company’s ability to generate cash.

Accordingly, management believes that Free Cash Flow provides

useful information to investors and others in understanding and

evaluating our ability to generate cash flow from operations after

capital expenditures. In order to provide investors with a

meaningful reconciliation, the Company has provided below a

reconciliation of cash flow from operating activities to Free Cash

Flow.

Adjusted Earnings Per Fully Converted Share is a non-GAAP

measure that is calculated by adjusting our Net income per share –

Basic, the most comparable GAAP measure. To effect this adjustment

with respect to Net income available to common stockholders, we

have (1) removed the accretion of Redeemable noncontrolling

interest in subsidiaries, (2) added back the dividends to

Redeemable convertible preferred stockholders and dividends paid to

unvested restricted stockholders, (3) made corresponding

adjustments to the amount allocated to participating securities

under the two class earnings per share computation method, and (4)

added back ESOP deferred compensation attributable to the shares of

Redeemable convertible preferred stock allocated to employee ESOP

accounts during the applicable period, which is a non-cash charge

to our earnings. We have also made adjustments to the weighted

average common shares outstanding – Basic to assume (1) share

conversion of the Redeemable convertible preferred stock

outstanding shares to common stock and (2) add shares of

outstanding unvested restricted stock. Adjusted Earnings Per Fully

Converted Share (non-GAAP) is a key metric used by management and

our board of directors to assess our financial performance. This

information is useful to investors as the preferred shares held by

the ESOP are required to be distributed to our employees over time,

which is done in the form of common stock after the conversion of

the preferred shares. As such, this measure is included because it

provides investors with information to understand the impact on the

financial statements once all preferred shares are converted and

distributed.

The following tables present a reconciliation of Adjusted EBITDA

to Net Income, Free Cash Flow to Cash Flow from Operating

Activities, and Adjusted Earnings Per Fully Converted Share to Net

income per share – Basic, the most comparable GAAP measures, for

each of the periods indicated:

Reconciliation of Adjusted EBITDA to

Net Income

Three Months Ended June 30,

(Amounts in thousands) 2016 2015 Net

income $ 25,351 $ 12,912

Depreciation and amortization 18,026 18,639 Interest expense 4,784

4,286 Income tax expense 16,909 8,148 EBITDA 65,070

43,985 Derivative fair value adjustments (4,907) 3,761 Foreign

currency transaction (gains) losses (1,762) 317 Loss on disposal of

assets or businesses 202 866

Unconsolidated affiliates interest, tax,

depreciation and amortization

778 870 Contingent consideration remeasurement 24 55 Stock-based

compensation 454 725 ESOP deferred stock-based compensation 2,738

3,125 Restatement-related costs 9,212 -

Adjusted

EBITDA $ 71,809 $ 53,704

Reconciliation of Segment Adjusted

EBITDA to Net Income

Three Months Ended June 30,

2016 2015

(Amounts in thousands) Domestic

International

Domestic International

Net income $ 23,634

$ 1,717

$ 5,571 $

7,341 Depreciation and amortization 15,678 2,348

16,417 2,222 Interest expense 4,673 111 4,037 249 Income tax

expense 14,868

2,041 7,094

1,054 EBITDA 58,853 6,217 33,119 10,866

Derivative fair value adjustments (4,907) - 3,721 40

Foreign currency transaction (gains)

losses

- (1,762) - 317

Loss on disposal of assets or

businesses

270 (68) 1,052 (186)

Unconsolidated affiliates interest, tax,

depreciation and amortization

279 499 286 584

Contingent consideration remeasurement

24 - 55 - Stock-based compensation 454 - 725 -

ESOP deferred stock-based compensation

2,738 - 3,125 - Restatement- related costs

9,212 -

- -

Adjusted EBITDA $ 66,923

$ 4,886

$ 42,083 $

11,621

Reconciliation of Free Cash Flow to

Cash flow from Operating Activities

Three Months Ended June 30,

(Amounts in thousands) 2016

2015 Cash flow from

operating activities $ (132) $ (18,142) Capital

expenditures (12,595) (11,535)

Free cash flow $ (12,727) $

(29,677)

Reconciliation of Adjusted Earnings Per

Fully Converted Share (non-GAAP) to Net Income per Share -

Basic

Three Months Ended June 30, (Amounts

in thousands, except per share data) 2016

2015 Net income available to

common stockholders $ 21,270 $

10,465 Weighted average common shares outstanding -

Basic 54,534 53,623 Net income per share –

Basic 0.39 0.20 Adjustments to net income

available to common stockholders: Accretion of Redeemable

non-controlling interest in subsidiaries 362 - Dividends to

Redeemable convertible preferred stockholders 426 371 Dividends

paid to unvested restricted stockholders 3 6 Undistributed income

allocated to participating securities 2,142

982

Total adjustments to net income available

to common stockholders

2,933 1,359 Net income attributable to

ADS $ 24,203 $ 11,824 Adjustments to net income

attributable to ADS:

Fair value of ESOP compensation related to

Redeemable convertible preferred stock

2,738 3,125

Adjusted net income —

(Non-GAAP) $ 26,941 $ 14,949

Weighted Average Common Shares Outstanding — Basic 54,534

53,623

Adjustments to weighted average common

shares outstanding — Basic

Unvested restricted shares 79 148 Redeemable convertible preferred

shares 19,065 19,693

Weighted

Average Fully Converted Common Shares (Non-GAAP)

73,678 73,464 Adjusted

Earnings per Fully Converted Share (Non-GAAP) $

0.37 $ 0.20

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161006005316/en/

Advanced Drainage Systems, Inc.Michael Higgins,

614-658-0050Mike.Higgins@ads-pipe.com

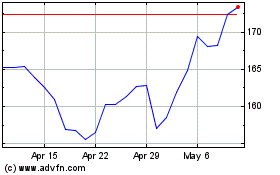

Advanced Drainage Systems (NYSE:WMS)

Historical Stock Chart

From Aug 2024 to Sep 2024

Advanced Drainage Systems (NYSE:WMS)

Historical Stock Chart

From Sep 2023 to Sep 2024