Current Report Filing (8-k)

October 03 2016 - 9:16AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

October 3, 2016 (September 30, 2016)

ALTISOURCE PORTFOLIO SOLUTIONS S.A.

(Exact name of Registrant as specified in its Charter)

|

|

|

|

|

|

|

|

|

Luxembourg

|

|

001-34354

|

|

98-0554932

|

|

(State or other jurisdiction of

incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer

Identification No.)

|

40, avenue Monterey

L-2163 Luxembourg

Grand Duchy of Luxembourg

(Address of principal executive offices including zip code)

+352 2469 7900

(Registrant’s telephone number, including area code)

NOT APPLICABLE

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01 Entry into a Material Definitive Agreement.

On September 30, 2016, Altisource Solutions S.à r.l. (“Altisource”), a wholly owned subsidiary of Altisource Portfolio Solutions S.A. (the “Company”) entered into an Amendment and Waiver Agreement (the “Amendment and Waiver Agreement”) to the Master Services Agreement (the “Agreement”) dated December 21, 2012 with Altisource Residential Corporation ("Residential"). Capitalized terms used herein and not otherwise defined herein shall have the meanings given such terms in the Agreement or the Amendment and Waiver Agreement, as applicable.

The Amendment and Waiver Agreement was entered into in connection with Residential’s acquisition of a portfolio of single family rental properties from investment funds sponsored by Amherst Holdings, LLC and the provision of property management services with respect to the acquired properties to Residential by the current property manager, as announced by Residential on September 30, 2016.

Pursuant to the Amendment and Waiver Agreement, Altisource has agreed to a limited waiver of the exclusivity provision contained in Section 8.1 of the Agreement which provides that Altisource is the exclusive provider of property management and other services to Residential and its affiliates. Such waiver will only apply with respect to the provision of property management services to Residential by the current property manager for properties contained in the Seller Property Portfolio until the end of the Waiver Term or extension thereof.

In exchange for such waiver, Residential has agreed that (i) upon a Change of Control of Residential, if Residential is not the surviving entity following such Change of Control, Residential will be obligated to cause the surviving entity to assume all rights and obligations of Residential under the Agreement (or pay to Altisource an amount equal to sixty million dollars ($60,000,000) if it breaches such obligation) and (ii) upon the occurrence of a Liquidation by Residential, Residential shall pay to Altisource an amount equal to sixty million dollars ($60,000,000); and (iii) if the current property manager for the Seller Property Portfolio seeks to outsource to any non-affiliated third party any portion of the services provided by the current property manager to the Seller Property Portfolio then, Residential shall (a) cause the current property manager to outsource any Sales and Settlement Services to Altisource on an exclusive basis and (b) use best efforts to cause the current property manager to allow Altisource to provide the other services provided by the current property manager with respect to the Seller Property Portfolio.

The foregoing descriptions of the Agreement and the Amendment and Waiver Agreement do not purport to be complete and are subject to and qualified in their entirety by reference to the full texts of such (i) Agreement which was filed as Exhibit 10.5 to the Current Report on Form 8-k filed by the Company on December 28, 2012 and (ii) Amendment and Waiver Agreement which is filed as Exhibit 10.1 hereto. The Agreement and the Amendment and Waiver Agreement are incorporated herein by reference.

Item 7.01 Regulation FD Disclosure.

On September 30, 2016, the Company issued a press release in connection with the Amendment. A copy of the press release is attached hereto as Exhibit 99.1.

Item. 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

Exhibit 10.1

|

|

Amendment and Waiver Agreement dated September 30, 2016 between Altisource Solutions S.à r.l. and Altisource Residential Corporation

|

|

Exhibit 99.1

|

|

Press release issued by Altisource Portfolio Solutions S.A. dated September 30, 2016

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: October 3, 2016

|

|

|

|

|

|

|

|

Altisource Portfolio Solutions S.A.

|

|

|

|

|

|

|

By:

|

/s/ Kevin J. Wilcox

|

|

|

Name:

|

Kevin J. Wilcox

|

|

|

Title:

|

Chief Administration and Risk Officer

|

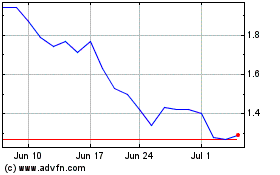

Altisource Portfolio Sol... (NASDAQ:ASPS)

Historical Stock Chart

From Mar 2024 to Apr 2024

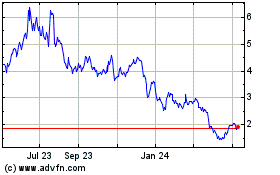

Altisource Portfolio Sol... (NASDAQ:ASPS)

Historical Stock Chart

From Apr 2023 to Apr 2024