Current Report Filing (8-k)

September 28 2016 - 1:38PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8 K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

September 23, 2016

Date of Report (Date

of earliest event reported)

ROYAL MINES AND MINERALS

CORP.

(Exact name of registrant as specified in its

charter)

|

NEVADA

|

000 52391

|

20 4178322

|

|

(State or other jurisdiction of

|

(Commission File

|

(IRS Employer Identification No.)

|

|

incorporation)

|

Number)

|

|

|

2580 Anthem Village Dr.

|

|

|

Henderson, NV

|

89052

|

|

(Address of principal executive offices)

|

(Zip Code)

|

(702) 588 5973

Registrant's telephone

number, including area code

Not Applicable

(Former name or former

address, if changed since last report)

Check the appropriate box below if the Form 8 K filing is

intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

____ Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425)

____ Soliciting material pursuant to Rule 14a 12 under the

Exchange Act (17 CFR 240.14a 12)

____ Pre commencement communications pursuant to Rule 14d 2(b)

under the Exchange Act (17 CFR 240.14d 2(b))

____ Pre commencement communications pursuant to Rule 13e 4(c)

under the Exchange Act (17 CFR 240.13e 4(c))

SECTION 1 – REGISTRANT’S BUSINESS AND OPERATIONS

|

ITEM 1.01

|

ENTRY INTO A MATERIAL DEFINITIVE

AGREEMENT.

|

On September 23, 2016, Royal Mines and Minerals Corp. (the

“Company”) entered into an amended and restated loan and joint venture agreement

(the “Amendment Agreement”) with GJS Capital Corp. (the "Creditor") and Gregg

Sedun (the “Consultant”). The Amendment Agreement replaces in its entirety the

original loan and joint venture agreement (the “Original Agreement”) dated April

16, 2014, between the Company and the Creditor.

Under the terms of the Amendment Agreement, the Creditor has

agreed to extend the previously advanced $150,000 Loan (the “Principal”). The

loan bears interest at a rate of 6% per annum, compounded annually and now has a

maturity date of December 31, 2016 (the “Maturity Date"). The Company settled

$329,000 in outstanding indebtedness in exchange for 15,065,570 shares of common

stock of the Company. Also, the Company has agreed to transfer 1,400,000 of its

1,600,000 common shares of Gainey Capital Corp. to the Creditor. The Creditor

represented that it was not a "US Person" as that term is defined by Regulation

S of the Securities Act of 1933, as amended.

At any time prior to the Maturity Date, on 65 days’ notice, the

Creditor may elect to receive units (each a “Unit") of the Company in exchange

for any portion of the Principal outstanding on the basis of one Unit for each

$0.05 of indebtedness converted (the “Unit Conversion Option"). Each Unit

consists of one share of the Company’s common stock and one warrant to purchase

an additional share of the Company's common stock at a price of $0.10 per share

for two years from the date of issuance. If the Creditor exercises the Unit

Conversion Option, the Creditor will forgive the interest that that accrued on

the converted portion of the Principal.

If the Creditor exercises the Unit Conversion Option, the

Creditor will receive a net profits interest (the “Net Profits Interest”) on any

future profits received by Company that are derived from the Company’s process

for the recovery of precious metals from coal ash and other materials (the

“Technology”) on the basis of 1% of the Company’s net profits for every $10,000

of converted Principal. The Net Profits Interest will terminate when the

Creditor receives eight times the amount of converted Principal.

The Company also agreed that in circumstances where the

Consultant introduces sub-licensees or joint venture partners (“Partners”) to

the Company for the purpose of using the Company’s Technology, the Company shall

pay 20% of the net cash proceeds received by the Company from the Partners (the

“Partnership Interest”) to the Consultant. The Company is under no obligation to

enter into an agreement or terminate any future agreement with any Partners.

The preceding description of the Amended Agreement does not

purport to be complete and is qualified in its entirety by reference to the full

text of the Amended Agreement attached as Exhibit 10.2 hereto.

SECTION 3 – SECURITIES AND TRADING MARKETS

|

ITEM 3.02

|

UNREGISTERED SALES OF EQUITY SECURITIES.

|

On September 23, 2016, Royal Mines and Minerals Corp. (the

"Company") issued 15,065,570 shares of common stock of the Company under the

terms of the Amendment Agreement. See above.

The issuance was completed under the provisions of Regulation S

of the Act. The Company did not engage in a distribution of this offering in the

United States. The consultant represented that it was not “US persons” as

defined in Regulation S of the Act and that it was not acquiring the shares for

the account or benefit of a US person.

2

SECTION 9 – FINANCIAL STATEMENT AND EXHIBITS

|

ITEM 9.01

|

FINANCIAL STATEMENTS AND EXHIBITS.

|

|

Notes:

|

|

|

|

(1)

|

Filed as an exhibit to our Current Report on

Form 8-K filed with the SEC on April 21, 2016 (SEC Accession No.

0001062993- 14-002297).

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of

1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

ROYAL MINES AND MINERALS CORP.

|

|

|

|

|

|

Date: September 28, 2016

|

|

|

|

|

By:

|

/s/

Jason S. Mitchell

|

|

|

|

|

|

|

|

JASON S. MITCHELL

|

|

|

|

Chief Financial Officer

|

3

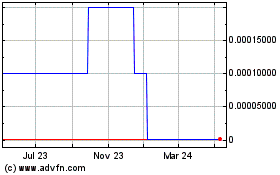

Royal Mines and Minerals (CE) (USOTC:RYMM)

Historical Stock Chart

From Mar 2024 to Apr 2024

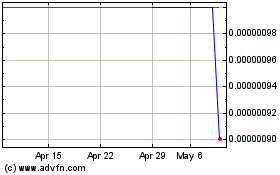

Royal Mines and Minerals (CE) (USOTC:RYMM)

Historical Stock Chart

From Apr 2023 to Apr 2024