UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

SCHEDULE

14A

Proxy

Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment

No. )

Filed

by the Registrant ☒

Filed

by a Party other than the Registrant ☐

Check

the appropriate box:

☐

Preliminary Proxy Statement

☐ Confidential, for Use of the Commission only (as permitted by Rule 14a-6(e)(2))

☒

Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to § 240.14a-11(c) or § 240.14a-12

TSR,

Inc.

(Name

of Registrant as Specified in Its Charter)

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment

of Filing Fee (Check the appropriate box):

☒

No

fee required.

☐

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

1) Title

of each class of securities to which transaction applies:____________________________________

2) Aggregate

number of securities to which transaction applies:

____________________________________

3) Per

unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which

the filing fee is calculated and state how it was determined):

____________________________________

4) Proposed

maximum aggregate value of transaction:

_________________________________________________

5) Total

fee paid:

_____________________________________________________________________________

☐

Fee paid previously with preliminary materials.

|

☐

|

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date

of its filing.

|

1) Amount

Previously Paid:

__________________________________________________________________

2) Form,

Schedule or Registration No.:

__________________________________________________________

3) Filing

Party:

____________________________________________________________________________

4) Date

Filed:

_____________________________________________________________________________

TSR,

Inc.

400

OSER AVENUE

HAUPPAUGE,

NY 11788

NOTICE

OF ANNUAL MEETING OF STOCKHOLDERS

to

be held on December 7, 2016

NOTICE

IS HEREBY GIVEN that the Annual Meeting of Stockholders (the “Annual Meeting”) of TSR, Inc. (the "Company"),

a Delaware corporation, will be held at the offices of the Company at 400 Oser Avenue, Suite 150, Hauppauge, New York 11788, on

December 7, 2016 at 9:00 a.m. local time, to consider and act upon the following matters:

|

|

1.

|

To

elect one (1) Class III Director.

|

|

|

2.

|

To

approve an advisory (non-binding) resolution approving the compensation of the Executive

Officers of the Company as described herein.

|

|

|

3.

|

To

ratify the appointment by the Audit Committee of the Board of Directors and the Board

of Directors of CohnReznick LLP as the independent registered public accountants of the

Company to audit and report on its consolidated financial statements for the fiscal year

ending May 31, 2017.

|

|

|

4.

|

To

transact such other business as may properly come before the Annual Meeting or any adjournment

thereof.

|

Stockholders

of record at the close of business on October 28, 2016 will be entitled to vote at the Annual Meeting or any adjournments thereof.

A list of stockholders entitled to vote at the Annual Meeting will be open for examination by any stockholder of the Company,

for any purpose germane to the Annual Meeting, during ordinary business hours at the offices of the Company for the ten-day period

prior to the date of the Annual Meeting.

|

|

By

Order of the Board of Directors,

|

|

|

|

|

|

John

G. Sharkey, Secretary

|

Hauppauge,

New York

November

4, 2016

WHETHER

OR NOT YOU EXPECT TO ATTEND THE ANNUAL MEETING, PLEASE COMPLETE, DATE, AND SIGN THE ENCLOSED PROXY AND MAIL IT PROMPTLY IN THE

ENCLOSED, SELF-ADDRESSED ENVELOPE SO THAT YOUR SHARES ARE REPRESENTED. NO POSTAGE IS NEEDED IF THE PROXY IS MAILED WITHIN THE

UNITED STATES.

TSR,

Inc.

400

Oser Avenue

Hauppauge,

NY 11788

ANNUAL

MEETING OF STOCKHOLDERS

to

be held on December 7, 2016

PROXY

STATEMENT

The

accompanying form of proxy is solicited on behalf of the Board of Directors of TSR, Inc. (the “Company”) for use at

the Annual Meeting of the Stockholders of the Company (the “Annual Meeting”) to be held at the offices of the Company

at 400 Oser Avenue, Suite 150, Hauppauge, New York 11788, on December 7, 2016 at 9:00 a.m. or at any adjournment thereof. The

solicitation of proxies will be made by the Board of Directors of the Company by mail and the cost will be borne by the Company.

Proxies

in the accompanying form which are properly executed and duly returned to the Company and not revoked will be voted as specified

and, if no direction is made, will be voted (i) in favor of the election of the candidate for director under Proposal 1, (ii)

in favor of the approval of the advisory resolution approving the compensation of the Executive Officers (as hereafter defined)

under Proposal 2 and (iii) in favor of the ratification of CohnReznick LLP as the Company’s independent registered public

accountants. Each of the proposals is set forth in the accompanying Notice of Annual Meeting of Stockholders. Each proxy granted

is revocable and may be revoked at any time prior to its exercise by advising the Company in writing of its revocation. In addition,

a Stockholder who attends the Annual Meeting in person may, if the Stockholder wishes, vote by ballot at the Annual Meeting, thereby

canceling any proxy previously given.

This

Proxy Statement, the enclosed form of proxy and the Company's Annual Report for the fiscal year ended May 31, 2016 were first

mailed on or about November 4, 2016 to holders of record of shares of the Company’s common stock, par value $.01 per share

(“Common Stock”), as of October 28, 2016. Only Stockholders of record at the close of business on October 28, 2016

are entitled to vote at the Annual Meeting. On October 28, 2016 there were 1,960,062 shares of Common Stock issued and outstanding.

The

presence of a majority of the issued and outstanding shares of Common Stock entitled to vote constitutes a quorum at the Annual

Meeting. Shares of Common Stock represented in person or by proxy at the Annual Meeting (including shares that abstain or do not

vote with respect to one or more of the matters presented at the Annual Meeting) will be tabulated by the inspector of election

appointed for the Annual Meeting whose tabulation will determine whether or not a quorum is present. Abstentions will be counted

as shares that are present and entitled to vote for purposes of determining the presence of a quorum with respect to any matter,

but will not be counted as votes in favor of such matter. If a broker holding stock in "street name" indicates on the

proxy that it does not have discretionary authority as to certain shares to vote on a matter, those shares will not be considered

as present and entitled to vote with respect to that matter. Accordingly, a "broker non-vote" on a matter will have

no effect on the voting.

Each

share of Common Stock is entitled to one vote on each matter. Candidates for election as members of the Board of Directors who

receive the highest number of votes, up to the number of directors to be chosen, shall stand elected; an absolute majority of

the votes cast is not a prerequisite to the election of any candidate to the Board of Directors. A majority of the votes cast

at the Annual Meeting is required to approve the non-binding advisory resolution under Proposal 2 approving the compensation of

the Company’s Executive Officers (as hereafter defined). A majority of the votes cast at the Annual Meeting is

required to ratify the appointment of CohnReznick LLP as the Company’s independent registered public accountants under Proposal

3. Accordingly, abstentions have no effect on the outcome of any of the Proposals subject to approval by the Stockholders.

Directions

to attend the Annual Meeting where you may vote in person can be found on the “Contact Us” section of our website

at www.tsrconsulting.com.

Important

Notice Regarding the Availability of Proxy Materials

for

the Stockholders Meeting to be held on December 7, 2016

This

Proxy Statement, a copy of the form of proxy and the Company’s Annual Report for the fiscal year ended May 31, 2016 are

available on the Investor Relations page of our website at www.tsrconsulting.com.

Security

Ownership of Certain Beneficial Owners and Management

The

outstanding voting stock of the Company as of September 16, 2016 consisted of 1,960,062 shares of Common Stock. The table below

sets forth the beneficial ownership of the Common Stock of the Company’s directors, executive officers and persons known

to the Company to be the beneficial owner of more than five percent (5%) of the outstanding shares of Common Stock as of September

16, 2016:

|

|

|

Beneficial Ownership of Common Stock

|

|

|

Name

of Beneficial Owner – Directors, Officers and 5% Stockholders

|

|

No. of

Shares (1)

|

|

|

Percent of

Class

|

|

|

James J. Hill (2)(3)

|

|

|

-

|

|

|

|

-

|

|

|

Christopher Hughes (2)(3)(4)(5)

|

|

|

11,842

|

|

|

|

0.6

|

%

|

|

Joseph F. Hughes (2)(3)(6)(7)

|

|

|

919,633

|

|

|

|

46.9

|

%

|

|

Brian J. Mangan (2)(3)

|

|

|

-

|

|

|

|

-

|

|

|

Raymond A. Roel (2)(3)

|

|

|

-

|

|

|

|

-

|

|

|

John G. Sharkey (2)(8)

|

|

|

6,750

|

|

|

|

0.3

|

%

|

|

Zeff Capital, LP (9)

|

|

|

142,709

|

|

|

|

7.3

|

%

|

|

All Directors and Executive Officers as a Group (6 persons) (7)

|

|

|

927,093

|

|

|

|

47.3

|

%

|

|

|

(1)

|

In

accordance with Rule 13d-3 of the Exchange Act, a person is deemed to be the beneficial

owner, for purposes of this table, of any shares of the Company’s Common Stock

if such person has voting or investment power with respect to such shares. This includes

shares of Common Stock (a) subject to options exercisable within sixty (60) days, and

(b) (1) owned by a person’s spouse, (2) owned by other immediate family members

who share a household with such person, or (3) held in trust or held in retirement accounts

or funds for the benefit of the such person, over which shares the person named in the

table may possess voting and/or investment power. Unless otherwise stated herein, each

beneficial owner has sole voting power and sole investment power.

|

|

|

(2)

|

This

executive officer and/or director maintains a mailing address at 400 Oser Avenue, Suite

150, Hauppauge, New York 11788.

|

|

|

(3)

|

Such

person currently serves as a director of the Company.

|

|

|

(4)

|

Includes

11,132 of the 875,151 shares held by JW Hughes Family LLC, in which each of Mr. Christopher

Hughes and his wife owns an interest. Mr. Hughes disclaims any beneficial ownership of

the shares held by the JW Hughes Family LLC except to the extent of his interest therein.

|

|

|

(5)

|

Mr.

Christopher Hughes serves as the Senior Vice President of the Company.

|

|

|

(6)

|

Mr.

Joseph F. Hughes serves as the Chairman, President, Chief Executive Officer and Treasurer

of the Company.

|

|

|

(7)

|

875,151

of the shares listed as beneficially owned by Mr. Hughes are held by JW Hughes Family

LLC of which Mr. Hughes is the manager. The shares owned by JW Hughes Family LLC include

106,834 shares of Common Stock in which his wife owns the pecuniary interest and 55,660

shares of Common Stock in which other family members hold the pecuniary interest. Mr.

Hughes disclaims beneficial ownership of the shares owned by JW Hughes Family LLC, except

to the extent of his pecuniary interest. The shares listed as beneficially owned by Mr.

Hughes also include 800 shares held of record by his wife, as to which Mr. Hughes disclaims

beneficial ownership.

|

|

|

(8)

|

Mr.

John G. Sharkey serves as the Vice President, Finance, Controller and Secretary of the

Company.

|

|

|

(9)

|

Based

on an amendment to Schedule 13G filed by Zeff Capital, LP with the Securities and Exchange

Commission on January 15, 2016, which was also filed on behalf of Zeff Holding Company,

LLC and Daniel Zeff. Zeff Capital, LP, Zeff Holding Company, LLC and Daniel Zeff maintain

a mailing address at 1875 Century Park E, Suite 700, Los Angeles, California 90067.

|

PROPOSAL

1 - ELECTION OF DIRECTORS

At

the Annual Meeting, one (1) Class III Director will each be elected for a three year term expiring at the Company’s 2019

Annual Meeting or until his successor has been elected and qualified.

If

the nominee listed below is unavailable for election at the date of the Annual Meeting, the shares represented by the proxy will

be voted for such nominee as the person or persons designated to vote shall, in their judgment, designate. Management at this

time has no reason to believe that the nominee will not be available or will not serve if elected.

Set

forth below is certain information with respect to the nominee, as of September 16, 2016.

|

Name of Director and Nominee for Election

|

|

|

Age

|

|

|

Nominee

for Class

of Director

|

|

|

Nominee

for Term

Expiring

|

|

|

Brian J. Mangan

|

|

|

58

|

|

|

Class III

|

|

|

2019

|

|

Mr.

Brian J. Mangan

has served as a director of the Company since January 2016. Mr. Mangan is a former senior finance executive

for the Disney/ABC Television Group. Prior to his retirement from the Disney/ABC Television Group in 2013, Mr. Mangan was the

east coast Senior Vice President Finance for the ABC Television Network (“ABC”) for six years. During that time, he

directed ABC’s executive team responsible for financial statement preparation and reporting, internal control review, annual

budgets, forecasts and long-term strategic plans. Mr. Mangan was also involved in many major company and network initiatives,

including the development of strategies to increase operational efficiency and reduce costs of programming and production to address

the television industry’s rapidly changing economics and technology. Having joined ABC as a Senior Accountant in 1983, Mr.

Mangan assumed positions of increasing responsibility during almost 30 years with the company. He was promoted to Director in

1993, Assistant Controller in 1997, Vice President in 2003 and then Senior Vice President in 2007. Mr. Mangan began his career

performing audits for New York State. He holds an MBA in Finance from Adelphi University, a BBA degree in Accounting from Hofstra

University and a Certificate in Financial Planning (CFP). Mr. Mangan’s extensive business background and experience make

him well qualified to serve as a member of the Company’s Board of Directors.

Directors

and Executive Officers of the Company

The

following table sets forth certain information concerning the executive officers and directors of the Company:

|

Name

|

|

Age

|

|

Position

|

|

Year First

Officer or

Director

|

|

|

|

|

|

|

|

|

|

James J. Hill (1)(2)(3)

|

|

83

|

|

Director

|

|

1989

|

|

Christopher Hughes

|

|

55

|

|

Senior Vice President, President, TSR Consulting Services, Inc. and Director

|

|

2000

|

|

Joseph F. Hughes

|

|

85

|

|

Chairman of the Board, Chief Executive Officer, President, Treasurer and Director

|

|

1969

|

|

Brian J. Mangan (1)(2)(3)(4)

|

|

58

|

|

Director

|

|

2016

|

|

Raymond A. Roel (1)(2)(3)(5)

|

|

60

|

|

Director

|

|

2005

|

|

John G. Sharkey

|

|

57

|

|

Vice President, Finance, Controller and Secretary

|

|

1990

|

|

|

(1)

|

Member

of the Compensation Committee of the Board of Directors.

|

|

|

(2)

|

Member

of the Audit Committee of the Board of Directors.

|

|

|

(3)

|

Member

of the Nominating Committee of the Board of Directors.

|

|

|

(4)

|

Mr.

Mangan is Chairman of the Audit and Nominating Committees.

|

|

|

(5)

|

Mr.

Roel is Chairman of the Compensation Committee.

|

Corporate

Governance Matters

The

Company maintains the following committees of the Board of Directors: the Compensation Committee, the Nominating Committee and

the Audit Committee.

James

J. Hill, Raymond A. Roel and Brian J. Mangan are independent members of the Board of Directors under the rules of the NASDAQ Capital

Market. In addition, each member of each committee

of the Board of Directors meets the definition of “independence”

under the rules of the NASDAQ Capital Market. The Board of Directors also has determined that Brian J. Mangan, the Chair of the

Audit Committee, meets the requirements of an “audit committee financial expert” as such term is defined in applicable

regulations of the Securities and Exchange Commission.

During

the fiscal year ended May 31, 2016, the Board of Directors held nine meetings; the Audit Committee held five meetings; the Compensation

Committee held two meetings; and the Nominating Committee held two meetings. During such fiscal year, no director attended fewer

than 75% of the aggregate of the total number of meetings of the Board and the total number of meetings of all committees of the

Board of which he was a member, except for Mr. Mangan, who was not appointed to the Board until January 2016. The Company does

not have a formal policy regarding attendance of directors at the Annual Meetings of Stockholders, but the Company encourages

all directors to attend. All of the directors attended the 2015 Annual Meeting of Stockholders, except for Mr. Mangan who had

not been appointed to the Board at the time of the 2015 Annual Meeting.

The

Audit Committee

The

Audit Committee’s current members are Brian J. Mangan (Chairman), James J. Hill and Raymond A. Roel. Robert A. Esernio,

the previous Chairman of the Audit Committee, resigned from the Board of Directors effective September 2, 2016, and the Board

appointed Mr. Mangan to succeed him as Chairman of the Audit Committee. Each of the members of the Audit Committee is an independent

director under the rules of the NASDAQ Capital Market. The Audit Committee’s primary functions are to assist the Board in

monitoring the integrity of the Company’s financial statements and systems of internal control. The Audit Committee has

direct responsibility for the appointment, independence and performance of the Company’s independent auditors. The Audit

Committee is responsible for pre-approving any engagements of the Company’s independent auditors. The Audit Committee operates

under a written charter approved by the Board on September 16, 2004, and amended as of October 10, 2008. A copy of this audit

committee charter is available on the Investor Relations page of the Company’s website at www.tsrconsulting.com.

The

Compensation Committee

The

Compensation Committee’s current members are Raymond A. Roel (Chairman), James J. Hill and Brian J. Mangan. Each of the

members of the Compensation Committee is an independent director under the rules of the NASDAQ Capital Market. The Compensation

Committee assesses the structure of the Company’s management team and the overall performance of the Company. It oversees

executive compensation by approving salary increases and other compensation to executive officers. The Board has adopted

a written charter for the Compensation Committee, a copy of which is available on the Company’s website at www.tsrconsulting.com.

Under its charter, the committee has authority to retain and approve the fees of independent compensation consultants or other

advisors.

The

Nominating Committee

The

Nominating Committee’s current members are Brian J. Mangan (Chairman), James J. Hill and Raymond A. Roel. Robert A. Esernio,

the previous Chairman of the Nominating Committee, resigned from the Board of Directors effective September 2, 2016, and the Board

appointed Mr. Mangan to succeed him as Chairman of the Nominating Committee. Each of the members of the Nominating Committee is

an independent director under the rules of the NASDAQ Capital Market. A copy of the Nominating Committee Charter is available

on the Investor Relations page of the Company’s website at www.tsrconsulting.com. The Nominating Committee determines the

criteria for nominating new directors, recommends to the Board of Directors candidates for nomination to the Board of Directors

and oversees the evaluation of the Board of Directors. The Nominating Committee’s process to identify and evaluate candidates

for nomination to the Board of Directors includes consideration of candidates for nomination to the Board of Directors recommended

by stockholders. Such stockholder recommendations must be delivered to the Corporate Secretary of the Company, together with the

information required to be filed in a Proxy Statement with the Securities and Exchange Commission regarding director nominees

and each such nominee must consent to serve as a director if elected, no later than the deadline for submission of stockholder

proposals as set forth in our Bylaws and under the section of this Proxy Statement entitled “Stockholder Nominations.”

In considering and evaluating such stockholder proposals that have been properly submitted, the Nominating Committee will apply

substantially the same criteria that the Nominating Committee believes must be met by a nominee recommended by the Nominating

Committee as described below. To date, the Company has not received any recommendations from stockholders requesting that the

Nominating Committee consider a candidate for inclusion among the Nominating Committee’s slate of nominees in this proxy

statement.

In

addition, certain identification and disclosure rules apply to director candidate proposals submitted to the Nominating Committee

by any single stockholder or group of stockholders that has beneficially owned more than five percent of the Common Stock for

at least one year (a “Qualified Stockholder Proposal”). If the Nominating Committee receives a Qualified Stockholder

Proposal that satisfies the necessary notice, information and consent provision referenced above, the Proxy Statement will identify

the candidate and the stockholder (or stockholder group) that recommended the candidate and disclose whether the Nominating Committee

chose to nominate the candidate. However, no such identification or disclosure will be made without the written consent of both

the stockholder (or stockholder group) and the candidate to be so identified. The procedures described in this paragraph are meant

to establish additional requirements and are not meant to replace or limit stockholders’ general nomination rights in any

way.

In

evaluating director nominees, the Nominating Committee currently considers the following factors:

|

|

●

|

the

Company’s needs with respect to the particular talents and experience of our directors;

|

|

|

●

|

the

knowledge, skills and experience of nominees, including experience in business or finance,

in light of prevailing business conditions and the knowledge, skills and experience already

possessed by other members of the Board of Directors;

|

|

|

●

|

familiarity

with the Company’s business and businesses similar or analogous to that of the

Company;

|

|

|

●

|

experience

with accounting rules and practices and corporate governance principles; and

|

|

|

●

|

such

other factors as the Nominating Committee deems are in the best interests of the Company

and the best interests of the Company’s stockholders.

|

Qualified

candidates for membership on the Board will be considered without a particular focus on the diversity of the Board’s membership,

and without regard to race, color, creed, religion, national origin, age, gender, sexual orientation or disability.

The

Nominating Committee identifies nominees by first evaluating the current members of the Board of Directors willing to continue

in service. If any member of the Board does not wish to continue in service or if the Nominating Committee or the Board of Directors

decides not to re-nominate a member for re-election, the Nominating Committee identifies the desired skills and experience of

a new nominee, and discusses with the Board of Directors suggestions as to individuals who meet the criteria.

Board

Leadership Structure

Mr. Joseph

Hughes serves as both the Company’s Chief Executive Officer and Chairman of the Board of Directors. Mr. Joseph Hughes

has served in this capacity since the Company’s formation in 1969. The Company does not presently have a lead independent

director. In view of the small size of the Company and Mr. Hughes’ traditional role as both Chief Executive Officer and

Chairman of the Board of Directors, the Board of Directors believes that the centralization of leadership through the combination

of these two roles in a single individual promotes the development and implementation of corporate strategy and advancement of

the Company’s goals. With over 40 years of experience as Chief Executive Officer of the Company, Mr. Hughes has

a breadth of unique and specialized knowledge about the Company’s business operations. Mr. Hughes solicits input from

the Company’s Board of Directors regarding the board agenda and processes.

The

Board of Directors’ Audit Committee, of which Brian J. Mangan acts as Chairman and which consists entirely of independent

directors, acts independently of the Chairman of the Board and exercises an oversight role in this capacity. The non-management

directors, each of whom is an independent director under the rules of the NASDAQ Capital Market, also meet in executive session

without any members of management present.

The

Company believes the role of management is to identify and manage risks confronting the Company. The Board of Directors plays

an integral part in the Company’s risk oversight, particularly in reviewing the processes used by management to identify

and report risk, and also in monitoring corporate actions so as to minimize inappropriate levels of risk. The Board of Directors

as a whole is also responsible for overseeing strategic and enterprise risk. A discussion of risks that the Company faces is conducted

at regularly scheduled meetings of the Board of Directors and committee meetings.

Meetings

of Independent Directors

Directors

who are independent under the NASDAQ Capital Market listing standards and applicable laws and regulations have not met in separate

committee; rather, the independent directors hold discussions among them without the presence of management in conjunction with

meetings of the Audit Committee and Compensation Committee, as they deem necessary.

Code

of Ethics

The

Company has adopted a code of ethics that applies to all of the employees, including the chief executive officer and chief financial

and accounting officer. The code of ethics is available on the Investor Relations page of the Company’s website at www.tsrconsulting.com.

The Company intends to post on its website all disclosures that are required by law or NASDAQ Capital Market listing standards

concerning any amendments to, or waivers from, the Company’s code of ethics. Stockholders may request a free copy of the

code of ethics by writing to Corporate Secretary, TSR, Inc., 400 Oser Avenue, Hauppauge, NY 11788. Disclosure regarding any amendments

to, or waivers from, provisions of the code of ethics that apply to the Company’s directors or principal executive and financial

officers will be included in a Current Report on Form 8-K filed with the Securities and Exchange Commission within four business

days following the date of the amendment or waiver, unless website posting of such amendments or waivers is then permitted by

the rules of the NASDAQ Capital Market and the Securities and Exchange Commission.

Stockholder

Nominations

Under

the Company’s Bylaws a stockholder must follow certain procedures to nominate persons for election as directors or to introduce

an item of business at an annual meeting of stockholders. Among other requirements, these procedures require any nomination or

proposed item of business to be submitted in writing to the Company’s Corporate Secretary at its principal executive offices.

The Company must receive the notice of a stockholder’s intention to introduce a nomination or proposed item of business

at an annual meeting no later than 75 days nor more than 120 days prior to the anniversary date of the prior year’s

annual meeting. However, if the annual meeting is scheduled to be held on a date more than 30 days before the anniversary date

or more than 60 days after the anniversary date, a stockholder’s notice must be given not later than the later of (i) the

75

th

day prior to the scheduled date of the annual meeting or (ii) the 15

th

day following the day on which

public announcement of the date of the annual meeting is first made by the Company.

Stockholder

Communications with Directors

Generally,

stockholders who have questions or concerns should contact the Company’s Corporate Secretary at (631) 231-0333. Any

stockholder who wishes to address questions regarding the Company’s business directly with the Board of Directors, or any

individual director, should direct his or her questions, in writing, in care of the Company’s Secretary, at the Company’s

offices at 400 Oser Avenue, Hauppauge, NY 11788.

Biographical

information of Directors and Executive Officers

Biographical

information of Brian J. Mangan is included under PROPOSAL 1 – ELECTION OF DIRECTORS above.

Mr.

Joseph F. Hughes

has served as the Chairman, President, Chief Executive Officer and Treasurer of the Company and as a director

of the Company since 1969. His current term as a director expires at the 2018 annual meeting of stockholders, and his term as

Chairman, President, Chief Executive Officer and Treasurer expires at such time as his successor(s) is duly appointed and qualifies.

From 1953 until forming the Company in 1969, Mr. Hughes was employed by International Business Machines Corporation (“IBM”)

in various systems engineering, marketing and administrative positions. Immediately prior to his employment with the Company,

Mr. Hughes was responsible for managing the market and technical sales group serving colleges and universities with IBM in Long

Island and Westchester County, New York. The Company believes that Mr. Joseph Hughes’ long experience with Company and extensive

knowledge of the Company’s business and the contract computer programming industry make him a valuable member of the Company’s

Board of Directors.

Mr.

Raymond A. Roel

has served as a director of the Company since January 2005. His current term as a director expires at

the 2018 annual meeting of stockholders. Beginning in July 2013, Mr. Roel became a principal of Ray Roel Consulting LLC,

and previously served as the Internal Communications Director of McCann Worldgroup, a unit of Interpublic Group of Companies,

Inc., since 1996. Mr. Roel is a 1977 graduate of Brown University with a B.A. in Semiotics (linguistics). The

Company believes that Mr. Roel’s experience in business, including his background in marketing and corporate communications,

make him well qualified to serve as a member of the Company’s Board of Directors.

Mr.

John G. Sharkey

has served as the Vice President, Finance, Controller and Secretary of the Company since 1990. Mr. Sharkey

received a Masters Degree in finance from Adelphi University and received his Certified Public Accountant certification from the

State of New York. From 1987 until joining the Company in October 1990, Mr. Sharkey was Controller of a publicly held electronics

manufacturer. From 1984 to 1987, he served as Deputy Auditor of a commercial bank, having responsibility over the internal audit

department. Prior to 1984, Mr. Sharkey was employed by KPMG LLP as a senior accountant.

Mr.

James J. Hill

has served as a director of the Company since December 1989. His current term as a director expires at the 2017

annual meeting of stockholders. In 1998, Mr. Hill retired from MRA Publications, Inc., a medical publishing business for which

he had been Executive Vice President of Sales and Marketing since 1979. Mr. Hill received a Bachelor of Science Degree in Business

Administration from the University of Arizona in 1958 and a Bachelor of Foreign Trade Degree from the American Institute of Foreign

Trade in Arizona in 1959. Mr. Hill’s experience in business and knowledge of the Company derived from his long service as

a director of the Company make him well qualified to serve as a member of the Company’s Board of Directors.

Mr.

Christopher Hughes

has served as the Senior Vice President of the Company since 2007 and as a director of the Company since

January 2005. His current term as a director expires at the 2017 annual meeting of stockholders, and his term as the Senior Vice

President of the Company expires at such time as his successor is duly appointed and qualifies. Mr. Hughes served a previous term

as a director of the Company from April 2000 until September 2004 and as the Vice President, Sales of TSR Consulting Services,

Inc., the Company’s computer programming services subsidiary, from 1991 through 2006. In 2007 Mr. Hughes was appointed Senior

Vice President of the Company and President of TSR Consulting Services, Inc. Mr. Hughes is a 1984 graduate of St. Bonaventure

University and is the son of Mr. Joseph F. Hughes. The Company believes that Mr. Hughes’ long experience with Company and

knowledge of the contract computer programming industry make him well qualified to serve as a member of the Company’s Board

of Directors.

Executive

Compensation

The

following table sets forth information concerning the annual and long-term compensation of the named executive officers for services

in all capacities to the Company for the fiscal years ended May 31, 2016 and 2015. The named executive officers are (1) Joseph

F. Hughes, Chairman, President, Chief Executive Officer and Treasurer, (2) John G. Sharkey, Vice President, Finance, and (3) Christopher

Hughes, Senior Vice President. Mr. Joseph Hughes, Mr. Sharkey and Mr. Christopher Hughes are referred to in this Proxy Statement

as the “Executive Officers.”

SUMMARY

COMPENSATION TABLE

|

Name and Principal Position

|

|

Fiscal

Year

|

|

Salary

|

|

|

Bonus

|

|

|

Stock

Awards

|

|

|

Option

Awards

|

|

|

Non-Equity

Incentive

Plan

Compen- sation

|

|

|

Change in Pension Value and Nonqualified Deferred Compensation Earnings

|

|

|

All Other Compensation

|

|

|

Total

|

|

|

Joseph F. Hughes

President and Chief Executive Officer

|

|

2016

2015

|

|

$

$

|

500,000

500,000

|

|

|

$

$

|

-

-

|

|

|

|

-

-

|

|

|

|

-

-

|

|

|

|

-

-

|

|

|

|

-

-

|

|

|

$

$

|

44,000

51,000

|

(1)

(1)

|

|

$

$

|

544,000

551,000

|

|

|

John G. Sharkey

Vice President, Finance

|

|

2016

2015

|

|

$

$

|

250,000

250,000

|

|

|

$

$

|

50,000

50,000

|

|

|

|

-

-

|

|

|

|

-

-

|

|

|

|

-

-

|

|

|

|

-

-

|

|

|

$

$

|

7,000

7,000

|

(2)

(2)

|

|

$

$

|

307,000

307,000

|

|

|

Christopher Hughes

Sr. Vice President

|

|

2016

2015

|

|

$

$

|

300,000

300,000

|

|

|

$

$

|

100,000

100,000

|

|

|

|

-

-

|

|

|

|

-

-

|

|

|

|

-

-

|

|

|

|

-

-

|

|

|

$

$

|

23,000

33,000

|

(3)

(3)

|

|

$

$

|

423,000

433,000

|

|

|

|

(1)

|

Of

these amounts, $22,000 related to Mr. Joseph Hughes’ personal use of an automobile

provided by the Company for each of the 2016 and 2015 fiscal years; $8,000 and $21,000

was paid to Mr. Joseph Hughes for a country club membership for the 2016 and 2015 fiscal

years, respectively; and $14,000 and $8,000 was paid to Mr. Joseph Hughes for premiums

for medical insurance benefits for the 2016 and 2015 fiscal years, respectively.

|

|

|

(2)

|

Amounts

related to Mr. Sharkey’s personal use of an automobile provided by the Company.

|

|

|

(3)

|

Of

these amounts, $3,000 related to Mr. Christopher Hughes’ personal use of an automobile

provided by the Company for each of the 2016 and 2015 fiscal years; and $20,000 and $30,000

was paid to Mr. Christopher Hughes for premiums for medical insurance benefits for the

2016 and 2015 fiscal years, respectively.

|

Outstanding

Equity Awards at Fiscal Year End

There

were no outstanding equity awards at the end of fiscal 2016.

Employment

Agreements and Arrangements

Mr.

Joseph Hughes was compensated at a base salary of $500,000 per annum during the fiscal year ended May 31, 2016. This is pursuant

to an unwritten employment agreement between Mr. Hughes and the Company. The Compensation Committee reviews and approves the base

salary and any bonus payable to Mr. Hughes on an annual basis.

In

June 2015, the Company entered into an employment agreement with Mr. John G. Sharkey, which terminates May 31, 2020. The employment

agreement provided for an initial annual base salary of $250,000, subject to increase in the discretion of the President of the

Company, and an annual bonus determined by the Compensation Committee in its discretion upon recommendation of the President based

on Mr. Sharkey’s individual performance and the Company’s overall performance in such year.

As set forth in

the Summary Compensation Table above, the Company paid an annual bonus to Mr. Sharkey in the amount of $50,000 for each of the

fiscal years ended May 31, 2016 and 2015.

In

March 2012, the Company entered into an employment agreement with Mr. Christopher Hughes, which terminates February 28, 2017.

The employment agreement provides for an annual base salary of $300,000 and an annual bonus to be approved by the Compensation

Committee in its discretion. As set forth in the Summary Compensation Table above, the Compensation Committee approved, and the

Company paid, an annual bonus to Mr. Hughes in the amount of $100,000 for each of the fiscal years ended May 31, 2016 and 2015.

The bonus paid to Mr. Hughes for the 2016 fiscal year was based on the Company’s improved operating results for fiscal 2016

and Mr. Hughes’ contribution toward such improvement.

Payments

in Connection with Termination of Employment and Change in Control

Mr.

Christopher Hughes’ employment agreement provides that if the Company terminates Mr. Hughes’ employment with the Company

for any reason other than for “cause” or Mr. Hughes’ disability as such terms are defined therein, he is entitled

to receive a severance payment equal two years base salary, payable in equal semi-monthly installments and all employee benefits

for twenty-four months at the Company’s expense. Mr. Hughes’ employment further provides that if his employment with

the Company is terminated without cause during the six-month period prior to, or within one year after, a “change in control”

of the Company as such term is defined therein, he is entitled to receive a lump sum payment equal to (i) two times his current

base salary plus (ii) two times his bonus for the then current fiscal year, or if that amount cannot be determined, two times

the amount of the bonus paid to him for the prior fiscal year, and all employee benefits for a period of twenty-four months after

termination.

Mr.

John Sharkey’s employment agreement provides that if he terminates his employment with the Company in connection with a

“change in control” of the Company as such term is defined therein, he is entitled to receive (i) his full salary

through the date of termination, (ii) an amount equal to two times his current base salary, (iii) the pro rata portion of the

annual bonus to which he is entitled for the then current year pro rated through the date of termination, or if such amount cannot

be determined, the pro rata portion of the annual bonus paid for the preceding year through the date of termination, (iv) an amount

equal to two times the annual bonus payable to him for the then current year, or if such amount cannot be determined, two times

the amount of the annual bonus paid to him for the prior year, and (v) all employee benefits for a period of two years after termination.

Director

Compensation

The

following table sets forth information concerning the compensation of the non-employee directors of the Company for the fiscal

year ended May 31, 2016:

|

Name

|

|

Fees

Earned

Or Paid

In Cash

|

|

|

Stock

Awards

|

|

|

Option

Awards

|

|

|

Non-Equity

Incentive

Plan

Compensation

|

|

|

Change in Pension

Value and Nonqualified Deferred Compensation Earnings

|

|

|

All Other Compensation

|

|

|

Total

|

|

Robert A. Esernio

|

|

$

|

20,000

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

$

|

20,000

|

|

James J. Hill

|

|

$

|

10,000

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

$

|

10,000

|

|

|

Brian J. Mangan

|

|

$

|

4,000

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

$

|

4,000

|

|

Raymond A. Roel

|

|

$

|

14,000

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

$

|

14,000

|

|

For

their service, members of the Board of Directors who are not salaried employees of the Company received an annual retainer of

$10,000, payable quarterly during fiscal 2016. Robert A. Esernio received an additional annual retainer of $10,000 for his services

as Audit Committee Chairman during fiscal 2016. Mr. Esernio resigned from the Board of Directors effective September 2, 2016.

Beginning in the second quarter of fiscal 2016, Raymond A. Roel received an additional annual retainer of $5,000 for his services

as Compensation Committee Chairman. Brian J. Mangan joined the board in January 2016 and was appointed as Chairman of the Audit

Committee upon Mr. Esernio’s resignation from the Board of Directors.

PROPOSAL

2 - ADVISORY RESOLUTION TO APPROVE COMPENSATION OF EXECUTIVE OFFICERS

Section

14A of the Exchange Act and the rules and regulations promulgated thereunder provide that, not less frequently than once every

three years, an issuer shall include in its proxy statement for its annual meeting of shareholders an advisory resolution subject

to a shareholder vote to approve the compensation of the Company’s Executive Officers. Accordingly, you are asked

to approve the compensation of the Company’s Executive Officers as described under the heading “Executive Compensation”

beginning on page 11, including the compensation tables and the related narrative discussion, by voting in favor of the following

advisory resolution:

“

RESOLVED

,

that the stockholders of TSR, Inc. approve the compensation of the Executive Officers as discussed and disclosed pursuant to Item

402 of Regulation S-K, including the compensation tables and narrative discussion.”

Under

the rules and regulations of the Securities and Exchange Commission, your vote is advisory and will not be binding upon the Company

or the Board of Directors and will not be construed to overrule any decision by the Company or the Board or require the Board

to take any action. However, the Compensation Committee and the Board of Directors will take the outcome of this advisory

vote into consideration when considering future compensation arrangements for the Executive Officers and whether any adjustments

or modifications are warranted.

In

fiscal 2013, the Compensation Committee engaged Steven Hall & Partners, an independent executive compensation consulting firm,

to review the compensation paid to the Company’s Executive Officers. Based on Steven Hall & Partners’ findings,

the Compensation Committee and the Board of Directors believe that the compensation paid to the Executive Officers is consistent

with competitive practice. The Compensation Committee will continue to monitor and review the amount and form of the Executive

Officers’ compensation on a going-forward basis. Accordingly, the Board of Directors unanimously recommends a

vote

FOR

the approval of the advisory resolution approving the compensation of the Executive Officers, as described in

this Proxy Statement.

The

affirmative vote of a majority of the votes cast at the Annual Meeting will approve this advisory resolution.

The

next vote to approve an advisory resolution approving the compensation of the Executive Officers will be held at the Company’s

2019 annual meeting of stockholders.

CERTAIN

RELATIONSHIPS AND RELATED TRANSACTIONS

The

Audit Committee is responsible for reviewing and approving all transactions between the Company and any related party pursuant

to the Audit Committee’s charter. The Company was not a participant in any transaction since the beginning of the 2016 fiscal

year in which any related person had a direct or indirect material interest and in which the amount involved exceeded the lesser

of $120,000 or 1% of the average of the Company’s total assets at the end of each of the Company’s two prior fiscal

years, and no such transactions are currently proposed, except that Lisa Bank, daughter of Joseph F. Hughes and sister of Christopher

Hughes, was employed by the Company during fiscal 2016 as Director of Training and was paid annual cash compensation of $120,000.

The employment relationship between the Company and Ms. Bank and the level of compensation paid to her was consistent with the

terms of employment with and compensation paid to unrelated persons.

Mr.

Joseph F. Hughes would be deemed to be a parent of the Company due to his beneficial ownership of 46.9% of the outstanding Common

Stock of the Company at September 16, 2016 and his positions as President and Chief Executive Officer.

AUDIT

COMMITTEE REPORT

The

Audit Committee has reviewed and discussed the audited consolidated financial statements of the Company for the 2016 Fiscal Year

with the Company’s management. The Audit Committee has separately discussed with CohnReznick LLP, the Company’s independent

registered public accounting firm for the 2016 Fiscal Year, the matters required to be discussed by Statement of Auditing Standards

No. 61, as amended, (AICPA, Professional Standards, Vol. 1, AU section 380), as adopted by the Public Company Accounting Oversight

Board in Rule 3200T.

The

Audit Committee has also received the written disclosures and the letter from CohnReznick LLP required by applicable requirements

of the Public Company Accounting Oversight Board regarding the independent accountant’s communications with the Audit Committee

concerning independence, and the Audit Committee has discussed with CohnReznick LLP the independence of that firm from the Company.

Based

on the Audit Committee’s review and discussions noted above, the Audit Committee recommended to the Board of Directors that

the Company’s audited consolidated financial statements be included in the Company’s Annual Report on Form 10-K for

the 2016 Fiscal Year for filing with the Securities and Exchange Commission.

Members

of the Audit Committee

|

Brian J. Mangan, Chairman

|

|

James J. Hill

|

|

Raymond A. Roel

|

SECTION

16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section

16(a) of the Securities Exchange Act of 1934, as amended, requires the Company’s officers and directors and persons who

beneficially own more than ten percent of a registered class of the Company’s equity securities to file reports of ownership

and changes in ownership with the Securities and Exchange Commission (the “Commission”). Officers, directors and greater

than ten percent Stockholders are required by regulation of the Commission to furnish the Company with copies of all Section 16(a)

forms they file.

Based

solely on its review of the copies of such forms received by it, or written representations from certain reporting persons that

no Forms 5 were required for those persons, the Company believes that, during the fiscal year ended May 31, 2016, all filing requirements

applicable to its officers, directors and greater than ten percent beneficial owners were satisfied.

PROPOSAL

3 – RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS

RELATIONSHIP

WITH INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS

CohnReznick

LLP has been appointed by the Company's Audit Committee and Board of Directors as the independent registered public accounting

firm for the Company to audit and report on the Company’s consolidated financial statements for the fiscal year ending May

31, 2017. CohnReznick LLP audited and reported on the Company's consolidated financial statements for the year ended May 31, 2016.

The Company expects that a representative of CohnReznick LLP will be present at the Annual Meeting with an opportunity to make

a statement if he or she desires to do so and will be available to respond to appropriate questions. The appointment of CohnReznick

LLP as the Company’s independent registered public accounting firm will be ratified if it receives the affirmative vote

of the holders of a majority of shares of the Company's Common Stock present at the Annual Meeting, in person or by proxy. Submission

of the appointment of the independent registered public accounting firm to the stockholders for ratification will not limit the

authority of the Audit Committee and Board of Directors to appoint another accounting firm to serve as the independent registered

public accounting firm if the present accountants resign or their engagement is otherwise terminated. If the stockholders do not

ratify the appointment of CohnReznick LLP at the Annual Meeting, the selection of CohnReznick LLP may be reconsidered by the Audit

Committee and Board of Directors. The Audit Committee is responsible for approving engagement of the independent registered public

accounting firm to render audit or non-audit services prior to the engagement of the accountants to render such services.

The

Board of Directors unanimously recommends a vote in favor of the approval of the ratification of the appointment of CohnReznick

LLP as the Company’s independent registered public accountants for the fiscal year ending May 31, 2017.

AUDIT

FEES

The

aggregate fees billed by CohnReznick LLP for professional services related to the audit of the Company’s consolidated financial

statements and the review of the consolidated condensed financial statements included in the Company’s Quarterly Reports

on Form 10-Q for the fiscal years ended May 31, 2016 and 2015 were $70,000 and $67,500, respectively.

AUDIT

RELATED FEES

There

were no fees billed by CohnReznick LLP for audit related services for the fiscal years ended May 31, 2016 or 2015.

TAX

FEES

There

were no fees billed by CohnReznick LLP for tax compliance, tax advice and tax planning during the fiscal years ended May 31, 2016

or 2015.

ALL

OTHER FEES

There

were no fees billed by CohnReznick LLP related to any other non-audit services for the fiscal years ended May 31, 2016 or 2015.

STOCKHOLDER

PROPOSALS

Any

proposal by a stockholder of the Company intended to be presented at the 2017 Annual Meeting of Stockholders must be received

by the Company at its principal executive office not later than July 7, 2017 for inclusion in the Company's proxy statement and

form of proxy relating to that meeting. Pursuant to the Company’s Bylaws, the deadline for submitting a proposal is the

date that is not less than 120 days prior to the anniversary of the date on which the Company released its proxy statement in

connection with the prior year’s annual meeting to its stockholders. The Company is releasing its proxy statement for the

2016 Annual Meeting to its stockholders on November 4, 2016. Any such proposal must also comply with the other requirements of

the proxy solicitation rules of the Securities and Exchange Commission.

FORM

10-K ANNUAL REPORT

UPON

WRITTEN REQUEST BY ANY STOCKHOLDER ENTITLED TO VOTE AT THE ANNUAL MEETING, THE COMPANY WILL FURNISH THAT PERSON, WITHOUT CHARGE,

WITH A COPY OF ITS ANNUAL REPORT ON FORM 10-K FOR THE FISCAL YEAR ENDED MAY 31, 2016, WHICH IS FILED WITH THE SECURITIES AND EXCHANGE

COMMISSION, INCLUDING THE FINANCIAL STATEMENTS AND SCHEDULES THERETO. IN THE EVENT THAT EXHIBITS TO SUCH FORM 10-K ARE REQUESTED,

A FEE WILL BE CHARGED FOR REPRODUCTION OF SUCH EXHIBITS. If the person requesting the report was not a stockholder of record on

October 28, 2016, the request must contain a good faith representation that the person making the request was a beneficial owner

of the Company's stock at the close of business on such date. Requests should be addressed to Mr. John G. Sharkey, Secretary,

TSR, Inc., 400 Oser Avenue, Hauppauge, NY 11788.

HOUSEHOLDING

The

Company has adopted a procedure called “householding,” which has been approved by the SEC. Under this procedure, the

Company is delivering only one copy of the Annual Report and Proxy Statement to multiple stockholders who share the same mailing

address and have the same last name, unless the Company has received contrary instructions from an affected stockholder. This

procedure reduces the Company’s printing costs, mailing costs and fees. Stockholders who participate in householding will

continue to receive separate proxy cards.

The

Company will deliver promptly upon written or oral request a separate copy of the Annual Report and the Proxy Statement to any

stockholder at a shared address to which a single copy of either of those documents was delivered. To receive a separate copy

of the Annual Report or Proxy Statement, you may write to Mr. John G. Sharkey, Secretary, TSR, Inc., 400 Oser Avenue, Hauppauge,

NY 11788, or call (631) 231-0333.

OTHER

BUSINESS SOLICITATION AND EXPENSES OF SOLICITATION

The

Board of Directors does not know of any other matters to be brought before the Annual Meeting, except those set forth in the notice

thereof. If other business is properly presented for consideration at the Annual Meeting, it is intended that the proxies will

be voted by the persons named therein in accordance with their judgment on such matters.

The

cost of preparing this Proxy Statement and all other costs in connection with this solicitation of proxies for the Annual Meeting

of Stockholders are being borne by the Company. In addition to solicitation by mail, the Company's directors, officers, and regular

employees, without additional remuneration, may solicit proxies by telephone, e-mail, facsimile and personal interviews. Brokers,

custodians, and fiduciaries will be requested to forward proxy soliciting material to the beneficial owners of Common Stock held

in their names, and the Company will reimburse them for their out-of-pocket expenses incurred in connection with the distribution

of proxy materials.

Your

cooperation in giving this matter your immediate attention and in returning your proxies will be appreciated.

|

|

By Order of the Board of Directors,

|

|

|

|

|

|

John G. Sharkey, Secretary

|

November

4, 2016

Annual

Meeting

of

Stockholders

December

7, 2016

9:00

A.M. local time

▲

FOLD

HERE

•

DO

NOT

SEPARATE

•

INSERT

IN

ENVELOPE

PROVIDED

▲

PROXY

FOR ANNUAL MEETING OF STOCKHOLDERS

OF

TSR,

INC.

400

OSER AVENUE, SUITE 150, HAUPPAUGE, NY 11788

THIS

PROXY

IS

SOLICITED

ON

BEHALF

OF

THE

BOARD

OF

DIRECTORS

The

undersigned hereby appoints JOSEPH F. HUGHES and CHRISTOPHER HUGHES or either of them, each with full power of substitution, proxies

of the undersigned to vote all shares of common stock of TSR, Inc. (the "Company") which the undersigned is entitled

to vote at the Annual Meeting of Stockholders of the Company to be held on the 7th of December, 2016 at 9:00 a.m., at the offices

of the Company at 400 Oser Avenue, Suite 150, Hauppauge, New York, and all adjournments thereof, as fully and with the same force

and effect as the undersigned might or could do if personally present thereat.

(Continued,

and

to

be marked, dated

and

signed,

on

the

other

side)

YOUR

VOTE

IS

I

MPO

R

T

AN

T

.

PLEASE

VOTE

TO

DAY.

|

|

2016

Annual

Meeting

of Stockholders

December

7, 2016

9:00

A.M. local time

This

Proxy is Solicited On Behalf

Of

The Board Of Directors

|

|

|

Please Be Sure to Mark, Sign, Date and Return

Your Proxy Card

In the Envelope Provided

|

|

▲

FOLD

HERE

•

DO

NOT

SEPARATE

•

INSERT

IN

ENVELOPE

PROVIDED

▲

|

PROXY

|

|

Please

mark

your

votes

like this

|

☒

|

THIS PROXY, WHEN PROPERLY EXECUTED,

WILL BE VOTED AS DIRECTED. IF NO DIRECTION IS INDICATED, IT WILL BE VOTED IN ACCORDANCE WITH THE BOARD OF DIRECTORS’ RECOMMENDATIONS.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE

FOR

THE NOMINEE LISTED UNDER PROPOSAL 1 AND A VOTE

FOR

THE APPROVAL OF

PROPOSAL 2 AND PROPOSAL 3.

|

1. Election of the following Class III Director for a three (3) year term:

|

|

|

3. Ratification of appointment of CohnReznick LLP as the Company’s independent registered accountants for the 2017 fiscal year.

|

FOR

☐

|

AGAINST

☐

|

ABSTAIN

☐

|

|

|

|

FOR

|

WITHHOLD

|

|

|

|

|

|

|

|

|

Brian J. Mangan

|

☐

|

☐

|

|

|

|

|

|

|

|

|

|

FOR

|

AGAINST

|

ABSTAIN

|

|

4

. In accordance with their best judgment with respect to any other business

that may properly come before the annual Meeting.

|

|

2. Advisory resolution to approve the compensation of executive officers.

|

☐

|

☐

|

☐

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COMPANY

ID:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PROXY

NUMBER:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ACCOUNT

NUMBER:

|

|

|

Signature

Signature

Date

,

2016

.

Note:

Please sign as name(s) appear(s) hereon. Proxies should be dated when signed. When signing as attorney, executor, administrator,

trustee or guardian, the full title of such should be given. Only authorized officers should sign for a corporation. If shares

are registered in more than one name, each joint owner should sign.

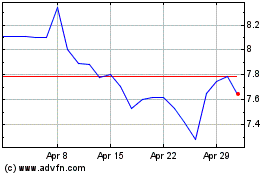

TSR (NASDAQ:TSRI)

Historical Stock Chart

From Mar 2024 to Apr 2024

TSR (NASDAQ:TSRI)

Historical Stock Chart

From Apr 2023 to Apr 2024