UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-A

FOR REGISTRATION OF CERTAIN CLASSES OF

SECURITIES

PURSUANT

TO SECTION 12(

b

) OR 12(

g

)

OF THE

SECURITIES

EXCHANGE ACT OF 1934

FXCM INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

27-3268672

|

|

(State or other jurisdiction of incorporation)

|

|

(I.R.S. employer identification no.)

|

|

|

|

|

|

55 Water Street, 50th floor, New York, N.Y.

|

|

10041

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

|

|

|

Securities to be registered pursuant to Section 12(b) of the Act:

|

|

|

|

Title of each class to be so registered

|

|

Name of

each exchange on which

each class is to be registered

|

|

Class A common stock, $0.01 par value

|

|

The NASDAQ Stock Market LLC

|

If

this form relates to the registration of a class of securities pursuant to Section 12(b) of the Exchange Act and is effective

pursuant to General Instruction A.(c), check the following box.

x

If

this form relates to the registration of a class of securities pursuant to Section 12(g) of the Exchange Act and is effective

pursuant to General Instruction A.(d), check the following box.

¨

Securities Act registration statement file number to which this

form relates: [N/A]

Securities to be registered pursuant

to Section 12(g) of the Act:

None

(Title of Class)

EXPLANATORY

NOTE

This Registration

Statement on Form 8-A is being filed by FXCM Inc., a Delaware corporation (the “Registrant” or the “Company”),

in connection with the transfer of the listing of its Class A Common Shares, par value $0.01 per share (the “Class A

Common Shares”), from the New York Stock Exchange to the NASDAQ Global Select Market (the “NASDAQ”).

Item 1. Description of Registrant’s Securities to be

Registered.

The

following description of our common stock does not purport to be complete and is qualified by our Amended and Restated Certificate

of Incorporation which is filed as Exhibit 3.1

to

the Registration Statement on Form S-1 filed by FXCM Inc. on September 3, 2010, the Certificate of Amendment to Amended and Restated

Certificate of Incorporation which is filed as to Exhibit 3.1 to Current Report on Form 8-K filed by FXCM Inc. on September 29,

2015,

the

Certificate of Designations for FXCM

Inc. Series A Junior Participating Preferred Stock, dated as of January 29, 2015 which is filed as Exhibit 3.1 to Current Report

on Form 8-K filed by FXCM Inc. on January 30, 2015, and our Amended and Restated Bylaws of FXCM Inc. which are filed as Exhibit

3.2 to Amendment No. 1 to the Registration Statement on Form S-1 filed by FXCM Inc. on October 12, 2010. Additionally, the General

Corporation Law of Delaware may also affect the terms of our common stock.

Our authorized capital stock consists of 3,000,000,000 shares

of Class A common stock, par value $.01 per share, 1,000,000 shares of Class B common stock, par value $.01 per share, and 300,000,000

shares of preferred stock, par value $.01 per share.

Common Stock

Class A Common Stock

Holders of shares of our Class A common

stock are entitled to one vote for each share held of record on all matters submitted to a vote of stockholders.

Holders of shares of our Class A common

stock are entitled to receive dividends when and if declared by our board of directors out of funds legally available therefor,

subject to any statutory or contractual restrictions on the payment of dividends and to any restrictions on the payment of dividends

imposed by the terms of any outstanding preferred stock.

Upon our dissolution or liquidation or the

sale of all or substantially all of our assets, after payment in full of all amounts required to be paid to creditors and to the

holders of preferred stock having liquidation preferences, if any, the holders of shares of our Class A common stock will be entitled

to receive pro rata our remaining assets available for distribution.

Holders of shares of our Class A common

stock do not have preemptive, subscription, redemption or conversion rights.

Shareholder Rights

Each holder of Class A common stock has

been issued one right (a “Right”) for each outstanding share of Class A common stock such shareholder holds. Each Right,

once exercisable, entitles the registered holder to purchase from us one one-thousandth (1/1000) of a share of our Series A Junior

Participating Preferred Stock (described below)(the “Preferred Stock”), at a price of $11.20 per one one-thousandth

(1/1000) of a share, subject to certain adjustments (the “Exercise Price”). The description and terms of the Rights

are set forth in a Amended and Restated Rights Agreement (as it may be supplemented or amended from time to time, the “Rights

Agreement”), dated as of January 26, 2016, by and between the Company and American Stock Transfer & Trust Company, LLC,

as Rights Agent (the “Rights Agent”).

As discussed below, initially the Rights

will not be exercisable, certificates will not be sent to stockholders and the Rights will automatically trade with the Class A

common stock.

The Rights, unless earlier redeemed or exchanged

by the Board of Directors, become exercisable upon the close of business on the day (the “Distribution Date”) which

is the earlier of (a) the tenth (10th) business day following a public announcement that a person or group of affiliated or associated

persons, with certain exceptions set forth below, has acquired beneficial ownership of either (i) 4.9% of our outstanding Capital

Stock (as defined in the Rights Agreement), or (ii) 10% or more our outstanding voting shares (an “Acquiring Person”)

and (b) the tenth (10th) business day (or such later date as may be determined by the Board of Directors prior to such time as

any person or group of affiliated or associated persons becomes an Acquiring Person) after the date of the commencement by any

person (other than an Exempt Person, as defined in the Rights Agreement) of a tender or exchange offer, the consummation of which

would result in such person or group of affiliated or associated persons becoming an Acquiring Person.

The Rights will expire upon the close of

business on the earliest to occur of: (i) January 26, 2019 and (ii) the date on which the rights are redeemed or exchanged by the

Corporation in accordance with the Rights Agreement.

Until a Right is exercised, the holder,

as such, will have no rights as a stockholder of the Company, including, without limitation, the right to vote or to receive dividends.

Class B Common Stock

Each holder of Class B common stock shall

be entitled, without regard to the number of shares of Class B common stock held by such holder, to one vote for each Holdings

Unit (as defined in our certificate of incorporation) of FXCM Holdings, LLC held by such holder. Accordingly, the unitholders of

FXCM Holdings, LLC collectively have a number of votes in FXCM Inc. that is equal to the aggregate number of Holdings Units that

they hold.

Holders of shares of our Class A common

stock and Class B common stock vote together as a single class on all matters presented to our stockholders for their vote or approval,

except as otherwise required by applicable law.

Holders of our Class B common stock do not

have any rights to receive dividends or to receive a distribution upon a liquidation or winding up of FXCM Inc.

Preferred Stock

Our certificate of incorporation authorizes

our board of directors to establish one or more series of preferred stock (including convertible preferred stock). Unless required

by law or by any stock exchange, the authorized shares of preferred stock will be available for issuance without further action

by you. Our board of directors is able to determine, with respect to any series of preferred stock, the terms and rights of that

series, including:

|

|

·

|

the designation of the series;

|

|

|

·

|

the number of shares of the series, which our board of directors may, except where otherwise provided in the preferred stock designation, increase or decrease, but not below the number of shares then outstanding;

|

|

|

·

|

whether dividends, if any, will be cumulative or non-cumulative and the dividend rate of the series;

|

|

|

·

|

the dates at which dividends, if any, will be payable;

|

|

|

·

|

the redemption rights and price or prices, if any, for shares of the series;

|

|

|

·

|

the terms and amounts of any sinking fund provided for the purchase or redemption of shares of the series;

|

|

|

·

|

the amounts payable on shares of the series in the event of any voluntary or involuntary liquidation, dissolution or winding-up of the affairs of our company;

|

|

|

·

|

whether the shares of the series will be convertible into shares of any other class or series, or any other security, of our company or any other entity, and, if so, the specification of the other class or series or other security, the conversion price or prices or rate or rates, any rate adjustments, the date or dates as of which the shares will be convertible and all other terms and conditions upon which the conversion may be made;

|

|

|

·

|

restrictions on the issuance of shares of the same series or of any other class or series; and

|

|

|

·

|

the voting rights, if any, of the holders of the series.

|

We could issue a series of preferred stock

that could, depending on the terms of the series, impede or discourage an acquisition attempt or other transaction that some, or

a majority, of you might believe to be in your best interests or in which you might receive a premium for your shares of Class

A common stock over the market price of the shares of Class A common stock.

Series A Junior Participating Preferred

Stock

We have designated 55,120 shares of our

Preferred Stock as Series A Junior Participating Preferred Stock (the “Series A Preferred”). Shares of Series A Preferred

purchasable upon exercise of the Rights will be non-redeemable and, unless otherwise provided in connection with the creation of

a subsequent series of preferred shares, will be subordinate to any other series of our preferred shares. The Series A Preferred

may not be issued except upon exercise of Rights or in connection with a redemption or exchange of Rights. Each share of Series

A Preferred will be entitled to receive when, as and if declared by the Board of Directors, a quarterly dividend in an amount equal

to the greater of $1.00 per share or one thousand (1,000) times the cash dividends declared on the Class A common stock. In addition,

the holders of the Series A Preferred are entitled to receive one thousand (1,000) times any non cash dividends (other than dividends

payable in equity securities) declared on the Class A common stock, in like kind. In the event of the liquidation of Company, the

holders of Series A Preferred will be entitled to receive, for each share of Series A Preferred, a payment in an amount equal to

the greater of $1,000 or one thousand (1,000) times the payment made per share of Class A common stock. Each share of Series A

Preferred will have one thousand (1,000) votes, voting together with the Class A common stock. In the event of any merger, consolidation

or other transaction in which the Class A common stock is exchanged, each share of Series A Preferred will be entitled to receive

one thousand (1,000) times the amount received per share of Class A common stock. The rights of Series A Preferred as to dividends,

liquidation and voting are protected by anti-dilution provisions.

Authorized but Unissued Capital Stock

Delaware law does not require stockholder

approval for any issuance of authorized shares. However, the listing requirements of the New York Stock Exchange, which would apply

so long as the shares of Class A common stock remains listed on the New York Stock Exchange, require stockholder approval of certain

issuances equal to or exceeding 20% of the then outstanding voting power or the then outstanding number of shares of Class A common

stock. We have received confirmation from the New York Stock Exchange that the calculation in this latter case assumes the exchange

of outstanding Holdings Units not held by FXCM Inc. These additional shares may be used for a variety of corporate purposes, including

future public offerings, to raise additional capital or to facilitate acquisitions.

One of the effects of the existence of unissued

and unreserved common stock or preferred stock may be to enable our board of directors to issue shares to persons friendly to current

management, which issuance could render more difficult or discourage an attempt to obtain control of our company by means of a

merger, tender offer, proxy contest or otherwise, and thereby protect the continuity of our management and possibly deprive the

stockholders of opportunities to sell their shares at prices higher than prevailing market prices.

Forum Selection Clause

Unless we consent in writing to the selection

of an alternative forum, the Court of Chancery of the State of Delaware will be the sole and exclusive forum for (i) any derivative

action or proceeding brought on our behalf, (ii) any action asserting a claim of breach of a fiduciary duty owed by any of our

directors, officers, employees or agents to us or to our stockholders, (iii) any action asserting a claim arising pursuant to any

provision of the Delaware General Corporation Law (the “DGCL”) or (iv) any action asserting a claim governed by the

internal affairs doctrine, in each such case subject to said Court of Chancery having personal jurisdiction over the indispensable

parties named as defendants therein. Any person or entity purchasing or otherwise acquiring any interest in shares of our capital

stock will be deemed to have notice of and consented to the forum selection clause.

Anti-Takeover Effects of Provisions of Delaware Law and Our

Certificate of Incorporation and Bylaws

Undesignated Preferred Stock

The ability to authorize undesignated preferred

stock will make it possible for our board of directors to issue preferred stock with super majority voting, special approval, dividend

or other rights or preferences on a discriminatory basis that could impede the success of any attempt to acquire us or otherwise

effect a change in control of us. These and other provisions may have the effect of deferring, delaying or discouraging hostile

takeovers, or changes in control or management of our company.

Shareholder Rights

The Rights will have certain anti-takeover

effects. The Rights will cause substantial dilution to any person or group that attempts to acquire the Company without the approval

of the Board of Directors. As a result, the overall effect of the Rights may be to render more difficult or discourage any attempt

to acquire our company even if such acquisition may be favorable to the interests of our stockholders. Because the Board of Directors

can redeem the Rights, however, the Rights should not interfere with a merger or other business combination approved by the Board

of Directors.

Requirements for Advance Notification

of Stockholder Meetings, Nominations and Proposals

Our bylaws provide that special meetings

of the stockholders may be called only by or at the direction of the board of directors, the chairman of our board of directors

or the chief executive officer. Our bylaws prohibit the conduct of any business at a special meeting other than as specified in

the notice for such meeting. These provisions may have the effect of deferring, delaying or discouraging hostile takeovers, or

changes in control or management of our company.

Our bylaws establish advance notice procedures

with respect to stockholder proposals and the nomination of candidates for election as directors, other than nominations made by

or at the direction of the board of directors or a committee of the board of directors. In order for any matter to be “properly

brought” before a meeting, a stockholder will have to comply with advance notice requirements and provide us with certain

information. Additionally, vacancies and newly created directorships may be filled only by a vote of a majority of the directors

then in office, even though less than a quorum, and not by the stockholders. Our bylaws allow the presiding officer at a meeting

of the stockholders to adopt rules and regulations for the conduct of meetings which may have the effect of precluding the conduct

of certain business at a meeting if the rules and regulations are not followed. These provisions may also defer, delay or discourage

a potential acquirer from conducting a solicitation of proxies to elect the acquirer’s own slate of directors or otherwise

attempting to obtain control of our company.

Our certificate of incorporation provides

that the board of directors is expressly authorized to make, alter, or repeal our bylaws and that our stockholders may only amend

our bylaws with the approval of 80% or more of all of the outstanding shares of our capital stock entitled to vote.

No Cumulative Voting

The DGCL provides that stockholders are

not entitled to the right to cumulate votes in the election of directors unless our amended and restated certificate of incorporation

provides otherwise. Our amended and restated certificate of incorporation does not expressly provide for cumulative voting.

Stockholder Action by Written Consent

Pursuant to Section 228 of the DGCL, any

action required to be taken at any annual or special meeting of the stockholders may be taken without a meeting, without prior

notice and without a vote if a consent or consents in writing, setting forth the action so taken, is signed by the holders of outstanding

stock having not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at

which all shares of our stock entitled to vote thereon were present and voted, unless the company’s certificate of incorporation

provides otherwise. Our amended and restated certificate of incorporation does not permit our Class A common stockholders to act

by consent in writing of such stockholders unless such action is recommended by all directors then in office.

Delaware Anti-Takeover Statute

We are subject to Section 203 of the DGCL.

Section 203 provides that, subject to certain exceptions specified in the law, a publicly-held Delaware corporation shall not engage

in certain “business combinations” with any “interested stockholder” for a three-year period after the

date of the transaction in which the person became an interested stockholder. These provisions generally prohibit or delay the

accomplishment of mergers, assets or stock sales or other takeover or change-in-control attempts that are not approved by a company’s

board of directors.

In general, Section 203 prohibits a publicly-held

Delaware corporation from engaging, under certain circumstances, in a business combination with an interested stockholder for a

period of three years following the date the person became an interested stockholder unless:

|

|

·

|

prior to the date of the transaction, the board of directors of the corporation approved either the business combination or the transaction that resulted in the stockholder becoming an interested stockholder;

|

|

|

·

|

upon completion of the transaction that resulted in the stockholder becoming an interested stockholder, the stockholder owned at least 85% of the voting stock of the corporation outstanding at the time the transaction commenced, excluding for purposes of determining the number of shares outstanding (1) shares owned by persons who are directors and also officers and (2) shares owned by employee stock plans in which employee participants do not have the right to determine confidentially whether shares held subject to the plan will be tendered in a tender or exchange offer; or

|

|

|

·

|

On or subsequent to the date of the transaction, the business combination is approved by the board of directors and authorized at an annual or special meeting of stockholders, and not by written consent, by the affirmative vote of at least 66 2/3% of the outstanding voting stock which is not owned by the interested stockholder.

|

Generally, a business combination includes

a merger, asset or stock sale, or other transaction resulting in a financial benefit to the interested stockholder. An interested

stockholder is a person who, together with affiliates and associates, owns or, within three years prior to the determination of

interested stockholder status, did own 15% or more of a corporation’s outstanding voting stock.

Under certain circumstances, Section 203

makes it more difficult for a person who would be an “interested stockholder” to effect various business combinations

with a corporation for a three-year period. Accordingly, Section 203 could have an anti-takeover effect with respect to certain

transactions our board of directors does not approve in advance. The provisions of Section 203 may encourage companies interested

in acquiring our company to negotiate in advance with our board of directors because the stockholder approval requirement would

be avoided if our board of directors approves either the business combination or the transaction that results in the stockholder

becoming an interested stockholder. However, Section 203 also could discourage attempts that might result in a premium over the

market price for the shares held by stockholders. These provisions also may make it more difficult to accomplish transactions that

stockholders may otherwise deem to be in their best interests.

Item 2. Exhibits.

|

Exhibit

|

|

|

|

No.

|

|

Description of Exhibit

|

|

|

|

|

|

|

3.1

|

|

|

Amended and Restated Certificate of Incorporation of FXCM Inc. (incorporated by reference to Exhibit 3.1 to the Registration Statement on Form S-1 filed by FXCM Inc. on September 3, 2010 (File No. 333-169234)).

|

|

|

|

|

|

|

3.2

|

|

|

Amended and Restated Bylaws of FXCM Inc. (incorporated by reference to Exhibit 3.2 to Amendment No. 1 to the Registration Statement on Form S-1 filed by FXCM Inc. on October 12, 2010 (File No. 333-169234)).

|

|

|

|

|

|

|

3.3

|

|

|

Certificate of Designations for FXCM Inc. Series A Junior Participating Preferred Stock, dated as of January 29, 2015 (incorporated by reference to Exhibit 3.1 to Current Report on Form 8-K filed by FXCM Inc. on January 30, 2015 (File No. 001-34986)).

|

|

|

|

|

|

|

3.4

|

|

|

Certificate of Amendment to Amended and Restated Certificate of Incorporation (incorporated by reference to Exhibit 3.1 to Current Report on Form 8-K filed by FXCM Inc. on September 29, 2015 (File No. 001-34986)).

|

|

|

|

|

|

SIGNATURE

Pursuant to the requirements of Section

12 of the Securities Exchange Act of 1934, the registrant has duly caused this registration statement to be signed on its behalf

by the undersigned, thereto duly authorized.

Date: September 23, 2016

|

|

FXCM Inc.

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ David S. Sassoon

|

|

|

|

|

Name: David S. Sassoon

Title: General Counsel

|

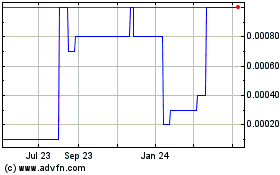

Global Brokerage (CE) (USOTC:GLBR)

Historical Stock Chart

From Mar 2024 to Apr 2024

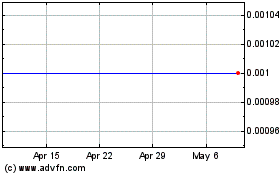

Global Brokerage (CE) (USOTC:GLBR)

Historical Stock Chart

From Apr 2023 to Apr 2024