Oil Prices Mixed as OPEC Meeting Looms -- Update

September 23 2016 - 7:57AM

Dow Jones News

By Mike Bird

Oil prices were mixed during morning European trading Friday,

following two days of strong gains as the market approaches next

week's meeting of major oil producers with caution.

Brent crude on London's ICE Futures exchange rose 0.29%, to

$48.35 a barrel. West Texas Intermediate, the U.S. benchmark, was

down 0.22% to $46.22.

After falling in early trading, prices rose around a Reuters

report that the Saudi Arabian government is ready to cut its own

oil output if the Iranian government freezes its production

levels.

But analysts remain skeptical over next week's meeting of the

Organization of the Petroleum Exporting Countries. The general view

is that OPEC heavyweights, such as Saudi Arabia, Iran and Iraq,

won't be able to forge a consensus to either slash or freeze

production due to their longstanding political rivalry and emphasis

to expand market share.

"Even an agreement to freeze would not be bullish either, given

how high current production levels are. The only bullish case would

be a credible and significant supply cut, which as it stands right

now is extremely unlikely," said Tamas Varga, an analyst at PVM Oil

Associates.

At 11 million barrels a day, Russian production levels are now

at their highest since the collapse of the Soviet Union, according

to Commerzbank commodities researchers. "The supply of crude oil

remains ample, in other words," the bank's analysts added in a note

Thursday.

There has been a blast of rhetoric from major OPEC producers

since the meeting was called in late August, which has lifted

prices. Saudi Arabia and Russia this month signed an

oil-cooperation agreement. OPEC oil chief Mohammed Barkindo last

weekend said that if agreed by all parties, an emergency meeting

could be called later this year to solidify a policy. Venezuelan

President Nicolás Maduro has also said OPEC and non-OPEC members

were close to a deal.

A senior OPEC official was quoted by The Wall Street Journal as

saying that OPEC has to keep the chatter going, "to make sure

prices don't fall to a certain level or rise to a certain level

they don't like, and recently we have seen a lot of that."

Nymex reformulated gasoline blendstock for October--the

benchmark gasoline contract--fell 1.1% to $1.385 a gallon.

Write to Mike Bird at Mike.Bird@wsj.com

(END) Dow Jones Newswires

September 23, 2016 07:42 ET (11:42 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

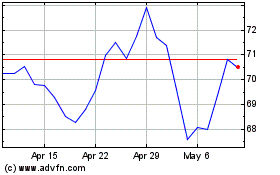

Service (NYSE:SCI)

Historical Stock Chart

From Aug 2024 to Sep 2024

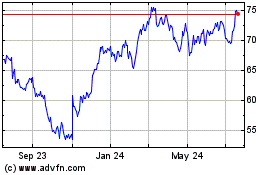

Service (NYSE:SCI)

Historical Stock Chart

From Sep 2023 to Sep 2024