General Mills Profit Falls -- Update

September 21 2016 - 2:04PM

Dow Jones News

By Annie Gasparro

General Mills Inc.'s sales fell 7% to $3.9 billion in the latest

quarter as its yogurt business plunged in the U.S., where shoppers

are trading Yoplait for Greek-style brands.

Minneapolis-based General Mills has struggled to keep up with

its customers rapidly changing eating habits, hurting brands such

as Cheerios cereal and Betty Crocker cake mix.

Chief Executive Ken Powell has prioritized revamping the U.S.

cereal business recently, eliminating artificial colors or gluten

and adding protein to draw buyers back. But now the dairy aisle has

become an equal challenge. Yoplait Light sales are down almost 30%,

according to Edward Jones analysts.

"In general, consumers are migrating away from low-calorie kinds

of light products," Mr. Powell said in an interview. "We need to

broaden and balance our portfolio."

Still, the company expects sales trends will improve over the

remainder of the year, and General Mills' profit for the quarter

came in better than analysts expected.

Edward Jones analyst Brittany Weissman said switching to simpler

and trendier ingredients was wise, but reviving cereal and yogurt

brands will take time in those highly competitive niches. Investors

might not have the patience to wait and see if General Mills

succeeds.

"They have been able to keep profits up by cutting cost, but at

some point sales have to matter," she said.

U.S. shoppers are buying more Greek-style yogurt, which has more

protein and less sugar, and organic varieties that don't use

artificial sweeteners. General Mills doesn't have a strong brand

recognition for such products. Instead, its Yoplait Light brand is

built on fans of low-calorie diets and 100-calorie snacks that have

gone out of style.

"The Yoplait brand isn't damaged any more than the Cheerios

brand was damaged before we made them gluten free," Chief Operating

Officer Jeff Harmening said. "Consumers still love the Yoplait

brand, we just have to give them what they want."

General Mills is adding more varieties of organic yogurt under

the Annie's Homegrown brand it bought two years ago and plotting

new products such as yogurt drinks and snacks that come in

different containers than the traditional yogurt cup.

General Mills' cereal overhaul appears to be working, with

retail sales of cereals without artificial colors and flavors up 3%

in the U.S. in the recent quarter.

"Consumers have changed relatively quickly," Mr. Harmening said

in an interview. "Certain fads come and go, but satiety, the focus

on protein -- we know these things aren't fads. They are trends

that are here to stay."

Excluding the sale of its Green Giant vegetable brand and other

items that affect comparability, sales fell 4% globally for the

three months that ended in August. General Mills' U.S. retail sales

fell 8% to $2.33 billion, including a 5% drop in comparable

sales.

The company has also been hurt recently by a strong U.S. dollar

that has cut into the value of international sales, which fell 6%

to $1.13 billion in the latest quarter.

General Mills reported a profit of $409 million, or 67 cents a

share, down from $426.6 million, or 69 cents a share, a year

earlier. Adjusted for certain restructuring costs and other

one-time items, per-share earnings fell to 78 cents from 79 cents.

Analysts expected 75 cents a share, according to Thomson

Reuters.

Joshua Jamerson contributed to this article.

Write to Annie Gasparro at annie.gasparro@wsj.com

(END) Dow Jones Newswires

September 21, 2016 13:49 ET (17:49 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

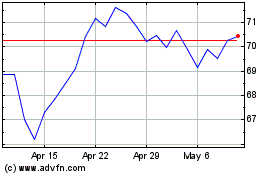

General Mills (NYSE:GIS)

Historical Stock Chart

From Mar 2024 to Apr 2024

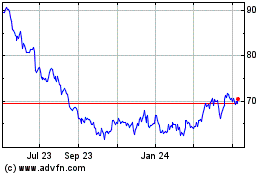

General Mills (NYSE:GIS)

Historical Stock Chart

From Apr 2023 to Apr 2024