Filed pursuant to Rule 424(b)(3)

|

|

Registration No. 333-210686

|

Prospectus Supplement No. 3

to prospectus dated April 20, 2016

This prospectus supplement no. 3 supplements and amends our prospectus dated April 20, 2016, as previously

supplemented by prospectus

supplements no. 1 and no.

2 dated May 16, 2016 and August 15, 2016, respectively, which we refer to collectively as the “prospectus.” The prospectus

relates to the offer and resale of up to 25,000,000 shares of our common stock, par value $0.001 per share, by the selling stockholder,

River North Equity, LLC (“River North”). All of such shares represent shares that River North has agreed to purchase

from us pursuant to the terms and conditions of an Equity Purchase Agreement we entered into with them on March 16, 2016 (the “Equity

Purchase Agreement”). Subject to the terms and conditions of the Equity Purchase Agreement, we have the right to “put,”

or sell, up to $5,000,000 worth of shares of our common stock to River North. This arrangement is also sometimes referred to in

the prospectus as the “Equity Line.” We will not receive any proceeds from the resale of shares of common stock by

River North. We will, however, receive proceeds from the sale of shares directly to River North pursuant to the Equity Line.

This prospectus supplement

no. 3 is filed for the purpose of including in the prospectus our Current Report on Form 8-K filed with the Securities and

Exchange Commission on September 21, 2016, a copy of which is attached. The information set forth in the attached Current Report

on Form 8-K supplements and amends the information contained in the prospectus.

This prospectus supplement

no. 3 should be read in conjunction with, and delivered with, the prospectus and is qualified by reference to the prospectus

except to the extent that the information in this prospectus supplement no. 3 supplements and amends the information contained

in the prospectus.

Our common stock is quoted

on the OTCQB Marketplace operated by the OTC Markets Group, Inc., or “OTCQB,” under the ticker symbol “ECPN.”

On September 19, 2016, the average of the high and low sales prices of our common stock was $0.10 per share.

Investing in our common

stock involves significant risk. See the “Risk Factors” section of the prospectus.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or determined if the prospectus or this prospectus

supplement no. 3 is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement no. 3 is September

21, 2016.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________

FORM 8-K

_________________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

September 15, 2016

_________________________

EL CAPITAN

PRECIOUS METALS, INC.

(Exact Name of Registrant as Specified in Charter)

|

Nevada

|

|

333-56262

|

|

88-0482413

|

|

(State or Other Jurisdiction

|

|

(Commission File Number)

|

|

(IRS Employer

|

|

of Incorporation)

|

|

|

|

Identification No.)

|

|

|

5871 Honeysuckle Road

Prescott, AZ

|

|

86305-3764

|

|

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

|

(928) 515-1942

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed

since last report)

_________________________

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

o

|

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425).

|

|

o

|

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12).

|

|

o

|

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)).

|

|

o

|

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)).

|

On August 23, 2016, El Capitan Precious Metals,

Inc. (the “Company”) issued a press release announcing that it has reached an agreement in principle on the terms and

conditions for the sale of 600,000 metric tons of head ore. Finalization and publication of the agreement are subject to certain

conditions, including but not limited to the Company successfully repeating the recovery demonstration of the precious metals consistent

with results of the recently completed demonstration. The press release is furnished as Exhibit 99.1 to this report.

|

Item 9.01

|

Financial Statements and Exhibits

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

99.1

|

|

Press Release dated September 15, 2016

|

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

EL CAPITAN PRECIOUS METALS, INC.

|

|

|

|

|

|

|

|

|

By:

|

/s/ Stephen J. Antol

|

|

Date: September 21, 2016

|

|

Name: Stephen J. Antol

|

|

|

|

Title: Chief Financial Officer

|

EXHIBIT INDEX

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

99.1

|

|

Press Release dated September 15, 2016

|

EXHIBIT 99.1

For Immediate

Release

September 15, 2016

For Further Information Contact

:

John F Stapleton | 480-440-1449

El Capitan Precious Metals Announces

Agreement for Sale of 600,000 Metric Tons

of Head Ore

Scottsdale, Arizona – El Capitan Precious Metals, Inc., (OTC/QB:

ECPN) announced today that it has reached an agreement in principle on the terms and conditions for the sale of 600,000 metric

tons of head ore. This agreement is an annual agreement with options to renew for five additional years. Finalization and publication

of this agreement are subject to certain conditions, the most significant of which is that El Capitan successfully repeats the

recovery demonstration of the precious metals, consistent with results of the recently completed demonstration.

The agreement also provides that title to the ore will transfer

to the buyer at the mine site once it is loaded into the transport vehicles provided by the buyer. Prepayment will be provided

for all ore transfers. The required demonstrations are currently being scheduled for this month, thereby satisfying all the conditions

that are required of El Capitan. Details of the agreement will be disclosed when all requirements are met.

In support of the demand for El Capitan ore, the Company has recently

completed the filing of claims on an additional 2,000 acres proximate to the current mining operation site. According to John F.

Stapleton, Chairman and CEO, these new claims had been identified previously by Clyde Smith, Ph.D., geologist and El Capitan Director,

as valuable to the Company’s strategic mining plan.

The Company’s 2016 Shareholders’ Meeting is slated for

September 28, 2016 at The Inn of the Mountain Gods in Ruidoso, New Mexico.

About El Capitan Precious Metals, Inc.:

El Capitan Precious Metals, Inc. is a mining company based in Scottsdale,

Arizona that is principally engaged in the mining of precious metals and other minerals. The Company’s primary asset is

its wholly owned subsidiary El Capitan, Ltd., an Arizona corporation, which holds the 100% equity interest in the El Capitan property

located near Capitan, New Mexico. www.elcapitanpmi.com

Forward-Looking Safe Harbor Statement:

The statements included in this press release concerning predictions

of economic performance and management’s plans and objectives constitute forward- looking statements made pursuant to the

safe harbor provisions of Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act

of 1933, as amended. Forward-looking statements are statements that are not historical facts. Words such as “expect(s),”

“feel(s),” “believe(s),” “will,” “may,” “anticipate(s)” and similar

expressions are intended to identify forward-looking statements. These statements include, but are not limited to, statements regarding

the expected completion, timing and results of metallurgical testing, interpretation of drill results, the geology, grade and continuity

of mineral deposits, results of initial feasibility, pre-feasibility and feasibility studies and expectations with respect to the

engaging in strategic transactions. All of such statements are subject to risks and uncertainties, many of which are difficult

to predict and generally beyond the control of the Company, that could cause actual results to differ materially from those expressed

in, or implied or projected by, the forward-looking information and statements. Specifically, there can be no assurance regarding

the timing and terms of any transaction involving the Company or its El Capitan property, or that such a transaction will be completed

at all. In addition, there can be no assurance that periodic updates to the Company’s geological technical reports will support

the Company’s prior claims regarding the metallurgical value and make-up of the ore on the New Mexico property. Additional

risks and uncertainties affecting the Company include, but are not limited to, the possibility that future exploration, development,

testing or mining results will not be consistent with past results and/or the Company’s expectations; discrepancies between

different types of testing methods, some or all of which may not be industry standard; the ability to mine precious and other minerals

on a cost effective basis; the Company’s ability to successfully complete contracts for the sale of its products; fluctuations

in world market prices for the Company’s products; the Company’s ability to obtain and maintain regulatory approvals;

the Company’s ability to obtain financing for continued operations and/or the commencement of mining activities on satisfactory

terms; the Company’s ability to enter into and meet all the conditions to consummate contracts to sell its mining properties

that it chooses to list for sale; and other risks and uncertainties described in the Company’s filings from time to time

with the Securities and Exchange Commission. Readers are cautioned not to place undue reliance on these forward-looking statements

that speak only as of the date hereof, and we do not undertake any obligation to revise and disseminate forward-looking statements

to reflect events or circumstances after the date hereof, or to reflect the occurrence of or non-occurrence of any events.

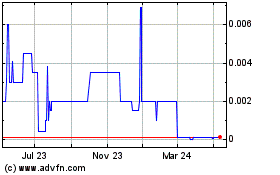

El Capitan Precious Metals (CE) (USOTC:ECPN)

Historical Stock Chart

From Mar 2024 to Apr 2024

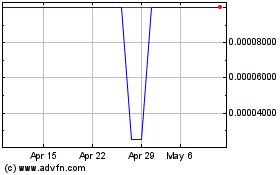

El Capitan Precious Metals (CE) (USOTC:ECPN)

Historical Stock Chart

From Apr 2023 to Apr 2024