UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of September 2016

Commission File Number: 001-35135

Sequans

Communications S.A.

(Translation of Registrant’s name into English)

15-55 boulevard Charles de Gaulle

92700 Colombes, France

Telephone : +33 1 70 72 16 00

(Address of Principal Executive Office)

Indicate by check mark whether

the registrant files or will file annual reports under cover of

Form 20-F

or

Form 40-F:

Form 20-F

x

Form 40-F

¨

Indicate by check mark if the registrant is submitting the

Form 6-K

in paper as permitted by

Regulation S-T

Rule 101(b)(1): Yes

¨

No

x

Note:

Regulation S-T

Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted

solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the

Form 6-K

in paper as permitted by

Regulation S-T

Rule 101(b)(7): Yes

¨

No

x

Note:

Regulation S-T Rule 101(b)(7) only permits the submission in paper of a

Form 6-K

if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated,

domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is

not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a

Form 6-K

submission or other Commission

filing on EDGAR.

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934: Yes

¨

No

x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):

82-

.

Exhibits 1.1, 5.1, 99.1 and 99.2 to this report, furnished on

Form 6-K,

shall be incorporated by reference

into each of the following Registration Statements under the Securities Act of 1933, as amended, of the registrant:

Form S-8

(File Nos. 333-177919, 333-180487, 333-187611, 333-194903 and 333-203539)

and

Form F-3

(File No. 333-198758).

EXPLANATORY NOTE

On September 15, 2016, Sequans Communications S.A. (the “Company”) entered into an underwriting agreement (the

“Underwriting Agreement”) with Canaccord Genuity Inc. (the “Representative”) (the “Underwriter”), relating to an underwritten public offering of 15,151,520 American Depositary Shares (the “ADSs”), each

representing one ordinary share, nominal value €0.02 per share, of the Company. The offering price to the public is $1.65 per ADS, and the Underwriter has agreed to purchase the ADSs pursuant to the Underwriting Agreement at a price

of $1.557 per ADS. Under the terms of the Underwriting Agreement, the Company granted the Underwriter a 30-day option to purchase up to an additional 2,272,728 ADSs.

The net proceeds to the Company are expected to be approximately $22.9 million, after deducting underwriting discounts and estimated offering

expenses payable by the Company. The Company intends to use the net proceeds from the offering for general corporate purposes.

The ADSs

will be issued pursuant to the Company’s effective shelf registration statement on Form F-3 (No. 333-198758), which was previously filed with the Securities and Exchange Commission (the “SEC”) on September 15, 2014 and

declared effective by the SEC on September 29, 2014, and a prospectus supplement filed with the SEC on September 15, 2016 and accompanying base prospectus dated September 29, 2014. The closing of the offering is expected to take place

on September 20, 2016, subject to the satisfaction of customary closing conditions.

The Underwriting Agreement contains customary

representations, warranties, and agreements by the Company, and customary conditions to closing, indemnification obligations of the Company and the Underwriter, including for liabilities under the Securities Act of 1933, as amended, other

obligations of the parties, and termination provisions.

Pursuant to the Underwriting Agreement, the Company agreed, subject to certain

exceptions, not to offer, issue or sell any ADSs or ordinary shares or securities convertible into or exercisable or exchangeable for ADSs or ordinary shares for a period of ninety (90) days following the offering without the prior written

consent of the Underwriter.

The Underwriting Agreement has been attached hereto as an exhibit to provide investors and security holders

with information regarding its terms. It is not intended to provide any other factual information about the Company. The representations, warranties and covenants contained in the Underwriting Agreement were made only for purposes of the

Underwriting Agreement and as of specific dates, were solely for the benefit of the parties to the Underwriting Agreement, and may be subject to limitations agreed upon by the contracting parties.

A copy of the Underwriting Agreement is attached hereto as Exhibit 1.1 and is incorporated herein by reference. The foregoing

description of the material terms of the Underwriting Agreement does not purport to be complete and is qualified in its entirety by reference to such exhibit. A copy of the legal opinion and consent of Orrick Rambaud Martel relating to the

ordinary shares represented by the ADSs is attached hereto as Exhibit 5.1. The Company issued press releases on September 14, 2016 and September 15, 2016 announcing the launch and pricing of the public offering. These press

releases are attached hereto as Exhibit 99.1 and Exhibit 99.2, respectively, and are incorporated herein by reference.

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

SEQUANS COMMUNICATIONS S.A.

(Registrant)

|

|

|

|

|

|

|

Date: September 19, 2016

|

|

|

|

By:

|

|

/s/ Deborah Choate

|

|

|

|

|

|

|

|

Deborah Choate

|

|

|

|

|

|

|

|

Chief Financial Officer

|

3

EXHIBIT INDEX

The following exhibits are filed as part of this Form 6-K:

|

|

|

|

|

Exhibit

|

|

Description

|

|

|

|

|

1.1

|

|

Underwriting Agreement dated September 15, 2016

|

|

|

|

|

5.1

|

|

Opinion of Orrick Rambaud Martel

|

|

|

|

|

99.1

|

|

Press release dated September 14, 2016

|

|

|

|

|

99.2

|

|

Press release dated September 15, 2016

|

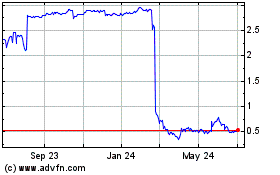

Sequans Communications (NYSE:SQNS)

Historical Stock Chart

From Mar 2024 to Apr 2024

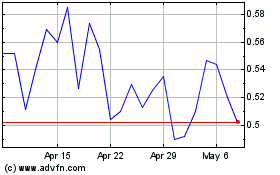

Sequans Communications (NYSE:SQNS)

Historical Stock Chart

From Apr 2023 to Apr 2024