Amended Statement of Beneficial Ownership (sc 13d/a)

September 16 2016 - 4:20PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

SCHEDULE 13D

INFORMATION TO BE INCLUDED IN STATEMENTS FILED PURSUANT

TO RULE 13d-1(a) AND AMENDMENTS THERETO FILED PURSUANT TO

RULE 13d-2(a)

(Amendment No. 2)*

BRIGHTCOVE INC.

(Name of

Issuer)

Common Stock, par value $0.001 per share

(Title of Class of Securities)

10921T101

(CUSIP Number)

Tenzing Global Management LLC

388 Market Street,

Suite 860

San Francisco, CA 94111

Telephone: (415)

645-2400

(Name, Address and Telephone Number of Person Authorized to

Receive Notices and Communications)

September 6, 2016

(Date of Event Which

Requires Filing of This Statement)

If the filing person has previously filed a statement on

Schedule 13G to report the acquisition that is the subject of this Schedule 13D,

and is filing this schedule because of Rule 13d-1(e), 13d-1(f) or 13d-1(g),

check the following box. [ ]

Note.

Schedules filed in paper format shall include a

signed original and five copies of the schedule, including all exhibits. See

Rule 13d-7(b) for other parties to whom copies are to be sent.

|

*

|

The remainder of this cover page shall be filled out for

a reporting person’s initial filing on this form with respect to the

subject class of securities, and for any subsequent amendment containing

information which would alter disclosures provided in a prior cover

page.

|

The information required on the remainder of this cover

page shall not be deemed to be “filed” for the purpose of section 18 of the

Securities Exchange Act of 1934 or otherwise subject to the liabilities of that

section of the Act but shall be subject to all other provisions of the Act

(however, see the Notes.)

CUSIP No.: 10921T101

|

1

|

Name of reporting person

|

|

|

S.S. OR I.R.S. IDENTIFICATION NO. OF ABOVE PERSON

|

|

|

|

|

|

Tenzing Global Management LLC

|

|

|

45-3120520

|

|

2

|

Check the appropriate box if a member of a group

|

|

|

(a) [ ] (b) [X]

|

|

|

|

|

3

|

SEC use only

|

|

|

|

|

4

|

Source of funds

|

|

|

|

|

|

WC

|

|

5

|

Check box if disclosure of legal proceedings is

required pursuant to Item 2(d) or 2(e) [ ]

|

|

|

|

|

6

|

Citizenship or place of organization

|

|

|

|

|

|

Delaware

|

|

|

7

|

Sole voting power

|

|

Number of

|

|

|

|

shares

|

|

0

|

|

beneficially

|

8

|

Shared voting power

|

|

owned by

|

|

|

|

each

|

|

1,421,900

|

|

reporting

|

9

|

Sole dispositive power

|

|

person

|

|

|

|

with

|

|

0

|

|

|

10

|

Shared dispositive power

|

|

|

|

|

|

|

|

1,421,900

|

|

11

|

Aggregate amount beneficially owned by each reporting

person

|

|

|

|

|

|

1,421,900

|

|

12

|

Check box if the aggregate amount in Row (11) excludes

certain shares [ ]

|

|

|

|

|

13

|

Percent of class represented by amount in Row (11)

|

|

|

|

|

|

4.3%

|

|

14

|

Type of reporting person

|

|

|

|

|

|

IA, OO

|

CUSIP No.: 10921T101

|

1

|

Name of reporting person

|

|

|

S.S. OR I.R.S. IDENTIFICATION NO. OF ABOVE PERSON

|

|

|

|

|

|

Tenzing Global Investors LLC

|

|

|

27-5132283

|

|

2

|

Check the appropriate box if a member of a group

|

|

|

(a) [ ] (b) [X]

|

|

|

|

|

3

|

SEC use only

|

|

|

|

|

4

|

Source of funds

|

|

|

|

|

|

WC

|

|

5

|

Check box if disclosure of legal proceedings is

required pursuant to Item 2(d) or 2(e) [ ]

|

|

|

|

|

6

|

Citizenship or place of organization

|

|

|

|

|

|

Delaware

|

|

|

7

|

Sole voting power

|

|

Number of

|

|

|

|

shares

|

|

0

|

|

beneficially

|

8

|

Shared voting power

|

|

owned by

|

|

|

|

each

|

|

1,025,606

|

|

reporting

|

9

|

Sole dispositive power

|

|

person

|

|

|

|

with

|

|

0

|

|

|

10

|

Shared dispositive power

|

|

|

|

|

|

|

|

1,025,606

|

|

11

|

Aggregate amount beneficially owned by each reporting

person

|

|

|

|

|

|

1,025,606

|

|

12

|

Check box if the aggregate amount in Row (11) excludes

certain shares [ ]

|

|

|

|

|

13

|

Percent of class represented by amount in Row (11)

|

|

|

|

|

|

3.1%

|

|

14

|

Type of reporting person

|

|

|

|

|

|

OO

|

CUSIP No.: 10921T101

|

1

|

Name of reporting person

|

|

|

S.S. OR I.R.S. IDENTIFICATION NO. OF

ABOVE PERSON

|

|

|

|

|

|

Tenzing Global Investors Fund I LP

|

|

|

36-4708131

|

|

2

|

Check the appropriate box if a member

of a group

|

|

|

(a) [ ] (b) [X]

|

|

|

|

|

3

|

SEC use only

|

|

|

|

|

4

|

Source of funds

|

|

|

|

|

|

WC

|

|

5

|

Check box if disclosure of legal

proceedings is required pursuant to Item 2(d) or 2(e) [ ]

|

|

|

|

|

6

|

Citizenship or place of organization

|

|

|

|

|

|

Delaware

|

|

|

7

|

Sole voting power

|

|

Number of

|

|

|

|

shares

|

|

0

|

|

beneficially

|

8

|

Shared voting power

|

|

owned by

|

|

|

|

each

|

|

1,025,606

|

|

reporting

|

9

|

Sole dispositive power

|

|

person

|

|

|

|

with

|

|

0

|

|

|

10

|

Shared dispositive power

|

|

|

|

|

|

|

|

1,025,606

|

|

11

|

Aggregate amount beneficially owned by each reporting

person

|

|

|

|

|

|

1,025,606

|

|

12

|

Check box if the aggregate amount in Row (11) excludes

certain shares [ ]

|

|

|

|

|

13

|

Percent of class represented by amount in Row (11)

|

|

|

|

|

|

3.1%

|

|

14

|

Type of reporting person

|

|

|

|

|

|

PN

|

CUSIP No.: 10921T101

|

1

|

Name of reporting person

|

|

|

S.S. OR I.R.S. IDENTIFICATION NO. OF ABOVE PERSON

|

|

|

|

|

|

Chet Kapoor

|

|

2

|

Check the appropriate box if a member of a group

|

|

|

(a) [ ] (b) [X]

|

|

|

|

|

3

|

SEC use only

|

|

|

|

|

4

|

Source of funds

|

|

|

|

|

|

WC

|

|

5

|

Check box if disclosure of legal proceedings is

required pursuant to Item 2(d) or 2(e) [ ]

|

|

|

|

|

6

|

Citizenship or place of organization

|

|

|

|

|

|

Kenya

|

|

|

7

|

Sole voting power

|

|

Number of

|

|

|

|

shares

|

|

0

|

|

beneficially

|

8

|

Shared voting power

|

|

owned by

|

|

|

|

each

|

|

1,421,900

|

|

reporting

|

9

|

Sole dispositive power

|

|

person

|

|

|

|

with

|

|

0

|

|

|

10

|

Shared dispositive power

|

|

|

|

|

|

|

|

1,421,900

|

|

11

|

Aggregate amount beneficially owned by each reporting

person

|

|

|

|

|

|

1,421,900

|

|

12

|

Check box if the aggregate amount in Row (11) excludes

certain shares [ ]

|

|

|

|

|

13

|

Percent of class represented by amount in Row (11)

|

|

|

|

|

|

4.3%

|

|

14

|

Type of reporting person

|

|

|

|

|

|

IN

|

EXPLANATORY NOTE

This Amendment No. 2 to Schedule 13D (“Amendment No. 2”) is

being filed with respect to the Reporting Persons’ beneficial ownership in

Brightcove, Inc. (the “Issuer”). This Amendment No. 2 supplements the Schedule

13D as previously filed on November 7, 2014, as amended on February 9, 2015 (the

“Schedule 13D”). Each Item below amends and supplements the information

disclosed under the corresponding Item of the Schedule 13D. Unless otherwise

indicated herein, capitalized terms used but not defined in this Amendment No. 2

shall have the same meaning herein as are ascribed to such terms in the Schedule

13D. Except as set forth herein, this Amendment No. 2 does not modify any of the

information previously reported by the Reporting Persons in the Schedule

13D.

As of September 6, 2016, the Reporting Persons beneficially own

less than 5% of the shares of Common Stock of the Issuer. This is the final

amendment to the Schedule 13D and constitutes an “exit filing” for the Reporting

Persons.

ITEM 5. Interest in Securities of the Issuer

Item 5 is hereby amended and restated in its entirety as

follows:

|

(a)

|

The Reporting Persons beneficially own:

|

|

|

|

|

|

|

(i)

|

Fund I directly owns 1,025,606 shares of Common Stock

representing 3.1% of all of the outstanding shares of Common Stock of the

Issuer.

|

|

|

|

|

|

|

(ii)

|

Tenzing Global Investors, as the general partner of Fund

I, may be deemed to beneficially own the 1,025,606 shares of Common Stock

held by Fund I, representing 3.1% of all of the outstanding shares of

Common Stock of the Issuer.

|

|

|

|

|

|

|

(iii)

|

Tenzing Global Management, as the investment advisor of

Fund I and the investment manager of the Parallel Account, may be deemed

to beneficially own 1,421,900 shares of Common Stock held by them,

representing 4.3% of all of the outstanding shares of Common Stock of the

Issuer.

|

|

|

|

|

|

|

(iv)

|

Mr. Kapoor may be deemed to be the beneficial owner of

the shares of Common Stock owned by Tenzing Global Management.

|

|

|

|

|

|

|

(v)

|

Collectively, the Reporting Persons beneficially own

1,421,900 shares of Common Stock representing 4.3% of all of the

outstanding shares of Common Stock.

|

Each Reporting Person disclaims beneficial ownership with

respect to any shares of Common Stock other than the shares owned directly and

of record by such Reporting Person.

The percentages set forth in this response are based on the

33,068,860 shares of Common Stock outstanding as of July 25, 2016, as reported

by the Issuer in its Quarterly Report on Form 10-Q for the quarterly period

ended June 30, 2016 as filed with the SEC on July 28, 2016.

(b) Tenzing Global Management, Tenzing Global Investors, and

Mr. Kapoor may be deemed to share with Fund I and the Parallel Account (and not

with any third party) the power to vote or direct the vote of and to dispose or

direct the disposition of the 1,025,606 shares of Common Stock and 396,294

shares of Common Stock reported herein, respectively.

(c) The following Reporting Persons engaged in the following

open-market transactions with respect to the Issuer’s Common Stock during the

last 60 days:

Tenzing Global Investors Fund I LP

|

|

Number

|

Price

|

|

|

|

of

|

per

|

Type of

|

|

Transaction Date

|

Shares

|

Share

|

Transaction

|

|

9/6/2016

|

104,925

|

13.0786

(1)

|

Sale

|

|

9/7/2016

|

52,463

|

12.981

(2)

|

Sale

|

|

9/8/2016

|

50,645

|

12.859

(3)

|

Sale

|

|

9/9/2016

|

3,988

|

12.287

(4)

|

Sale

|

Parallel Account

|

|

Number

|

Price

|

|

|

|

of

|

per

|

Type of

|

|

Transaction Date

|

Shares

|

Share

|

Transaction

|

|

9/6/2016

|

45,075

|

13.0786

(1)

|

Sale

|

|

9/7/2016

|

22,537

|

12.981

(2)

|

Sale

|

|

9/8/2016

|

21,755

|

12.859

(3)

|

Sale

|

|

9/9/2016

|

1,712

|

12.287

(4)

|

Sale

|

Other than the foregoing, no transactions in the Common Stock

have been effected by the Reporting Persons in the last sixty (60) days.

(d) Not applicable.

(e) On September 6, 2016, the Reporting Persons ceased to be

the beneficial owners of more than five percent of the shares of Common Stock of

the Issuer.

_____________________________________________

|

(1)

|

Reflects the weighted average sale price, for multiple

trades executed at prices ranging from $12.86 to $13.39 per

share.

|

|

(2)

|

Reflects the weighted average sale price, for multiple

trades executed at prices ranging from $12.84 to $13.08 per

share.

|

|

(3)

|

Reflects the weighted average sale price, for multiple

trades executed at prices ranging from $12.75 to $13.05 per

share.

|

|

(4)

|

Reflects the weighted average sale price, for multiple

trades executed at prices ranging from $11.995 to $12.72 per

share.

|

SIGNATURE

After reasonable inquiry and to the best of its knowledge and

belief, the undersigned each certifies that the information with respect to it

set forth in this Statement is true, complete and correct.

Dated: September 16, 2016

|

|

|

Tenzing Global Management

LLC

|

|

|

|

|

|

|

By:

|

/s/ Chet Kapoor

|

|

|

|

Chet Kapoor

|

|

|

|

Managing Partner of Tenzing

Global

|

|

|

|

Management LLC

|

|

|

|

|

|

|

|

Tenzing Global Investors

LLC

|

|

|

|

|

|

|

By:

|

/s/ Chet Kapoor

|

|

|

|

Chet Kapoor

|

|

|

|

Managing Partner of Tenzing

Global Investors

|

|

|

|

LLC

|

|

|

|

|

|

|

|

Tenzing

Global Investors Fund I LP

|

|

|

By:

|

Tenzing Global Investors, LLC,

its General

|

|

|

|

Partner

|

|

|

|

|

|

|

By:

|

/s/ Chet Kapoor

|

|

|

|

Portfolio Manager of Tenzing

Global

|

|

|

|

Investors Fund I LP

|

|

|

|

|

|

|

|

/s/ Chet Kapoor

|

|

|

|

Chet Kapoor

|

EXHIBIT INDEX

|

Exhibit 99.1

|

Joint Filing Agreement*

|

|

Exhibit 99.2

|

Agreement, by and among Brightcove Inc., Tenzing Global

Management LLC, Tenzing Global Investors LLC, Tenzing Global Investors

Fund I LP and Chet Kapoor, dated February 5, 2015.*

|

|

Exhibit 99.3

|

Press release, issued by Brightcove Inc. on February 5,

2015.*

|

*Previously filed.

Brightcove (NASDAQ:BCOV)

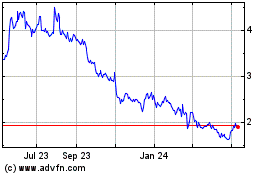

Historical Stock Chart

From Mar 2024 to Apr 2024

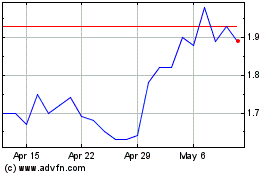

Brightcove (NASDAQ:BCOV)

Historical Stock Chart

From Apr 2023 to Apr 2024