Home Depot, TJX Buck Retail Trends

August 16 2016 - 5:30PM

Dow Jones News

Not all retailers are in a funk. Americans are still visiting

stores to pick out new kitchen cabinets or hunt down deals on

designer clothes.

On Tuesday, home-improvement chain Home Depot Inc. reported a

4.7% jump in sales at established stores during the second quarter,

while TJX Cos., the parent of T.J. Maxx and other off-price chains,

posted a 4% increase at existing stores. Both companies are

forecasting similar gains for the rest of the year.

Both Home Depot and TJX have enjoyed a much better stretch of

sales than the broader retail market by operating in sectors where

consumers are willing to spend and building models that can blunt

the intrusion of online competitors like Amazon.com Inc. Their

growth has outpaced that of department stores like Macy's Inc.,

which has tabbed more stores for closing, and big-box chains like

Target Corp. and Wal-Mart Stores Inc., which both report later this

week.

Other chains are benefiting as competitors falter. Dick's

Sporting Goods Inc. on Tuesday raised its profit outlook for the

year, as the impact from closeout sales at its bankrupt competitor

Sports Authority Inc. wasn't as bad as feared. "We are definitely

seeing market share coming to us," CEO Ed Stack said. Sales rose

2.8% at existing stores in the second quarter and they are expected

to rise up to 3% for the year.

The latest results show that the consumer, whether helped by

rising wages or feeling flush from their home value rising to near

peak levels, are willing to spend. "The fundamentals for consumers

are good, they're just spending their money differently," said

Carol Tome, Home Depot's finance chief.

TJX says its model, where it buys goods through closeouts and

sells them at discounted prices, is helping win over shoppers. "We

are convinced that we are attracting new customers, driving more

frequent visits to our stores, and gaining market share," CEO Ernie

Herrman told analysts on Tuesday. It also operates the HomeGoods

and Marshalls chains.

Home Depot and rival Lowe's Co.'s, which reports earnings

Wednesday, are both buffeted by the rising housing market, which is

spurring homeowners to take on pricey projects like renovating

bathrooms or replacing roofs. Home Depot on Tuesday said the number

of transactions over $900 rose 8.1% in the period and that the

number of items purchased at a time rose because more ambitious

projects require more tools and parts.

"You're looking at 40, 50, 60, even 70 items in the basket," CEO

Craig Menear said. In the second quarter, Home Depot's profit rose

9.3%, while revenue climbed 6.6% to $26.47 billion. For the full

year, the Atlanta-based company expects same-store sales to rise

6.3%.

Executives at TJX said they expect sales at existing stores to

rise 3% to 4% this year and plan to add hundreds of stores in North

America in coming years. The Framingham, Mass., company's profit

rose 2.3% to $562.2 million in the second quarter, while revenue

rose 7% to $7.88 billion.

But TJX's shares took a hit after its third-quarter outlook

disappointed investors. The company cautioned that higher wages,

investment projects and foreign currency swings would pressure

profits. Shares of TJX, which hit a high Monday, fell 5.5% to

$78.12 on Tuesday.

Suzanne Kapner contributed to this article.

Write to Paul Ziobro at Paul.Ziobro@wsj.com

(END) Dow Jones Newswires

August 16, 2016 17:15 ET (21:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

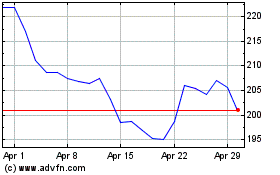

Dicks Sporting Goods (NYSE:DKS)

Historical Stock Chart

From Mar 2024 to Apr 2024

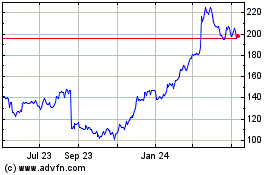

Dicks Sporting Goods (NYSE:DKS)

Historical Stock Chart

From Apr 2023 to Apr 2024