UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14F-1

(Amendment

No. 1)

INFORMATION STATEMENT PURSUANT TO SECTION

14(f) OF

THE SECURITIES EXCHANGE ACT OF 1934 AND

RULE 14f-1 THEREUNDER

_______________________________________________

3DICON CORPORATION

(Exact Name of Registrant as Specified

in its Charter)

Commission File No.: 000-54697

|

Oklahoma

|

|

73-1479206

|

|

(State or Other Jurisdiction of Incorporation or Organization)

|

|

(I.R.S. Employer Identification No.)

|

July 21,

2016

6804 South Canton Avenue, Suite 150

Tulsa, OK 74136

(Address of Principal Executive Offices

and Zip Code)

(

918) 494-0505

(Registrant’s Telephone Number,

including Area Code)

_______________________________________________

With copies to:

Gregory Sichenzia, Esq.

Sichenzia Ross Friedman Ference LLP

61 Broadway, 32

nd

Floor

New York, New York 10006

(212) 930-9700

NO VOTE OR OTHER ACTION OF THE COMPANY’S

SHAREHOLDERS IS REQUIRED IN CONNECTION WITH THIS INFORMATION STATEMENT

WE ARE NOT ASKING YOU FOR A PROXY

AND YOU ARE REQUESTED NOT TO SEND US A PROXY

3DICON CORPORATION

6804 South Canton Avenue, Suite 150

Tulsa, OK 74136

(918) 494-0505

INFORMATION STATEMENT

PURSUANT TO SECTION 14(f) OF THE

SECURITIES EXCHANGE ACT OF 1934

AND RULE 14f-1 THEREUNDER

SCHEDULE 14F-1

Notice of Change in the

Majority of the Board of Directors

July 21, 2016

NO VOTE OR OTHER ACTION OF OUR STOCKHOLDERS

IS REQUIRED IN CONNECTION WITH THIS INFORMATION

STATEMENT.

NO PROXIES ARE BEING SOLICITED AND

YOU ARE REQUESTED NOT TO SEND US A PROXY

This Information Statement

is being mailed on or about July 22, 2016 to holders of record as of July 14, 2016 (the “Record Date”), of common stock,

par value $0.0002, of 3DIcon Corporation (the “Company,” “we,” or “us”). The Company has entered

into a Share Exchange Agreement (the “Agreement”), dated as of May 31, 2016, with Coretec Industries LLC, a North Dakota

limited liability company (“Coretec”), and the members of the Company (each a “Member” and collectively

the “Members”). Pursuant to the Agreement, Coretec will become a wholly-owned subsidiary of the Company (the “Share

Exchange”).

Coretec was organized

under the laws of the State of North Dakota on June 2, 2015 to create technology based solutions (products and services) that address

energy-related market needs globally.

Please read this Information

Statement carefully. It contains biographical and other information concerning our executive officers, directors and those nominees

to be appointed as directors and executive officers upon the closing of the Agreement. Additional information about the Share Exchange

is contained in Annual Report on Form 10-K, which was filed with the United States Securities and Commission on March 30, 2016.

All of the Company’s filings and exhibits may be inspected without charge at the public reference section of the Commission

at 100 F Street, N.E., Washington, D.C. 20549. Copies of this material also may be obtained from the Commission at prescribed rates.

The Commission also maintains a website that contains reports and other information regarding public companies that file reports

with the Commission. Copies of the Company's filings may be obtained free of charge from the Commission's website at http://www.sec.gov.

Our common stock trades

on the OTC PINK under the symbol of “TDCP.”

INTRODUCTION AND CHANGE OF CONTROL

Upon the closing of

the Share Exchange, 100% of the membership interest of Coretec will be exchanged for Four Million Four Hundred Eleven Thousand

Seven Hundred Ten (4,411,710) shares of our Series B Convertible Preferred Stock, par value $0.0002 per share (“Series B

Preferred”).

After the closing of

the Share Exchange, considering any preferred stock on an “as converted” basis, approximately 65% of the Company’s

issued and outstanding common stock will be owned by the Coretec Members. The remaining 35% will be held by the Company’s

current stockholders.

VOTING SECURITIES

As of July 14, 2016,

we had 1,481,754,533 shares of common stock issued and outstanding, which is the only class of voting securities that would be

entitled to vote for directors at a stockholders’ meeting if one were to be held. Each share of common stock is entitled

to one vote.

DIRECTORS AND OFFICERS

PRIOR TO THE CHANGE OF CONTROL

The following table

sets forth information regarding the Company’s executive officers and directors prior to the Change of Control. All directors

serve until the next annual meeting of shareholders or until their successors are elected and qualified. There are no agreements

with respect to the election of these directors.

|

Name

|

|

Age

|

|

Position

|

|

Since

|

|

Victor F. Keen

|

|

74

|

|

Chief Executive Officer and Director

|

|

November 2007

|

|

Ronald Robinson

|

|

70

|

|

Chief Financial Officer

|

|

January 2013

|

|

John O'Connor

|

|

61

|

|

Chairman of the Board

|

|

October 2006

|

|

Martin Keating

|

|

74

|

|

Director

|

|

August 2011

|

Victor F. Keen

- Chief Executive Officer and

Director

Since November 2013 Mr. Keen has served

as the Chief Executive Officer of the Company. From November 2007 through the present time Victor F. Keen has served as a member

of the Board of Directors of the Company. Currently, he is the largest shareholder of the Company. Mr. Keen currently serves on

the Board of Directors and is the head of the Compensation Committee of Research Frontiers, and serves as of counsel to the Tax

Practice Group of Duane Morris, LLP. Previously, Mr. Keen served as the Chair of the Tax Practice Group at Duane Morris, LLP.

He has been an active investor in various companies including Lending Tree, Circle Lending, Inc., and Rollover Systems, Inc. Mr.

Keen graduated from Trinity College and then went on to receive a J.D. from Harvard Law School.

Ronald Robinson

- Chief

Financial Officer

Since Ronald Robinson January 28, 2013

has served as Chief Financial Officer to the Company and has been an SEC compliance and accounting consultant to the Company since

2010. He is licensed to practice by the Oklahoma Board of Accountancy and is a member of the American Institute of Certified Public

Accountants and the Oklahoma Society of Certified Public Accountants. From 1999-2010 Mr. Robinson was the Managing Partner of

Sutton Robinson Freeman & Co., PC, a CPA firm where he performed SEC/PCOAB audits for various clients including 3DIcon Corporation.

Since 1976 he has been a partner in three CPA firms. Mr. Robinson received a B.S. in Accounting from East Central University Ada,

Oklahoma.

John O' Connor

- Chairman

of the Board of Directors

From October 2006 through the present

time, John O'Connor has served as director of the Company. He has practiced law in Tulsa since 1981, concentrating in the areas

of corporate and commercial law and is admitted to practice before the U.S. District Court of the Northern District of Oklahoma

and state courts in Oklahoma and the U.S. Tax Court. He is also a member of the Cherokee Nation Bar Association. Currently, Mr.

O’Connor is Chairman of the Board of the Tulsa law firm of Newton, O'Connor, Turner & Ketchum. Mr. O’Connor has

served two terms on the board of the Oklahoma Bar Association-Young Lawyers Division, and he has served on several committees

of the Tulsa County Bar Association. Mr. O'Connor is a regular presenter at continuing legal education seminars sponsored by the

Oklahoma Bar Association and the University Of Tulsa College Of Law and is a member of the American Bar Association, the Oklahoma

Bar Association, and the Tulsa County Bar Association.

He is a former member of the Oklahoma

Academy of Mediators and Arbitrators, and has served as a Barrister in The Council Oak American Inn of Court. Mr. O’Connor

received his law degree from the University Of Tulsa College Of Law and his B.A. in political science from Oklahoma State University.

He studied international law at the Friedreich Wilhelm RheinischeUniverstat in Bonn, Germany.

Martin Keating

– Director

From 1998 through the present time, Martin

Keating has served as a member of the Board of Directors. He was the Chief Executive Officer from 1998 through August 8, 2011.

Mr. Keating is a founder of the Company and was previously chairman and Chief Executive Officer. He is an attorney licensed to

practice law in Oklahoma and Texas. Prior to founding the Company, he structured and managed numerous investment vehicles including

the capitalization and NASDAQ listing of CIS Technologies, where he served as general counsel and financed the motion picture “The

Buddy Holly Story.” Mr. Keating has been a guest lecturer at several colleges and universities across the country and has

been featured on national television and radio programs including CNN, CNBC and HARD COPY.

CORPORATE GOVERNANCE

Committees of the Board of Directors

Audit Committee

On February 25,

2008, the Board of Directors created an Audit Committee, which is now comprised of Mr. Victor Keen. Currently, there is no member

of the Audit Committee who is a financial expert due to limited resources. The Audit Committee does not have a charter.

Compensation Committee

On February 25,

2008, the Board of Directors created a Compensation Committee, which is now comprised of Mr. Victor Keen. The Compensation Committee

does not have a charter. Executive and director compensation are determined by disinterested members of the committee.

Nomination and

Corporate Governance Committee

On February 25, 2008,

the Board of Directors created Nominations and Corporate Governance Committee, which is now comprised of Mr. Victor Keen.

Director Independence

Of the members of

the Company’s Board of Directors, none of the members are considered to be independent under the listing standards of the

Rules of NASDAQ set forth in the NASDAQ Manual.

Shareholder Communications

Shareholders may communicate

with our Board by directing their communication in care of the Secretary of the Company, at the address set forth on the front

page of this Information Statement. You will receive a written acknowledgement from the Company upon receipt of your communication.

Meetings of the Board of Directors and

Committees

The Board took a number

of actions by written consent of all of the directors during the year ended December 31, 2015. Such actions by the written consent

of all directors are, according to Nevada corporate law and the Company’s by-laws, valid and effective as if they had been

passed at a meeting of the directors duly called and held. The Company's directors and officers do not receive remuneration from

the Company unless approved by the Board or pursuant to an employment contract.

Legal Proceedings

We are not a party

to any pending legal proceeding, nor is our property the subject of a pending legal proceeding, that is not in the ordinary course

of business or otherwise material to the financial condition of our business. None of our directors, officers or affiliates is

involved in a proceeding adverse to our business or has a material interest adverse to our business..

RELATED PERSON TRANSACTIONS

Related Party Transactions

Employment Agreements

We have not entered into employment agreements

with any of our executive officers.

Director Compensation

Our directors currently

do not receive monetary compensation for their service on the Board of Directors. Directors may receive compensation for their

services and reimbursement for their expenses as shall be determined from time to time by resolution of the Board.

Except as below, none

of the following parties has, since our date of incorporation, had any material interest, direct or indirect, in any transaction

with us or in any presently proposed transaction that has or will materially affect us:

|

|

.

|

Any of our directors or officers;

|

|

|

.

|

Any person proposed as a nominee for election as a director;

|

|

|

.

|

Any person who beneficially owns, directly or indirectly, shares carrying more than 10% of the voting rights attached to our outstanding shares of common stock;

|

|

|

.

|

Any member of the immediate family of any of the foregoing persons.

|

3DIcon has engaged

the law firm of Newton, O'Connor, Turner & Ketchum as its outside corporate counsel from 2005 through 2008 and certain

legal services subsequent to 2008. John O'Connor, a director of 3DIcon, is the Chairman of Newton, O'Connor, Turner & Ketchum.

Subsequent to December

31, 2015, the Company issued an aggregate of 1,589,010 shares of the Company’s Series B Convertible Preferred in connection

with Securities Purchase Agreements (the “Securities Purchase Agreements”) dated December 11, 2015. Pursuant the Securities

Purchase Agreements, the Company had agreed to issue, and on March 23, 2016 issued, to certain officers, directors, consultants

and service providers (collectively, “Recipients”) and the Recipients had agreed to accept, and on March 23, 2016 received,

shares of Series B Preferred in consideration for the satisfaction, in lieu of cash payment, of an aggregate of $1,105,402.72 owed

by the Company to the Recipients. Series B Preferred may be converted in whole or in part, from time to time, into One Thousand

Nine Hundred Fourteen (1,914) shares of Common Stock. Among the Recipients were (i) Victor F. Keen, the Company’s Chief Executive

Officer, who received 1,193,582 shares of Series B Preferred in satisfaction of $685,354.62 owed to him under certain notes, in

connection with certain advances he provided to the Company and for services he provided to the Company; (ii) Ronald W. Robinson,

the Company’s Chief Financial Officer, who received 85,771 shares of Series B Preferred in satisfaction of $90,291.25 owed

to him for services he provided to the Company; (iii) Martin Keating, a Director of the Company, who received 19,266 shares of

Series B Preferred in satisfaction of $20,280.82 owed to him under certain notes and for services he provided to the Company; and

(iv) Newton, O'Connor, Turner & Ketchum, PC, a law firm of which John O’Connor, a Director of the Company, is a

partner, that received 50,149 shares of Series B Preferred in satisfaction of $52,791.49 owed to it for services provided to the

Company.

DIRECTORS AND OFFICERS

AFTER THE CHANGE OF CONTROL

The following table sets forth information regarding 3DIcon

Corporation’s executive officers and directors as of the date of this information statement and three director nominees that

will be elected directors effective upon completion of Merger and the executive officers after the Merger.

|

Name

|

|

Current Position with 3DIcon

|

|

Position with 3DIcon After

the Share Exchange

|

|

Victor Keen

|

|

Chief Executive Officer, Director

|

|

Chief Executive Officer, Director

|

|

Ronald Robinson

|

|

Chief Financial Officer

|

|

Chief Financial Officer

|

|

Ron Dombrowski

|

|

none

|

|

Director

|

|

Simon Calton

|

|

none

|

|

Director

|

|

Dennis Anderson

|

|

none

|

|

Director

|

Ron Dombrowski

–

Director

Ron Dombrowski, age 52, will serve

as a Director of the Company. Since August 2015, Mr. Dombrowski served as a member of Coretec’s Board of Directors. Between

April 2015 and November 2015, he was Director of Sales and Marketing at Lifting Solutions Automation Inc. From August 2010 to

April 2015 Mr. Dombrowski served as the Vice President of Sales and Marketing at Limited Solutions Automation Inc. He is a graduate

of the Southern Illinois University with degrees in Electrical Engineering and Management. Mr. Dombrowski has also attended executive

education programs at University of Phoenix and the Marquette University.

Mr. Dombrowski has over 25 years of

global sales and operations experience, growing and scaling both startups and Fortune 500 technology companies. We believe that

Mr. Dombrowski is qualified to serve on our board of directors because of his background in sales and operations experience.

Simon Calton –

Director

Simon Calton, age 36, will serve as

a Director of the Company. Simon Calton has over 12 years of experience in financing and company structuring and utilizes his

experience to find opportunities in different sectors. Since 2008 Mr. Calton has structured a number of Alternative Investment

Products geared around Construction and Development in the United States and United Kingdom. In 2012 he co-founded the Carlton

North Dakota Ltd, which specializes in funding specific projects and developments in throughout the United States. In 2007 Mr.

Calton co-founded the Carlton James Private and Commercial, a project investment and global financing firm which helps to fund

projects around the globe.

We believe Mr. Calton is qualified

to serve on our board of directors because of his extensive business and management experience.

Dennis Anderson

–

Director

Dennis Anderson, Age 60, will serve

as a Director of the Company. Since June 2015 Mr. Anderson has been the President of Cortec Industries LLC. From June 2003

to May 2015 Mr. Anderson served as the Associate Vice President of the Office of Research and Creative Activities at North Dakota

State University where he spent his time creating, procuring funding, and managing various high technology research centers and

programs, especially those funded by both federal and state governmental agencies as well as small and large private sector partners.

Mr. Anderson graduated with a B.Sc. (microbiology) from North Dakota State University and M.Sc. (virology) from Kansas State University.

He is an entrepreneur with over 23

years of experience in creating, funding, and/or managing technology-based startups and emerging companies primarily focused on

research, development, and commercialization of new biotechnology and biopharmaceutical products for human and veterinary markets.

He also has experience in intellectual property creation, procurement, development, technology transfer (including licensing),

and commercialization of various technologies and associated IP in both private sector and academic settings. Mr. Anderson is

a founding member of ChymaTek Energy Solutions, LLC which holds equity interests in Coretec.

We believe that Mr. Anderson is qualified

to serve on our board of directors because of his biotechnology and biopharmaceutical knowledge and experience.

SECURITY OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

As of the Record Date,

there were approximately 1,481,754,533 shares of our common stock outstanding. The following table sets forth certain information

regarding our common stock, beneficially owned as of December 31, 2015, by each person known to us to beneficially own more than

5% of our common stock, each executive officer and director, and all directors and executive officers as a group. We calculated

beneficial ownership according to Rule 13d-3 of the Exchange Act as of that date. Shares issuable upon exercise of options, warrants

or other securities that are exercisable, exchangeable or convertible within 60 days after the Record Date are included as beneficially

owned by the holder. Beneficial ownership generally includes voting and dispositive power with respect to securities. Unless otherwise

indicated below, the persons and entities named in the table have sole voting and sole dispositive power with respect to all shares

beneficially owned.

|

Name of Beneficial Owner (1)

|

|

Number of

Shares

Beneficially Owned (7)

|

|

|

Class of Stock

|

|

Percentage

Outstanding (2)(7)

|

|

|

Victor F. Keen, CEO, Director(3)(7)

|

|

|

67,848,690

|

|

|

Common

|

|

|

4.72

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ronald Robinson, CFO(4)(7)

|

|

|

222,426

|

|

|

Common

|

|

|

*

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Martin Keating, Director(5)(7)

|

|

|

2,635,524

|

|

|

Common

|

|

|

*

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

John O’Connor, Director(6)(7)

|

|

|

2,968,888

|

|

|

Common

|

|

|

*

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All directors and executive officers as a group (4 person)

|

|

|

73,675,528

|

|

|

Common

|

|

|

5.12

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Golden State Equity Investors, Inc.(8)

|

|

|

164,455,976

|

|

|

Common

|

|

|

9.99

|

%

|

* Less than 1%

(1) Unless otherwise indicated, the address

of each beneficial owner listed below is c/o 3DIcon Corporation, 6804 South Canton

Avenue, Suite 150, Tulsa, Oklahoma 74136.

(2) Applicable percentage ownership is

based on 1,370,953,255 shares of common stock outstanding as of December 31, 2015. Beneficial ownership is determined in accordance

with the rules of the Securities and Exchange Commission and generally includes voting or investment power with respect to securities.

Options to acquire shares of common stock that are currently exercisable or exercisable within 60 days of March 30, 2016 are deemed

to be beneficially owned by the person holding such securities for the purpose of computing the percentage of ownership of such

person, but are not treated as outstanding for the purpose of computing the percentage.

(3) Represents 3,020,152 shares owned by

Mr. Keen and (i) 11,078,538 shares of common stock issuable upon exercise of vested options to purchase 11,078,538 shares of common

stock at a weighted average of $0.09 per share; (ii) 1,500,000 shares of common stock issuable upon conversion of a $15,000 Convertible

Note; (iii) 19,000,000 shares of common stock issuable upon conversion of a 265,000 shares of Series A convertible Preferred stock;

(iv) 20,000,000 common stock issuable upon conversion of a $60,000 convertible Note assuming a $0.003 conversion price; (v) 13,250,000

shares of common stock issuable upon exercise of warrants to purchase shares of common stock. Victor Keen is our Chief Executive

Officer and Director. Does not include the 1,193,582 shares of Series B Preferred held by Mr. Keen or the Common Stock into which

the Series B Preferred are convertible.

(4) Represents 178,366 shares owned by

Mr. Robinson, 999 shares in Mr. Robinson’s IRA, and 43,061 shares owned by Robinson, Freeman, PC, a corporation of which

Mr. Robinson owns a 50% interest. Ronald Robinson is our Chief Financial Officer. Does not include the 85,771 shares of Series

B Preferred held by Mr. Robinson or the Common Stock into which the Series B Preferred are convertible.

(5) Represents (i) 1,942,499 shares of

common stock owned by Mr. Keating, (ii) 286,453 options and (iii) 406,572 shares of common stock owned by Mr. Keating's wife, Judy

Keating. Does not include the 19,266 shares of Series B Preferred held by Mr. Keating or the Common Stock into which the Series

B Preferred are convertible.

(6) Represents (i) 3,143 shares of common

stock owned by Mr. O'Connor and (ii) 2,857 shares of common stock owned by the John M. and Lucia D. O'Connor Revocable Living Trust

over which Mr. O'Connor has voting and investment control and, (iii) 619,205 shares owned by Newton O’Connor & Ketchum

(“NOTK”), a corporation of which Mr. O’Conner is partial owner; (iv) 1,144,710 shares of common stock issuable

upon conversion of a $29,007 Convertible Note owned by NOTK; and (v) 1,198,973 options and warrants owned by Mr. O'Connor or NOTK.

Does not include the 50,149 shares of Series B Preferred held by NOTK or the Common Stock into which the Series B Preferred are

convertible.

(7) None of the beneficially owned shares

or percentages of the outstanding include shares of Common Stock into which the respective holdings of Series B Preferred could

be converted. Due to the lack of authorized and unreserved shares of Common Stock, the Company is currently unable to issue shares

of Common Stock, even if the holders of Series B Preferred stock were to request conversion. However, if the Company had enough

authorized shares, each share of Series B Preferred owned by the respective officer or director would be convertible into 1,914

shares of Common Stock.

(8) Represents (i) 4,537 shares of

Common stock and (ii) 164,451,439 shares of Common Stock issuable upon conversion of a Convertible Note which contains a limit

of ownership of 9.99%.

SUMMARY COMPENSATION TABLE

The following information is furnished

for the years ended December 31, 2015, 2014 and 2013 for our principal executive officer and the two most highly compensated officers

other than our principal executive officer who was serving as such at the end of our last completed fiscal year:

|

Name & Principal

Position

|

|

Year

|

|

|

Salary

($)

|

|

|

Bonus

($)

|

|

|

Stock Awards

($)

|

|

|

Option

Awards

($)

|

|

|

Non-Equity

Incentive Plan Compensation

($)

|

|

|

Change in

Pension Value and Non-Qualified Deferred Compensation Earnings

($)

|

|

|

All Other

Compensation

($)

|

|

|

Total

($)

|

|

|

Victor

Keen

|

|

|

2015

|

|

|

$

|

150,000

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

150,000

|

|

|

CEO*

|

|

|

2014

|

|

|

$

|

150,000

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

150,000

|

|

|

|

|

|

2013

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mark Willner

|

|

|

2015

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

Former CEO**

|

|

|

2014

|

|

|

$

|

162,000

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

162,000

|

|

|

|

|

|

2013

|

|

|

$

|

173,000

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

73,360

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

248,300

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ronald Robinson

|

|

|

2015

|

|

|

$

|

72,000

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

72,000

|

|

|

CFO****

|

|

|

2014

|

|

|

$

|

72,000

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

72,000

|

|

|

|

|

|

2013

|

|

|

$

|

66,000

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

66,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Chris Dunstan

|

|

|

2015

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

Former CFO***

|

|

|

2014

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

|

|

|

2013

|

|

|

$

|

5,000

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

5,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Martin Keating

|

|

|

2015

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

Director &

Former

|

|

|

2014

|

|

|

$

|

-

|

|

|

$

|

5,000

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

5,000

|

|

|

CEO

|

|

|

2013

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hakki Refai

|

|

|

2015

|

|

|

$

|

36,000

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

36,000

|

|

|

|

|

|

2014

|

|

|

$

|

144,000

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

144,000

|

|

|

|

|

|

2013

|

|

|

$

|

144,000

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

144,000

|

|

|

|

*

|

Victor Keen was appointed CEO November 1, 2013 and

waived any compensation for 2013.

|

|

|

**

|

Mark Willner was the Company’s Chief Executive Officer from March 19, 2012 to November 1, 2013. See the “Employment

Agreement” section for a discussion of Mr. Willner’s compensation arrangement.

|

|

|

***

|

On January 28, 2013, the Company decided not to renew its agreement with Christopher T. Dunstan pursuant to which Mr. Dunstan

served as the Company’s Interim Chief Financial Officer.

|

|

|

****

|

Ronald Robinson was appointed CFO of the Company effective January 28, 2013.

|

Outstanding Equity Awards at Fiscal Year-end

The following table sets forth with respect to grants of options

to purchase our common stock to the executive officers as of December 31, 2015:

|

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END

|

|

OPTION

AWARDS

|

|

STOCK

AWARDS

|

|

Name

|

|

Number

of Securities Underlying Unexercised Options

(#)

Exercisable

|

|

|

Number

of Securities Underlying Unexercised Options

(#)

Unexercisable

|

|

|

Equity

Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options (#)

|

|

|

Option

Exercise

Price

($)

|

|

|

Option

Expiration

Date

|

|

Number

of Shares or Units of Stock That Have Not Vested

(#)

|

|

|

Market

Value of Shares or Units of Stock That Have Not Vested

($)

|

|

|

Equity

Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested

(#)

|

|

|

Equity

Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested

(#)

|

|

|

Victor Keen,

CEO

|

|

|

11,078,538

|

|

|

|

-

|

|

|

|

-

|

|

|

$

|

0.01

to 0.234

|

|

|

2018-2022

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

Allen Lin

|

|

|

228,572

|

|

|

|

-

|

|

|

|

-

|

|

|

$

|

0.35

|

|

|

2017

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

Compensation of Directors

See foregoing Summary Compensation Table.

Options/SAR Grants in the Last Fiscal

Year:

None

Employment Agreements

None

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING

COMPLIANCE

Section 16(a) of

the Exchange Act requires our directors and executive officers, and persons who own more than 10% of a registered class of our

equity securities, to file initial reports of ownership and reports of changes in ownership with the SEC. Such persons are required

by the SEC to furnish us with copies of all Section 16(a) forms they file. Based solely on a review of copies of reports furnished

to us, or written representations that no reports were required, we believe that during the year ended December 31, 2015, our

executive officers, directors and 10% holders complied with all filing requirements.

WHERE YOU CAN FIND ADDITIONAL INFORMATION

We are required to

file annual, quarterly and special reports, proxy statements and other information with the SEC. You may read and copy any document

we file at the SEC’s public reference rooms at 100 F Street, N.E, Washington, D.C. 20549. You may also obtain copies of the

documents at prescribed rates by writing to the Public Reference Section of the SEC at 100 F Street, N.E., Room 1580, Washington,

D.C. 20549. Please call the SEC at 1-800-SEC-0330 for more information on the operation of the public reference rooms. Copies of

our SEC filings are also available to the public from the SEC’s web site at www.sec.gov/edgar/searchedgar/companysearch.html.

SIGNATURE

In accordance with

Section 14(f) of the Exchange Act, the Registrant has caused this Information Statement to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

3DICON CORPORATION

|

|

|

|

By Order of the Board of Directors

|

|

|

|

|

|

|

By:

|

/s/ Victor F. Keen

|

|

|

|

Name:

|

Victor F. Keen

|

|

|

|

Title:

|

Chief Executive Officer

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dated: August 15, 2016

|

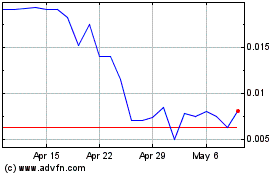

Coretec (QB) (USOTC:CRTG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Coretec (QB) (USOTC:CRTG)

Historical Stock Chart

From Apr 2023 to Apr 2024