RWE Net Is Hurt By Trading Losses -- WSJ

August 12 2016 - 3:03AM

Dow Jones News

By Monica Houston-Waesch

FRANKFURT -- German power utility RWE AG's earnings fell by more

than two thirds in the first half of the year partly on losses at

its trading business in the second quarter, the company said on

Thursday.

Net profit plunged to EUR457 million ($510.3 million) in the six

months to the end of June from EUR1.74 billion in the year-earlier

period, which was boosted by around EUR1.5 billion in gains from

the sale of its RWE Dea oil and gas unit. RWE's operating profit

fell 7% to about EUR1.9 billion in the first half.

Like other utilities in Germany and parts of Europe, RWE has

been hurt by low wholesale electricity prices amid a power glut

spawned by a rise in renewable energy and low commodity prices. In

addition, uncertainty surrounding nuclear liabilities is weighing

on German operators.

RWE's results could spark downward revisions to market consensus

estimates, although RWE confirmed its own guidance for the year,

investment bank Bryan, Garnier & Co. said in a research note.

Recent gains for the stock aren't justified, it added. After

tumbling over 5% at the open, RWE shares were up 2.5% at

midday.

Despite a successful start to the year, RWE's trading business

suffered "significant unexpected losses in the second quarter," RWE

said.

The trading division's operating loss was EUR156 million in the

first half, versus profit of EUR73 million in the year-earlier

period.

"There was nothing irregular, everything was very transparent,

but as it is in this business, sometimes you get it right and

sometimes you don't, " Chief Executive Peter Terium said in a

conference call.

He declined to say whether trading positions will continue to

burden the company during the remainder of the year, but RWE said

the division will end the year "much lower" than in 2015, after

previously expecting improvement.

"You can assume that price fluctuations in coal and power prices

played a role," Mr. Terium added.

Net debt widened to EUR28.3 billion at the end of June, compared

with EUR25.5 billion at the end of December, due to negative free

cash flow and additional pension provisions, given low interest

rates.

Mr. Terium repeated that the U.K.'s decision to leave the EU was

"manageable" and the turnaround at its operations there is on

track. Given customer gains in June and July, fully offsetting

customer losses in the first half, the company expects its U.K.

operations to be back in the black in 2017, he said.

Turning to Germany, Mr. Terium said there is little clarity on

the amount RWE will need to pay into a state fund to finance

nuclear waste, noting many details remain unclear. RWE has nuclear

provisions of around EUR4.8 billion. Unlike its rival E.ON, which

has hinted a capital increase could be needed to finance additional

risk provisions for the fund, RWE said it had no immediate plans to

raise capital. RWE suspended its common dividend for 2015, and said

it would only review a dividend policy for 2016 once its nuclear

obligations are concrete.

During the first six months of the year, electricity sales rose

4%, offset by a 7% decline in gas sales volumes. Group revenue fell

to about EUR23.9 billion, from EUR24.8 billion in the first six

months of 2015.

Adjusted net income rose 10% to EUR598 million, due to a low tax

rate and a one-off effect of deferred taxes related to the group's

restructuring. Cost management at RWE's conventional power

generation and the one-off sale of property also supported

earnings.

RWE said plans were on track to spin off its renewable energy,

power grid and retail operations into a new company, Innogy SE,

later this year.

RWE confirmed its full-year outlook, despite worsening prospects

for its trading division, tweaking its guidance for its supply

division a bit higher. RWE still expects an operating result of

between EUR2.8 billion and EUR3.1 billion for the year, and

adjusted after-tax profit of EUR500 million to EUR700 million.

--Jenny Busche contributed to this article.

Write to Monica Houston-Waesch at nikki.houston@wsj.com

(END) Dow Jones Newswires

August 12, 2016 02:48 ET (06:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

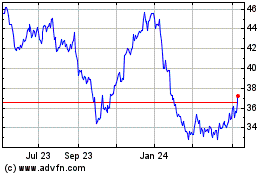

Rwe (PK) (USOTC:RWEOY)

Historical Stock Chart

From Mar 2024 to Apr 2024

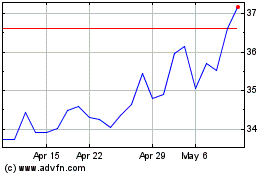

Rwe (PK) (USOTC:RWEOY)

Historical Stock Chart

From Apr 2023 to Apr 2024