Spectrum ASA : 2nd Quarter 2016 Financial Results

August 12 2016 - 1:15AM

| Summary |

|

|

|

|

| |

|

|

|

|

| |

|

|

SPECTRUM GROUP |

| |

|

|

Quarter |

Quarter |

6

months |

6

months |

12

Months |

| |

|

|

ended |

ended |

ended |

ended |

ended |

| |

|

|

30.06.16 |

30.06.15 |

30.06.16 |

30.06.15 |

31.12.15 |

| (USD 1000) |

|

|

(Unaudited) |

(Unaudited) |

(Unaudited) |

(Unaudited) |

(Audited) |

| |

|

|

|

|

|

|

|

| Net operating revenue |

|

|

13 601 |

34 743 |

31 826 |

49 630 |

109 844 |

| |

|

|

|

|

|

|

|

| EBIT |

|

|

(9 898)

|

8 701 |

(16 690)

|

4 397 |

(5 169)

|

| |

|

|

|

|

|

|

|

|

Net Profit / (Loss) |

|

|

(10 993)

|

5 286 |

(18 893)

|

1 964 |

(8 654)

|

| |

|

|

|

|

|

|

|

| Cash flow from operating activities |

|

|

(6 037)

|

15 199 |

37 977 |

33 193 |

98 199 |

| |

|

|

|

|

|

|

|

| Investment in Multi-Client library |

|

|

7 414 |

120 244 |

35 147 |

133 408 |

174 618 |

| |

|

|

|

|

|

|

|

| Multi-Client library Net book value |

|

|

220 393 |

233 364 |

220 393 |

233 364 |

220 686 |

| |

|

|

|

|

|

|

|

| Cash and

cash equivalents |

|

|

14

882 |

17

445 |

14

882 |

17

445 |

23

373 |

-

Net Multi-Client revenues in the quarter totaled

MUSD 13.2 (2015: MUSD 34.5)

-

Net Multi-Client revenues were comprised of late

sales of MUSD 7.8 (2015: MUSD 31.9), prefunding on Multi-Client

investments of MUSD 5.4 (2015: MUSD 2.6)

-

EBIT for the quarter was MUSD (9.9) (2015: MUSD

8.7)

-

Multi-Client investments were MUSD 7.4 with

73.0% prefunding rate (2015: Multi-Client investments were MUSD

120.2. Investments in new acquisitions were MUSD 11.5 with 22.7%

prefunding rate )

-

Operational cash flow in Q2 was MUSD (6.0)

(2015: MUSD 15.2)

-

Net Multi-Client revenues totaled MUSD 31.1

(2015: MUSD 49.1)

-

Net Multi-Client revenues were comprised of late

sales of MUSD 13.3 (2015: MUSD 35.8), prefunding on Multi-Client

investments of MUSD 14.6 (2015: MUSD 10.0) and other revenue of

MUSD 3.1 (2015: MUSD 3.4).

-

EBIT was MUSD (16.7) (2015: MUSD 4.4)

-

Multi-Client investments were MUSD 35.1 with

41.7% prefunding rate (2015: Multi-Client investments were MUSD

133.4. Investments in new acquisitions were MUSD 24.8 with 40.3%

prefunding rate

-

Operational cash flow was MUSD 38.0 (2015: MUSD

33.2)

This information is subject

to the disclosure requirements pursuant to section 5-12 of the

Norwegian Securities Trading Act.

Q2 2015 Presentation

Q2 2016 Financial Report

This

announcement is distributed by NASDAQ OMX Corporate Solutions on

behalf of NASDAQ OMX Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: Spectrum ASA via Globenewswire

HUG#2034751

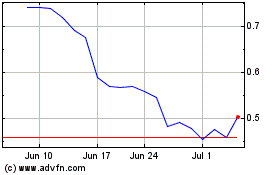

Future FinTech (NASDAQ:FTFT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Future FinTech (NASDAQ:FTFT)

Historical Stock Chart

From Apr 2023 to Apr 2024