Current Report Filing (8-k)

August 02 2016 - 4:32PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 29, 2016

American Superconductor Corporation

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

000-19672

|

|

04-2959321

|

|

(State or other jurisdiction

|

|

(Commission

|

|

(IRS Employer

|

|

of incorporation)

|

|

File Number)

|

|

Identification No.)

|

|

|

|

|

|

64 Jackson Road

Devens, Massachusetts

|

|

01434

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code

(978) 842-3000

Not Applicable

(Former

name or former address, if changed since last report.)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Item 5.02.

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

(e) Amendments to 2007 Stock Incentive Plan and Amended and Restated 2007 Director Stock Plan.

On July 29, 2016, American Superconductor

Corporation (the “

Company

”) held its Annual Meeting of Stockholders (the “

Annual Meeting

”) at which the Company’s stockholders approved amendments to the Company’s 2007 Stock Incentive Plan, as amended

(the “

2007 Plan

”), and Amended and Restated 2007 Director Stock Plan (the “

2007 Director Plan

”).

2007 Plan

At the Annual Meeting, the Company’s stockholders approved the following amendments to the 2007 Plan:

|

|

•

|

|

an increase in the total number of shares of common stock authorized for issuance under the 2007 Plan from 2,050,000 shares to 3,400,000 shares; and

|

|

|

•

|

|

an increase the maximum number of shares issuable to any person in any calendar year from 100,000 shares to 250,000 shares.

|

In addition, the Company’s stockholders approved the material terms of performance goals that may apply to awards granted under the 2007

Plan for purposes of Section 162(m) of the Internal Revenue Code of 1986, as amended.

The foregoing amendments to the 2007 Plan had

been approved by the Board of Directors of the Company on June 14, 2016, subject to and effective upon stockholder approval.

The

foregoing description of the amendments does not purport to be complete and is qualified in its entirety by reference to the 2007 Plan, a copy of which is attached as Exhibit 10.1 hereto and incorporated herein by reference.

2007 Director Plan

At the Annual

Meeting, the Company’s stockholders approved the following amendments to the 2007 Director Plan:

|

|

•

|

|

an increase in the total number of shares of common stock authorized for issuance under the 2007 Director Plan from 80,000 shares to 230,000 shares; and

|

|

|

•

|

|

a decrease in the maximum value of equity awards granted to any director in any fiscal year from $1,000,000 to $500,000.

|

The foregoing amendments to the 2007 Director Plan had been approved by the Board of Directors of the Company on June 14, 2016, subject

to and effective upon stockholder approval.

The foregoing description of the amendments does not purport to be complete and is qualified

in its entirety by reference to the 2007 Director Plan, a copy of which is attached as Exhibit 10.2 hereto and incorporated herein by reference.

|

Item 5.07.

|

Submission of Matters to a Vote of Security Holders.

|

On July 29, 2016, the Company

held its Annual Meeting at which the Company’s stockholders took the following actions:

1. The Company’s stockholders

elected the following directors to its board:

|

|

|

|

|

|

|

|

|

|

|

DIRECTOR

|

|

VOTES

FOR

|

|

|

VOTES

WITHHELD

|

|

|

|

|

|

|

Vikram S. Budhraja

|

|

|

4,597,226

|

|

|

|

890,027

|

|

|

|

|

|

|

Pamela F. Lenehan

|

|

|

5,359,082

|

|

|

|

128,171

|

|

|

|

|

|

|

Daniel P. McGahn

|

|

|

5,358,564

|

|

|

|

128,689

|

|

|

|

|

|

|

David R. Oliver, Jr.

|

|

|

5,281,246

|

|

|

|

206,007

|

|

|

|

|

|

|

John B. Vander Sande

|

|

|

4,441,791

|

|

|

|

1,045,462

|

|

|

|

|

|

|

John W. Wood, Jr.

|

|

|

4,602,194

|

|

|

|

885,059

|

|

2

There were 4,733,487 broker non-votes for each director.

2. The Company’s stockholders voted to approve amendments to the Company’s 2007 Plan to add 1,350,000 shares to the total

number of shares available for issuance under the plan and to increase the maximum number of shares issuable to any person in any calendar year to 250,000 by a vote of 4,653,532 shares of common stock for, 795,855 shares of common stock against and

37,866 shares of common stock abstaining. There were 4,733,487 broker non-votes on this matter.

3. The Company’s stockholders

voted to approve amendments to the Company’s 2007 Director Plan to add 150,000 shares to the total number of shares available for issuance under the plan and to decrease the maximum value of equity awards granted to any director in any fiscal

year to $500,000 by a vote of 5,126,045 shares of common stock for, 320,288 shares of common stock against and 40,920 shares of common stock abstaining. There were 4,733,487 broker non-votes on this matter.

4. The Company’s stockholders voted to approve an amendment to the Company’s 2000 Employee Stock Purchase Plan to add 300,000

shares to the total number of shares available for issuance under the plan by a vote of 5,188,879 shares of common stock for, 275,482 shares of common stock against and 22,892 shares of common stock abstaining. There were 4,733,487 broker non-votes

on this matter.

5. The Company’s stockholders voted to ratify the selection by the Audit Committee of the Board of Directors of

RSM US LLP (f/k/a McGladrey LLP) as the Company’s independent registered public accounting firm for the current fiscal year by a vote of 9,954,404 shares of common stock for, 92,772 shares of common stock against and 173,564 shares of common

stock abstaining.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits:

|

|

|

|

|

Exhibit

No.

|

|

Description

|

|

|

|

|

10.1

|

|

2007 Stock Incentive Plan, as amended.

|

|

|

|

|

10.2

|

|

Amended and Restated 2007 Director Stock Plan.

|

3

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

AMERICAN SUPERCONDUCTOR CORPORATION

|

|

|

|

|

|

Date: August 2, 2016

|

|

By:

|

|

/s/ David A. Henry

|

|

|

|

|

|

David A. Henry

|

|

|

|

|

|

Executive Vice President and Chief Financial Officer

|

4

EXHIBIT INDEX

|

|

|

|

|

Exhibit

No.

|

|

Description

|

|

|

|

|

10.1

|

|

2007 Stock Incentive Plan, as amended.

|

|

|

|

|

10.2

|

|

Amended and Restated 2007 Director Stock Plan.

|

5

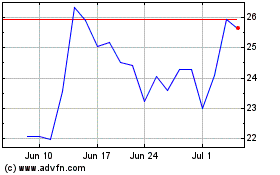

American Superconductor (NASDAQ:AMSC)

Historical Stock Chart

From Mar 2024 to Apr 2024

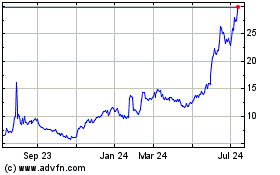

American Superconductor (NASDAQ:AMSC)

Historical Stock Chart

From Apr 2023 to Apr 2024