Capstone Companies, Inc. Announces Effective Date of 1:15 Reverse Stock Split and Up-listing Plan to OTCQB Venture Market

July 21 2016 - 4:15PM

Capstone Companies, Inc. (OTC:CAPC) (“Capstone” or the “Company”),

a designer of innovative LED lighting solutions including power

failure lighting, today announced the effective date of the

previously announced 1-for-15 reverse split of common stock.

The Company has also announced that it plans to list its common

stock on the OTCQB Venture Market Exchange, effective August 22,

2016.

Stewart Wallach, Capstone’s President and CEO commented, “These

are important steps in our strategy to broaden our exposure to the

investing community and enable us to communicate our promising

growth trajectory and strengthening financial performance to a

larger audience. With the reverse stock split our expanding

earnings will be significantly more obvious on a per share basis.

We believe this will result in greater interest in our

exciting story.

“By up-listing from the OTC Pink and onto the OTCQB Venture

Market, investors can have confidence in Capstone because we must

meet the strict listing standards of the OTCQB. We believe that the

reverse split and subsequent up-listing will ultimately draw more

eyes to our strong fundamentals and prospects for top- and

bottom-line growth.”

The previously announced 1-for-15 reverse stock split will

become effective at the opening of trading on Monday, July 25,

2016, when its common stock will begin trading on a post-split

basis. The reverse split will reduce the number of Capstone’s

common shares outstanding from 722.0 million shares to 48.1 million

shares, and the share price as of the closing of trading on Friday,

July 22, 2016 will be proportionally adjusted upwards.

Market capitalization does not change as a result of this

reverse split. On the effective date of the reverse split, every 15

shares of issued and outstanding common stock will be converted

into one new share of common stock, which will be assigned a new

CUSIP. Capstone will retain its ticker symbol, “CAPC.”

Fractional shares resulting from the reverse split will be rounded

up to the nearest whole share. Shares of Capstone’s common

stock will trade with a “D” appended to its ticker for 20 trading

days following the split to signify that the split has

occurred.

Capstone has received approval from the OTC Markets, pending the

receipt of listing fees, for its common stock to be up-listed to

the OTCQB Venture Market exchange. A critical requirement for

approval to be listed on the OTCQB Venture Market is that the

issuer be current with its financial disclosures with the

Securities and Exchange Commission, which Capstone has been for

several years.

Shareholders of record will not be required to take any action

in connection with the reverse split and will see the impact of the

reverse split automatically reflected in their accounts on the

effective date. There will be no change to the voting power

or percentage of total ownership of any stockholder as a result of

the reverse split.

FORWARD-LOOKING STATEMENTS:This news release

contains "forward-looking statements" as that term is defined in

the Private Securities Litigation Reform Act of 1995, as

amended. Such statements consist of words like “anticipate,”

“expect,” “project,” “continue” and similar words. These

statements are based on the Company’s and its subsidiaries’ current

expectations and involve risks and uncertainties, which may cause

results to differ materially from those set forth in the

forward-looking statements. Factors that may cause actual

results to differ materially from those contemplated by such

forward-looking statements, include consumer acceptance of the

Company’s products, its ability to deliver new products, the

success of its strategy to broaden market channels and the

relationships it has with retailers and distributors. Prior

success in operations does not necessarily mean success in future

operations. The ability of the Company to adequately and

affordably fund operations and any growth will be critical to

achieving and sustaining any expansion of markets and

revenue. The introduction of new products or the expanded

availability of products does not mean that the Company will enjoy

better financial or business performance. The risks associated with

any investment in Capstone Companies, Inc., which is a small

business concern and a "penny-stock Company” and, as such, a highly

risky investment suitable for only those who can afford to lose

such investment, should be evaluated together with the risks and

uncertainties more fully described in the Company’s Annual and

Quarterly Reports filed with the Securities and Exchange

Commission. Capstone Companies, Inc. undertakes no obligation

to publicly update or revise any forward-looking statement, whether

as a result of new information, future events, or otherwise.

Contents of referenced URLs are not incorporated into this press

release.

For more information, contact

Company:

Aimee Gaudet

Corporate Secretary

(954) 570-8889, ext. 313

Investor Relations:

Garett Gough, Kei Advisors LLC

(716) 846-1352

ggough@keiadvisors.com

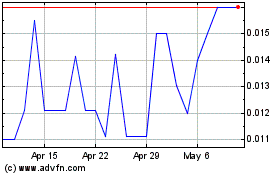

Capstone Companies (QB) (USOTC:CAPC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Capstone Companies (QB) (USOTC:CAPC)

Historical Stock Chart

From Apr 2023 to Apr 2024